Macroeconomic Effects of FOMC Forward Guidance

Introduction

The setting for this paper is the current monetary policy environment. The Federal Reserve has a dual mandate to promote maximum employment and price stability. At 8.3 percent, the unemployment rate is substantially above reasonable measures of the natural rate; the output gap is probably 5 to 6 percent; and underlying inflation measures are projected to be below our 2 percent objective for a number of years.

Clearly, more accommodation would be appropriate. For example, Chung, Laforte, Reifschneider and Williams (2011)[1] use the FRB/U.S. model (a macroeconometric model developed and maintained at the Federal Reserve Board) to show how optimal monetary policy that is unconstrained by the zero lower bound (ZLB) would call for substantially more accommodation than anything we have tried to date. Today, however, we can only use non-standard tools. Recently, the Federal Reserve has employed new language and tools to communicate the likely nature of future monetary policy accommodation. The most prominent developments have manifested themselves in the formal statement that follows each meeting of the Federal Open Market Committee (FOMC). In January we said, the FOMC “currently anticipates that economic conditions … are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.”

It seems safe to say that it is not a first-best policy tool to use calendar-dates alone for forward guidance. After all, is “late 2014” a promise to keep the funds rate at the ZLB beyond the time that policy would normally begin raising the federal funds rate? That would be moving in the direction of the optimal policy of Eggertsson-Woodford[2] and Werning.[3] Alternatively, is “late 2014” simply a policy expectation based on forecasts of low inflation and high unemployment? Jeff Campbell, Jonas Fisher, Alejandro Justiniano and I use economic theory and empirical methods to disentangle these two views and examine the potential roles of forward guidance in the current policy environment.[4] Specifically, our paper looks at simple regression analyses to argue that forward guidance has been an effective tool of monetary policy during the crisis. Then, we use our Chicago dynamic stochastic general equilibrium (DSGE) model to analyze macroeconomic forecasts under different policies. In an attempt to better clarify calendar-date forward guidance, we will compare our model simulation results against what we refer to as "bright-line economic thresholds." I have argued in many speeches that more policy accommodation can be delivered in a risk-controlled fashion if the federal funds rate remains exceptionally low as long as the unemployment rate is above 7 percent or medium-term inflation stays below 3 percent. This is an example I refer to as a bright-line 7/3 threshold rule.

Taxonomy of Forward Guidance

Just to be clear regarding “late 2014,” the key questions are: Is the Committee offering a forecast of economic activity and indicating it will follow its usual behavior in that environment? Or is the FOMC instead committing itself to a particular course of action different from its usual approach? To make progress in answering these questions, we need to impose more discipline on the analysis.

Throughout, we assume there is an interest rate reaction function that describes the typical FOMC response to economic conditions and projections. In addition, there are deviations from this response. We use this to distinguish between two classes of forward guidance. In John Taylor’s seminal 1993 article,[5] he provides a lengthy discussion of both of these types of policy actions.

Odyssean forward guidance originates in the term labeled deviations from interest rate rule. Odyssean forward guidance publicly commits the FOMC to future deviations from its underlying policy rule, and this guidance changes private expectations. Eggertsson-Woodford and Werning have shown that optimal monetary policy at the ZLB requires a commitment to keep rates lower than they otherwise would be after the economy begins its recovery. These actions are deviations from a more normal rule. We label these policies Odyssean forward guidance for the following reason: As the economy accelerates and inflation rises, circumstances will tempt any conservative central banker to renege on these promises. This is precisely because the normal policy rule describes its truly preferred behavior. Hence, this forward guidance resembles Odysseus commanding his sailors to tie him to the ship’s mast so that he won’t be tempted by the Sirens’ musical calls for an early exit.

Delphic forward guidance focuses on descriptions of the normal monetary policy response function. Delphic forward guidance encompasses statements that describe only the economic outlook and the typical monetary policy stance. Such forward guidance about the economic outlook influences expectations of future policy rates only by changing market participants’ views about the likely outcomes of variables that enter the FOMC’s policy rule. The introduction of the “considerable period” language in 2003 exemplifies Delphic forward guidance, if the FOMC was most likely motivated by its (ultimately correct) forecast of lower-than-usual inflation coming out of a recession.

With these definitions firmly in mind, we first examine the FOMC’s use of forward guidance in the past. The punchline is: The FOMC has used forward guidance in the past; and this builds confidence for our macro-policy simulations that use Odyssean forward guidance.

FOMC Experience with Forward Guidance

The FOMC has used forward guidance since mid-1999, when the statement first included explicit forward-looking language. There is a literature showing that forward guidance had significant effects on asset prices before the crisis, particularly on Treasury yields. Work since the crisis has focused on large-scale asset purchase announcements. Our analysis here uses the Gurkaynak-Sack-Swanson[6] (GSS) event-study methodology applied to the post-crisis period. We find that forward guidance has had similar effects during the crisis period. We interpret this as saying that “markets listen” to the FOMC, and thereby forward guidance influences interest rates relevant for household and firm decisions.

Do Markets Hear the Oracle of Delphi or Odysseus?

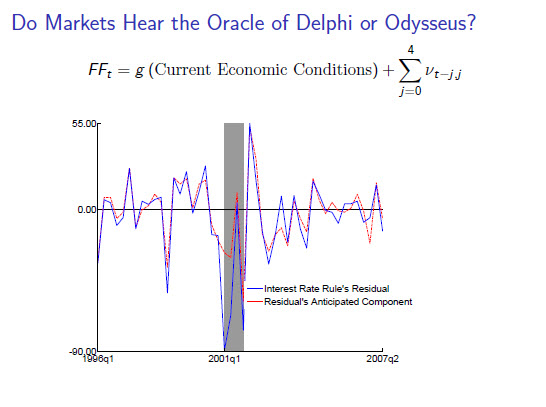

Since optimal monetary policies like Eggertsson-Woodford and Werning have a strong Odyssean forward-guidance component, we are particularly interested in documenting their history and effects. However, the GSS/event-study methodology alone does not separate Odyssean from Delphic forward guidance. To do so, we need to place more structure on the previously noted deviations from interest rate rule. We model Odyssean forward guidance with a sequence of shocks, which we label “nu,” (ν). Here, the public learns νt-j,t in quarter t–j, but it gets applied to the interest rate rule in quarter t. We estimate these shocks using: 1) the interest rate rule, 2) expectations of future fed funds rates from markets and 3) expectations of economic conditions from the Blue Chip consensus forecasts. We assume forward guidance goes out four quarters from the present.[7]

Figure 1 plots the residual for the interest rate rule versus its forward guidance component. It is mostly future forward guidance, not just the contemporaneous shock. Our results show that the public anticipates about 80 percent of deviations from the interest rate rule at least one quarter in advance. Forty percent of the deviations are anticipated two to four quarters in advance. Apparently, the FOMC and the public together have experience with Odyssean forward guidance. We find significant effects of forward guidance on Treasuries. Also, corporate bond rates respond in the direction suggested by theory.

Now that we have established statistical examples of Odyssean forward guidance, we move to analyzing a strong commitment to future accommodation within the context of an empirically viable dynamic stochastic general equilibrium (DSGE) model of the U.S. economy.

Forecasts from the Federal Reserve Bank of Chicago New Keynesian DSGE Model

To explore the effects of forward guidance in the current policy environment, we make forecasts with the Chicago Fed’s New Keynesian DSGE model. This is an adaptation of a model created by Justiniano and two co-authors and, as such, is essentially an off-the-shelf model. In the model, business cycles are primarily demand determined. The length of the delayed recovery in the model is importantly influenced by “deleveraging behavior.” To have a chance at capturing the improvements due to monetary accommodation so far, we introduce Odyssean forward guidance shocks into the model’s interest rate policy rule and impose a parsimonious factor structure. To capture the current “late 2014” language, we extend the horizon for forward guidance from four to ten quarters.

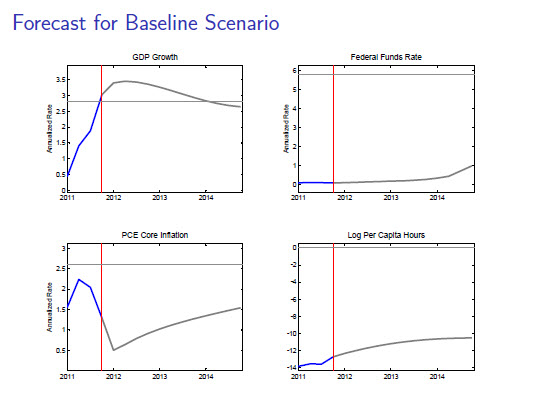

Forecast for Baseline Scenario

As in prior work, the ZLB binds from the onset of the crisis because households are unusually patient. Households have a larger than usual incentive to accumulate savings, so we think of this as a proxy for the deleveraging that has been going on since the crisis. In the analysis, the rate of impatience slowly returns to its steady state level (half life of 3.4 years). We set Odyssean forward guidance in the model to match the expected federal funds rates from futures markets through mid-2014. So policy roughly conforms to the “late 2014” language. As you can see, forecasted real gross domestic product growth exceeds 3 percent for 2012, and (quarterly) core inflation (based on personal consumer expenditures) starts well below 1 percent but rises to 1.5 percent by the end of 2014. Hours worked start well below their average level and make only modest progress toward recovery.

Inflation and Unemployment in the Baseline Forecast

In figure 2, we have translated our baseline forecast into the unemployment-inflation space. The green bar represents our policy objectives: 2 percent inflation and a 5.25 to 6 percent range for the natural rate of unemployment (from January Summary of Economic Projections).The blue dot is data from 2011:Q4. The forecast follows in sequence from that point. Grey dots indicate the period of a near zero federal funds rate and red dots indicate forecast dates where the federal funds rate has risen above the zero lower bound. The dashed red lines are the bright-line 7 percent unemployment/3 percent inflation thresholds.

By the end of 2014, core inflation is closer to our explicit objective. However, the endpoint for unemployment seems high relative to any rate that would be consistent with the FOMC’s mandated goal of maximum sustainable employment.

Compared with this baseline scenario, extending the time the FOMC keeps the federal funds rate at zero would bring policy closer to the optimum identified by Eggertsson-Woodford and Werning. However, it is well known that central bankers are genetically disinclined to push the limit of monetary accommodation very far in this direction. Although calendar-date communications may have an Odyssean component, most market analyses seem to interpret the dates as Delphic communications. What would another conditioning set look like?

Finding acceptable bright-line economic thresholds might better impart a larger commitment to accommodation. The 7/3 threshold rule I have advocated is an alternative “second-best” policy that conditions on economic outcomes. Notice that in our baseline forward-guidance scenario, our forecast does not breach either the 7 percent unemployment threshold or the 3 percent inflation threshold. In this case, the funds rate could remain low for a longer period, according to the threshold rule. There are important details to work through with this analysis, but this chart is encouraging. It has the feel of a frugal person’s nominal income targeting strategy.

Having suggested that 7/3 rules can provide additional Odyssean forward guidance, I want to mention that bright-line economic thresholds also offer a risk-management approach to guarding against unforeseen adverse circumstances. How can we use this analysis to shed light on alternative specifications that impart more inflation risk?

Risk Assessment

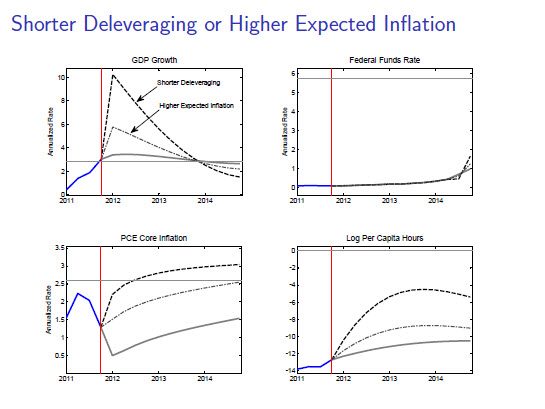

Now we consider two alternatives that give rise to greater inflation concerns. In each case, monetary policy remains Odyssean and conforms to the “late 2014” language. In one scenario, we lower the half-life of the natural rate of interest from about 3.5 years to about one half year. We interpret this scenario as capturing a shorter deleveraging period. The second scenario embodies an unanticipated rise in long-run inflation expectations. We do not impose the bright-line 7/3 threshold policy in either scenario. Rather, we simply monitor the boundaries to examine whether such conditional 7/3 forward guidance would call for a liftoff from the ZLB sooner than currently anticipated.

Shorter Deleveraging or Higher Expected Inflation

Both risks are “upside” risks, in the sense that the economy expands and inflation rises. “Shorter deleveraging” delivers the boom-expansion and acceleration of inflation that is evident in Eggertsson-Woodford and Werning’s optimal policy with overshooting.

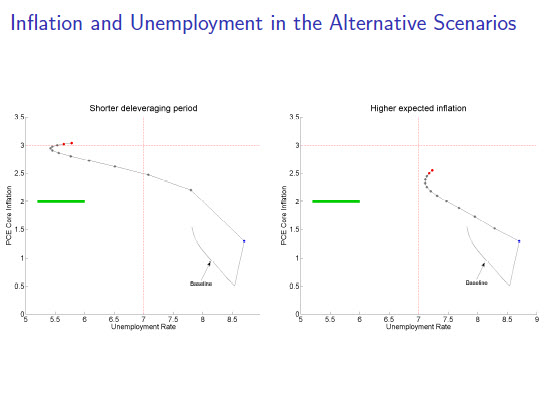

Inflation and Unemployment in the Alternative Scenarios

Under faster deleveraging, unemployment falls faster and inflation rises by more. In that scenario, the economy crosses the 7 percent unemployment threshold in 2012:Q3, and reaches the 3 percent inflation threshold in late 2013. Therefore, adherence to the 7/3 threshold policy dictates liftoff from the ZLB in late 2012. Given the improvement in the economy and labor markets, an earlier exit seems palatable. Even without the 7/3 exit, the endpoint with 3 percent quarterly inflation and below 6 percent unemployment is a potentially better dual mandate outcome than today’s situation.

When the 10-year average inflation expectation rises, the unemployment rate skirts the 7 percent threshold without hitting it. The inflation rate remains well below the 3 percent inflation threshold through the end of 2014. While the 7/3 threshold policy would dictate keeping rates at the ZLB, the turn in direction of unemployment is quite worrisome. Monitoring long-run inflation expectations for evidence of substantial deterioration remains an important safeguard against unforeseen adverse developments.

Notes

[1] Krugman (1998).

[2] See, for example, Bernanke, Reinhart and Sack (2004) and Eggertsson and Woodford (2003).

[3] See FOMC (2005).

[4] Taylor (1979), Svensson (1997) and Woodford (2003).

[5] Note a weight of 1 on the unemployment rate is equivalent to a weight of about ¼ on the output gap. Of course, policymakers could debate the relative weights to put on inflation and the real-side goal variable in their loss function.

[6] Eggertsson and Woodford (2003), Werning (2011) and Krugman (1998).

[7] Note that if inflation had fallen to 1 percent (below our 2 percent objective) while unemployment improved to 7 percent, it would be against both our employment and price stability objectives to tighten at that point.

References

Campbell, Jeffrey R., Charles L. Evans, Jonas D. M. Fisher and Alejandro Justiniano, 2012, "Macroeconomic effects of FOMC forward guidance," Brookings Institution, Spring Panel on Economic Activity, paper, March 22.

Chung, Hess, Jean-Philippe Laforte, David Reifschneider and John C. Williams, 2011, "Have we underestimated the likelihood and severity of zero lower bound events?," Federal Reserve Bank of San Francisco, working paper, No. 2011-01, January, available at http://www.frbsf.org/publications/economics/papers/2011/wp11-01bk.pdf.

Eggertsson, Gauti B., and Michael Woodford, 2003, “The zero bound on interest rates and optimal monetary policy,” Brookings Papers on Economic Activity, Vol. 34.

Federal Open Market Committee, 2012, Committee statement, Federal Reserve Board, January 25, available at http://www.federalreserve.gov/newsevents/press/monetary/20120125a.htm.

Gurkaynak, Refet, Brian Sack, and Eric Swanson, 2004, “The effect of monetary policy on asset prices: An intraday event-study analysis,” Board of Governors of the Federal Reserve System, working paper, February.

Justiniano, A., G. E. Primiceri, and A. Tambalotti, 2011, "Investment shocks and the relative price of investment," Review of Economic Dynamics, Vol. 14, No. 1, pp. 101-121.

Taylor, John B., 1993, "Discretion versus policy rules in practice," Carnegie-Rochester Conference Series on Public Policy, Vol. 39, pp. 195–214, available at http://econpapers.repec.org/article/eeecrcspp/default1993.htm.

Werning, Ivan, 2011, “Managing a liquidity trap: Monetary and fiscal policy,” National Bureau of Economic Research, working paper, No. 17344, August.