Our Regional Structure

The Federal Reserve’s System of Regional Banks

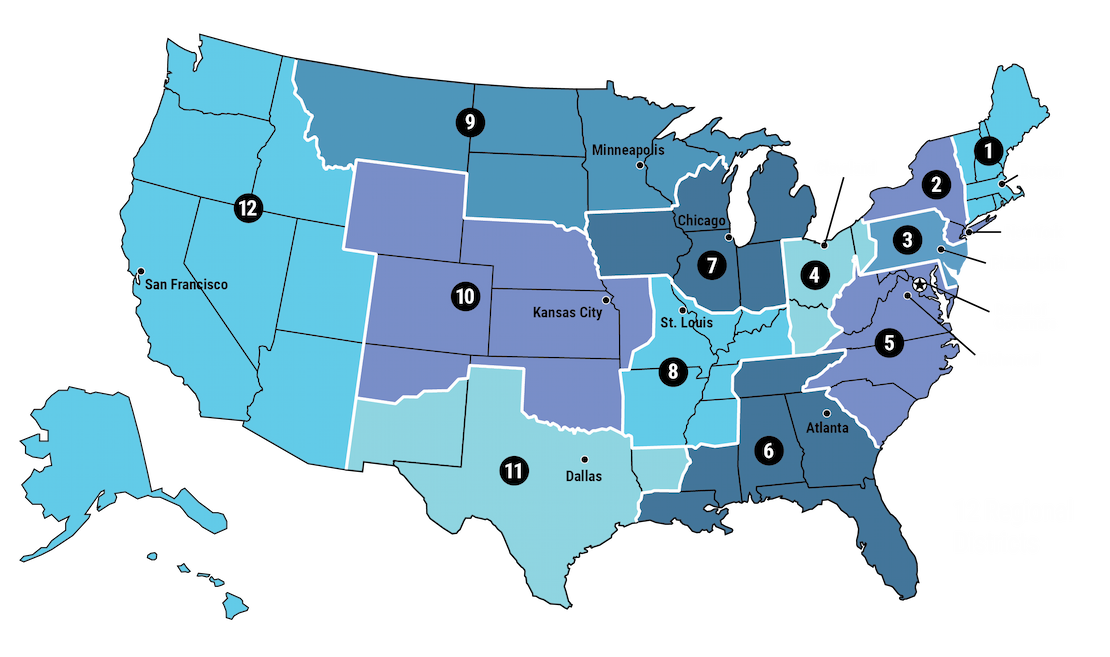

The Federal Reserve’s 12 Regional Banks operating around the nation help ensure all household, community, and business economic conditions and perspectives inform Fed policies, actions, and decision-making. The Banks work together to keep the U.S. economy strong—focusing on stable prices, full employment, safe banking, and secure payments.

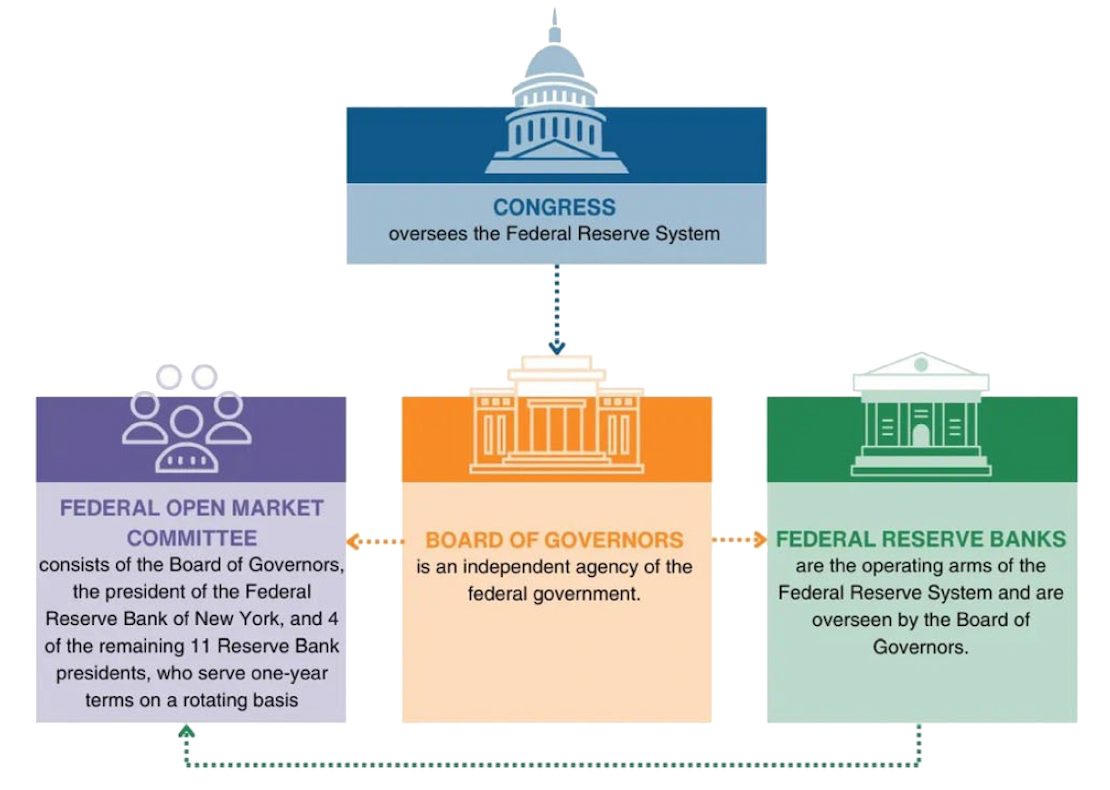

The 12 regional Reserve Banks work independently with oversight from the Board of Governors in Washington D.C. The Reserve Banks are the operating arms of the Federal Reserve System and function within their own geographical districts. The Fed identifies its districts by number and the city where its main office is located. The region served by the Federal Reserve Bank of Chicago is the Seventh District.

Each Reserve Bank has a nine-member board of directors that serves as a link between the Federal Reserve and the private sector. Directors come from a range of backgrounds and bring valuable insights into the economic conditions within each District.

"This structure of regional independence is extremely important. There are 12 regional Federal Reserve Banks because—just like today—when they set up the system in 1913, they wanted to be certain that the entire country had input into the way the U.S. financial system operates."

–Austan D. Goolsbee, President and CEO, Federal Reserve Bank of Chicago

How the Fed Works

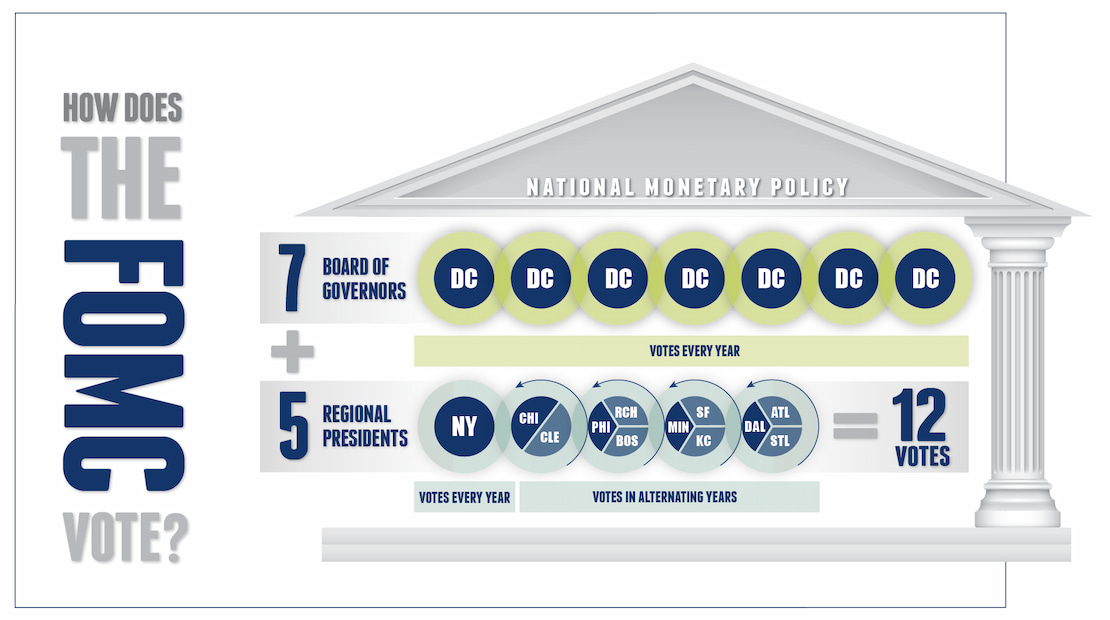

Meeting eight times per year to set national monetary policy—including a benchmark interest rate that ripples through the economy—the Federal Open Market Committee combines regional Bank presidents, who cast votes on a rotating basis, and the Fed’s Board of Governors. This decentralized structure is designed to ensure that viewpoints from across the country are brought to the table.