Bridging the Gap: Alternative Providers of Credit to Small Businesses

Community-based lenders and other nonbank entities saw a steep rise in demand when bank lending to small businesses dropped by more than 50% between 2007 and 2010.1 A recent article in ProfitWise News and Views, “Small Business Credit: Alternative Resources Bridging the Gap,” reviews some current trends in demand for credit at nonbank lenders and profiles some of the resources available to small businesses seeking loans.

Increase in Demand

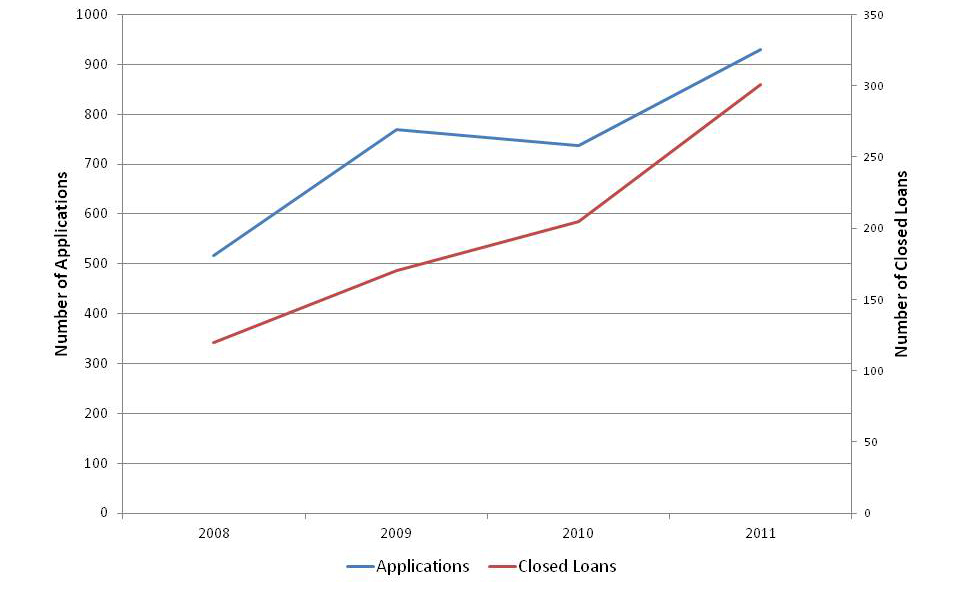

Data provided by Accion-Chicago, a nonprofit microlender and a Community Development Financial Institution, illustrate the experiences of community-based alternative credit providers during the recession. As chart 1 indicates, demand—as demonstrated by both completed applications and closed loans—increased by 80% between 2008 and 2011.2

1. ACCION Chicago: Loan demand and production, 2006-2011

Change in Borrower Profile

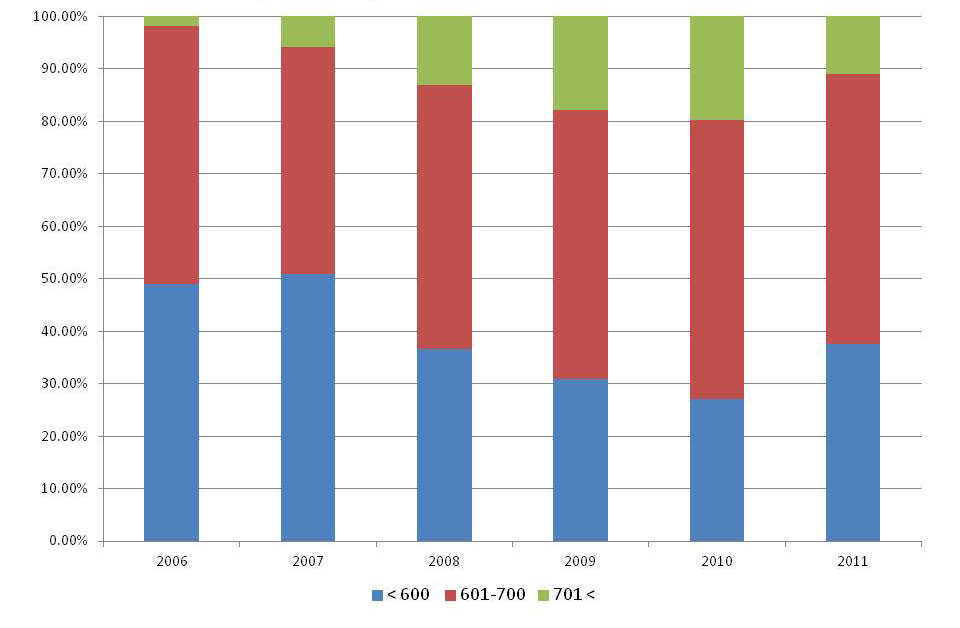

At the same time that demand took off, Accion saw a change in the profile of its borrowers. As the definition of “bankable” shifted during the recession, so did the profile of business owners who turned to Accion and other providers for assistance. Microlenders–lending below the $50,000 threshold–typically serve those who are not served by banks. By 2010, the percentage of Accion’s borrowers with a credit score above 700 had increased from 2% in 2006 to 20%; in 2011, it decreased to 16% (see chart 2).3

2. ACCION Chicago: Percentage breakdown in borrower credit scores, 2006-2011

The Response

Funders and nonbank financial entities have mobilized in response to the growing demand for credit. A group of institutions recently came together to create The Chicago Microlending Institute, a citywide network for community-based, nonprofit, small business lenders that leverages the expertise of Accion to provide technical assistance and start-up capital to build a small business lending infrastructure in Chicago. Nonbank providers of capital increasingly use technology to help them connect with borrowers as well. Online credit intermediaries, such as TheFundWell.com, operate exclusively via the Internet to connect borrowers with lenders, including alternative providers, increasing the range of options available to small businesses seeking capital, especially minority- and women-owned businesses. According to company leadership, half of FundWell’s users have been in business for more than two years and their credit scores are evenly spread from below 600 to over 700. Biz2Credit.com is another online financial intermediary that matches prospective borrowers with an appropriate form of credit; it currently processes between 8,000 and 9,000 funding requests per month.

By expanding the range of options for those businesses still seeking capital, nonbank and community-based providers of credit have played a valuable role for small business owners as credit conditions have tightened at banks.

For more information about providers of alternative credit to small businesses and their role during the recession, please see the full article in Profitwise News and Views.

Footnotes

1 The National Bureau of Economic Research (NBER) defines the most recent recession as lasting from December 2007 through June 2009. According to Community Reinvestment Act data, loans to businesses with less than $1 million in revenues fell by 53% in dollar amounts and 71% in total number of loans originated between 2007 and 2010.

2 Data provided by Accion Chicago.

3 Data provided by Accion Chicago.