Impact of Lower Natural Gas Prices on the Freight Transportation Sector

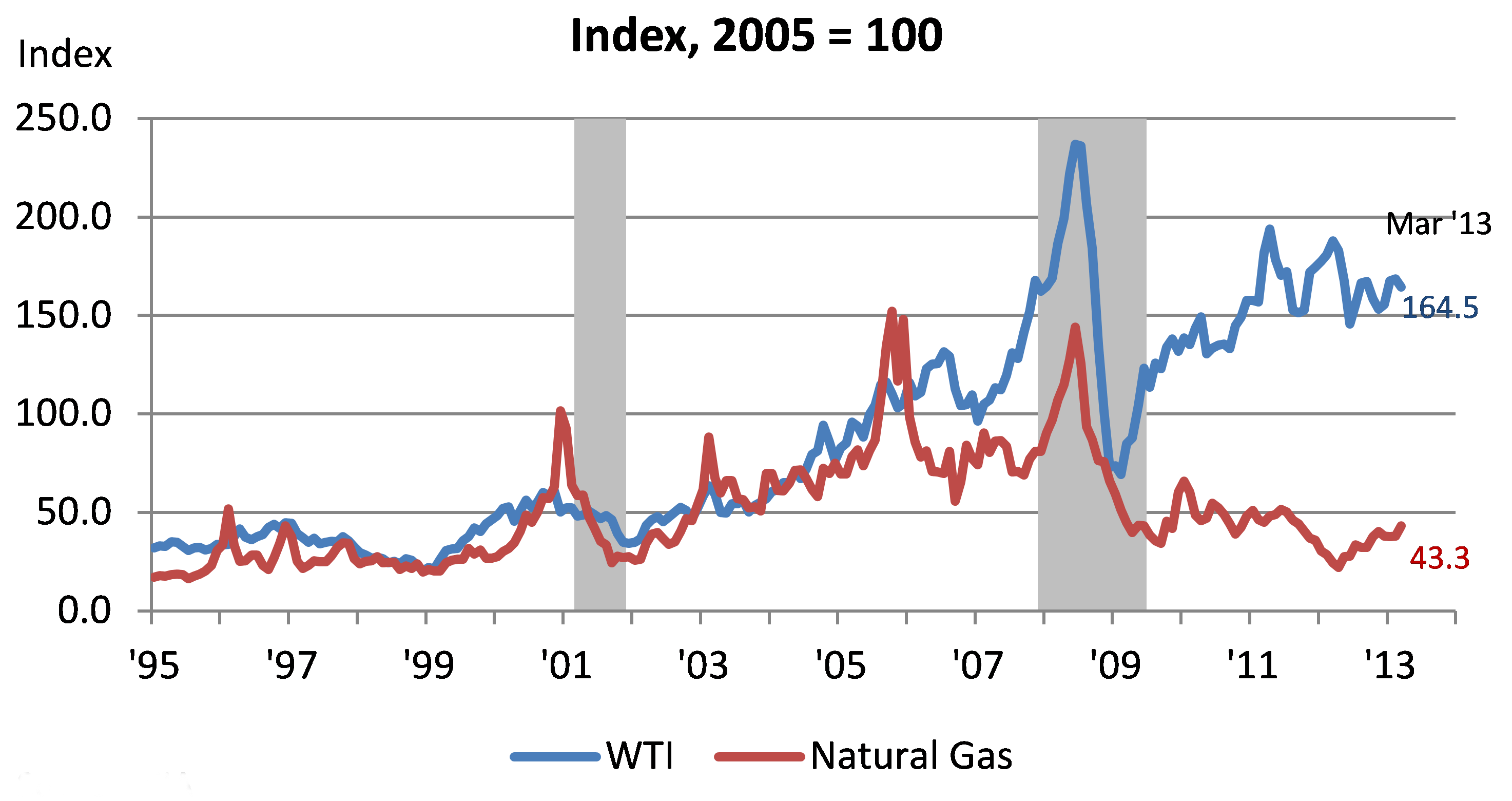

Enhanced exploration and recovery of natural gas and other fuels from shale rock have significantly boosted expected availability of energy in the United States. Projections of natural gas supply in this country have gone up so quickly in the past decade that it is hard to get a good handle on where energy markets are going to settle in the decade ahead—that is, at what price and in what industries it will be used as the fuel of choice. One thing is clear—natural gas is now readily available. Nothing shows this better than the falling price of natural gas relative to oil. While the price of oil is up 64.5 percent from 2005, the price of natural gas has actual fallen by 56.7 percent.

1. Oil and natural gas

Falling prices of natural gas will surely result in increased investment in the many industries and activities that can use natural gas. Natural gas can be used not only as a less expensive alternative for energy and electric power generation, but also as a material input for such products as petro chemicals, plastics and fertilizers. To consider the implications of this new energy revolution, the Federal Reserve Bank of Chicago recently held an event entitled, New Access to Energy: Midwest and Global Industry Impacts. The conference featured panels on diverse topics, including the availability of supply, regional and global market impacts, re-shoring of manufacturing, and developments in the freight transportation sector.

The transportation industry has quickly adapted to falling natural gas prices, especially freight transportation by truck. The trucking sector has had to overcome some significant challenges over the past couple of decades, including rising diesel prices, added emissions standards, and enhanced driver safety regulations, just to name a few.

In an effort to understand more about how falling natural gas prices might impact the trucking industry, the conference’s transportation session covered four specific areas:

- Overview of the medium and heavy truck market.

- Implementation of natural gas vehicles into a delivery fleet.

- The development of natural gas heavy duty trucks.

- The availability of natural gas and associated infrastructure development.

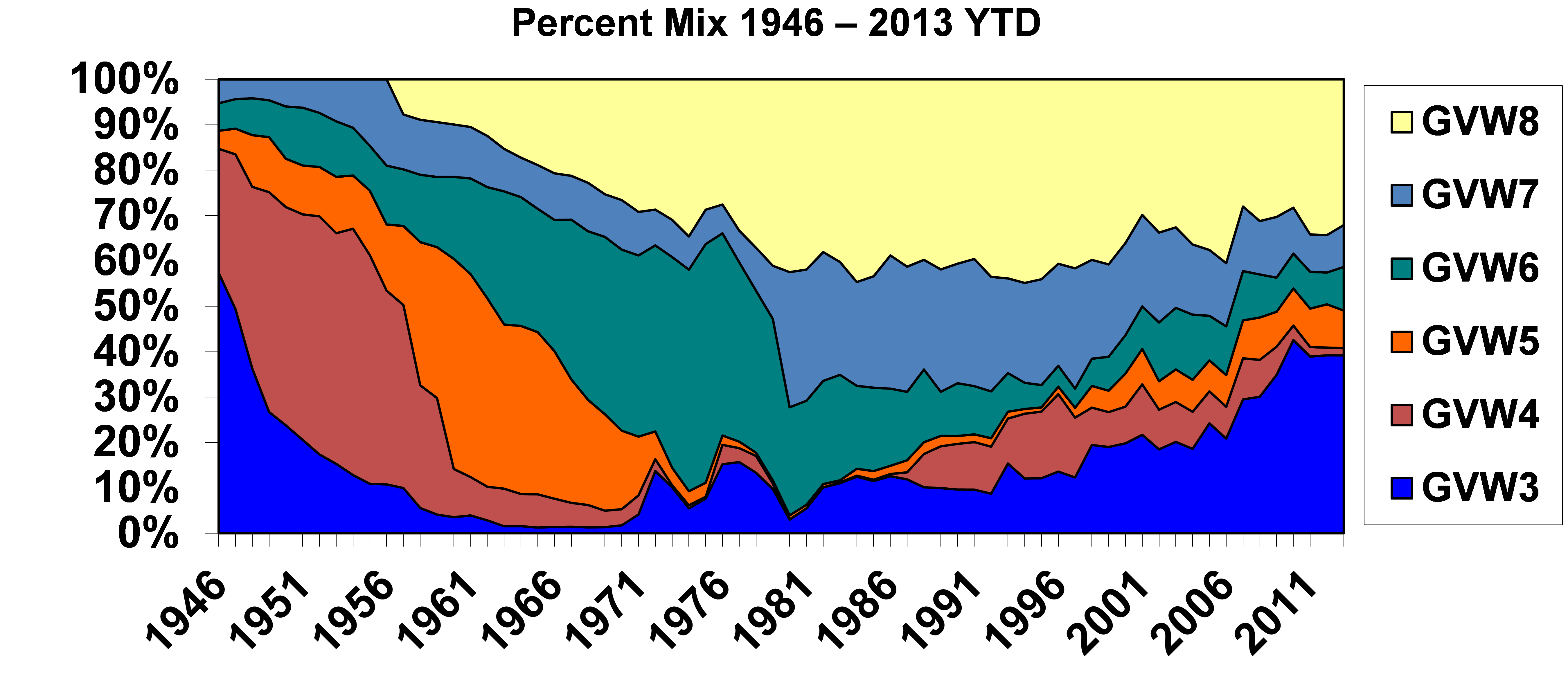

The U.S. class 8 trucks industry outlook was presented by Ken Vieth, senior partner and general manager for Americas Commercial Transportation (ACT) Research Company, LLC. Vieth’s presentation overviewed the heavy duty truck market and its potential for conversion to natural gas. In the U.S., trucks are classified by size or gross vehicle weight rating (GVWR). Most commercial trucks are rated from GVWR 3 (10,001–14,000 pounds) to GVWR 8. Heavy duty or class 8 trucks are trucks with a GVWR above 33,000 pounds. These are the vehicles most often used for carrying freight over long distances. The mix of trucks by GVWR has changed significantly over the last 65 years, with class 8 truck share growing from virtually zero in 1946 to over 30 percent in 2012. According to data from Ward’s Automotive, in calendar year 2012 class 8 trucks accounted for 34.2 percent of all class 3 through class 8 trucks sold in the United States.

2. History at a glance: U.S. Class 3-8 trucks

In 2012, there were 201,300 class 8 trucks produced in the United States. Of those, only about 3.0 percent were designed to use natural gas. However, ACT Research expects the share of natural gas powered class 8 trucks to grow to 50 percent in the next 10 to 20 years. Two of the main reasons cited for this dramatic change in demand for natural gas driven trucks (NG trucks) are regulatory considerations related to more stringent emissions standards and the competitive cost advantage natural gas provides compared with gasoline or diesel fuel. Vieth pointed out that, at today’s prices, on a cost per gallon equivalency basis, natural gas is 33 percent less expensive than gasoline and 39 percent cheaper than diesel. A natural gas truck is more expensive to buy than a comparable gasoline or diesel vehicle but, over a five-year period, the cost savings with an NG truck could be as high as $100,000, more than offsetting the higher initial investment. As for emissions and other regulatory issues, natural gas burns cleaner, resulting in far less greenhouse gas and particulate matter being released into the atmosphere.

To gain a better understanding of how NG trucks are currently being used, a case study of the implementation of natural gas vehicles into a delivery fleet was provided by Jeff Shefchik, president of Paper Transport, Inc. in Green Bay, Wisconsin. Paper Transport is one of the early adopters of natural gas powered trucks for the freight industry. In February 2010, Paper Transport purchased two Freightliner M-2 tractors powered by the Cummins ISL-G natural gas engine. Today they have 35 such vehicles in operation out of a fleet of 390 tractors, and their fleet has logged over 3.5 million miles. Shefchik pointed out that Paper Transport began converting to natural gas for the environmental benefits, as well as the economics of natural gas versus diesel. The decision to convert so many of their trucks wasn’t without some concerns—specifically, finding the right applications, convincing the drivers, maintaining the engines, and the fuel delivery infrastructure. But, according to Shefchik, these issues were easily overcome. He said that the return on investment and payback are application dependent, but for a regional over-the-road model, the payback was just four years for a truck that would most likely stay in service for ten years or more. Shefchik’s payback model was consistent with that presented by Vieth. Shefchik also mentioned that natural gas prices tended to be a lot more stable over time than gasoline and diesel fuel prices, which is helpful for business planning purposes.

We heard about the development of natural gas trucks and what lies ahead from Robert Carrick, sales manager for natural gas vehicles at Daimler Trucks N.A. LLC. Carrick has worked in the trucking industry for 28 years and has held a number of management positions. While working for Freightliner Trucks, which is the largest division of Daimler Trucks N.A., he initiated the first natural gas project for the ports of Los Angeles and Long Beach and delivered over 500 natural gas trucks all across North America. Since that time, Freightliner has delivered an additional 1,500 natural gas trucks. Daimler has developed NG trucks for a variety of applications, including port tractors, food delivery, regional haul tractors, refuse trucks, sewer trucks, utility trucks, and municipal vehicles. Carrick pointed out that natural gas engines produce less pollution and are significantly quieter than comparable diesel engines, making them preferable for many applications in cities or confined areas. Also, municipal and utility fleets that return to the same location every evening are good applications for natural gas because vehicles can be refueled onsite overnight. Another good application for natural gas is long-haul freight distribution, because NG trucks can be equipped with fuel tanks that allow them to go up 600 miles between fill-ups. To prove this point, Freightliner completed a cross country tour from Los Angeles to Washington D.C. in seven days. During the trip, the vehicle refueled just four times, stopping in Phoenix, Oklahoma City, Little Rock, and Nashville. Carrick said Daimler recognizes that natural gas prices could increase again and infrastructure improvements need to continue, but he predicted that by 2020, NG trucks could equal 10 percent of Daimler Truck N.A.’s total production.

The final presentation addressed the availability of natural gas and the development of the fuel distribution infrastructure for the trucking industry and was given by David Jaskolski, a senior account manager for Pivotal LNG, a wholly owned subsidiary of AGL Resources. Jaskolski has over 30 years of experience in developing and implementing strategic plans for key accounts in commercial on-highway, construction, marine, petroleum, and rail markets, and is recognized as an expert in the use of natural gas as an alternative fuel for heavy duty trucks.

Jaskolski pointed out that the U.S. already has an extensive natural gas pipeline network that runs throughout the country. Using a plumbing analogy, he said the pipes are already in the house—we just need to decide what types of faucets we need and where we want to put them. There are two options for using natural gas, each requiring a different faucet—compressed natural gas (CNG) and liquid natural gas (LNG). CNG is a better option for buses, refuse trucks, and utility or municipal fleets, for which fuel consumption is low (less than 65 gallons a day), space for numerous tanks is available on the vehicle, vehicle weight is not important, wheelbase is not an issue, time to fuel is not an issue (can fuel overnight), and vehicles may sit idle for long periods. The exact opposite of this holds true for long-haul vehicles. Because of this, they are better suited to using LNG. LNG is the same natural gas that is used in homes across America and, thus, it is readily available. The major difference is that the gas is cooled in an industrial process to –260 degrees, at which point it turns into a liquid. Once cooled to a liquid, 1 cubic foot of LNG is equal to 600 cubic feet of natural gas. Care must be taken when fueling, because the fuel will turn back to a gaseous state if it is not kept cold. This is why LNG is not good for applications in which vehicles are allowed to sit idle for extended periods as the gas will just dissipate. However, the quick dissipation of liquid natural gas is a plus in terms of safety and the environment. In the event of a spill, unlike diesel fuel and gasoline that can pool on the ground or flow into lakes and streams, LNG will just evaporate into atmosphere. In addition, LNG is not explosive or flammable like gasoline or diesel fuel. For LNG to be flammable, it must return to vapor first, and natural gas vapor will only ignite in a ratio of 5 percent to 15 percent natural gas to air and only if there is an ignition source present. For natural gas vapor to get to the level of concentration needed to ignite, it must be in a confined area. Unlike gasoline, natural gas vapor is not explosive in the open air.

In summary, there appear to be many applications in the trucking industry for which natural gas makes good economic sense. Early adopters have had good success in incorporating natural gas vehicles profitably into their fleets. Truck developers are working on creating more options for the future. And for CNG and LNG, most of the distribution network is already in place.

For more on the conference and to access copies of the presentations cited here and others from the conference, please visit the New Access to Energy: Midwest and Global Industry Impacts page.