Autonomous and electric vehicles: Two potentially disruptive forces in the transportation sector

On June 1–2, 2017, the Federal Reserve Bank of Chicago held its 24th annual Automotive Outlook Symposium (AOS) at its Detroit Branch.1 In this blog entry, we cover the first day’s panel, which was on autonomous vehicles and battery electric vehicles (BEVs).2 The panel’s three experts focused on how these types of vehicles might affect personal mobility and the organization of our society; automotive manufacturers’ product planning; and energy usage. All of the speakers agreed that these innovations have the potential to play significant and disruptive roles in the automotive industry’s future. Yet, they all conceded that the speed at which these new technologies will be rolled out is still uncertain.

Autonomous vehicles and their potential impact on society

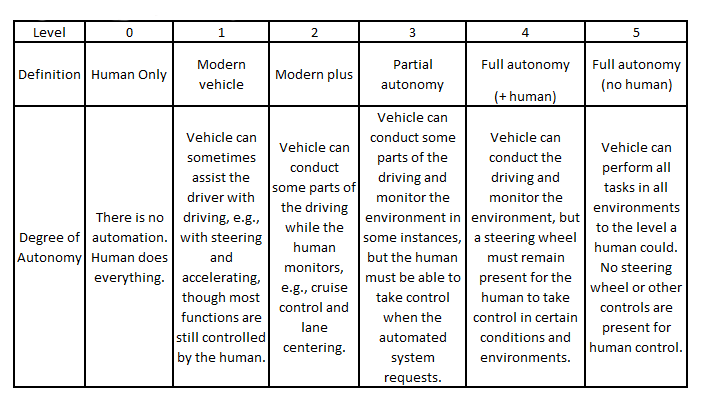

James Sayer, University of Michigan Transportation Research Institute (UMTRI), discussed how the wide use of autonomous vehicles could affect society as a whole. To begin, Sayer said vehicles can be divided into “levels” based on the degree of autonomy they possess. A table describing the different levels of vehicle autonomy is shown below.3

Table 1. Levels of vehicle autonomy

Sayer said he sees great potential benefits from the wide adoption of autonomous vehicles (i.e., those in levels 3–5). For example, autonomous vehicles could be used to transport lower-skilled workers to more workplaces than they can presently access, increasing their employment opportunities. That said, autonomous vehicles could displace millions of workers who now earn livings as taxi drivers, chauffeurs, bus drivers, and delivery drivers. So, there may also be significant societal costs that cancel out some of the benefits we get from autonomous vehicles being integrated into everyday life.

In addition, Sayer wondered aloud how our time spent in vehicles—particularly during our commutes—might change once consumers have access to autonomous vehicles. Because they won’t have to drive their cars, vehicle users could use their commuting periods to increase their labor productivity as well as decrease stress. Among other things, that would allow for longer commuting distances for more workers, which would increase energy usage. In addition, empty vehicles would likely drive to a parking lot after having dropped off their passengers and drive back to the workplace to pick them up for the return trip. On net, that would likely increase congestion and total miles travelled, Sayer contended. If autonomous transportation became more widely used, it seems that people might, on balance, spend more time in vehicles, said Sayer. That could translate into less time spent exercising or engaging in other activities that address a person’s well-being. After discussing these possible changes in societal patterns, Sayer raised the related question of vehicle ownership. The traditional model of owning vehicles outright might well change to one where some (possibly many) people forgo individual ownership and participate in ride-sharing and vehicle-sharing programs.

The technical challenges for autonomous vehicles remain substantial, Sayer observed. For instance, developing better sensors and algorithms to improve autonomous transportation is very important. However, he argued that the greatest challenges for the wide adoption of this technology are social, behavioral, and legal in nature. These types of challenges related to autonomous cars are not getting enough attention, at least compared with the technical ones, Sayer argued. When thinking about how to integrate autonomous vehicles into our societies, driver accountability should be near the top of the list. Who’s responsible in an accident involving an autonomous vehicle, especially when it’s not operated by a human at the time of the accident? Does the responsibility fall on the owner of the vehicle, the manufacturer, or the developer of the software system used in the vehicle? Because there’s still so much learn about how autonomous vehicles operate in the real world, Sayer said a good implementation plan would be to deploy them in small numbers at first. This way they will be refined before they’re more widely deployed. The very ways in which societies and their economies are organized will be transformed if autonomous vehicles become ubiquitous, but we still have much to learn about how best to integrate this innovation into our daily lives.

Autonomous and electric vehicles from a manufacturer’s perspective

Jeff Mazoway, Hyundai/Kia, presented the challenges automotive manufacturers will have to overcome in order to successfully bring substantial amounts of autonomous and electric-powered vehicles to the market. At the outset, he said that vehicle autonomy and electrification will likely be introduced in conjunction with each other. To address the question of consumer acceptance of a technology as disruptive as autonomous vehicles, Hyundai and others have been conducting much research. Mazoway discussed survey results showing that currently just over half of consumers wouldn’t buy an autonomous vehicle because of concerns about the safety of the new technology. More worrisome to automotive manufacturers is that at present, Generation Z consumers4 are more concerned about autonomous vehicle safety than the average consumer. This is troubling because Generation Z is considered the intended audience for this technology given the time it will take to implement fully autonomous driving (level 5 in table 1). In addition, Mazoway said that these safety concerns have opened the door to tech companies, such as Apple and Google, to compete with traditional automotive manufacturers for the autonomous vehicle market; many consumers simply do not trust the traditional carmakers to come up with safe and reliable autonomous vehicles. Engineering trust among consumers and automobile manufacturers (whether they’re from Detroit or Silicon Valley or elsewhere) will be vital to complete the transition to fully autonomous vehicles.

According to Mazoway, fully autonomous vehicles with a human still needed to drive under certain circumstances or conditions (level 4 in table 1) are projected to be introduced to the market by 2025. Today, vehicles capable of performing at least a couple of automated functions, such as cruise control and lane centering (level 2), are widely available. In other words, the vast majority of vehicles are one level away from partial autonomy (level 3) and two levels away from full autonomy, though still with a steering wheel for a human to be able to take control (level 4). To get us to wide use of vehicles with level 4 autonomy by 2025, Mazoway said technologies to facilitate vehicle-to-vehicle communication need further improvements (specifically, further advances in artificial intelligence capabilities and information technology).

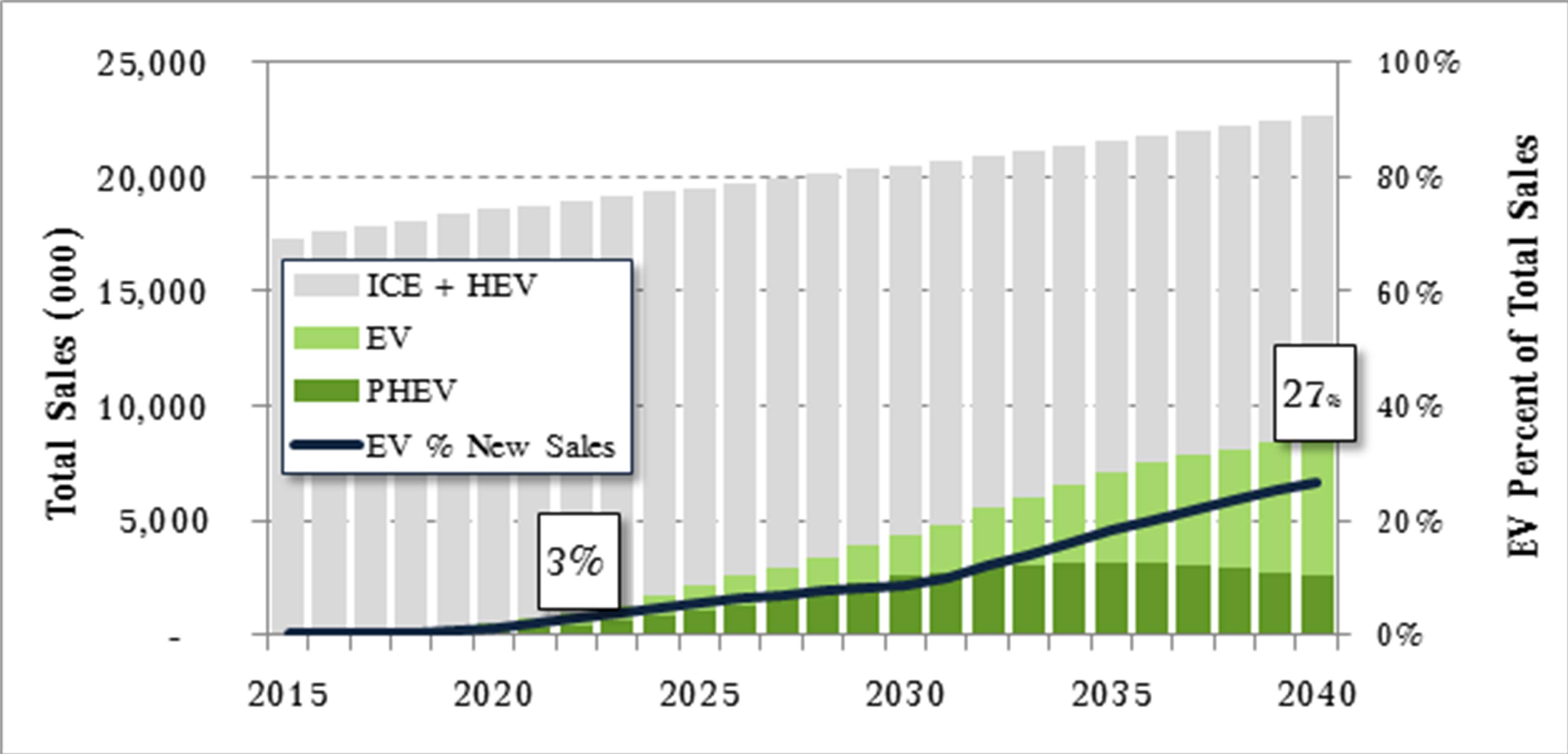

Meanwhile, Mazoway said he projects that BEVs will increase their market share of all new vehicle sales from 3% in 2022 to 27% by 2040, as seen in the chart below.

Chart 1. U.S. electric vehicle sales forecast, 2015–40

Sources: IHS Markit and Bloomberg New Energy Finance.

Presently, the majority of consumers don’t view electric vehicles as a compelling option, specifically because gasoline prices remain quite low. However, Mazoway said consumers’ concerns for the environment and the fuel cost savings from owning and operating an electric vehicle do give him reasons to be optimistic about electric vehicles gaining market share in the future. One additional contributing factor to this optimism is the expectation that battery costs will drop by two-thirds before 2030. Also, as battery electric vehicles increase how far they can go on a single charge, more consumers will show interest in that technology, Mazoway contended. Mazoway indicated that a 300-mile driving range for a BEV as the tipping point for buyer interest. To help make battery electric vehicles more financially appealing, automotive manufacturers are engaging in creative selling practices, which include leasing, reimbursing down payments by covering them with the California clean vehicle rebate, and other innovative marketing techniques. According to Mazoway, the average price for battery electric vehicles is projected to be on par with that for gasoline-powered vehicles by 2025. It will be a significant moment for auto manufacturers and consumers whenever those two prices actually do match.

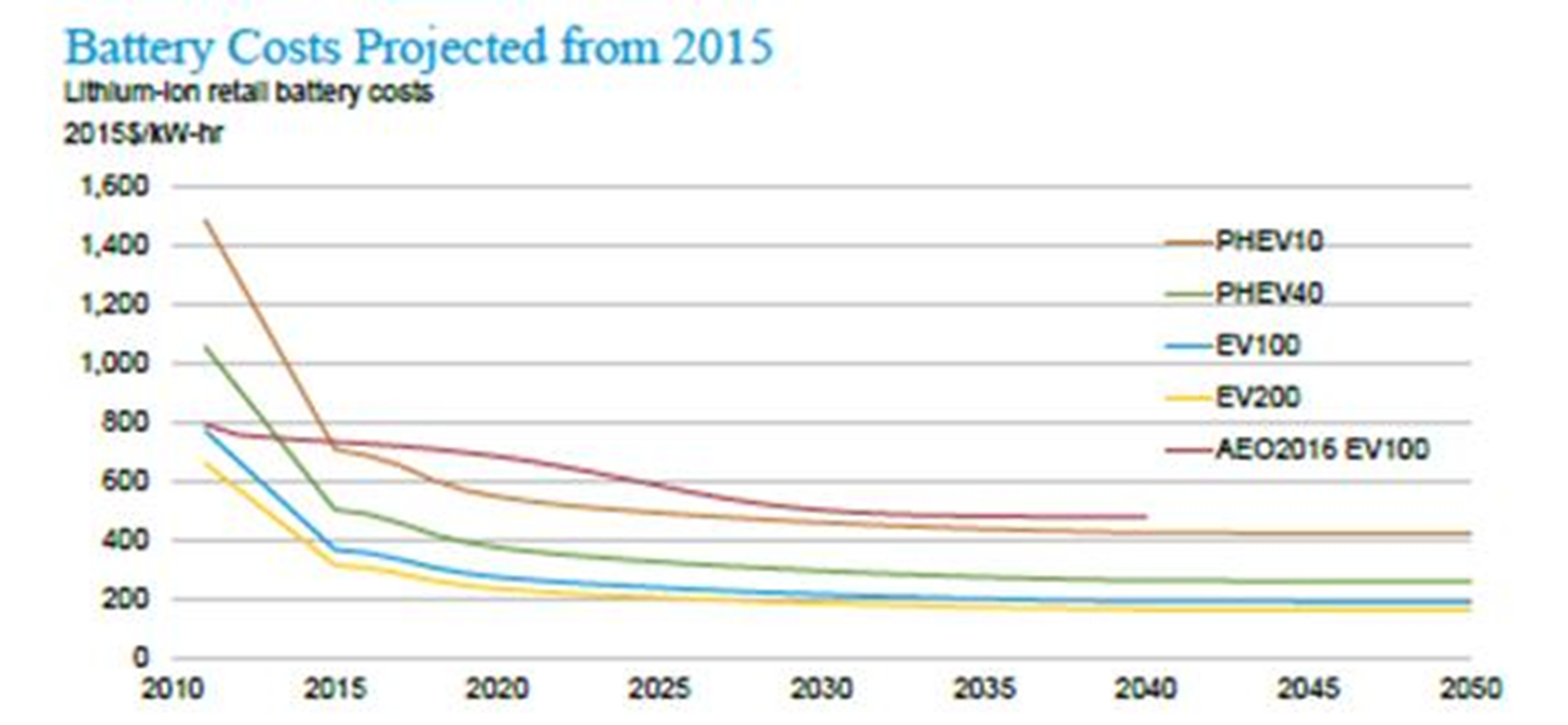

BEVs and long-range energy forecasts

John Staub, U.S. Energy Information Administration (EIA), said he doesn’t see battery electric vehicles gaining as much market share as Mazoway does by 2040. His forecast is for BEVs to reach one-sixth of all new vehicle sales by that year. Displayed in the chart below are Staub’s forecasts for battery costs. According to his projections, there will be a sizable drops in battery costs that will lead to more battery electric vehicle sales. In addition, state-level programs such as California’s Zero Emission Vehicle (ZEV) program are expected to incentivize additional BEV sales.5

Chart 2. Projected lithium-ion battery costs, 2010–40

Source: U.S. Energy Information Administration (EIA).

Staub said the EIA expects battery electric vehicle sales to jump from 100,000 units presently to around 900,000 units by 2025. Thereafter, the pace of increase in battery electric vehicle sales is expected to slow, with sales anticipated to reach only about 1.1 million units by 2040.6

While BEV sales are projected to grow over the forecast horizon, gasoline-powered vehicles are still expected to dominate the new vehicle market for quite some time, Staub commented. Additionally, light truck sales are projected to continue to make up over 55% of new vehicle sales until at least 2040. Even so, fuel economy for all vehicles is still expected to improve because micro hybrid7 systems will be incorporated into a larger number of vehicles from 2020 onward.

Staub said the EIA projects oil prices to jump to $75 per barrel by 2020,8 but slow their pace of increase thereafter. According to the EIA, gasoline prices are expected to increase at a slow and steady rate, not rising above $3 per gallon until 2030, Staub reported.9 Notably, the EIA’s projections for battery electric vehicle sales (mentioned earlier) generally follow its projections for energy prices.

Conclusion

There are many open questions regarding the future of autonomous vehicles and battery electric vehicles. Some of these were raised at the AOS: What societal issues are autonomous vehicles capable of addressing? When will autonomous vehicles be feasible for wide public use? How much market share can autonomous vehicles and battery electric vehicles take? These questions are beginning to receive more media attention. For instance, one recent Detroit Free Press article explored how Downtown Detroit parking might change with, among other things, the introduction of autonomous vehicles. And another story, from the Associated Press, reported that UK automotive parts maker Delphi and French transportation company Transdev would be deploying autonomous taxis without backup drivers as early as next year in order to conduct road testing. Over the coming years, auto producers and policymakers will have to carefully consider how autonomous vehicles and battery electric vehicles will become integrated into people’s daily lives.

Footnotes

1 The agenda and some materials presented at the event are available online.

2 The rest of the most recent AOS will be summarized in an upcoming Chicago Fed Letter article by William Strauss and Thomas Haasl.

3 This table was compiled by the blog entry authors (not any of the panelists). It was a common point of reference for the panel. The two charts in this blog entry are from panelists’ presentations.

4 Generation Z is the generation after the millennials (or Generation Y). While there is no true consensus yet, Generation Z is typically thought to begin with those born in the mid-1990s to the early 2000s.

5 See p. 98 of the Annual Energy Outlook. Also, for more details on California’s ZEV program—which has been adopted by nine additional states—see this site.

6 See p. 97 of the Annual Energy Outlook.

7 Micro hybrid systems are automated engine start–stop systems, which reduce engine idling time.

8 Brent Crude oil price in 2016 dollars. See p. 27 of Annual Energy Outlook.

9 See p. 49 of Annual Energy Outlook.