Detroit Economic Growth Slower in June, According to Chicago Fed Index

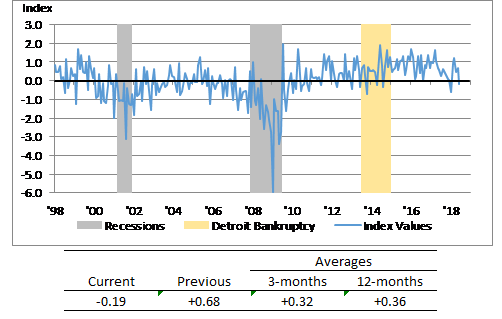

The Chicago Fed's Detroit Economic Activity Index (DEAI) was –0.19 in June, which points to economic growth slightly below trend for the city of Detroit that month. Over the past year, the index has averaged +0.36, which is above its long-run average. An index value greater than zero points to the city of Detroit’s economic activity growing faster than trend and a value less than zero points to the city’s economic activity growing slower than trend. The complete history of the index through June is shown below (chart 1).

Chart 1. Detroit Economic Activity Index (standard deviations from trend)

For the first time since June 2009, contributions from all four of the DEAI’s major categories (income, labor, real estate, and trade) were negative in June 2018. The income category’s contribution to DEAI turned negative primarily because of slower growth in the number of electric utility residential customers. The labor sector, which had contributed the most to the index in March, also experienced a setback in June: While the number of persons employed fell only slightly in June (–262) when compared with May, it was enough to help push the unemployment rate for the city back over 9.0%. As for the negative contribution to the DEAI from real estate, this can explained by single-family home prices slipping 5.4% in June from May and building permits dropping by 50%, to just 1,602. Trade’s negative contribution to the DEAI is simply due to the fact that both the city’s exports and imports fell—by 1.2% and 6.3%, respectively. (The values referenced in this paragraph have all been seasonally adjusted—and in the case of the labor data, they have also been adjusted for breaks in their time series resulting from the decennial censuses.)

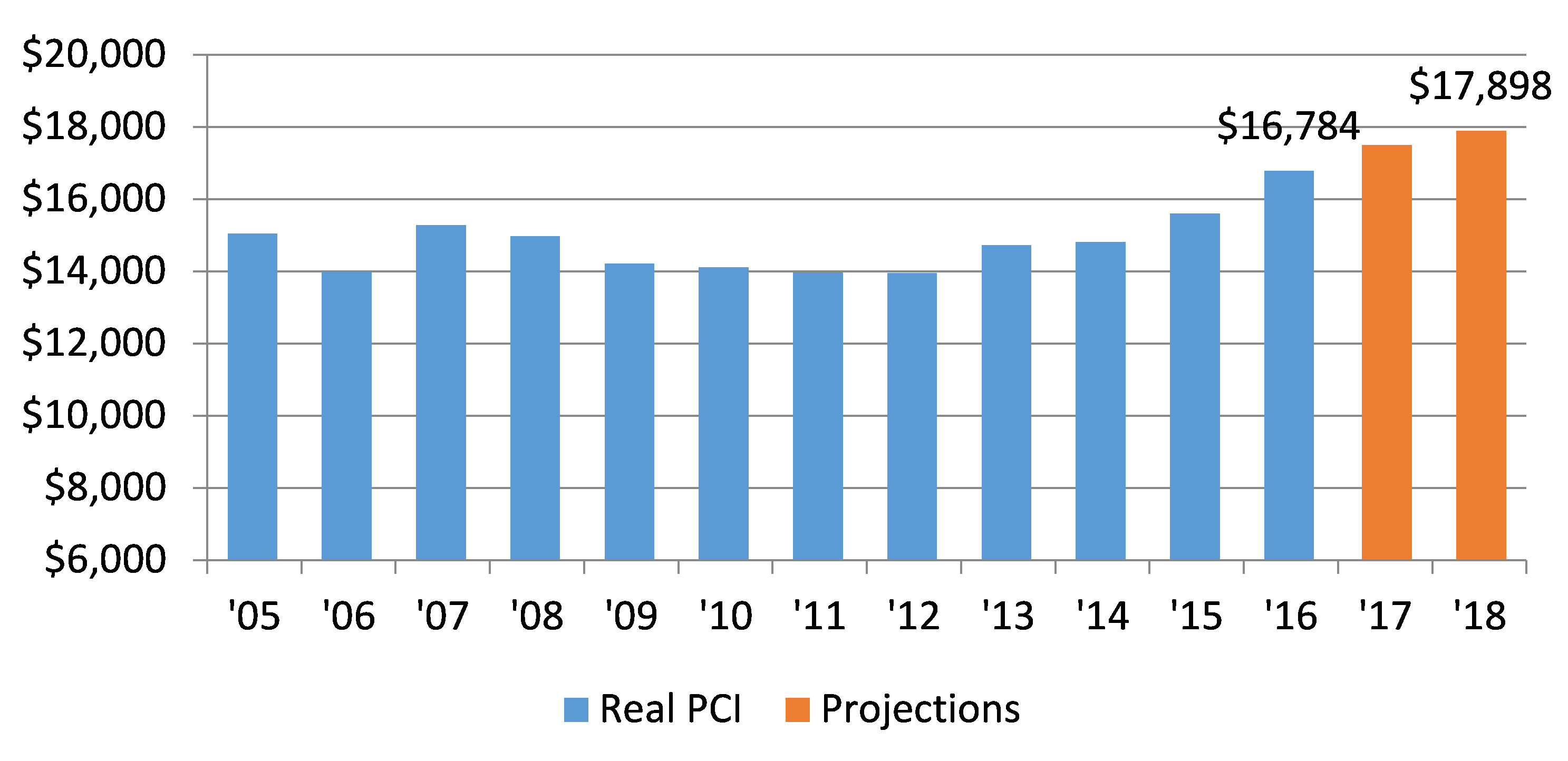

However, there was still some positive news for the city of Detroit based on the model’s predictions for 2017 and 2018 gross city product (GCP) and per capita income (PCI). Early estimates show real GCP with a growth rate of 1.5% in 2017 and a growth rate close to 1.0% in 2018. While these estimated growth rates for Detroit are considerably lower than the nation’s current growth rate of 2.9% (on a year-over-year basis), they are still an improvement from their long-run trends. In addition, the model estimates that real PCI for the city will reach $17,500 in 2017 and $17,898 in 2018 (chart 2). The 2018 real PCI estimate equates to a predicted increase of 6.6% between 2016 and 2018. While Detroit’s projected real PCI compares unfavorably with the nation’s ($44,731) and Michigan’s ($40,171) for 2017, the model’s projected rate of increase for real PCI between 2016 and 2018 is encouraging and is forecasted to contribute significantly to growth in city income tax revenues.

Chart 2. Real per capita income (city of Detroit - $2016)

The September DEAI release (covering the third quarter) will be posted on December 6, 2018. The release data and future release dates can be found on the DEAI page of the Federal Reserve Bank of Chicago website. A copy of the June DEAI release and a summary of each individual component’s contribution to the index can be found here.