Bullish on the Chicago Metropolitan Economy

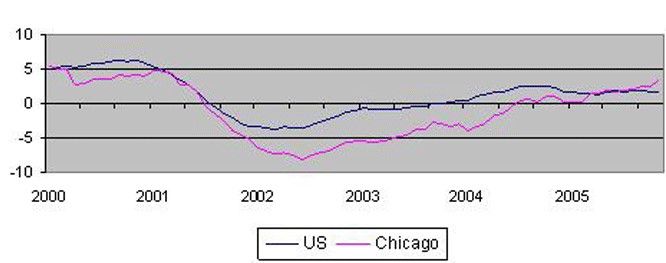

So far this decade, the Chicago metropolitan area’s economic performance has been disappointing. As in the surrounding Midwest, job declines during the recent recession were worse here than in the nation as a whole, and this area’s job growth during the expansion has since been lagging. With this lackluster performance, there has been a special disappointment for Chicagoans; the metropolitan region’s economy led the nation and most of the surrounding Midwest during the 1990s. During that time, there was a sense that Chicago’s economy had evolved beyond its role as regional business capital into one as national and global business center.

What is Chicago’s outlook for 2006? I am optimistic, although there are some defensible reasons for caution. For one, goods producing industries in the surrounding region may continue to pull down Chicago’s service sectors. Chicago’s outsized business and professional service sector continues to serve the Midwest, as do its travel, distribution, and business meeting services. But looking ahead, the Midwest economic outlook is clouded by the prospects for its automotive industry. Nationally, automotive sales growth is not expected to be robust this coming year, especially for the Big Three automakers and their suppliers that populate the eastern part of the Midwest region as well as northern Illinois and southern Wisconsin. Accordingly, this segment of the Midwest cannot be expected to propel Chicago’s service economy in 2006.

There is a second reason to be cautious: National economic growth is expected to moderate modestly in 2006. Since Chicago and the Midwest generally follow national trends—perhaps even follow them in a magnified fashion—there is some doubt that the metropolitan economy’s performance will gain momentum as the national economy moderates.

Still, despite these trends, and with a great deal of uncertainty, I offer some reasons for optimism for those of us who are inclined to be bullish about Chicago.

Not all of the surrounding Midwest manufacturing activity is moribund. The region’s capital goods industries, such as the machinery and equipment industry, are expanding. Looking forward, as national and global economic growth continues, U.S. and world demand for “new tools” and added production capacity tend to lift capital goods sectors. In turn, employment in manufacturing sectors, along with physical expansion of factories, tend to take place with a lag as excess capacity becomes squeezed.

More generally, recently reported data indicate that improvement in Chicago’s labor markets is already underway. During the autumn, Chicago’s year-over-year payroll job growth exceeded 1 percent for the first time since the year 2000, while the unemployment rates were down in the fourth quarter (according to preliminary reports).

Chicago’s vaunted business and professional services industry is once more reporting strong employment growth. Though it has much catching up to do from its poor performance in recent years, Chicago’s year-over-year job growth in this sector is exceeding the nation’s.

1. Professional, scientific, and technical services — year-over-year job growth, Jan. 1990-Nov 2005

In the travel and meeting arena, passenger arrivals to the Chicago area and hotel demand continue to recover. Plans for local conventions have edged up for 2006, as have planned developments of new hotel space.

Chicago’s financial exchanges also form a bright spot. Chicago’s importance as a financial center is defined by its exchanges and associated dealers and brokers. The Chicago exchanges can claim close to two-thirds of the volume of exchange-traded contracts in the U.S., and they once dominated global trading as well. However, in the 1990s, competing exchanges in Europe and Asia made strong gains in global market share, depressing the metropolitan area’s income and employment. But recently, Chicago’s two major exchanges, the Chicago Mercantile Exchange and the Chicago Board of Trade, have rebounded strongly. Not only are contract volumes up markedly, but both exchanges have gained market share on their global competitors over the past two years.

Chicago’s central area remains head and shoulders above all mid-continental contenders as a magnet for attracting younger skilled workers. Such workers are now greatly coveted for regional growth and development. A recent study of the 40 major U.S. metropolitan areas reported that Chicago’s downtown ranks sixth in the share of 25–34 year-olds, and Chicago experienced the third greatest percentage gains in this group (up 28%) during the last decade. Chicago’s downtown has the second highest share of residents with bachelor’s and advanced degrees with 67.6%, only behind Midtown Manhattan.

The Chicago area manufacturing sector was hit hard in the early years of the decade, especially in its own high tech hallmarks of IT and telecommunications manufacturers, such as Tellabs and the much larger Motorola. Thankfully, the region’s machinery and equipment sectors have bottomed out because national investment spending has recovered, growing at double-digit rates in 2004 and 2005. Such strong national demand for equipment and software is expected to continue into 2006.

In the high tech start-up arena, a flurry of activity took place in the Chicago area at the end of the last decade. Chicago’s timing was very unfortunate in this regard, coming in at the national peak of activity such that the Chicago region suffered greatly through the subsequent collapse. Now, however, the region’s technology businesses appear to be gathering steam once again for another push at realizing the metropolitan area’s full potential for technology start-ups. Positive developments include the Technology Development Fund of the Illinois Science and Technology Innovation Campus in Skokie, Illinois, and the research park expansion planned by the Illinois Institute of Technology. Tech commercialization policy initiatives are also moving forward. To name but a few of many, the Chicago Biomedical Consortium will be sharing new medical research equipment among Chicago area institutions, and the Midwest Research University Network will be cooperatively fostering start-ups out of Midwest universities and research labs.

The Chicago area economy has not been fortunate in recent years. Its economy is driven by its business service and headquarters functions; its role as distribution hub of the Midwest’s goods and materials; and its business travel/meeting activity. These sectors have been buffeted by weakness in the surrounding regional economy and, more globally, by weakness in manufacturing and business travel/meeting activity. Recent trends portend that Chicago’s performance will catch up with the nation’s somewhat in 2006.