Manufacturing jobs, increasingly undercounted

As I described in my August 2006 entry, government statistics tend to significantly undercount manufacturing activity. The undercounting occurs because manufacturing companies increasingly outsource service activities that they formerly performed “inhouse,” such as accounting, payroll, design, R&D, and others. These activities are increasingly attributed to service industry sectors in the national statistics rather than to manufacturing. For the Midwest, where manufacturing plays an important part in its economy, the undercounting can seriously mislead us as we try to understand the source of our livelihood.

But, more than services are being outsourced. Susan Houseman of the Upjohn Institute and her co-authors Matthew Dey and Anne Polivka of the Bureau of Labor Statistics find that U.S. manufacturing companies have also increasingly outsourced their “blue-collar” and production roles. They do this in an indirect way; they use temporary and leased workers (usually on-site) who are technically counted as employees of “employment services agencies.” Because these workers remain technically employees of the employment services agencies, the statistical counts of the work force of the companies that use employment services appear light, and declines in employment may be illusory, merely reflecting this outsourcing.

The number and size of employment services workers in the U.S. economy has grown rapidly over the past 16 years, easily outstripping overall payroll employment growth by a factor of six. And behind this growth, worker occupations in the employment services industry have been shifting toward industrial workers at the expense of office and administrative occupations. According to a survey by the American Staffing Association, 58 percent of customers engage temporary or contract workers to fill needs in industrial occupations.

In their research, Houseman and her co-authors draw on public databases to estimate the rapidly growing use of temporary and contract workers by manufacturing companies in the United States. They find that “the number of employment services workers assigned to manufacturing grew by about 1 million, from about 419,000 in 1989 to over 1.4 million in 2000.”

How does this practice affect the size of the U.S. manufacturing work force? Per the Houseman research, the outsized growth of temporary and contract workers by manufacturing companies implies that, rather than falling as reported, manufacturing employment actually grew by 1.4 percent in the U.S. between 1989 and 2000.

In researching why manufacturing firms use temporary workers, research by Yukako Ono and Daniel Sullivan finds that growing firms tend to take on temporary workers rather than permanent employees when they expect that their output may fall in the near future. By doing so, firms are spared the high costs of firing workers when they must curtail their production.

Because of such company behaviors, temporary or contract workers tend to be first hired and fired by companies during swings in national economic activity. During the 2001 recession, for example, the Houseman research finds that job declines in the manufacturing sector tended to be sharper than reported. Similarly, post-2001, manufacturers were more likely to hire workers from employment services agencies than to hire permanent workers, thereby understating recovery in manufacturing.

The miscounting also wreaks havoc with official productivity statistics. Since many measures of productivity are constructed as “output per worker,” an increasing tendency to undercount workers employed by manufacturers tends to overstate productivity growth in the manufacturing sector in comparison to many other industry sectors.

What are the regional differences in undercounting of manufacturing? We do not know this yet. However, if Midwest manufacturing companies behave like their national counterparts with respect to outsourcing of staff, Houseman’s findings for the nation imply that employment-services workers add 8.7 percent to direct-hire employment in Midwest manufacturing.

While we do not know that Midwest manufacturers outsource from employment service firms to the same extent as the nation, we do know that the employment services industry is very prominent in the Midwest. As measured by annual revenue, the nation’s top employment services corporation, Manpower, is headquartered in Milwaukee; the number two corporation is Kelly Services near Detroit.

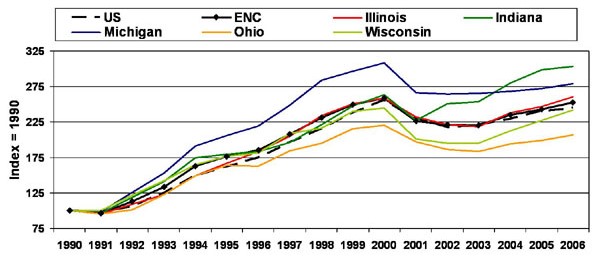

More broadly, the chart below tracks the growth in “employment services” employees for both the U.S. and the East North Central region since 1990. The top chart indicates that the growth in these outsourced jobs has grown equally rapidly in comparison to the nation. Indiana and Michigan, ranking number first and fourth nationally in relative manufacturing concentration in 2005, experienced especially strong growth in employment services.

1. Employment services index (NAICS 5613)

2. Employment services concentration index (NAICS 5613)

The second chart indicates that the Midwest’s concentration of employees of the employment services industry has grown in relation to the U.S. Michigan has led the way, with a concentration that is now more than one-third greater than the U.S.

In examining hiring patterns from the employment services sector, Susan Houseman and her co-researchers are on to an important avenue in assisting the nation and the regions to understand the composition of their economies.