OPEB … Oh No!

Beginning in the 2008 fiscal year, state and local governments with over $100 million in revenues will begin to report the accrued liability they face for funding non-pension post-employment benefits. In government parlance this is referred to as OPEB—other post-employment benefits—with the largest expense being comprised of retiree healthcare. Given that state and local governments have long provided healthcare benefits to both working and retired employees, why is the identification of this burden on the government’s books creating such consternation?

The answer to this question can be divided into three parts—government worker demographics, the size of the obligation and how government has traditionally paid for retiree healthcare, and the difficulty of restructuring employee benefits once granted.

Government worker demographics

Following the national trend of an aging population, a large share of the workforce of many state and local governments is approaching retirement eligibility. For example, the Illinois Comptroller reports that in FY2006, 65% of public employees in the state were either in their 40s or 50s, up from 41% in 1986. As these workers retire, the pressure on healthcare expenditures is skyrocketing. A report by the Pew Center on the States reports that in California, retiree health costs will rise from $4 billion in 2006 to $10 billion in 2012 and $27 billion in 2019.

The size of the OPEB liability and traditional method by which government has paid for OPEB costs.

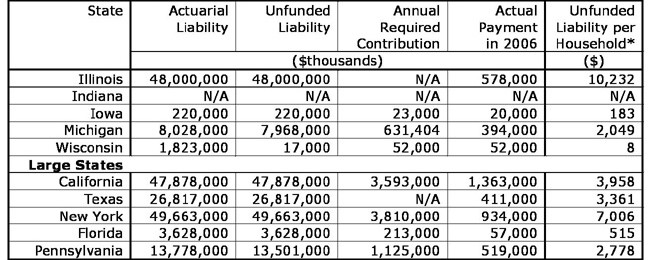

Prior to GASB 45, which requires governments to record their OPEB liabilities, most states simply met their retiree benefit costs on a pay as you go basis, where costs are paid out of current revenues. As such, few states actually put aside money to fund OPEB costs. While governments have saved to meet pension obligations, the Pew Center report estimates that 97% of the OPEB liability is currently unfunded. Estimates of the outstanding OPEB liability range from $370 billion (for a subset of governments that have reported their liability) to $1.5 trillion for the entire sector. The size of the unfunded balance differs considerably from state to state (see figure below).

1. OPEB funding levels in Seventh District and large states

N/A indicates not available.

* number of households are from the 2005 American Community Survey, authors calculations.

Difficulty in restructuring retiree healthcare.

In the private sector, a clear strategy for limiting a firm’s exposure to retiree healthcare costs has been to either eliminate or restructure healthcare benefits. A survey by the Kaiser Family Foundation reports that only one-third of large companies still offer retiree health insurance and that these companies have often reduced their premium contribution, leaving the retiree to shoulder a larger share of the tab. The state and local governments that have been the most active in addressing OPEB costs have taken on changes to health benefits, but this has led to several difficult bargaining sessions with public employee unions and frequent legal challenges.

Are there strategies for meeting OPEB obligations?

On March 12, the Chicago Fed and the Civic Federation will host a half-day conference on what governments are doing to meet their OPEB obligations.

Presentations will include officials from the Ohio Public Employees Retirement System (OPERS) and Oakland County, Michigan. Both of these governments have been seen as innovative leaders in identifying and developing a strategy to fund OPEB expenses. Ohio had accumulated over $11 billion in assets by FY2006 to meet OPEB obligations and has moved to restructure benefits as well by placing a cap on lifetime benefits and increasing co-payments and deductibles. While the state has an unfunded liability of $6.5 billion, it has shown fiscal discipline in consistently reducing its outstanding liability.

Oakland County has used a series of fiscal tools over the last 20 years to meet its OPEB liability. These have included:

- in 1985, creating a tiered vesting schedule for retirement;

- beginning in 1987, adopting a policy to fund the full actuarially required contribution (ARC) for retiree healthcare liabilities;

- in 1988, creating a self-insurance pool for active and retired employees;

- in 2000, creating a VEBA trust which allowed the County to create a tax-exempt investment plan; and

- closing the retiree health care plan and creating a defined contribution plan in 2006.

The March 12 Chicago Fed/Civic Federation program will also bring in a number of Illinois governments to discuss their evolving strategies for meeting OPEB costs. This will include representatives from the city of Aurora, the Metropolitan Water Reclamation District, and the Chicago Public Schools. Illinois governments face a particularly acute problem. The Civic Committee of the Chicago Commercial Club has estimated that the state’s unfunded OPEB liability is $48 billion. Given that the state also faces an unfunded pension liability of $40 billion, developing a strategy to meet this challenge will be exceedingly important. Discussions in Illinois have already examined such strategies as issuing OPEB bonds, creating irrevocable trust funds and selling assets to allow for one-shot infusions of capital to help meet OPEB obligations.

For many states, meeting the twin responsibilities of pension and OPEB funding will be dominant public finance issues for some time to come. Given the increasing pressures of funding elementary and secondary education, Medicaid, and deferred infrastructure costs, creating a strategy for managing labor related benefits costs will be critical to the health of the state and local sector.