State Government Fiscal Performance in the Seventh Federal Reserve District: How bad is it? How bad will it be?

Throughout the nation, state governments have been crying uncle as revenues have hit a tailspin and expenses for Medicaid and public welfare have accelerated. Estimates of the cumulative deficit facing state governments exceed $100 billion, and the National Association of State Budget Officers is calling this the worst fiscal situation facing the states since World War II. Not surprisingly, states in the Midwest are feeling stress. Here I provide an update on current fiscal issues in Seventh District states (Illinois, Indiana, Iowa, Michigan, and Wisconsin), and I describe the impact on the region of the federal stimulus package (American Recovery and Reinvestment Plan).

Illinois

Illinois’s new governor, Pat Quinn, presented his budget on March 18. In response to current estimates of the state budget deficit ranging from $9 billion to $11 billion, the proposal includes a series of tax changes. Foremost is an increase in the state income tax rate for both individuals and businesses. The personal income tax rate would increase from a flat 3% to a flat 4.5% and would include an increase in the standard deduction from $2,000 to $6,000. The corporate tax rate would increase from 4.8% to 7.2%. The changes would raise about $3.1 billion in revenues. The governor also proposed increases in fees for several licenses, along with a cigarette tax increase.

On the spending side, education expenditures would receive a modest increase. Transportation funding would see a substantial gain through the multiyear, $26 billion “Illinois Jobs Now” program. Much of the funding would come from increases in driver’s license and auto registration fees.

The depth of the state’s problems has been highlighted by several recent reports. The comptroller’s report estimates the current backlog of unpaid bills at $4.5 billion. A March 2 report by the Civic Committee of The Commercial Club of Chicago found that total liabilities (including those for state workers’ pensions and health care) now exceed $116 billion, or $10,000 per resident. The report noted that these liabilities are a chronic problem for the state—that is, they form a structural deficit, which was caused by prior budget actions. This structural deficit is now being exacerbated by the recession.

Indiana

The state’s economy has had one of the sharper reversals of fortune with the December unemployment rate rising to 9.2%, second worst in the Seventh District. In response, Governor Mitch Daniels has proposed a two-year budget of $28.3 billion, which includes an 8% cut for all state agencies, a 4% reduction in higher education spending, and no increase in K–12 education. The state also has the luxury of a $1.3 billion budget reserve, although the governor’s proposal does not draw on any of these funds.

On February 20, the state’s Democratic-controlled House of Representatives passed a one-year $14.5 billion plan. The plan received no Republican support and is likely to be revised in the state’s Republican-controlled Senate. A major sticking point is that the House’s plan requires spending $200 million of the state budget reserve as well as using $540 million in stimulus money for Medicaid. The bill also allows for some creative accounting by allowing schools to pay for utility bills out of capital funds. There is also a debate about which capital projects to support, with the Democrats favoring several higher education projects and the Republicans favoring prison expansion.

A final side issue has been a proposal to abandon the biennial budget in favor of a one-year budget. Proponents suggest that this would be more prudent in times of fiscal uncertainty. The governor opposes this, believing that more fiscal discipline is required in adopting a biennial budget.

Iowa

In the face of faltering revenues, Iowa legislators have been trimming Governor Chet Culver’s proposed $6.2 billion budget for fiscal year 2009–10. So far $133 million in cuts have been approved by the legislature. In addition it has been proposed that $100 million from the state’s reserve funds be spent in the next budget. The governor has also cut $30 million from the current budget to close a smaller current budget gap. The legislature is also investigating revenue-raising options including eliminating corporate tax breaks that are not designed to create jobs. There is also a proposal to create a middle-class tax relief program, which would be funded by ending federal deductibility in state income taxes.

On the positive side, a member of the state’s Revenue Estimating Conference suggested that the revised revenue projections for the state appear to be holding steady. The conference makes its next formal projection on March 20.

Finally, Iowa anticipates receiving $1.9 billion in stimulus funds from the federal government.

Michigan

Michigan—with the highest unemployment rate in the nation (11.6%)—continues to struggle. The state has faced a budget deficit every year since 2001. This year will be no exception. The estimated deficit for the next budget (beginning on October 1) is $1.4 billion. Governor Jennifer Granholm’s proposed budget will cut $670 million and calls for 1,500 state employee layoffs. The state is also planning on using $464 million in federal stimulus funds to help with Medicaid payments. The state’s budget director has been frank in stating that Michigan has two deficits—a structural deficit that has been ongoing since 2001 and a cyclical deficit that is compounding problems. Michigan intends to spend $313 million of the federal stimulus money during the current fiscal year.

Wisconsin

Governor Jim Doyle unveiled his plan to close an estimated $5.9 billion budget gap for the next biennium. On the revenue side, the governor proposed $1.4 billion in new taxes, including a new higher income tax bracket for families earning more than $300,000, an 85 cent increase in the cigarette tax, a new tax on multistate companies, a tax on oil companies’ windfall profits, and a sales tax on Internet downloads. Most of the tax package was signed into law on February 18. The budget also assumes $2 billion in federal stimulus money.

On the spending side, $2.2 billion is expected to come from reductions to state agency budgets and $245 million from “budget efficiencies.” No layoffs are included in the budget. The proposed budget would have Wisconsin spending in 2011 what it spends in 2009.

What will be the impact of the federal stimulus money?

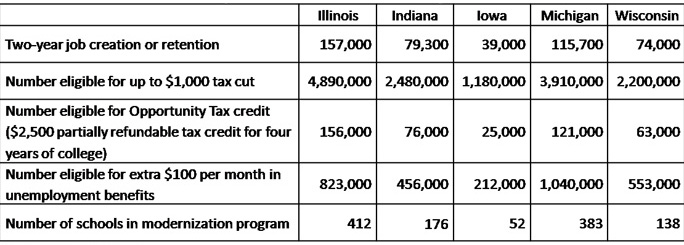

Seventh District states would be facing even tougher times if it had not been for the passage of the federal stimulus package. With money flowing into transportation, education, and Medicaid, the states have been able to avoid raising revenues through taxes (and other means) and cutting expenditures. On the broadest level, the following two charts illustrate the estimated multiyear impacts of the federal stimulus package’s major proposals on Seventh District states.

1. White House estimates of state impacts from the American Recovery and Reinvestment plan

2. Estimates of funding levels for major stimulus programs

Source: Center for Budget and Policy Priorities.

Relative to other federal aid efforts in past recessions, this package is notable for bolstering education spending. Previous programs tended to target Medicaid, unemployment insurance, and infrastructure. This package adds education to those other areas.

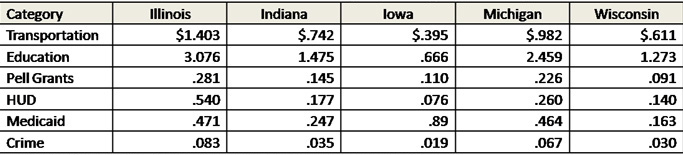

There are also estimates available for stimulus funds that have already been allotted as of March 12.

3. Current stimulus allocations in Seventh District by major category (in billions)

Source: Wall Street Journal

4. Current stimulus allocations per capita in the Seventh District by major category

Concluding thoughts

Despite federal stimulus money, state governments in the Seventh District are under significant stress. In some cases, sharp downturns in the local economy are partially to blame (e.g., Michigan and Indiana), but structural imbalances in state fiscal systems are in many cases compounding cyclical declines in the economy. The issues concerning restructuring state revenues in the face of current economic conditions will be the topic of a special program at the Chicago Fed on May 12. Click the link for more information on the conference Assessing the State and Local Sector: Where Will the Money Come From?—sponsored by the Federal Reserve Bank of Chicago, National Association of State Budget Officers, and National Tax Association.