Hog Butchers and Mad Men?

Some local policy leaders remain optimistic about the growth prospects for manufacturing in the Chicago area. For example, a recent development strategy from the Mayor’s office and World Business Chicago proclaims that “Chicago can preserve its competitiveness in manufacturing, a key component of the region’s economy, by capitalizing on the shift into high-tech products and processes underway in the manufacturing sector nationwide.”1 Such optimism follows a recent rebound in manufacturing employment in the Chicago area, which has added 11,000 jobs since 2009. And against a broader backdrop, the five-state Midwest region surrounding Chicago, ranging from Ohio west to Wisconsin and Illinois, has added 260,000 manufacturing jobs over the same period.

Looking beyond recent growth trends for signs of resurgence, falling energy prices are expected to assist particular manufacturing sectors such as chemicals and plastics. More generally, a possible re-shoring of manufacturing activity is expected to unfold due to rising production costs in low-cost Asian countries, along with mounting concerns from some manufacturers about intermittent disruptions to extensive Asian-American supply chains.

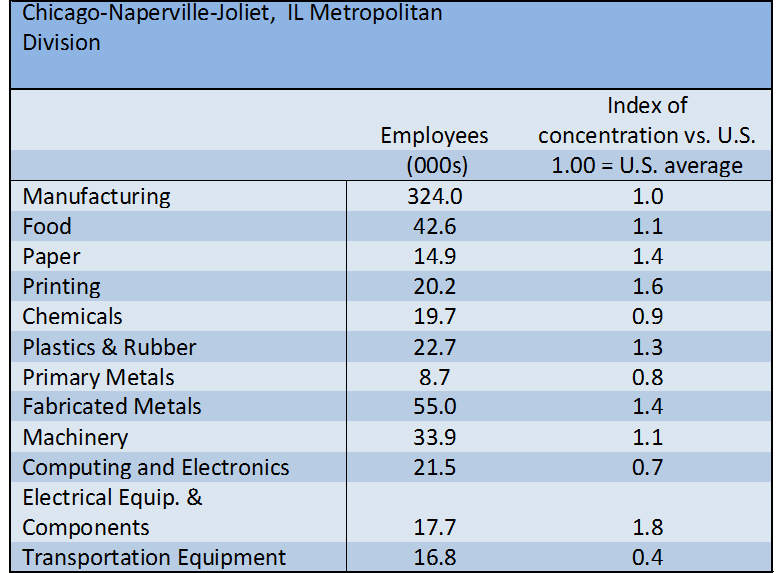

But the fact that manufacturing remains a key part of the regional economy lies at the core of strategies to bolster the sector. The Chicago metropolitan statistical area (MSA) remains a bulwark of manufacturing in the U.S. economy. While the manufacturing share of Chicago’s economy is close to the national average, Chicago’s size vaults its manufacturing rank to third among U.S. metropolitan areas in manufacturing output. And as measured by employment, Chicago ranks first in the following subsectors: Electrical Equipment, Fabricated Metal Products, Food, and Plastics & Rubber. The table below indicates those subsectors in which employment is more concentrated (or less) in Chicago than in the U.S. overall.

Table 1. Establishment survey: All employees, 2012

Still, we can see from the chart below that workers directly employed in manufacturing in Chicago have fallen dramatically as a share of the work force. In 1969, 30 percent of workers were employed in manufacturing in the Chicago area, well above the national level of 23 percent. By 2012, however, Chicago’s manufacturing job prominence had fallen to near-parity with the nation—to around 7 or 8 percent.

Chart 1. Manufacturing share of total jobs - U.S. vs Chicago MSA

The absolute number of manufacturing workers in the Chicago MSA has also fallen—by 432,000 since 1947, which represents more than half of the 1947 employment size.

Much of the employment loss is due to productivity gains in the manufacturing sector rather than to falling output. For example, as estimated by the U.S. Department of Commerce (BEA), real (inflation-adjusted) manufacturing output in the Chicago region rose by 10 percent from 2001 to 2011, even while employment fell by 30 percent (180 thousand).2

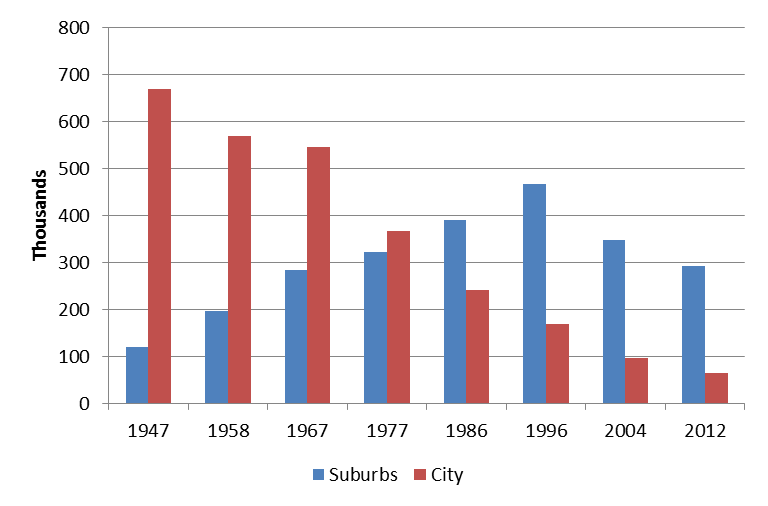

The location of Chicago’s manufacturing employment has shifted significantly toward the suburbs. From a city peak of 668,000 in 1947, manufacturing employment had fallen to just 65,000 by 2012, representing just 6 percent of the city’s total payroll employment across all sectors.

While suburban manufacturing jobs have also been falling (since the mid-1990s), in 2012 there were more than four suburban manufacturing jobs for every one that remained in the city.

Chart 2. Payroll manufacturing jobs, city and Chicago SMSA

Given such dramatic and ongoing declines in the manufacturing work force, it may be puzzling to find that economic development plans and strategies continue to focus on the sector’s growth prospects. In addition to the optimism surrounding reshoring prospects for the manufacturing sector itself, the broader cluster of economic activity that is linked to manufacturing may also promote economic growth. Manufacturing establishments purchase many services from local companies, including management consulting, R&D, advertising, accounting, and transportation and logistics. Manufacturing establishments have tended to increase their use of these services over time, as well as tending to purchase the services from outside companies rather than producing them in-house.

The Chicago area economy specializes in such service industries, which are in turn sold to manufacturing clients in town, as well as in the surrounding Great Lakes region and further afield. The city of Chicago’s manufacturing interests, then, are evident in that Chicago’s central area, “The Loop,” remains a thriving job center of these related service sectors. Meanwhile, the outlying city neighborhoods continue to directly depend on manufacturing for jobs. According to the U.S. Census Bureau, of the manufacturing jobs that remain in the city, 62 percent of the workers also live in the city. Of the manufacturing jobs that are located in Chicago’s suburbs, only 25 percent are held by workers who live in the city. However, since there are many more manufacturing jobs in the suburbs, this means that there are twice as many manufacturing job commuters travelling from city to suburb as there are from suburbs to city.

The Chicago area, and even the central city itself, then, are motivated in several ways to preserve and build on the local and regional manufacturing base, even in the face of stark and ongoing declines in the number of paychecks that are directly generated from production activities. A policy focus on so-called advanced manufacturing is one such direction—one that may require the training of a work force with advanced skills. As documented in the recent report by World Business Chicago, a number of local efforts< are underway to build a local work force with needed skills.3 Another strategic policy focus for Chicago is transportation—many manufacturing operations continue to require intensive transport of materials and intermediate goods, and efforts to maintain and enhance surface transportation infrastructure will also benefit the economy. Finally, all manufacturing—advanced or not—will likely need to stay abreast of ever-rising standards in process and product technology in order to compete in the global marketplace.

Footnotes

1 See World Business Chicago, "Plan for Economic Growth and Jobs", pg. 36. See also the 2013 report from Cook County, Partnering for Prosperity: An Economic Growth Action Agenda for Cook County, which puts forward a strategy of “Increase the productivity of Cook County’s manufacturing clusters,” p. 12.

2 The BEA reports GRP on a broad geography; the Chicago MSA is defined to include Cook County, DeKalb County, DuPage County, Grundy County, Kane County, Kendall County, McHenry County, and Will County, Illinois.

3 Op cit, pp. 36-37.