Mexico’s Growing Role in the North American Auto Industry

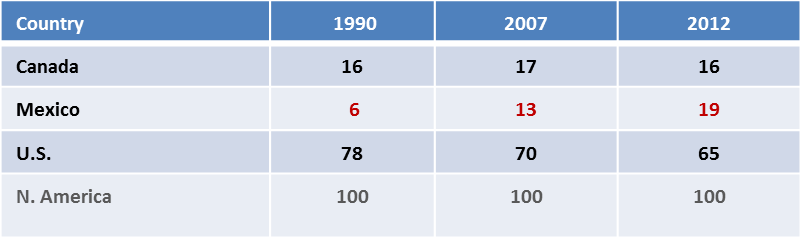

Mexico’s auto industry has experienced tremendous growth since the mid-1980s. Last year, 19% of all light vehicles produced in North America originated in Mexico (see table 1). That is up sharply from 20 years ago and puts Mexico ahead of Canada in terms of the number of vehicles produced.

Table 1: Distribution of light vehicle production in North America

On May 30, a panel of distinguished experts gathered at an event hosted by the Detroit branch of the Chicago Fed to discuss factors behind Mexico’s growth as a vehicle producer.

Most of the presentations are available here.

Also, see a recent Chicago Fed Letter on the same topic.

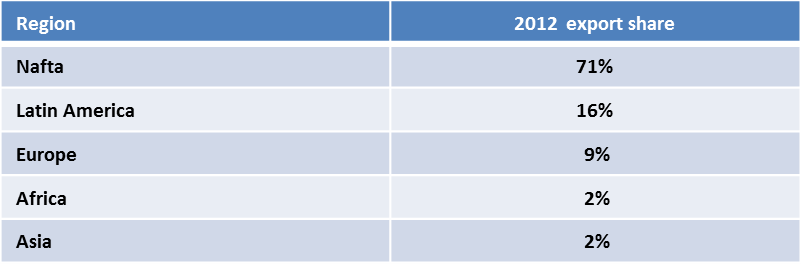

Mexico has a long history of vehicle production; by the late-1930s Ford, GM, and Chrysler were producing vehicles in the country. Over the years, the Mexican auto industry was shaped by economic development policies put in place by the Mexican government. Starting in the mid-1960s, a policy of import substitution favored production of vehicles and parts within Mexico. A number of years later, the policy focus changed to export promotion, which encouraged Mexican producers to seek international markets for their products. In 1995, Mexico, the U.S., and Canada signed the North American Free Trade Agreement (Nafta). It established a framework and set out a timetable for boosting trade among the three countries. In the process, Mexico has become a very attractive export platform for North, Central, and South America (see table 2). In fact, the country has negotiated more than 40 free trade agreements, more than any other North American country. In addition, Mexico has benefited from a general improvement in its manufacturing competitiveness during the past few years. Its productivity-adjusted wages are the lowest among major manufacturing countries, it is an energy rich country, and it has a history of manufacturing (35% of the country’s GDP is represented by manufacturing).

Table 2: Light vehicle exports from Mexico by destination region

In that context, it comes as no surprise that last year Mexico exported 83% of its light vehicle production. In fact, growing exports explain nearly all of the growth in Mexican light vehicle production during the last 30 years or so. Mexican light vehicle production is up by 2.4 million units since 1985. During the same time, its light vehicle exports rose by 2.3 million units. Lately it has been foreign-headquartered vehicle producers, such as Nissan, VW, Mazda, and Honda that have announced expansions of their Mexican production operations, continuing the upward trend of Mexican light vehicle exports.

Not as visible but at least as important is the ongoing growth of motor vehicle parts suppliers in Mexico. Companies large and small continue to invest in order to keep up with growing demand for parts in vehicle assembly in Mexico, as well as to feed the supply chain north of the border. Supply chain linkages, however, extend in both directions. Due to the integrated nature of the North American auto industry, growth in Mexico’s vehicle assembly has resulted in growing U.S. motor vehicle parts exports to our neighbor to the south.