Economic Development in Detroit

Detroit is the focus of this blog examining economic development issues in the five largest cities in the Chicago Fed’s District. (For a complete profile of all five cities. see Industrial clusters and economic development in the Seventh District’s largest cities). Relative to the other large cities, Detroit faces some special challenges. Home to the domestic auto industry, Detroit grew and flourished until increased foreign auto competition began to erode the dominant position of Detroit-based auto producers. With a challenged industrial base and increasing racial strife culminating in the 1967 riots, Detroit began a long process of population out-migration. The city’s population fell from a high of 1.8 million in 1950 to the most recent estimate of just under 700,000. This combination of industrial and population decline severely challenged the fiscal condition of the city. The city’s large geographic footprint (140 square miles) and declining tax base made it increasingly difficult to provide city services, culminating in a 2013 Chapter 9 bankruptcy filing, which is still being resolved. Not surprisingly, the city’s immediate economic development plans aim to stabilize its population, restore government services, and attract new businesses that should find its relatively low property prices attractive.

Detroit’s Industry Structure

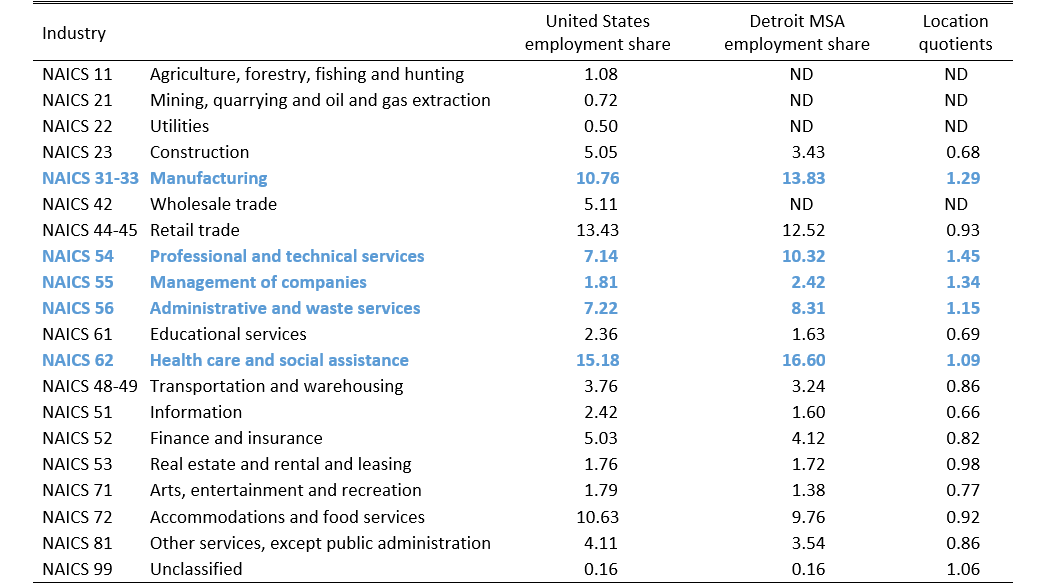

Figure 1 shows Detroit’s employment structure and industry concentrations (location quotients or LQs) relative to the U.S. Detroit has five industries with above U.S. average employment shares and location quotients above 1. These industries are manufacturing (LQ of 1.29 or 29% above the U.S. average), professional and technical services (LQ 1.45), management of companies (LQ of 1.34), administrative and waste services (1.15), and health care and social assistance (1.09). This reflects recent efforts by the city to develop business and professional services in the downtown business district, which has led to investments by Quicken Loans and Compuware.

Table 1. Detroit MSA employment shares and location quotients, 2012

Source: U.S. Bureau of Labor Statistics

Economic Development Strategy in Detroit

In December 2012, the Detroit Strategic Framework Plan was released.1 The long-term planning aspect of the report was produced by a mayor-appointed, 12-member steering committee drawn from the business, community, faith-based, government, and philanthropic communities. The Detroit Economic Growth Corporation managed the project. The plan is designed to recognize core assets that the city has and to examine ways to leverage those assets to restore and stabilize the Detroit economy. The plan creates four benchmark goals for the city to achieve by 2030.

- Stabilize the residential population at between 600,000 and 800,000.

- Increase the number of jobs available per city resident from the current level of 27 per 100 people to 50 per 100 people.

- Enhance the regional transportation network to better integrate Detroit and the rest of the MSA and develop land-reuse plans that will repurpose existing vacant tracks for new types of development.

- Establish an ongoing framework for civic involvement.

The plan also has specific economic development elements that are captured by five implementation strategies.

- Emphasize support for four key sectors with highest potential growth—education and medical, industrial, digital/creative, and local entrepreneurship. To support growth in these sectors, the plan calls for aligning private and civic investments. This includes having work force development strategies specific to these four industry clusters.

- Use a place-based strategy for growth. In practice, this would target “employment districts” where resources would be channeled to promote growth. The plan establishes seven of these districts and assumes these geographic areas have the greatest ability to bring job growth to scale. This would be complimented by growth in industrial business improvement districts and developing capacity for green business.

- Encourage local entrepreneurship and minority business participation. The strategy here is to develop local business clusters that serve the Detroit market—for example, using local suppliers to feed existing businesses as well as seeking to diversify the economic base of the city. This strategy assumes the provision of low-cost shared space and improvements in other local services that are currently being underprovided in Detroit.

- Improve skills and support education reform. Much of this focuses on improving existing work force training by linking it more closely to the private sector and aligning training to local industry needs. It also calls for better integrating work force development with transportation, encourages hiring of Detroit natives, and calls for a study designed to improve city-wide graduation rates.

- Review land regulations, transactions, and environmental actions. This is a broad land-reuse program that focuses on land banking for industrial and commercial property as well as improving development outcomes by speeding permitting in employment districts and identifying alternative sources of capital for development.

It is clear that much of Detroit’s plan emphasizes stabilizing the current economic base as a necessary step to attract new investment. The plan also emphasizes the creation of home-grown businesses, which is likely necessary to fill in declines in retail and other services found in many Detroit neighborhoods.

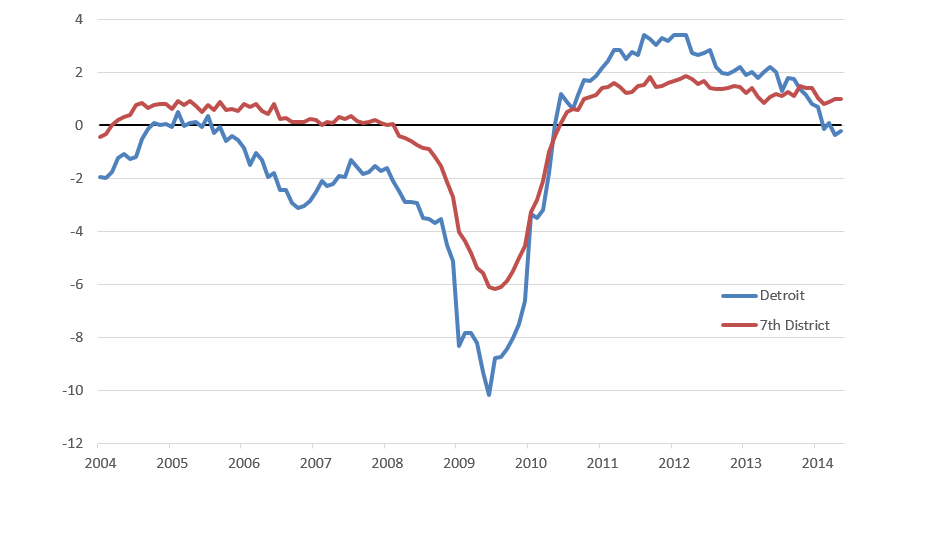

If we look at Detroit’s recent history of employment growth over the recent business cycle (figure 2), we see that for almost the entire 2000s, Detroit had negative year-over-year employment growth and performed significantly below the average for the Seventh District. However, emerging from the Great Recession, Detroit’s employment growth is above the Seventh District average up until late 2013 and early 2014, which happens to coincide with the bankruptcy filing. The rise coming out of the recession likely reflects the rebound in the domestic auto industry, which still exerts a heavy influence on Detroit’s economy.

Figure 1. Employment growth: Detroit and Seventh District (percent change year-over-year)