The small business ecosystem in the greater Chicagoland area includes over 130 business service organizations (BSOs) that offer advice, training, and workshops to entrepreneurs at various stages of business development. Small businesses make an important contribution to the U.S. economy, and they are often up against tremendous odds to survive. BSOs are a good source for identifying the concerns of the small businesses that they work with, and as the economic and policy environment evolves, BSOs themselves are facing a growing number of issues.

This article highlights perspectives shared in a session that the Chicago Fed’s community development team facilitated at the Capacity Building for Capacity Builders workshop in Chicago in late May 2025. This workshop, hosted by the Quinlan School of Business at Loyola University, brought together staff from BSOs and other members of the Chicago small business ecosystem to ask about current sources of uncertainty affecting both their organizations and the businesses they serve. For their own BSOs, participants focused on potential cuts in public sector support and how to manage an organization in an uncertain environment, one in which information about government funding sometimes evolves very quickly. For their small business clients, participants focused on the uncertainty about government policy changes and their potential near-term economic effects, inflation, new regulations, tariffs, the quick pace of technological advancements, and how changes in social service programs might affect their clients’ employees and customers.

What we heard

Our session featured approximately 50 leaders from small business service organizations, county and city government agencies, and funders. During this session, we asked participants to answer three polling questions regarding 1) sources of uncertainty facing BSOs, 2) sources of uncertainty facing their clients, and 3) how BSOs are addressing these uncertainties. These prompts were guided by feedback we received from participants in response to preregistration questions about the challenges facing their small business clients, as well as the BSO services that most contribute to the success of their clients, which we present in figures 1 and 2 later. The subsequent summary of our session at the workshop is organized around the responses to the live polling questions we received during it.

Question 1: What is creating uncertainty for your organization now?

Participants highlighted two main issues generating current uncertainty for BSOs—reduced funding and communication challenges around funding.

Reduced funding

The announcement of planned funding cuts to the Minority Business Development Agency (MBDA), to the Small Business Administration (SBA), to the Community Development Financial Institutions (CDFI) Fund, and to other government programs that support small businesses have heightened concerns that current BSO services may be curtailed, that BSO staff will look for jobs with greater stability elsewhere, and that demand for BSO services will decline. BSOs in Chicago typically rely on philanthropic and public sector money to provide training and other supports for entrepreneurs. That the proposed cuts to longstanding small business programs coincide with the wind-down of Covid-era American Rescue Plan Act (ARPA) funds used in part for grants to small businesses compounds the uncertainty.1 Also compounding the uncertainty is that organizations with government funding often receive it as reimbursements for work done in previous quarters (or even the previous fiscal year). That means that some BSOs already spent money based on the expectation they would be paid back. The BSOs that describe themselves as “hyper-focused” on certain populations, such as women- and minority-owned businesses, spoke of the potential for additional revenue disruptions, as well as fewer clients, given that some of these intermediaries run certification programs to help certified businesses bid on government contracts, whose numbers are set to shrink under current government proposals.

Quickly evolving information about funding

Information about potential future funding levels has sometimes changed quickly, creating communication challenges that can exacerbate underlying uncertainty and affect service delivery. Much of BSO funding comes from “someone who gets funding from someone who gets funding from someone,” according to one session participant. As BSOs face uncertainties about government funding, so do the state or local public sector entities that deliver these funds. According to several participants, the county or city office that manages that funding may want to provide updates about its availability or the amounts to be distributed, but the fast-moving environment discourages that office from announcing changes. The desire to avoid sharing information that may need to be retracted has a knock-on effect at all levels of the BSO organization—and to the clients they serve. Because “heads [of BSOs] don’t want to put something out and then come back to say ‘never mind,’” shared one participant, staff often feel they are not getting clear information from leadership, noting that “for us there are conflicting strategies and a lack of communication.” The effect is felt down the chain, as another participant noted, “for every issue the funder has, that translates to the organizations receiving the funding, which translates to the community members receiving the services.”

Question 2: What is creating uncertainty for the small businesses you serve?

Participants discussed concerns such as clients’ hesitancy to invest in their businesses, clients’ difficulty in responding to rising costs, and challenges to existing marketing strategies and revenue models as a result of new technologies and a dynamic policy environment.

Hesitancy to invest

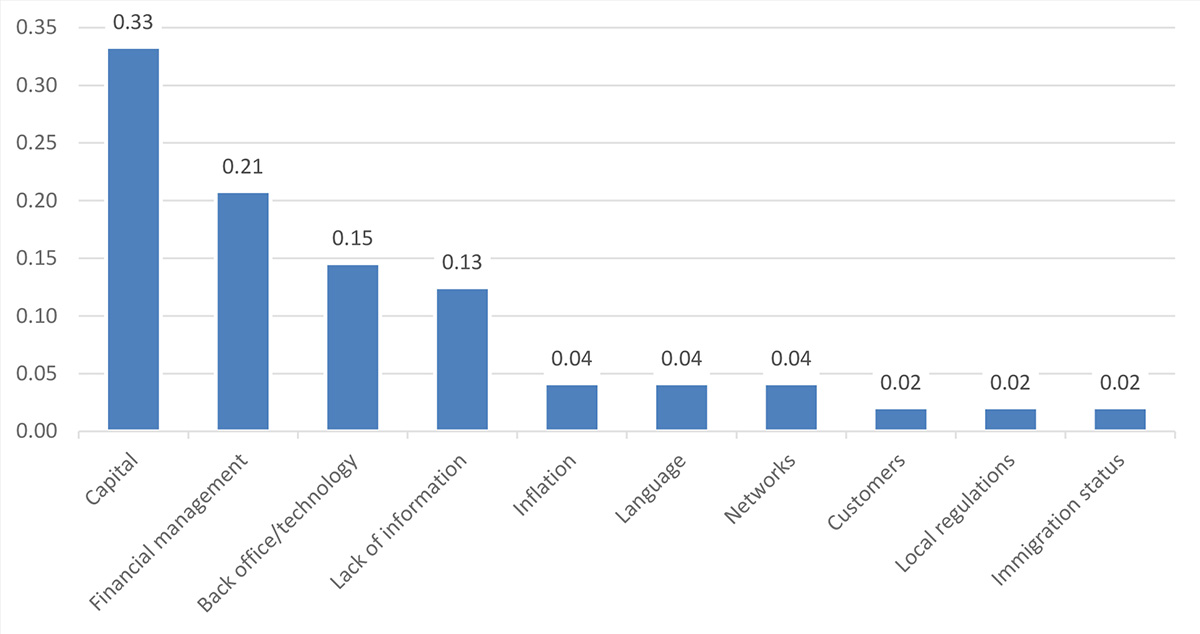

Participants reported that uncertainty about economic conditions has led some small businesses to hesitate on investing for growth, if not develop an outright aversion to debt.2 Access to capital is a top priority for small businesses, and workshop participants underscored this point when responding to a preregistration question that capital was the main challenge that stood in the way of their clients’ ability to grow their businesses (see figure 1). However, among participants in our session, the discussion focused as much on the demand for capital as on the supply. According to participants, many “businesses are fearful about money,” in general and particularly in a time of when they perceive economic conditions to be uncertain. So, nowadays, clients of BSOs are more likely to hold on to their money, instead of making investments.

1. What are the main challenges for businesses that BSOs serve?

Rising costs: Inflation, new regulations, and tariffs

Inflation, new regulations, and tariffs are other sources of uncertainty for many small businesses.3 At the workshop, BSO leaders highlighted food sector businesses as being particularly affected not only by food price inflation, but also by higher wages and new city regulations regarding paid time off for employees. BSO representatives also identified housing-related costs as creating greater hardship for home-based businesses. Participants shared anecdotes of business owners having to leave their residences—and their communities—because they could no longer afford to live there. Participants recognized it is hard for small businesses to respond to rising costs given the general complexity of making pricing decisions and the sensitivity of customers to price changes. As one BSO staff member commented, “We saw a longtime restaurant close because they were trying not to raise prices,” as would-be customers were increasingly staying home and cooking meals. Questions about how much tariffs will affect input costs make pricing decisions more complex. BSO clients vary in the extent to which they rely on overseas suppliers. Still, uncertainty about tariff levels—and to which goods they will apply and when—has made it more difficult to project whether businesses will have to pay more for their inputs in the future, determine whether they should look to diversify their suppliers, or figure out whether they should seek substitute inputs that may be inferior but cost less. As one participant observed, some business owners report that they plan to switch to just-in-time inventories in response to the growing uncertainty.

New technology

Participants discussed evidence that innovations, such as those based on advances in artificial intelligence (AI), create advantages for businesses that adopt it quickly and effectively. They also talked about how AI adoption (or the lack thereof) could affect the survival of small businesses. Participants reported wide variation in how comfortable and knowledgeable small business owners are in deploying new technologies. As an example, they noted how it has become more difficult for longtime mom and pop outfits to compete with firms that have built a marketing strategy around social media. Whereas businesses might have relied on street traffic to obtain new customers in the past, now buyers decide (at least in part) on where to shop through social media reviews and influencers. Some participants shared deep concerns that businesses less agile at adopting new technologies will fall further behind.

Potential reductions in government contracts for women- and minority-owned enterprises

Potential cuts in government contracts are creating uncertainty for some women- and minority-owned businesses, in particular.4 Every year, the U.S. government purchases billions of dollars of goods and services through federal contracts. While women- and minority-owned small businesses receive a modest fraction of federal contract dollars, some of these enterprises have become successful by bidding on (and winning) government contracts.

How changes to social service programs could affect small business employees and customers

Even if a small business is well positioned to navigate the challenges that we’ve covered to this point, multiple evolving government policies could affect its employee pool and customer base, creating additional uncertainty. This is especially true in the neighborhoods that are home to many of the BSOs represented at the workshop. Participants shared that businesses are unsure about how potential changes in funding for social service programs could affect labor markets and consumers. In other neighborhoods, immigration concerns are leaving some businesses without employees or with a reduced pool of available labor. Moreover, as one participant observed, “diverse groups of businesses are beginning to see the effects of lower foot traffic” in their neighborhoods.

Question 3: How are you addressing the uncertainty for your organizations and your communities to deliver success?

Respondents shared the steps they are taking to navigate the uncertainties facing their business service organizations, focusing on strengthening their integration into the small business ecosystem and redoubling their efforts to connect clients with trustworthy resources of information and financial support.

Strengthening integration into the small business ecosystem

We heard a range of answers on what types of actions BSOs could take to adapt to the current environment. One general strategy that emerged was for BSOs to leverage the small business ecosystem to counterbalance potential revenue reductions. Participants discussed focusing their operations on core strengths and referring clients to other intermediaries that have niche specializations. As one BSO representative noted, “We want to be everything to everybody, but maybe this is a chance for us to consider more deeply what is our sweet spot.” Likewise, BSO staff members talked about identifying new revenue streams, either by offering more opportunities for fee-for-service programs or by creating for-profit elements within their nonprofit organizations. For example, if a BSO has staff with bookkeeping skills, they could sell this service to business owners who need quality, affordable back-office support.

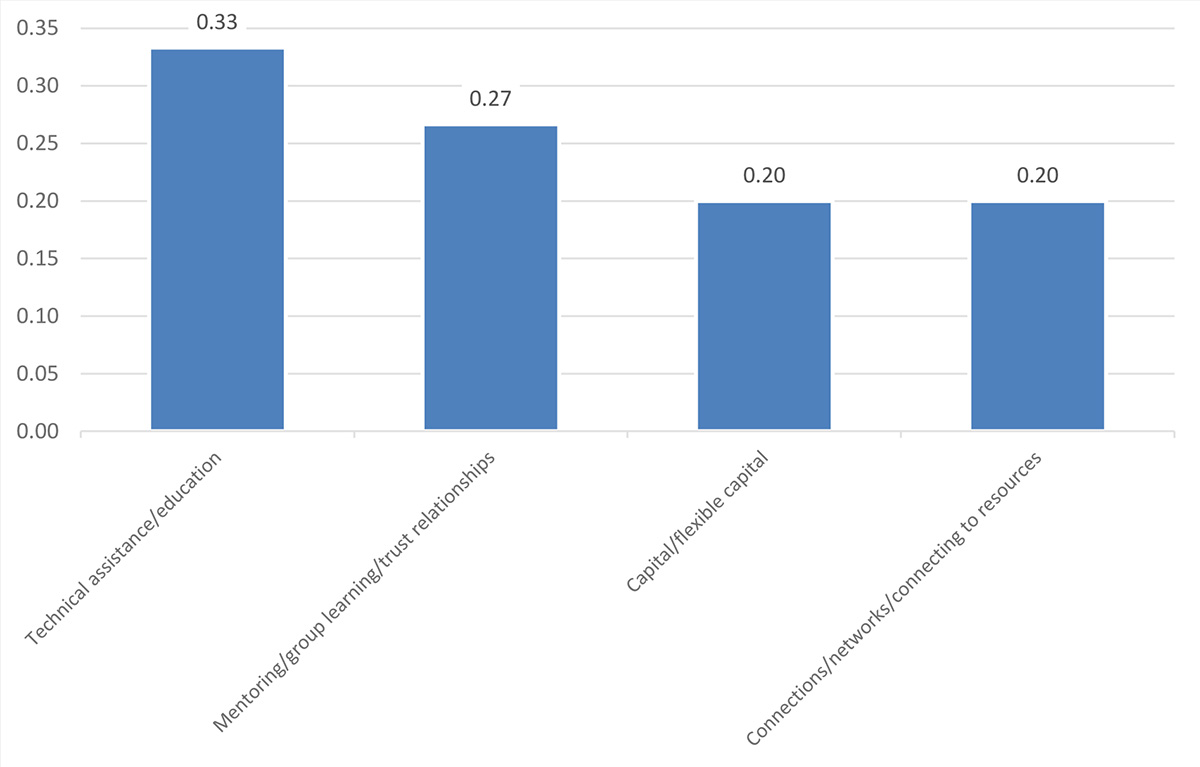

Developing expertise on the policy environment

A second general strategy that emerged was for BSOs to embrace their role as trusted sources of information for small business clients. As participants explained, being trustworthy is what assures clients that the BSO will connect them with reliable sources of information that can help grow their bottom lines and expand their operations. Indeed, in response to a preregistration question about what BSO service contributes most to their clients’ success, many underscored the importance of BSOs facilitating connections between small businesses and the informational and financial resources they need (as indicated by all the bars in figure 2). Now, an additional component of being a trusted source for small businesses is distilling the noise and not spreading wrong information or misstating facts, as many at the workshop pointed out. Participants agreed that BSOs can be an important resource for answering questions when small businesses do not know what sources to turn to. To do this, they agreed that BSOs need to practice the same level of vigilance in sorting out facts from rumors and validating correct information that they emphasize their small business clients must do.

2. What BSO services most contribute to client success?

Conclusion

This article identifies the uncertainties confronting business service organizations and their clients in the economic and policy environment as of late May 2025. When asked about current sources of uncertainty for their BSOs, participants in the session that the Chicago Fed’s community development team facilitated at the May 2025 Capacity Building for Capacity Builders workshop focused on potential cuts to BSO funding. When asked about current sources of uncertainty for their small business clients, participants highlighted rising costs, the quick pace of technological change, and changes to social service programs that can affect both small business employees and customers. Participants acknowledged that they do not know how these issues will play out, and we heard a range of perspectives on the degree to which they plan to adapt to the current environment. Regardless of the outcomes, participants tended to agree that BSOs and their clients can benefit from efforts BSOs put into vetting information and into connecting small businesses with networks, individual mentors, and other reliable sources of assistance.

Notes

1 ARPA funds had to be obligated by December 31, 2024, and must be spent by December 31, 2026, as noted by the National Conference of State Legislatures in its ARPA State Fiscal Recovery Fund Allocations Database.

2 The issue of debt aversion also surfaced in a Chicago Fed survey of small businesses in Indianapolis.

3 The rising costs of goods, services, and/or wages were the most commonly cited financial challenge for small businesses in the latest two sets of responses to the Federal Reserve’s Small Business Credit Survey.

4 See, e.g., this May 2025 story in the Washington Post.