The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

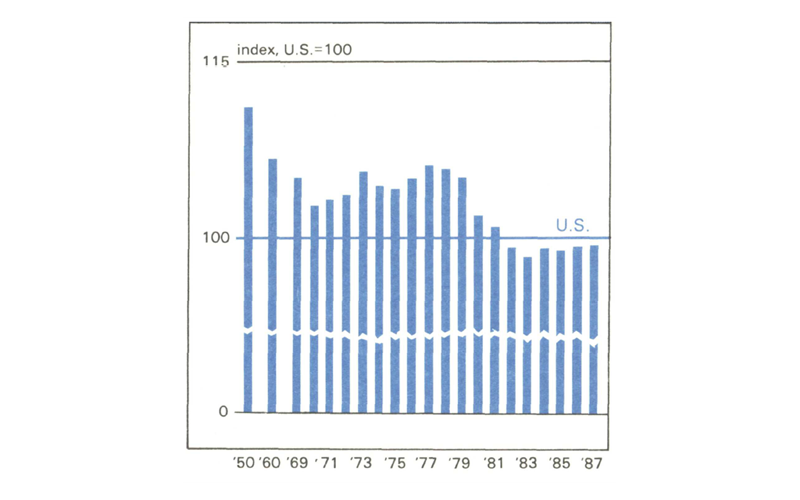

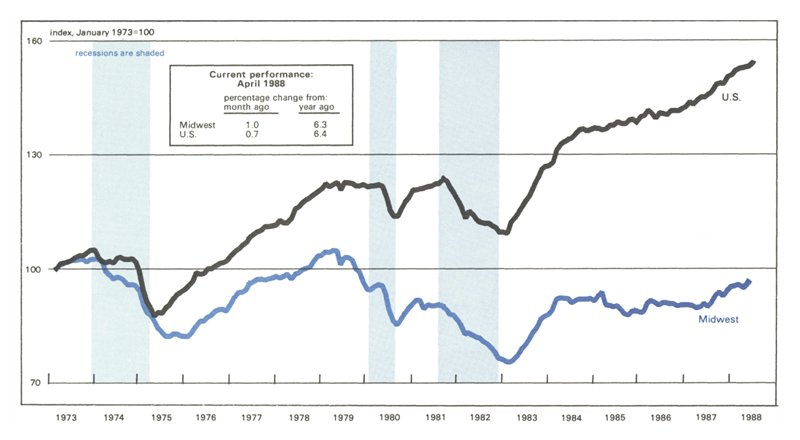

In 1982, for the first time at least since World War II, per capita income in the Seventh Federal Reserve District fell below the national average. There, despite the recent broad-based recovery in the Midwest, it has remained.

While the District lost jobs during the 1970-1971 and 1974-1975 recessions, most manufacturing jobs were subsequently regained. But the District lost far more jobs—over 900,000—from 1979 to 1983 and only a small fraction has since been recovered. That severe recessionary period set the stage for extensive and ongoing industrial restructuring. It also annihilated many manufacturing jobs. Because manufacturing jobs generally are higher paid than other jobs, their disappearance has heavily contributed to the Midwest’s per capita income drop.

In response, regional, state, and local planners and policymakers have put much effort into programs intended to attract new manufacturing jobs to the region and to maintain the existing job base. To aid these policymakers and business leaders, the Federal Reserve Bank of Chicago has undertaken a statistical study exploring the determinants of manufacturing job growth in the nation’s 75 largest metropolitan areas over the 1976-1985 period.1

The manufacturing job “growth factors” we examined—wages, unemployment taxes, general taxation, education, federal spending, technology, and exports—are pretty much the ones dealt with in regional development plans. Some affect job growth positively, some negatively. They vary greatly in strength of effect on job growth. Most importantly, they differ from each other in the degree to which policymakers can manipulate them. In this Letter, we look at these job “growth factors.”

1. Midwest income falls

High pay is not a plus

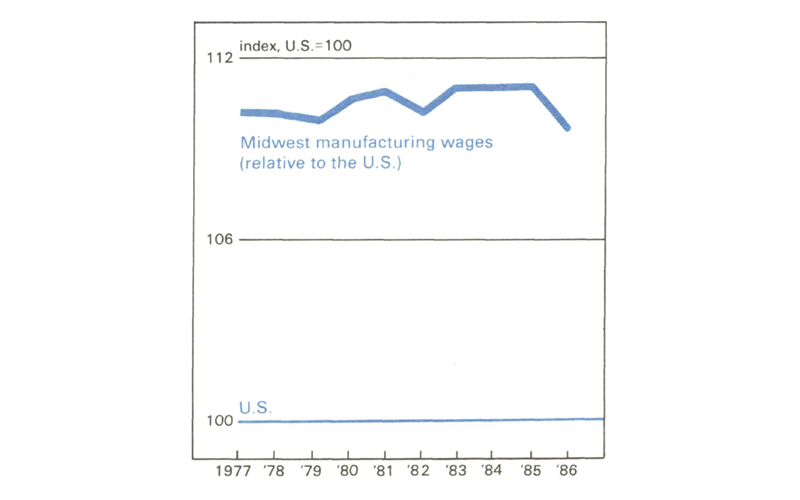

Evidence for the Seventh District suggests that high hourly wage levels in manufacturing may have had a detrimental effect on industrial job growth. The manufacturing wage index in figure 2 shows that, although District manufacturing wages have possibly begun to edge down relative to the nation, they have remained about 10% above the national average.

2. Midwest wages: high

On the surface, the finding that higher hourly wages exert a strong and negative impact on job growth seems to contradict economic theory that suggests that job growth should expand in high-wage areas. If workers are mobile, the theory goes, they will migrate to high-wage areas until wages there are bid down, leading to an ultimate convergence of regional wage levels.

However, manufacturing job expansions in low-wage areas are not inconsistent with theory. Workers are not always willing to undertake long-distance moves, because monetary and personal costs of moving are often high and information on job availability may be limited. Furthermore, theory also suggests that returns to capital investment in factories would be higher in low-wage regions, leading to such an expansion in job opportunities. And, indeed, many corporations have moved manufacturing operations to, or established new ones in, lower-wage areas in recent decades.

Whatever the theoretical case is, interregional wage differences in the U.S. have been historically persistent and seemingly impervious to public policy. Apparently, this high-wage factor requires a marketplace solution, as recent restrained wage demands, give-back wage contracts, and two-tier pay arrangements may indicate.

Unemployment insurance costs

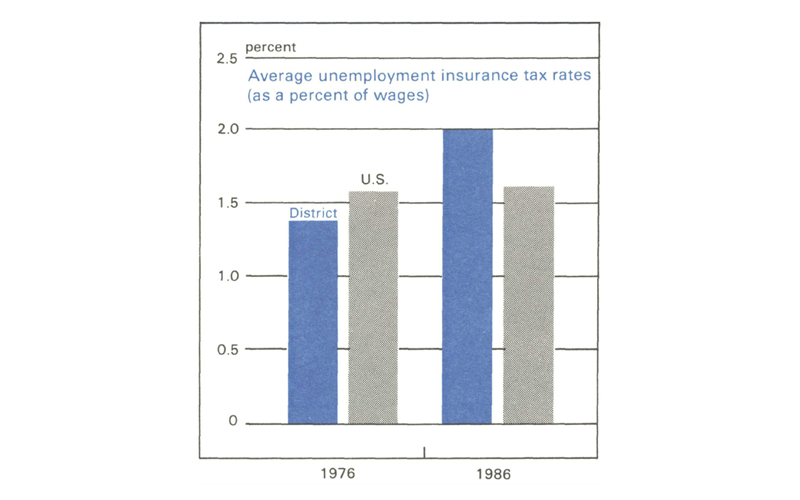

Along with wages, unemployment insurance (UI) taxes can be an important component of a state’s labor-related costs. We found that UI costs had a negative effect on employers’ decisions to establish or expand in the Midwest.

The unemployment insurance tax rates in the Seventh District states are higher than for the nation as a whole (figure 3). Part of the difference is explained by the 1980-1982 downturn, which left District states struggling to repay money owed to the federal UI fund and to rebuild their own reserve funds.

3. Midwest UI rates: high

Unlike hourly wages, high UI tax rates are not self-correcting over time. High regional wages may decline, albeit slowly, in response to lagging business conditions as unemployed workers bid down wages. In contrast, unemployment insurance costs often respond in the opposite fashion, rising in those regions undergoing economic decline. Workers become unemployed; benefit payouts are increased to meet the claims of laid-off workers; the state’s unemployment costs go up. These added costs must be paid from the wage base of those who remain employed, driving up employer tax rates. To the extent that these costs further discourage job growth, the unemployment system becomes a self-reinforcing “double whammy” in a region with declining industry.

Unfortunately, there appears to be little policy recourse to the high tax rates incurred by the District’s employers. Aside from possible social damage, the trimming of insurance benefits to the unemployed does little to lower tax rates; most of the interstate variation in tax rates can be attributed to regional differences in unemployment experience and not to generosity.2 Thus, it may well be that adjusting UI taxes, while certainly within the realm of public policy, may not be a useful stratagem for attracting manufacturing jobs.

Taxes—levels and growth

The findings that UI taxes have influenced growth does not carry over to other state and local taxes. In our study, and in others, there is little evidence to suggest that differences in the level of state and local taxes greatly influence regional growth.

Differences in overall tax burdens often represent differing public service levels to a region’s businesses and residents. To the extent that businesses and their workers value these services, there is little reason to believe that the taxes to pay for these services are, in themselves, detrimental to business expansion.

So, tax levels do not seem to have any negative impact on manufacturing job growth. However, higher growth in taxes (measured on a per capita basis) does seem to be detrimental. While these findings should not be interpreted too broadly, they are consistent with the general tenor of previous studies. Differing tax levels largely reflect differing regional preferences for government services, but high tax growth could indicate spendthrift tendencies relative to a region’s service demands.

The decade of the 1970s was characterized by grassroots citizens’ actions in many regions to curb state and local governments’ appetite for spending, action typified by California’s Proposition 13. Our statistical study suggests that those areas that were unable to curb tax and spending increases suffered from lagging business expansions over the 1976-1985 period. Overall, taxes are an area requiring restraint and skill on the part of policymakers, particularly because some other job “growth factors” depend on taxes.

Education—a plus

Because existing studies seem unable to demonstrate a strong influence of tax levels on business location decisions, researchers are investigating the finer features of state and local fiscal systems and their influence on growth and development. These features include state and local tax structure and the allocation of expenditures among services such as education.

In our metro-area study, the measure of educational spending per pupil displayed a significant beneficial impact on manufacturing employment growth. While it is simplistic to characterize an issue as complex as education by such a one-dimensional variable, our results suggest that further inquiry into the relationship of education and economic growth would be useful to planners.

Educational spending per pupil in the Seventh District exceeds the U.S. average. But there are clearly areas in the District where the educational systems have severe quality control problems.

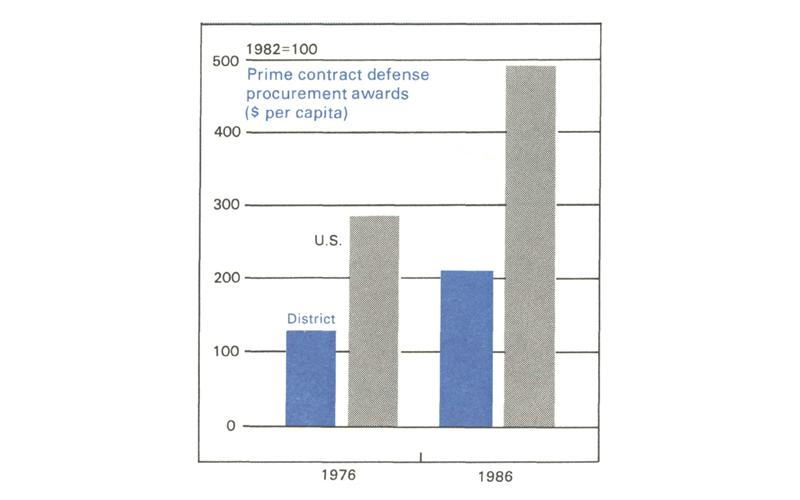

The geography of federal spending

A net outflow of federal dollars (that is, federal tax dollars paid minus federal dollars spent) from the Seventh District has long characterized the region. In real dollar spending for procurement contracts, the Midwest fell short of the nation by $155 per capita in 1976. By 1987, that gap had widened to $283 per capita (See figure 4).

4. Midwest defense dollars: low

Much of this outflow reflects the region’s eroding status in originating federal purchases from the Department of Defense. As military spending has shifted toward rebuilding the Navy and increasingly toward sophisticated aerospace weaponry, Midwest industry has become a less important supplier to the military. The economic impact of this unfavorable industry mix was severe over the 1976-1985 period when increases in the defense segment of the federal budget were especially rapid.

So far, regional development policy efforts have taken a two-pronged approach to redressing this imbalance. The Midwest region has encouraged the federal government to apportion greater shares of its contract procurement to Midwest suppliers. And, the region’s development officials have worked with their own congressional delegations to identify opportunities for Midwest firms at an early stage.

Nonetheless, progress has been slow. Most defense procurement must logically be bought from those regions that already have large defense industries.

R&D—a possible Rx

In measuring the region’s access to technology, our study found a significant variable—the number of scientists and engineers who are engaged in R&D activity in large metro areas. The Midwest employs scientists and engineers at a rate below the remainder of the nation.3 Much of this gap arises from the scarcity of federal contract awards for R&D (reflecting the region’s net outflow of federal funds). Despite the lack of federal government support in some sectors, the Midwest is relatively strong in supporting scientific and engineering employment in the private sector, especially in manufacturing, and in the high number of engineering and science degrees awarded by the region’s colleges and universities. These strengths suggest a basis of stronger ties in the Midwest between government or university labs and the region’s industry mainstays.

New England’s high-tech boom of the late 1970s and early 1980s greatly heightened public awareness of the importance of technology to regional development. The technological legacy of a region’s founding industries can, under some circumstances, rejuvenate the regional economy as new industries are born and others are revived with the help of university, government, and industrial R&D.

The conditions under which such revivals can occur are far from clear, but economic planners are attempting to enhance industry access to the technological resources of the Midwest. Economic development programs are encouraging the transfer of academic and government R&D from the lab to the factory floor. So far, these programs are in their infancy, and there is little means of quantifying their efforts.

Export goods good

In addition to our own study of metro area growth, two other studies have documented a significant relation between a state economy’s orientation to export overseas and its rate of economic growth. As recently as the early 1970s, the Midwest manufacturing economy was more oriented to overseas exports than the nation was as a whole. While the wide fluctuations in the value of the dollar on foreign exchange markets have had much to do with an eroding Midwest export position, its capital goods and metal industries have also succumbed to product and process innovation by overseas competitors.

As private industry in the Midwest has worked to regain its advantage in product cost and quality, policymakers in the Midwest have scrambled to regain the region’s prominence in U.S. exports. Overseas export missions have been established as a service to firms with potential export markets. In addition, state governments have taken initiatives to educate smaller firms about the opportunities and processes necessary to establish overseas markets.

It is still too early to tell whether these efforts have been effective in their purpose but at least one study has uncovered a statistical link between export promotion and state export activity.4

Conclusions

Direct costs encountered by the manufacturing sector, such as hourly wage costs, taxes, and unemployment insurance costs are influential in metro area job growth. So are more elusive features of local economies, such as education, access to technology, export orientation, and the flow of federal funds. Many of these features, especially those related to labor costs, cannot be easily or quickly changed. However, other features such as education, fiscal soundness, and access to technology do fall within the scope of the District’s policymakers.

MMI—Midwest Manufacturing Index

Manufacturing production nationally rose 0.7 percent in April, following an upwardly revised 0.3 percent gain in the previous month. Machinery (both consumer appliances and capital goods) led other sectors within manufacturing as it continued its sharp advance begun almost a year ago. A notable gain also occurred in the consumer auto component of transportation equipment.

Midwest manufacturing activity jumped a full percentage point in April, led by a 2.5 percent gain in the transportation equipment industry. In the machinery sector, electrical equipment and instruments equaled or exceeded the MMI’s growth, but nonelectrical machinery lagged the MMI. The primary metals industry edged down for the third consecutive month but was still 9 percent above its year-ago level.

Notes

1 William A. Testa, Understanding Metro Area Job Growth From 1976 to 1985, Working Paper Series on Regional Economic Issues, Federal Reserve Bank of Chicago, (forthcoming).

2 William A. Testa and Natalie A. Davila, The Unemployment Insurance System: A Regional Development Perspective, Working Paper Series on Regional Economic Issues, Federal Reserve Bank of Chicago, (forthcoming).

3 Alenka S. Giese and William A. Testa, Measuring Regional High Tech Activity with Occupational Data, Working Paper Series on Regional Economic Issues, Federal Reserve Bank of Chicago, January 1987.

4 Cletus C. Coughlin and Phillip A. Cartwright, “An Examination of State Foreign Export Promotion and Manufacturing Exports,” Journal of Regional Science, Vol. 27, No. 3, 1987.