The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

The recent successful completion of the North American Free Trade (NAFTA) talks raises serious questions about the potential economic, social, and political ramifications of an agreement that may result in the world’s largest and potentially most prosperous common market. Among the industries that are likely to be affected, few are of greater concern to the Midwest than the auto industry. One critical question is how the pact may alter trade flows of automotive products and consequently the location of jobs in North America. This Chicago Fed Letter summarizes the auto-related agreements on this issue and finds that the major impact of NAFTA, especially in the Midwest, may be simply to accelerate a process that most likely would take place regardless of the treaty. However, the question may become whether the U.S. chooses to export goods or jobs.

Existing auto trade and trade provisions

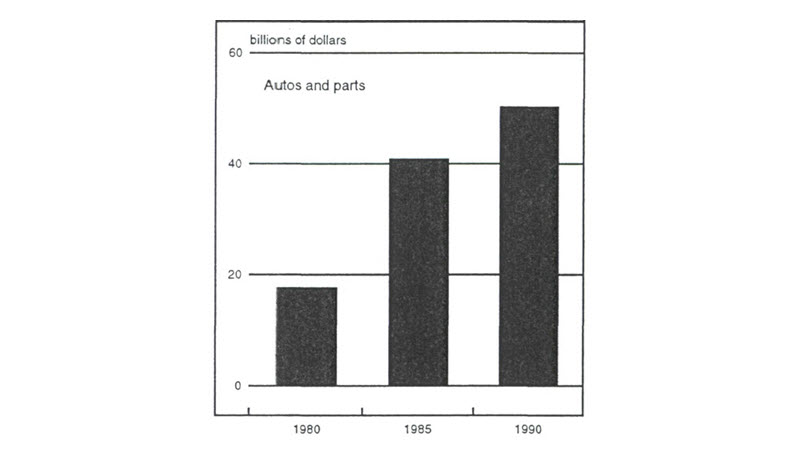

To a greater extent than trade in most other products, the existing North American market for vehicles is already a highly integrated and growing market where finished goods and parts transcend borders. Total North American trade in automobiles and auto components has almost tripled in the last decade to over $50 billion annually (see figure 1). This integration reflects such developments as the explosive growth of the Mexican domestic industry, further integration of U.S.-Canadian production, and the presence of four major manufacturers in all three markets along with other manufacturers rapidly following suit.1 Furthermore, integration in auto parts has also occurred with two-way trade between the U.S. and Mexico more than doubling in the last decade to over $8 billion annually. In the aggregate, trade in automotive products accounts for roughly one-fourth of all trade in North America. That level has accelerated since the mid-1980s and continues to grow substantially.

1. North American trade

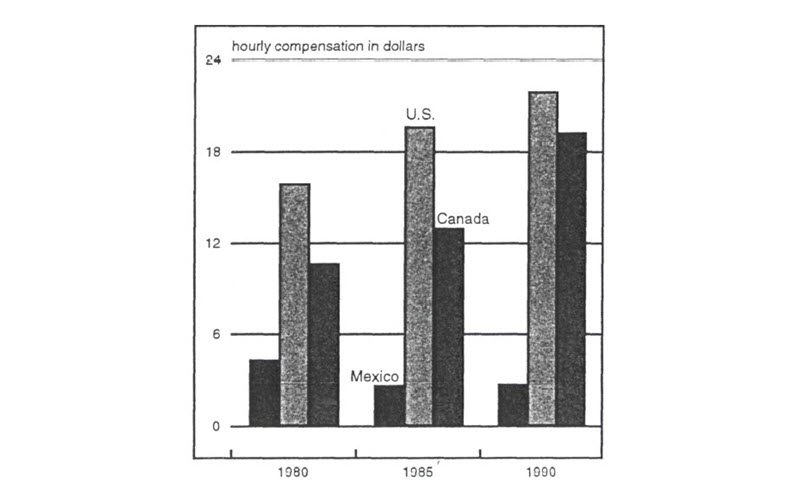

Integration has been encouraged first and foremost by the economic benefits to producers in the respective markets. These benefits accrue from cheaper inputs, especially labor in Mexico, and access to a burgeoning Mexican consumer market, especially for U.S. producers. As indicated in figure 2, these elements were stimulants in the 1980s.2 Further integration, especially between U.S.-Canadian assembly and technical component facilities and labor-intensive facilities in Mexico, are widely expected to continue.

2. Auto industry wage rates

Previous trade pacts and adjustments, which have attempted to liberalize the trading environment, are an additional impetus to integration. In the U.S. the most important provisions have included the 1965 auto pact with Canada, the Free Trade Agreement (FTA) of 1989, Harmonized Tariff Rules (HTS) and the Generalized System of Preferences (GSP).

The auto pact of 1965 between the U.S. and Canada began the process of duty-free automotive trade in North America. Under the provisions of the agreement, most new autos and auto parts could be shipped between the U.S. and Canada duty free. The exception to the rules included replacement parts, used cars, and some domestic content requirements. A loophole in the pact was the duty remission program of the Canadian government, which did produce some trade distortion by encouraging some production in the Canadian market.

The FTA of 1989 removed some of the distortions of the duty remission program and solidified the provisions of the pact. The duty-free status of products with a domestic content level of 50% was established between the U.S. and Canadian markets. Furthermore, the duty remission program was curtailed by removing its provisions regarding trade with the U.S. and future extension of the program to non-U.S. producers. Consequently, since the mid-1960s, trade in automobiles and auto parts has been relatively unrestricted between the U.S. and Canada, with more than 95% of all trade in autos currently being tariff free.

Far and away the most important current provisions with respect to U.S. imports from Mexico have been HTS items 9802.00.60 and 9802.00.80. Under these provisions, and within the GSP rules, a large portion of Mexican auto components enter the U.S. under limited and/or reduced tariffs. Specifically, the provisions reduce the applicable tariffs levied to the amount of Mexican value added to a product excluding U.S. components and, therefore, reduce the overall effective tariff rate on products. Estimates of tariffs on auto parts alone indicate that perhaps over half of all parts imported from Mexico are favorably impacted by reduced tariffs under these terms. Trade in this environment, especially Mexican exports to the U.S., has been encouraged, as indicated by the fact that three-quarters of Mexican automobile exports are destined for the U.S. The favorable trade provisions have also been a stimulus for the maquiladora program. Maquiladoras are facilities established for processing and/or assembly of imported components which are then re-exported to the original component-producing market, usually the U.S. The original program was created in 1965 to assist displaced Mexican migrant workers who had been adversely affected by cessation of a seasonal migrant worker program (the bracero program) in the U.S.

Canadian imports from Mexico also have been influenced by preferential trade terms. The duty remission program allows for waiver of all tariffs on many imports from Mexico. The third-party provisions of the program have long been an area of contention between the U.S. and Canada. However, the program has been a plus to the Mexican auto industry. Under the terms of the remission program and other production programs, tariffs on assembled vehicles and parts are eliminated for firms that maintain a certain level of production in Canada. Consequently, due to the presence of firms with facilities in both Mexico and Canada, the programs have removed many barriers to the Canadian market.

Of course, the Mexican market is still not completely open in terms of trade provisions, and specific external barriers in the U.S. and Canada may be relatively high. For instance, corporate average fuel efficiency (CAFE) standards, countervailing duties, and quotas for autos still exist. Furthermore, within North America, Mexico still has aggressive trade restrictions, which distort the trading environment. Although the 1989 auto decree brought a realignment and movement toward more progressive policies, the permissions prior to NAFTA have been rather stringent. After 1989, for instance, the following standards were established:

- A local content level of 36% was established as a minimal level for all vehicles sold in the domestic market.

- Vehicle manufacturers must maintain an export to import ratio greater than 1. An initial target of $2.50 of exports to $1.00 of imports was established for 1991 and the schedule slides down to $1.75 by 1994.

- The total number of import vehicles sold in the domestic market is restricted to 15% of the market.

- Duties of 20% and 13%, respectively, are imposed on vehicles and auto parts.

Undoubtedly, the distortive effects of these terms have been severe, especially in light of the robust growth in the Mexican market since the mid-1980s. More importantly, current trade restrictions give strong incentives to U.S. producers to locate in Mexico to have access to Mexico’s rapidly growing consumer market. However, even in the case of Mexico, many of the provisions have been weakened substantially in the last decade and the movement to make further modifications has become stronger recently, as evidenced by the willingness of President Salinas’ government to participate in the NAFTA talks.

Changes under NAFTA

NAFTA will impact the North American market by reinforcing underlying trends and altering some aspects of the market, primarily the rules for domestic content levels, duties, and trade-balancing procedures. According to the agreement, domestic content levels for duty-free and/or reduced-duty provisions will be set at 62.5%, which is above the existing U.S.-Canadian level of 50%. This provision would be phased in over eight years, with a reduced level of 60% for auto parts and other vehicles.

Upon implementation of NAFTA, the U.S. would eliminate its duty of 2.5% on cars and cut its 25% duty on trucks to 10%. The truck tariff would then be phased out over a five-year period. The significance of this agreement is diminished by existing HTS rules, which have already liberalized the trading environment. In conjunction with these revisions, Mexico would immediately cut in half its existing duties and phase the remainder out over a ten-year period. Finally, Mexican officials have also agreed to phase out the trade balancing rules and its domestic content rules over a 10-15-year period.

The impact of the accord will be influenced in a number of ways by the existing environment. First, general integration in North America will continue as domestic producers in particular struggle to maintain market share, reduce costs, and improve profitability. These efforts will likely include movement of some production facilities to lower-cost environments in Mexico, closure of surplus capacity in some market segments (mostly in the U.S. and Canada), and increased production of some goods to capture a growing market in North America and abroad. These trends are in large measure independent of NAFTA and are being driven by global economic and social factors.

Additionally, it should not be assumed that movement of production and future expansion as a result of NAFTA will take place only in Mexico. Quality, efficiency, and labor productivity are important elements in the production decision, and U.S. and Canadian suppliers may have an advantage in certain areas. Mexican parts suppliers, for instance, have been sheltered from competition under existing rules. Liberalization of trade terms in Mexico will also open up the Mexican market to imports for the first time, and this may dampen some of the movement of production facilities as well. Under current trade rules, auto producers must have Mexican production facilities (domestic and export oriented) to sell in the growing Mexican market, a key restriction which in large measure is removed by the agreement.

In addition, U.S. and Canadian exports of certain products and parts will likely receive a boost from the opening of the Mexican domestic market. A consumer market of 83 million is currently underserved and sales are growing rapidly. Thus, liberalization will help to increase exports in this growing market.

Still, it is likely that investment flows into Mexico, given the current environment, will accelerate under NAFTA. This inflow will boost labor productivity, and the question then becomes whether or not wages keep pace. How much growth in Mexican production displaces U.S. production will be determined by relative growth in productivity and wages. If Mexican wages remain low relative to their productivity growth in this environment, then displacement may occur to a greater degree than if Mexican wages rose quickly.

One source of displacement may involve domestic producers, especially transplants, switching from overseas suppliers to North American suppliers. As written, the pact gives greater preference to Mexican suppliers than other producers. Consequently, there may be displacement of Asian and/or other overseas suppliers. A substitution of North American for overseas suppliers could then produce an overall gain in production and employment for industries, like autos, throughout North America. Nevertheless, it must be remembered that the phase-in period is extended to 10 to 15 years, thus minimizing any shock to formerly protected markets.

Conclusion

In the North American market, the existing trade terms and recent modifications of autos and auto parts trade have further accelerated the integration of the market across national borders. Undoubtedly, further liberalization will intensify these trends, especially with regards to vehicle sales and production in the growing Mexican market and will result in fundamental changes in the Mexican and Canadian markets. But in the U.S., for the most part, it will merely accelerate the process of integration already begun. Thus, while the U.S. market will make adjustments, the immediate significance of the accord will be muted by the existing liberal trading rules of the U.S. and the gradual phasing in of the treaty’s provisions over 10 to 15 years.

This analysis does not mean to deemphasize the importance of the trade pact or minimize concerns over displacement of labor and other harsh effects like downsizing. These are very real and important issues. However, the pact itself is not the sole cause of liberalization of auto trade in North America, nor will it radically alter the composition of the industry. To say otherwise would be to understate the economic and political changes which have been occurring absent the agreement. The industry in North America is already highly integrated and although the environment is not completely unrestricted trade, restrictions have been minimized throughout the last 25 years. Furthermore, it should be stressed that the major modifications of the pact involve changes in access to the domestic Mexican market, which has been highly restrictive for foreign producers. The existing restrictions, given the recent growth and potential future growth of the Mexican market, have encouraged the movement of facilities—and with them jobs—from the U.S. and Canada in order to access this market. With the agreement, however, necessary changes will be made to allow easier access to the Mexican economy. Consequently, job displacement directly attributable to the trade agreement should be minimal and, with the potential growth in the Mexican market, there may even be job growth.

In sum, NAFTA, along with other factors, will encourage further restructuring in the industry; however, independently of these other factors, it will likely not fundamentally change the motor vehicle industry in the U.S. and North America.

Tracking Midwest manufacturing activity

Manufacturing output index (1987=100)

| September | Month ago | Year ago | |

|---|---|---|---|

| MMI | 109.0 | 110.9 | 110.6 |

| IP | 109.4 | 109.8 | 108.9 |

Motor vehicle production (millions, saar)

| October | Month ago | Year ago | |

|---|---|---|---|

| Autos | 5.5 | 5.6 | 5.9 |

| Light trucks | 4.2 | 3.6 | 4.2 |

Purchasing manager’s association: production index

| October | Month ago | Year ago | |

|---|---|---|---|

| MW | 58.4 | 64.1 | 57.5 |

| U.S. | 54.3 | 52.6 | 60.2 |

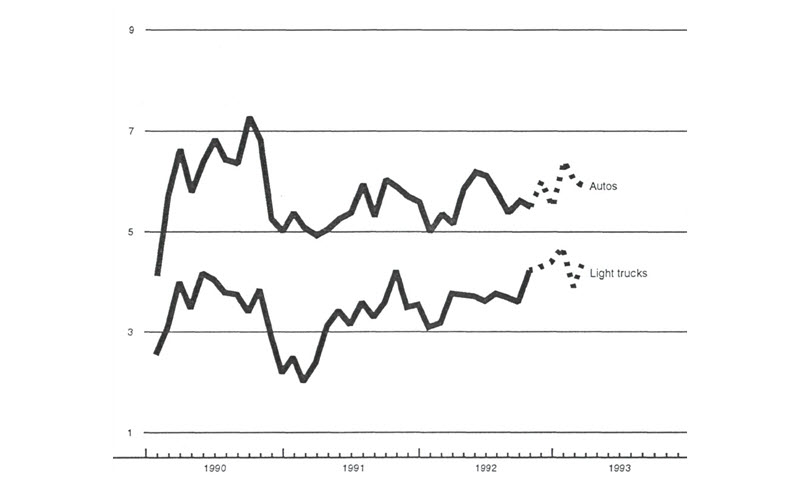

Motor vehicle production, millions (saar)

Note: Dotted lines are estimated production.

Sources: The Midwest Manufacturing Index (MMI) is a composite index of 17 industries based on month hours

worked and kilowatt hours. IP represents the FRBB industrial production index for the U.S. manufacturing

sector. Autos and light trucks are measured in annualized physical units, using seasonal adjustments

developed by the Federal Reserve Board. The PMA survey for the U.S. is the production components of the NPMA

survey and for the Midwest is a weighted average of the production components of the Chicago, Detroit, and

Milwaukee PMA survey, with assistance from Bishop Associates and Comerica.

The Midwest manufacturing sector could be feeling the strain of keeping its own and the nation’s recovery moving forward. Both the MMI and the Purchasing Managers’ Survey in recent months has been indicating a slowing of momentum. But most disturbing has been unexpected weakness in car production, following lower than expected sales.

Domestic car producers cut assemblies in the third quarter to a 5.6 million-unit annualized rate—half a million below the second quarter rate. Fourth quarter production plans call for virtually no change in assemblies in the fourth quarter. Light trucks, so far, are expected to provide an offset by increasing production to a 4.3 million rate this quarter from 3.7 million last quarter.

Notes

1 Currently, General Motors, Ford, Chrysler, and Volkswagen have significant presences in all three markets. Japanese nameplates (i.e., all brands produced by a particular maker), in particular Nissan and Toyota, have begun to enter the Mexican market aggressively.

2 Total labor costs are affected by productivity in addition to wage rates. Also, access to the growing Mexican market is an important incentive for establishing production facilities because the existing trade restrictions make it very difficult for Mexico to import significant quantities of vehicles.