The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Over the past year, the state of Michigan has profoundly changed the way in which the state’s elementary and secondary schools are funded and, at the same time, fundamentally reformed the state’s revenue system. With the passage of Senate Bill 1 during the summer of 1993, the Michigan Legislature effectively abolished the use of local property taxes as a primary funding mechanism for elementary and secondary education. In doing so, the state eliminated over $6 billion in locally imposed property taxes that would have provided more than 60% of the cost of the state’s public elementary and secondary education. In its place, Michigan recently put together a blend of other tax sources, including a statewide property tax and an increase in the sales tax. This new state tax structure is intended to enhance the state’s competitiveness and environment for growth and investment. At the same time, the state has established an entirely new system for distributing revenues for education that will reduce disparities between communities in per pupil spending.

Michigan’s new tax plan has been more dramatic than most, but it reflects a combination of forces that has put both education and tax reform near the top of many states’ agendas since the 1980s. For this reason, other states are examining the Michigan reform package as one way of achieving both school reform and tax reform. In this Chicago Fed Letter, we look at the Michigan education finance reform plan and the ways in which it changes the state’s tax structure while attempting to improve the delivery of educational services.

Michigan’s new plan

A ballot measure passed by Michigan voters on March 15 makes wholesale changes to the state’s tax structure in order to replace property tax revenues for education and boost overall spending on education. The measure raises the state sales tax from 4% to 6% effective May 1, 1994, increases the tax on cigarettes from $.25 to $.75, and levies a new real estate transfer tax and a new 6% tax on out-of-state phone calls. The proposal also trims the state’s personal income tax rate from 4.6% to 4.4%.

Michigan’s new plan does not eliminate property taxes to fund education. In place of a locally determined common rate on all types of property, however, the state now has statewide tax rates for different classes of property. The plan significantly reduces the school operating property tax rate for homeowners and makes modest average reductions for business property. The new state property tax rates will be 6 mills on primary homes (an 82% reduction from the previous statewide average property tax rate for homeowners) and 24 mills on secondary homes and businesses (a 30% reduction).

Rather than being dedicated to local school operation, tax revenues raised from local real property will now be pooled and distributed to local school districts through the state’s school aid allocation program. In the process, some of the traditional disparity in per pupil expenditure across districts will be eliminated. Minimum per pupil expenditures will be raised from the current $3,000 to $4,200 in the first year. Districts that have been spending less than $4,200 per pupil—primarily rural and some urban districts—will be the major beneficiaries.1 Elsewhere, districts’ historic decisions on school spending will help determine prospective funding. Districts that currently spend between $4,200 and $6,500 per pupil (mostly large urban and suburban districts) may gain some additional revenues because of increases in state aid for districts with high concentrations of at-risk pupils.

At the same time that low-spending school districts experience enhanced funding, the Michigan plan discourages high-spending districts. Districts that currently spend more than $6,500 per pupil have two possible avenues to maintain existing spending. However, both of these avenues may discourage them from doing so because they involve either obtaining approval through a local referendum or narrowing the local property tax base from all property down to local homesteads only. Additionally, employer contributions to teacher retirement funds and Social Security will now become the responsibility of individual school districts rather than being funded by the state. Wealthy districts tend to have higher salaries and lower pupil-teacher ratios. These districts will now have to pay their own way for relatively costly pension programs.

Other features intended to equalize spending are more binding than discouraging. Beginning in 1995-96, districts that currently spend $6,500 or more per pupil will be allowed to increase their spending only within prescribed limits.

Tax reform to spur economic development

Over the last two decades, Michigan has changed from a national leader to a laggard in terms of economic growth and living standards. Much of this change is due to massive realignments in the automotive sector that have reduced the number of high-paying jobs in manufacturing even while new jobs have been generated in lower-wage occupations. By 1992, Michigan’s per capita personal income had fallen to slightly below the U.S. average.2 Part of this economic decline has been ascribed to the high cost of doing business in the state, with the state’s sharp reliance on the property tax portrayed as a contributing factor.3 In 1990, for instance, on a per capita basis, Michigan’s average property tax was nearly 31% higher than the U.S. average (see figure 1).

1. Property tax, 1990

| Per capita | Rank | Percent of U.S. average | Percent of personal income | Rank | |

|---|---|---|---|---|---|

| U.S. | $626 | -- | -- | 3.6 | -- |

| Illinois | 754 | 14 | 120.4 | 3.9 | 20 |

| Indiana | 472 | 33 | 75.4 | 2.9 | 32 |

| Iowa | 660 | 19 | 105.4 | 4.1 | 17 |

| Michigan | 820 | 10 | 131.0 | 4.7 | 9 |

| Wisconsin | 738 | 15 | 117.9 | 4.4 | 12

|

| Range | $163—1,2246 | 1.2—6.1 |

Michigan’s tax reform will do little to lower the overall tax burden in the state, especially since overall educational funding will be enhanced rather than diminished.4 Yet the reforms are expected to bring a much-needed element of balance into the state’s revenue system. The principle of balance among revenue sources suggests that overreliance on any one source tends to impede economic performance by distorting the prices that people and businesses face when making economic choices. It is still debated just what the optimal balance of revenue sources is. In practice, states tend not to want their own state revenue systems to fall too much out of line with the nation or neighboring states.

While Michigan’s revenue system differed from the average, the case against the state’s reliance on local property taxes was not open and shut. Average statewide property taxes were high, but businesses enjoyed ample choices among localities in Michigan, with many communities having low or average property tax rates. Moreover, in Michigan and elsewhere, some types of business activity may be acutely noxious to a local community in terms of creating a dangerous or unpleasant environment, or in demanding costly levels of public services. If so, rather than simply deterring business location and investment, high property taxes may be seen as a bargain struck between community and business concerning the use of land for industrial purposes.

In Michigan and other states, however, it appears that this mechanism whereby property taxes act as a “fair price” for the costs of development has been overshadowed by a more detrimental behavioral pattern of business location. In the process of searching out the lowest property tax rates, businesses have tended to locate within certain school districts in such great concentrations that they more than compensate local residents for the price of public services they require or any noxious effects they may generate. “Tax havens” have come about where community tax rates are very low while business property concentration is very high, thereby enabling extraordinary levels of school funding.5 Not all tax havens have heavy concentrations of business and industry. Some wealthy communities have very low property tax rates because of the generally high average value of the residential property. At the same time, however, in communities such as Detroit, the heavy property tax burden is sharply deterring investment in the city (see figure 2).

2. Homeowner’s tax rate, 1990

| Detroit, MI | 4.40% |

| Milwaukee, WI | 3.7 |

| Newark, NJ | 2.96 |

| Philadelphia, PA | 2.64 |

| Baltimore, MD | 2.46 |

| Houston, TX | 2.19 |

| Jacksonville, FL | 2.18 |

| Atlanta, GA | 2.08 |

| Cleveland, OH | 2.00 |

| Memphis, TN | 1.77 |

| Indianapolis, IN | 1.62 |

| Chicago, IL | 1.59 |

| U.S. averagea | 1.67% |

a Unweighted average effective property tax rate for the largest city in each state.

Source: Office of Economic and Tax Policy, “Tax rates and tax burdens in the District of Columbia: A nationwide comparison, 1990,” Washington, June 1991.

Michigan’s revised tax structure may help on two fronts. First, it will help level the playing field for investments inside the state. No longer will high property tax rates for education deter investment. Second, even with a 6% sales tax, Michigan’s tax structure will not be out of line with those of neighboring states when the state competes for economic development, since the state sales tax throughout the Midwest is between 5% and 6%. With greater balance in the state’s tax structure and lower property tax rates, the state may improve its business climate and enhance its development prospects. Whether this new mix of taxes will improve the business climate of Michigan will ultimately depend on how the modified tax structure plays itself out for existing businesses as well as for businesses Michigan hopes to attract. Each business will find some types of taxes more burdensome than others, depending on its mix of production inputs and the market for its product. Further research and observation will be needed to determine the ultimate impacts.

Education reform to reduce inequities between school districts

Because Michigan relies so heavily on local property taxes to fund education, per pupil spending largely reflects the combination of the relative property wealth of the school’s community, and that community’s willingness to fund education. While the state’s average per pupil expenditure is higher than the U.S. average, the pattern of local spending displays a high variation, ranging from $3,000 to $11,000 per pupil. Property-poor towns have been unable to levy sufficient revenues to provide adequate local education.

In support of greater equalization, it is argued that education is a fundamental interest to both society and the individual. For society, an educated populace is essential to the economic and social well-being of the country as well as a necessary ingredient to the proper functioning of a democracy. For the individual, education is a requirement for successful participation in the economy. This reasoning holds that at a minimum, the state’s responsibility is to ensure or provide a foundation level of educational services. Investing in the education of lower-income children may be particularly important to the state’s economic development efforts, since globally competitive industries require a productive labor force.

While the movement to boost and equalize education funding may be laudable from the perspectives of both equity and social investment, there is nonetheless some concern that shifting more of the responsibility for education funding onto the state will diminish local control and the ability to customize school programs to fit local conditions. At times, centralization of educational funding in the U.S. has been accompanied by centralized or bureaucratic control of how the money is spent. This happened to some extent in the 1970s and early 1980s throughout the nation as states took on more of the financial responsibility for education. To address such concerns, the state of Michigan will allow local interests to establish “charter schools” outside the regular network of local school districts. These will be specialty schools emphasizing the development of particular skills such as math and science.

Over the long term, other features of Michigan’s plan may facilitate additional school choice programs. In an effort to boost school productivity and match students with schools, other Midwestern states such as Iowa and Minnesota now allow students to choose to attend any public school in their respective states. This option is intended to promote customization of local school services to their clients and to improve school performance and accountability through competition. When students choose to attend schools outside their home districts, they carry state and/or local funding with them to their chosen schools. More equalized resources per pupil would ensure that migrating students carry along funds that are on par with spending levels at the new schools. Similarly, establishing a statewide uniform core curriculum, as the Michigan plan promises to do, will help ensure that fundamental education is being provided in those schools that otherwise choose to specialize in special subject areas or innovative modes of operation.

Conclusion

The Michigan plan is a dramatic attempt to combine tax reform with education reform. Other states will closely evaluate this combination as a way of achieving tax reform and reducing disparities in school funding, while increasing the effectiveness of education spending.

Tracking Midwest manufacturing activity

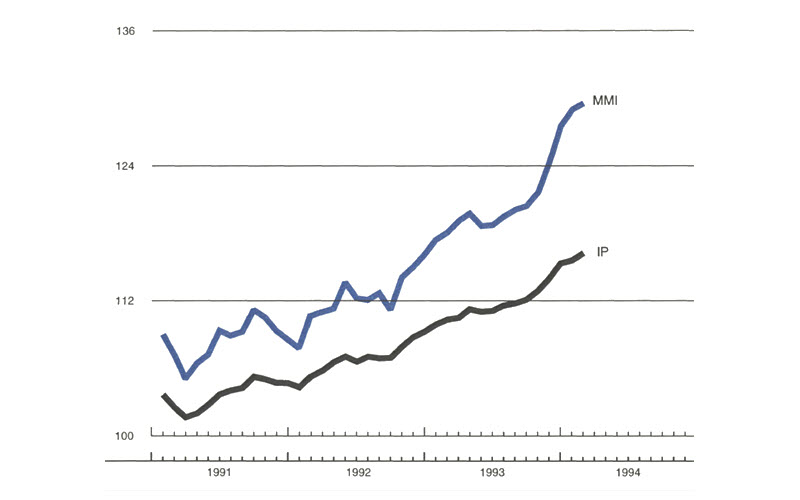

Manufacturing output index, 1987=100

| February | Month ago | Year ago | |

|---|---|---|---|

| MMI | 129.6 | 129.1 | 118.1 |

| IP | 116.3 | 115.6 | 110.4 |

Motor vehicle production (millions, seasonally adj. annual rate)

| March | Month ago | Year ago | |

|---|---|---|---|

| Cars | 7.2 | 7.6 | 6.3 |

| Light trucks | 5.8 | 5.6 | 4.8 |

Purchasing Managers’ Surveys: production index

| March | Month ago | Year ago | |

|---|---|---|---|

| MW | 72.7 | 72.9 | 66.3 |

| U.S. | 64.0 | 58.7 | 57.4 |

Manufacturing output index, 1987=100

Midwest manufacturing output continued to climb in January and February after surging in the fourth quarter. The early 1994 gains were also impressive for having overcome the direct and indirect effects of unusually harsh winter weather. Growth was centered in cyclically sensitive industries important to the region, including primary metals, industrial machinery, and motor vehicles and parts.

Production of cars and light trucks slipped in March, but only after surging to the highest level in 15 years in February. Purchasing managers’ surveys indicate that expansion in Midwest manufacturing activity changed little in March.

Notes

1 According to the Michigan Fiscal Agency, the distribution of school district per pupil expenditures prior to the passage of the new law was as follows: 119 districts (including 13 K-6 districts) serving approximately 181,000 students spent less than $4,200 per pupil. 397 districts with 1,245,000 students spent between $4,200 and $6,500 per pupil. 41 districts with 166,400 students spent in excess of $6,500 per pupil.

2 $20,114 for the U.S. versus $19,680 for Michigan. (U.S. Department of Commerce, Bureau of Economic Analysis, “Survey of current business,” September 1993, Vol. 75, No. 9, p. 74.)

3 National “business climate” surveys such as the GrantThornton Manufacturing Climates Study have ranked Michigan at or near the bottom in a number of cost-of-doing-business categories including hourly wages (50), unemployment compensation benefits (49), worker compensation cost per case (49), and overall state tax effort (47). For more details, see GrantThornton Accountants and Management Consultants, Manufacturing Climates Study, No. 11, Chicago: GrantThornton, August 1990.

4 Funding in fiscal year 1994-95 will be 4% higher than in 1993-94. This excludes possible revenue enhancements that local school districts may decide to fund.

5 There will be clear winners and losers and certain inequities in any changes that do away with the current system of tax havens. For example, some inequities will result to those who have recently purchased property in tax havens. These property owners presumably will now have to pay for the previous fiscal surplus attendant to the community in which they purchased property; i.e., the lower tax rate was reflected in a higher purchase price.