The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Federal deposit insurance was first introduced in the United States in 1933 during the depths of the Great Depression and accompanying bank crisis, which saw a reduction in the number of commercial banks from more than 25,000 to near 15,000, mostly by failure. The insurance system has been changed a number of times since. Most recently, it was modified in the 1990s after the savings and loan (S&L) crisis of the 1980s drove the old Federal Savings and Loan Insurance Corporation (FSLIC) into insolvency—requiring taxpayers to finance its near $150 billion deficit to protect depositors at the failed institutions from loss—and widespread bank failures threatened also to bankrupt the Federal Deposit Insurance Corporation (FDIC). Provisions primarily in the Federal Deposit Insurance Corporation Improvement Act (FDICIA) of 1991 dramatically reduced the liability of taxpayers for losses from future bank failures and, combined with provisions in the Deposit Insurance Funds Act (DIFA) of 1996, changed both the premium structure and the way the FDIC collects the premiums.

Recently, the FDIC published two important papers. The first identified a number of provisions in the current structure that the FDIC believes require revisiting and discussed a number of options.1 The second presented the FDIC’s own recommendations for changes.2 In response, Congress has started a dialogue on whether and which further changes in the structure are desirable. This Chicago Fed Letter briefly describes the current structure of deposit insurance and discusses some of the provisions that the FDIC recommends be revisited.3

The current structure

The most important change made by FDICIA in the structure of deposit insurance was to greatly scale back the liability of the government (taxpayer) for losses resulting from the failure of insured depository institutions. This was done by requiring the FDIC to achieve and maintain a minimum ratio of reserves to insured deposits—set at 1.25%—and effectively to raise premiums on insured institutions to regain this value within one year whenever losses from bank failures drive reserves below 1.25%. As a result, deposit insurance is now basically privately funded. Before this change, the taxpayer was on the hook. The deposit insurance agencies could, but were not required to, increase premiums when their funds declined or even were exhausted. As a result, in the 1980s as their reserves were being depleted, the agencies raised insurance premiums on their insured institutions only very late and partially. Thus, the major cost of the S&L failures was borne by the taxpayers. Under the current structure, the taxpayers become liable only after losses exhaust the banking system’s resources to the extent that it cannot pay the required higher premiums. Such a scenario is unlikely to occur, however, even in banking crises and indeed did not occur in the 1980s. Had the current structure been in place, the institutions and not the taxpayers would likely have paid for most if not all of the cost of the failures in that period. Of course, Congress can always change the rules and in a major crisis may be more likely to do so.

The likelihood of tapping the taxpayer is further reduced by two other provisions in FDICIA. The first provision requires bank supervisors to intervene in financially troubled institutions promptly and to impose progressively harsher sanctions as an institution’s financial condition deteriorates in order to prevent it from failing—prompt corrective action (PCA). But, if these actions fail and the institution becomes insolvent, the FDIC is required to resolve it promptly and at least cost to itself—least cost resolution (LCR). Although it does not affect the treatment of insured depositors, least cost resolution makes it more difficult for the FDIC to protect uninsured depositors at banks that it perceives to be “too big to fail.” The LCR provision requires any losses incurred by the FDIC in protecting these depositors to be paid by a special assessment on all banks. In effect, to protect uninsured depositors at these banks against loss from insolvency, the board of directors of the FDIC, the Board of Governors of the Federal Reserve, and the Secretary of the U.S. Treasury (after consultation with the President) need to make a written determination that not protecting these depositors would “have serious adverse effects on economic conditions or financial stability” and that protecting them “would avoid or mitigate such adverse effects.” This is much more restrictive than before, when the FDIC regularly tended to protect uninsured depositors at most failed large, as well as medium-sized, banks.4

In 1996, DIFA effectively made the 1.25% reserve ratio a ceiling as well as a floor and limited premiums, when this designated ratio was reached, only to risky banks. These were defined as institutions that were classified as undercapitalized according to the definitions set by the regulators for PCA or received a rating of 3 or greater on the 1 to 5 CAMELS examination rating scale used by the federal bank regulatory agencies, where 1 represents the best rating. As a result, currently less than 10% of all insured institutions pay premiums. By prohibiting the FDIC either from building up the fund much above the 1.25% floor or from using it to finance losses if this reduces the fund below 1.25% for more than one year, this provision effectively puts the FDIC on a “pay as you go basis.” Except for brief periods, the fund can provide little liquidity. It cannot be used. In addition, premiums can be charged all banks only when future losses decrease and keep the fund below the 1.25% floor. This converts the system from an ex ante to basically an ex post funded system.

Outstanding issues

In its deposit insurance options paper, the FDIC argues that the current structure both is unfair, as all banks do not pay premiums to finance future losses, and prohibits the FDIC from encouraging all insured institutions to reduce their risk exposure and, thereby, also the possibility and cost of failure through charging risk-based premiums. But, although few banks currently pay premiums, all can again pay if bank failures increase in the future and the resulting losses draw the ratio below 1.25%. Thus, it is primarily a question not of if but of when. In particular, the FDIC is concerned about a number of primarily newly chartered banks that are owned by security dealers and where the dealers are transferring their customers’ monies from noninsured money market funds to insured time deposits at the banks. To the extent that these banks are in good financial condition, they do not pay insurance premiums and may be viewed as getting a free ride and possibly even increasing premiums for other banks if their rapid deposit growth causes the FDIC reserve ratio to dip below 1.25% of insured deposits. However, these banks will pay premiums if and when future failures drive the reserve ratio down sufficiently and, at that time, excessive growth can be included as a risk factor. Nevertheless, when premiums are reestablished, the banks that failed and were responsible for the losses to the FDIC would have disappeared and would not be paying for the losses. Thus, unlike ex ante premiums, ex post premiums do not have all banks contributing monies to pay for their own future losses. The guilty get off freer.

In addition, it may be argued that, if institutions know that they will have to pay higher premiums in ex ante structures if they are perceived to be more risky and thus more likely to contribute to the losses, they will act more cautiously and become less risky. In contrast, in ex post structures, in which if banks fail and generate losses to the fund, they will not have to pay any premiums at all and will have less incentive to reduce risk-taking. That is, by reducing market discipline, ex post premiums may exacerbate moral hazard behavior that ex ante premiums may control. However, members of the insurance pool could impose at least some degree of discipline, if, knowing that failures would increase premiums for all surviving banks, they monitored each other and exerted pressure both on each other to avoid excessive risk-taking and on the insurer to subject riskier pool members to greater monitoring, regulation, and covenants. But this is more difficult to do successfully the larger and more diverse are the members of the pool. In the current ex post settling-up structure, it might be desirable to consider dividing all insured banks into smaller and more homogenous pools, say, according to their primary regulator.5 This would enhance both interbank monitoring and discipline. In addition, competition among the pools on the basis of premiums could be expected to increase the incentives of regulators to intensify pressure on their members to limit their losses in order to lower premiums. Recent studies on a large sample of countries conducted at the World Bank conclude that, if deposit insurance premiums are ex post and funding is provided by private banks rather than the government, market discipline is increased, and the banking system becomes less fragile.6

Is the current ability of the FDIC to control risk-taking by banks hampered by its inability to impose risk-based premiums on most banks? Probably, but not necessarily to a major extent. Risk-based premiums are currently imposed on the few banks that are classified as risky under DIFA. But, if risk-taking by other banks increases sufficiently, they may reasonably be expected to be downgraded into the risky classification. Moreover, as noted above, once losses are sufficiently large to drive the reserve ratio below its floor level, all banks will again be eligible to pay premiums and the FDIC can impose a risk structure at that time.

Lastly, neither the appropriate measure of risk to use in charging premiums nor how to scale the premiums is easy to determine. Losses from bank failure are a function of both the probability of failure and the loss when there is a failure. The probability of failure, in turn, is a function not only of the behavior of the bank itself but also of that of the regulators, who supervise and examine the bank. The better the supervision, the smaller will be the probability of failure. The loss if there is a default is largely under the control of the regulatory agencies, which have the authority to resolve the bank. FDICIA requires that banks be resolved when or shortly after the value of their tangible equity declines to no less than 2% of their assets. Thus, the more timely the resolution, the smaller the loss. But the regulator’s speed of action is based not only on the ability of the agency to act in such a manner, but also on the political will to do so. The loss to the FDIC in recent failures has varied greatly, from 0% to nearly 75% in the 1999 failure of the First National Bank of Keystone (West Virginia) and an estimated 20% to 45% in the 2001 failure of the Superior Bank (Chicago). This suggests that a premium based solely on the risk characteristics of banks is incomplete, and that it is difficult to include the appropriate characteristics of the regulatory agencies. In sum, although they sound fine in theory, effective risk-based insurance premiums would be difficult to implement in practice.

The FDIC also recommends increasing the account insurance coverage maximum from $100,000, where it has been since 1980. Because of inflation, the constant dollar value of the coverage has declined by some 50% since then. On the other hand, on this basis, the coverage is still higher than before that increase or at any time since the introduction of insurance in 1934, with the exception of the mid-1970s. About 98% of all domestic deposit accounts are currently fully insured and 71% of total domestic deposits are insured.

On the one hand, increasing the maximum account coverage would protect more depositors and might increase the account amount that some depositors would hold at any one bank, particularly smaller banks. On the other hand, it would also decrease the number of depositors at risk and, thus, the number of depositors motivated to monitor the financial condition of their banks and to charge a higher deposit rate or to withdraw their deposits (run) if they believe the banks are assuming too much risk. Such discipline by depositors reduces the probability of bank failures and, consequently, potential losses to the FDIC.

Before the recent restructuring of deposit insurance, the extent of deposit insurance coverage per account was an important public issue because it affected the loss exposure of taxpayers. But under the current structure, it is less of a public policy concern and more of a private concern for the premium paying banks, as are issues of when, how, and on which institutions to impose premiums. After all, it is the banks that will be picking up the larger share, if not all, of the losses to the FDIC. The major public policy concern should be to prevent any change in the deposit insurance structure that might intentionally or inadvertently put the taxpayer back on the hook for FDIC losses from bank failures.

Tracking Midwest manufacturing activity

Manufacturing output indexes (1992=100)

| August | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 151.0 | 154.0 | 169.5 |

| IP | 146.1 |

147.5 |

154.6 |

Motor vehicle production (millions, seasonally adj. annual rate)

| August | Month ago | Year ago | |

|---|---|---|---|

| Cars | 4.7 | 4.9 | 5.7 |

| Light trucks | 6.8 | 6.9 | 6.8 |

Purchasing managers' surveys: net % reporting production growth

| September | Month ago | Year ago | |

|---|---|---|---|

| MW | 47.5 | 45.1 | 56.6 |

| U.S. | 51.3 | 52.2 | 52.1 |

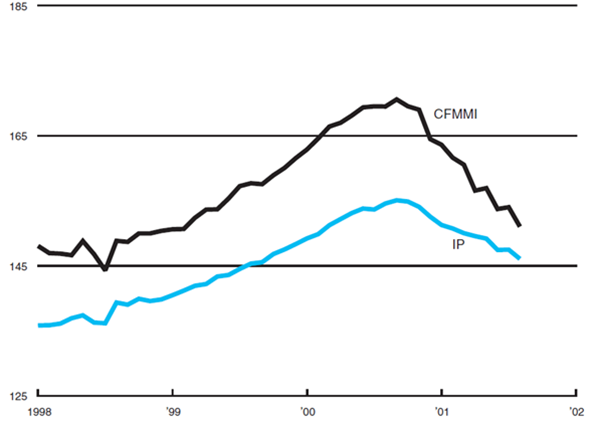

Manufacturing output indexes, 1992=100

The Chicago Fed Midwest Manufacturing Index (CFMMI) fell 1.9% from July to August, reaching a seasonally adjusted level of 151. Revised data show the index was at 154 in July and had risen 0.2% from June. The Federal Reserve Board’s Industrial Production Index (IP) for manufacturing fell by 1% in August after being unchanged in July.

Auto production decreased from 4.9 million units in July to 4.7 million units in August, and light truck production also decreased from 6.9 million units to 6.8 million units. The Midwest purchasing managers’ composite index (a weighted average of the Chicago, Detroit, and Milwaukee surveys) for production increased from 45.1% in August to 47.5% in September. The indexes for Chicago and Milwaukee increased, while the Detroit index decreased. The national purchasing managers’ survey decreased from 52.2% to 51.3% during this period.

Notes

1 Federal Deposit Insurance Corporation, 2000, Deposit Insurance Options Paper, Washington, DC, August.

2 Federal Deposit Insurance Corporation, 2001, Keeping the Promise: Recommendations for Deposit Insurance Reform, Washington, DC, April.

3 A more detailed analysis appears in George G. Kaufman, 2001, “The current status of deposit insurance in the United States and proposals for reform,” Loyola University Chicago, working paper, July, and George G. Kaufman and Peter Wallison, 2001, “The new safety net,” Regulation, Summer, pp. 28–35.

4 George J. Benston and George G. Kaufman, 1998, “Deposit insurance reform in the FDIC Improvement Act: The experience to date,” Federal Reserve Bank of Chicago, Economic Perspectives, Second Quarter, pp. 2–20.

5 Such a suggestion was recently made in U.S. Shadow Financial Regulatory Committee, 2000, “Deposit insurance reform options,” American Enterprise Insurance, Washington, DC, statement, No. 165, December 4.

6 See, for example, Asli Demirgüç-Kunt, and Edward J. Kane, 2001, Deposit Insurance Around the Globe: Where Does It Work? Washington, DC: World Bank, July.