To answer the question in the title: Thus far, not dramatically so. In this Chicago Fed Letter, I document three facts supporting this conclusion.1 First, although the Covid period has seen multiple months with high rates of worker movement (reallocation) across industry sectors (relative to previous recessions), net cumulative reallocation from the onset of the pandemic through December 2020 is only the third highest among post-1945 recessions over the same horizon (and is only modestly outside the confidence bound for the average across those recessions). Thus, much of the reallocation during Covid seems to have been a reversion toward the pre-crisis allocation following the highly dispersed initial impact of the virus.

Second, excluding the leisure and hospitality sector yields an even stronger result. In the absence of the outsized effect on this one sector, despite the large initial spike in reallocation, the Covid recession has had the lowest degree of net reallocation through ten months among post-1945 recessions. Thus, the data suggest that the Covid recession may accurately be characterized as “a tale of two sectors”: leisure and hospitality versus all others.

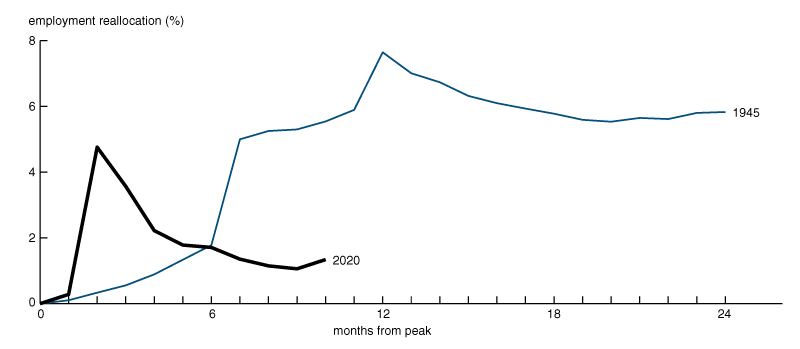

Third, a comparison with the post-World War II recession in 1945 (which was excluded in calculating the first two facts) shows that net reallocation during the Covid period is dwarfed by that during 1945. For example, after ten months of Covid, about 1% of workers were in a different sector than at the business cycle peak preceding the onset of the pandemic (relative to what we would expect in normal times); the same figure in 1945 was almost 6%. Further, the reallocation during 1945 was persistent, whereas that during Covid has been largely transitory. Thus, the 1945 recession seems to fit the mold of a “reallocation recession”; the Covid recession less so.

Reallocation during Covid-19

Covid-19 has had an enormous impact on the U.S. labor market. Further, a number of recent studies, e.g., Barrero, Bloom, and Davis (2020), David (2020), and Barrero et al. (2021), have examined the heterogeneous effects of the Covid pandemic across industries and firms and the resulting reallocation of economic activity.2 Assessing the extent of such reallocation can be crucial in understanding the current and future impact of Covid, both in the short and longer run. For example, large-scale reallocation may signal a costly disruption to the economy entailing a potentially difficult and time-consuming reshuffling of workers with detrimental effects on aggregate labor market outcomes, e.g., an extended period of heightened unemployment.3 I construct an index of cross-sector worker reallocation as:4

$${{I}_{t\to t+h}}=\frac{1}{2}\sum\limits_{i}{\left| E_{t+h}^{i}-E_{t}^{i} \right|}$$where $E_{t}^{i}$ is the share of total employment in sector $i$ in month $t$. The index ${{I}_{t}}_{\to t+h}$ measures the fraction of workers who move between sectors from month $t$ to month $t+h$ and hence can be interpreted as a reallocation rate. To calculate the index, I use employment data from the U.S. Bureau of Labor Statistics. In order to obtain a consistent set of industries over the entire postwar period, I use a set of 14 sectors. These are: mining/logging, construction, durable goods manufacturing, nondurable manufacturing, wholesale trade, retail trade, transportation/warehouses/utilities, information, finance, professional/business services, education/health services, leisure/hospitality, other services, and government.5 Using monthly data on employment in these sectors, which add up to total nonfarm employment, I compute the reallocation index over horizons ranging from one to 24 months. The index only reflects the differences in changes in employment shares across sectors and thus captures reallocation across those sectors alone. For example, if all sectors featured the same proportionate employment decline over a particular period, the index would equal zero.

1. Monthly employment reallocation

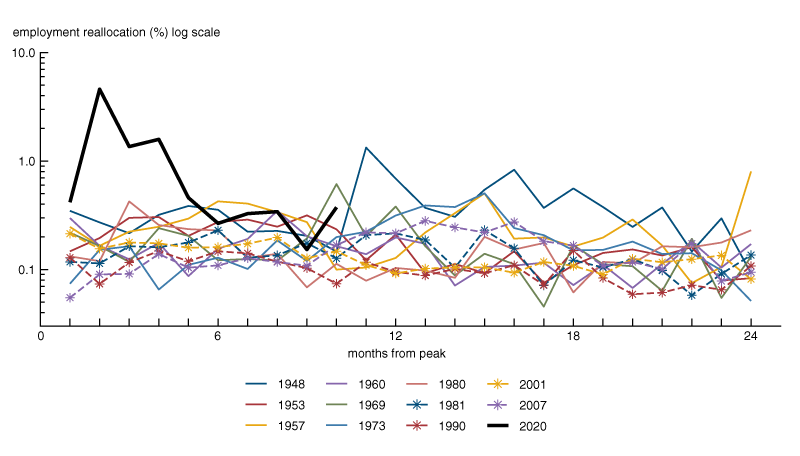

Figure 1 plots month-by-month reallocation rates during the first ten months of Covid against the monthly reallocation rates among all post-1945 recessions (i.e., $t$ varies from zero to 23, and $h$ is always one). For each recession, month zero represents the business cycle peak prior to the onset of the downturn according to the National Bureau of Economic Research recession dates (e.g., for Covid, month zero is February 2020). The figure shows a large spike in the monthly reallocation rate beginning in April, which persists for about six months. The reallocation rate remains on the high side through month ten (December 2020), but is broadly within the range experienced in previous recessions.

2. Cumulative employment reallocation

3. Cumulative reallocation, 2020 versus previous post-1945 recessions

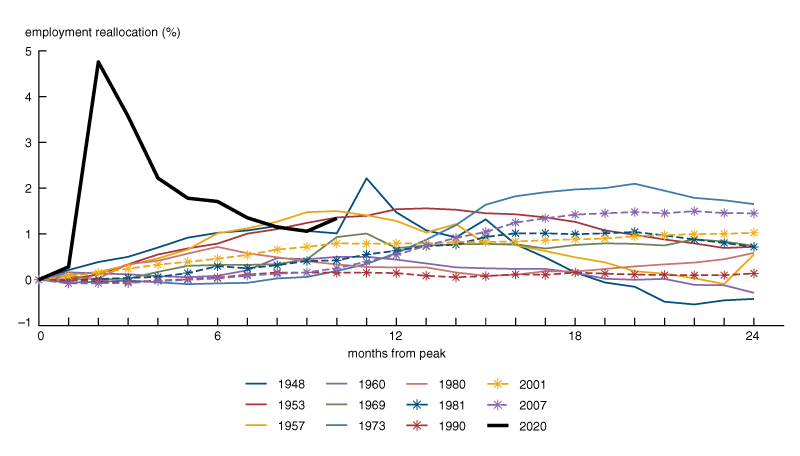

Month-to-month reallocation rates may not be sufficient to gauge the extent of net, or cumulative, reallocation over the course of the pandemic. Specifically, the monthly rates do not indicate whether the reallocation occurring in later months is in the same direction as the initial changes and thus cumulative reallocation is increasing over time, or whether the sectors that lost workers in the early months are actually regaining workers such that the net effect is falling. Figure 2 plots (excess) cumulative reallocation rates during each recession (i.e., $t$ is always equal to zero, while $h$ varies from one to 24).6 The figure shows that after the initial spike in April 2020, cumulative reallocation generally fell through December. Thus, the persistently high rates of reallocation seem to represent reversion toward the pre-Covid allocation, rather than a propagation of the initial effects through April. On net, cumulative reallocation in the first months of Covid was markedly higher than in any previous post-1945 recession; by month ten (December) the net effect is not the largest among these recessions.

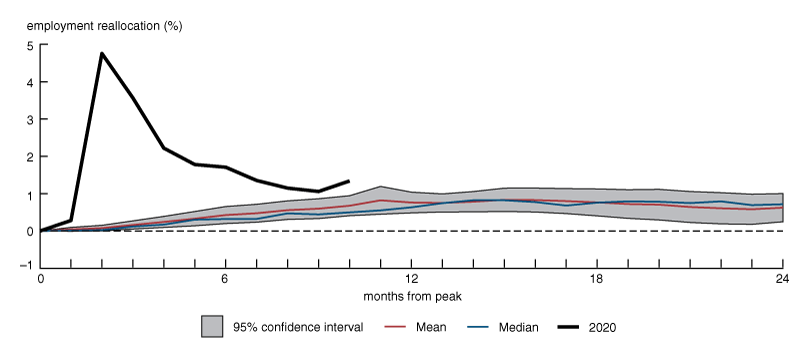

In figure 3, I plot the cumulative reallocation rate during Covid against the average of the previous post-1945 recessions, along with a 95% confidence interval around that average at each horizon. Cumulative reallocation during Covid remains above the confidence region over the entire ten-month period, but only modestly so at the later months (the upper bound of the interval in month ten is 0.95%, and the value during Covid is 1.3%). Thus, much of the initial reallocative effects of Covid seem to have dissipated by this point.

4. Cumulative reallocation, excluding leisure and hospitality

The role of leisure and hospitality

Figure 1 plots month-by-month reallocation rates during the first ten months of Covid against the monthly reallocation rates among all post-1945 recessions (i.e., $t$ varies from zero to 23, and $h$ is always one). For each recession, month zero represents the business cycle peak prior to the onset of the downturn according to the National Bureau of Economic Research recession dates (e.g., for Covid, month zero is February 2020). The figure shows a large spike in the monthly reallocation rate beginning in April, which persists for about six months. The reallocation rate remains on the high side through month ten (December 2020), but is broadly within the range experienced in previous recessions.

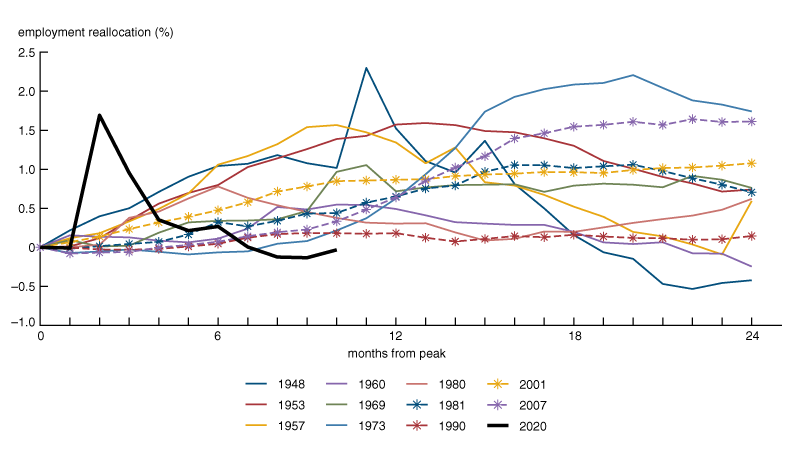

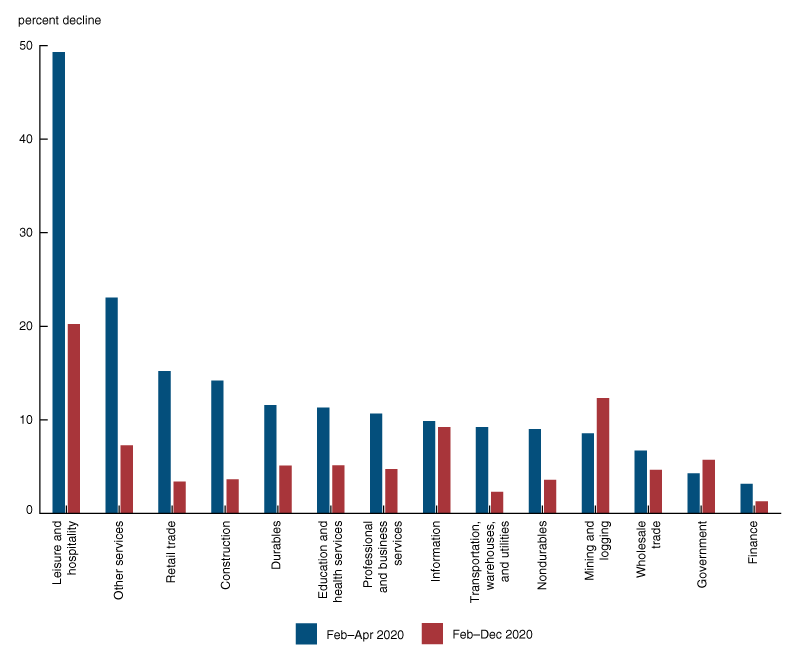

The disproportionate effects of Covid on the leisure and hospitality sector is the primary driver of reallocation during the pandemic recession. Figure 4 plots the cumulative reallocation rate excluding this single sector for the Covid period and for all previous post-1945 recessions. Here, the picture is more stark: After the initial spike, the Covid recession ends up exhibiting the lowest degree of net reallocation. In this sense, we may be able to safely view the Covid recession as “a tale of two sectors”: the leisure and hospitality sector, which experienced a massive decline in relative employment, and all other sectors, which experienced employment declines that were not identical but turned out be less dispersed than in any previous post-1945 recession.

Figure 5 plots the percentage employment decline in each of the 14 sectors over two periods: February to April and February to December. The leisure and hospitality sector is clearly the hardest hit over both horizons, with declines of about 49% and 20%, respectively. However, the dispersion in employment losses across the remaining sectors is considerably smaller over the longer horizon, driving the sharp difference in the ranking of the reallocation rate during Covid relative to previous recessions as illustrated in figures 2 and 4 (e.g., Covid is third highest in figure 2 and lowest in figure 4 after ten months).

The 1945 recession

An informative comparison can be made between Covid and the post-World War II recession of 1945. A common narrative for this downturn is that government spending declined sharply and workers needed to be reallocated away from war-related sectors. Figure 6 plots the path of cumulative reallocation during Covid against that in 1945. The 1945 recession exhibits a very different pattern from Covid: Rather than a sharp jump in reallocation and then a slow reversion toward the pre-recession allocation as during Covid, cumulative reallocation in 1945 increased gradually over approximately one year to a peak considerably higher than the peak during Covid (4.75% versus 7.6%) and then essentially plateaued, falling only slightly over the next year. In other words, the worker reallocation of 1945 was both substantially larger than that during Covid and induced long-lasting changes in the distribution of workers, whereas Covid does not seem to have done so.

5. Employment declines, 2020

6. Cumulative reallocation: 2020 versus 1945

Figure 7 plots the percentage employment declines by sector two and ten months after the onset of the 1945 recession and so is the analog of figure 5 (note that negative values indicate employment gains). Two months into the 1945 recession, differences in employment changes across sectors remained relatively modest. In contrast, after ten months there are extremely large disparities, ranging from a loss of about 30% (durable goods) to a gain of almost 10% (construction and wholesale trade). This degree of cross-sector reallocation is considerably larger than we saw ten months into the Covid recession.

The measure of reallocation

Before concluding, I want to share some observations on the measure of reallocation used in this article. First, as noted above, the measure captures only the reallocative effects of the Covid recession—it does not include the effects that are common across sectors and thus does not (and is not intended to) paint a complete picture of the aggregate impact of the Covid-19 pandemic and recession on the labor market (e.g., average employment across all sectors fell dramatically by over 6% between February and December 2020, a decline that is not captured in the reallocation measure at all).

7. Employment declines, 1945

Second, the measure is by no means perfect and may not pick up all relevant margins of reallocation: For example, by only analyzing the number of workers, the measure may miss important changes in labor utilization. For example, furloughed workers may be counted as employed, even though they are not actively engaged in productive activities. Similarly, workers whose hours are reduced will not count toward reallocation away from their sectors, and workers whose hours are increased (e.g., through overtime) do not count toward reallocation into their sectors. As a second example, although the monthly employment data at the sectoral level enable a high-frequency analysis covering the entire economy going back as far as World War II, recent evidence suggests that a considerable amount of reallocation during the Covid recession may be taking place across firms within a sector (e.g., Barrero, Bloom, and Davis, 2020). Due to its coarser level of aggregation, the reallocation measure calculated here would not capture these within-sector movements.

Third, the reallocation measure is purely backward-looking and accounts for the actual reallocation that has taken place, but is not necessarily reflective of expected reallocation going forward or of the extent of desired reallocation, e.g., whether there are firms or sectors that would like to expand but are limited by other capacity constraints or the ability to find and hire available and willing workers with the appropriate skills. A number of important recent studies have examined various forward-looking measures of reallocation during Covid and found potentially sizable effects. For example, Barrero, Bloom, and Davis (2020) and Barrero et al. (2021) construct measures of expected sales and employment reallocation across firms using survey data at various points during the Covid downturn. Barrero et al. (2021) and David (2020) use dispersion in stock returns across firms and industries as another indicator of the heterogeneous effects of the pandemic. Thus, in sum, while the reallocation index calculated and analyzed in this article is a useful gauge of the extent of reallocation experienced to date during the Covid era, it is far from the full story of the impact of the virus on the U.S. economy and may not be fully indicative of the changes we should expect going forward.

Conclusion

Reallocation during Covid-19 has been on the high side relative to other recent recessions, but not dramatically so, at least thus far. Thus, caution should be taken before labeling Covid-19 a “reallocation recession.” Three main facts support this conclusion: 1) after an initial spike, net reallocation during the Covid period is not the highest among post-1945 recessions and is only slightly above the statistical range for the average of previous recessions; 2) even the modest amount of excess reallocation relative to previous recessions is entirely driven by a single sector, namely, leisure and hospitality, while reallocation across the rest of the economy has, in fact, been lower than all previous post-1945 recessions; and 3) a comparison to the 1945 recession provides some insight into what a true “reallocation recession” can look like. During that downturn, net cumulative reallocation was substantially larger than during Covid and was in large part persistent, whereas the impact of Covid has turned out be more transitory, with much of the initial effects already reversed.

Notes

1 I would like to thank Christopher De Mena for excellent research assistance.

2 See Jose Maria Barrero, Nicholas Bloom, and Steven J. Davis, 2020, “Covid-19 is also a reallocation shock,” National Bureau of Economic Research, working paper, No. 27137, May, Crossref, https://doi.org/10.3386/w27137; Joel M. David, 2020, “Will the Covid-19 pandemic lead to job reallocation and persistent unemployment?,” Federal Reserve Bank of Chicago, Chicago Fed Letter, No. 444, August, Crossref, https://doi.org/10.21033/cfl-2020-444; and Jose Maria Barrero, Nicholas Bloom, Steven J. Davis, and Brent H. Meyer, 2021, “Covid-19 is a persistent reallocation shock,” University of Chicago, Becker Friedman Institute for Economics, working paper, No. 2021-02, January, available online.

3 See David (2020) for an examination of this possibility using data from the early months of the pandemic.

4 The index was developed in Gueorgui Kambourov, 2009, “Labour market regulations and the sectoral reallocation of workers: The case of trade reforms,” Review of Economic Studies, Vol. 76, No. 4, October, pp. 1321–1358, Crossref, https://doi.org/10.1111/j.1467-937X.2009.00552.x; it has been used in previous studies of reallocation patterns during Covid, e.g., David (2020).

5 These 14 correspond roughly to two-digit NAICS (North American Industry Classification System) sectors. Employment data on three-digit sectors are available since 1990. I have verified that the patterns of reallocation across these more detailed sectors during the four recessions since 1990 are similar to those across the baseline two-digit ones (the rate of reallocation is somewhat higher in all recessions, but the comparisons across recessions are largely unchanged).

6 At each horizon, I calculate the average reallocation rate over the entire pre-Covid period (January 1947–January 2020) and subtract the average for that horizon from the values observed in each recession. This is what I call excess reallocation. I use this measure throughout when analyzing cumulative reallocation rates, although for purposes of parsimony I do not always explicitly use the term “excess.”.