The U.S. health insurance industry, which owns over $380 billion in financial assets, was placed in the spotlight when the Covid-19 pandemic began in the spring of 2020.1 The pandemic led to health-care-specific changes, such an increase in Covid-19 testing and related hospitalizations, as well as a temporary postponement or cancellation of elective procedures to make space for Covid-19 patients. It also led to changes in financial markets, notably a decrease in interest rates. These changes affected the risks that health insurers are subject to and the overall profitability of the industry.

The pandemic affected health insurer earnings by changing the pattern of payments on claims and by decreasing investment income. In 2020 the increase in Covid-19 hospitalizations and testing requirements placed upward pressure on health insurer costs. At the same time, the postponement and cancellation of elective procedures placed downward pressure on costs and offset the increase in Covid-related costs. Furthermore, the industry benefited from a large increase in premiums in 2020 due to a general increase in enrollment and premium rates. Thus, while one might have expected the pandemic to be bad for health insurers, they actually experienced an increase in underwriting income that helped buttress them against their investment losses, leading to an increase in total net income for the sector overall.2 In fact, 2020 turned out to be the most profitable year for the industry since before the 2008 financial crisis. This increase in profits was short-lived, however, with costs increasing in 2021 due to pent-up demand for medical care.

In this Chicago Fed Letter, I examine the impact of the pandemic on the health insurance industry’s underwriting gains and investment returns. I then tie these two outcomes together to explain the impact of the pandemic on the industry’s profits across 2020 and 2021.

Effect of the pandemic on underwriting

As Covid-19 first surged in 2020, many individuals needed to be hospitalized, leading to hospital bed and health care worker shortages across the nation. The increase in Covid-19-related hospitalizations, along with the fact that insurers were required to cover the cost of Covid-19 tests (so long as they were considered medically appropriate), put upward pressure on insurer costs. Many insurers even waived out-of-pocket expenses for policyholders who were hospitalized with Covid-19. However, health insurers also saw a reduction in costs associated with elective surgeries and other procedures, as they were quickly postponed or canceled after the onset of the pandemic to curb the spread of the virus and to make hospital beds and general facilities available for Covid-19 patients. Furthermore, primary care visits dropped despite the surge of telehealth. This decrease in non-Covid-related medical care utilization offset the increase in Covid-related utilization in 2020.

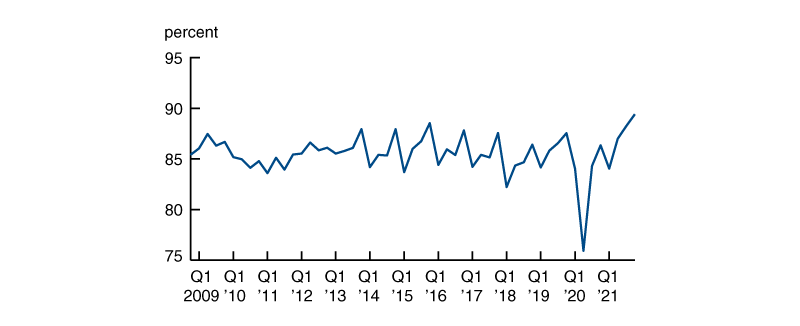

The impact of the cancellation and postponement of elective surgeries and procedures in the second quarter of 2020 is evident through changes in the health insurance industry’s average medical loss ratio (MLR). A health insurer’s MLR is a standard measure depicting the share of premiums they spend on medical expenses and activities that improve the quality of health care, such as efforts to improve patient safety and reduce medical errors. The industry average MLR fell by 9.6% between the first and second quarters of 2020 (see figure 1). The MLR increased by the third quarter of 2020 as elective procedures began to resume, and nearly reached pre-pandemic levels by the end of 2020.

1. Health insurance industry: Weighted average medical loss ratio

Source: Author’s calculations based on insurance regulatory data provided by Standard & Poor’s.

As the temporary decrease in non-Covid-related medical care utilization offset the increase in Covid-related costs, benefit payments increased by 5.5% in 2020, which is consistent with prior year-over-year changes. Furthermore, the industry experienced a 10% increase in earned premiums in 2020. The increase in premiums, which is larger than prior year-over-year changes, can be attributed to increases in enrollment and premium rates (rather than the pandemic). As the increase in benefit claims remained consistent with prior year-over-year changes and premiums earned increased, underwriting income increased by more than 80% in 2020.3

It is important to note that while average insurer MLRs were low in early 2020, health insurers were still required to meet the MLR requirement introduced by the Affordable Care Act (ACA). As of 2011, the ACA required that health insurers have MLRs of at least 80% in the individual market and 85% in the group market. If 80% of premiums are not spent toward policyholder benefits, then the insurer must issue a rebate to its policyholders. Thus, rebates in 2020 were the highest they have been since the MLR requirement was instituted—at $2.2 billion.4 Nevertheless, rebates form a very small proportion of premiums earned. Rebates as a share of net premiums earned increased from 0.18% in 2019 to 0.27% in 2020. Thus, overall, the decrease in non-Covid-related medical care utilization and increase in premiums earned in 2020 positively impacted insurers’ earnings. The decrease in medical care utilization in 2020 negatively impacted 2021 earnings, however, as pent-up demand for medical care caused benefit claims to increase significantly.

Effect of the pandemic on investment returns

Health insurers, and insurers in general, receive premiums from policyholders in exchange for promising to pay for claims in the future. They invest these premiums in a variety of assets and derive profit from the difference between investment returns and payments made toward policyholder benefits (primarily medical expenses).

The pandemic, through its impact on financial conditions, ultimately dampened the industry’s income earned from investments.

2. Health insurance industry assets, 2021:Q4

| Billions of dollars | Percent of invested assets | |

| Bonds and securitizations |

160.0 |

56.2 |

| Government debt |

54.6 |

19.2 |

|

Treasury |

25.8 |

9.0 |

|

Agency mortgage-backed securities |

13.5 |

4.7 |

|

Municipal |

15.3 |

5.4 |

| Corporate debt |

105.5 |

37.0 |

|

Corporate public |

75.9 |

26.7 |

|

Corporate private |

0.9 |

0.3 |

|

Corporate mortgage-backed securities/ |

28.6 |

10.0 |

| Equity |

45.1 |

15.8 |

|

Common stock |

44.1 |

15.5 |

|

Preferred stock |

0.9 |

0.3 |

| Mortgage loans |

0.3 |

0.1 |

| Real estate |

6.0 |

2.1 |

| Cash, cash equivalents, and short-term investments |

52.5 |

18.4 |

|

Cash |

19.2 |

6.7 |

|

Cash equivalents |

29.4 |

10.3 |

|

Short-term investments |

3.9 |

1.4 |

| Other investments |

21.0 |

7.4 |

| Total invested assets | 284.8 | 100.0 |

Insurers generally make investment decisions based on investment returns available in the market and the characteristics of their liabilities, such as duration and liquidity. Since the health insurance industry’s liabilities primarily consist of promises to pay future policyholder medical claims, health insurers structure their asset portfolios, in part, to match the timing of cash flows from the assets to their expected liability payments. While some medical expenses require consistent payouts over a long period (e.g., due to long-term treatments), many are short term in nature, so health insurers can expect to pay claims from the first day the policy has been issued. Thus, they invest in a mix of long-term and short-term securities. By doing so, health insurers can generate a sustainable return on their investments while also maintaining enough liquidity to make short-term payments, particularly sudden payments that may result from unexpected waves of claims.

The largest component of the health insurance industry’s invested asset portfolio is bonds and securitizations, which were 56.2% of total invested assets at year-end 2021. Bonds are the predominant form of long-term investment for insurers, with the health insurance industry’s bond portfolio having an average remaining maturity of roughly ten years. Within bonds, health insurers invest 13.7% of their assets in U.S. Treasury bonds and agency mortgage-backed securities (MBS), 5.4% in municipal bonds, and 37.0% in corporate debt (see figure 2).

The second-largest component of the health insurance industry’s invested asset portfolio is cash, cash equivalents, and short-term investments, which equaled 18.4% of total invested assets at year-end 2021. Cash and cash equivalents are low-risk instruments that act as a source of liquidity for health insurers but provide limited returns. Specifically, cash equivalents include instruments, such as money market mutual funds and bonds with maturities of three months or less. Short-term investments include commercial paper, as well as mortgage loans and bonds with maturities of one year or less. The low-risk and short-term nature of cash and short-term securities makes them liquid investments, bolstering health insurers’ ability to make claim payments at short notice.

While maintaining greater liquidity and lower levels of risk helps health insurers maintain timely short-term payments, there is a trade-off between risk and return, with safer assets generally providing lower yields. In 2021, the average yield of health insurer investments by asset type was: corporate debt (2.97%), municipal bonds (4.03%), Treasury securities and agency mortgage-backed securities (1.80%), and cash-equivalent securities and short-term investments (0.07%).

Finally, investments in equity securities comprise the third-largest component of the health insurance industry’s asset portfolio. As of year-end 2021, health insurers held 15.8% of their invested assets in equity. Equities generally involve greater risk than bonds and short-term investments but offer the potential for larger returns.

There are two primary mechanisms through which the health industry’s asset portfolio was affected by the pandemic. First, the pandemic induced significant uncertainty about claim payments and within financial markets in 2020. It appears that health insurers held new premiums in cash and short-term investments to account for this uncertainty about the impact of the pandemic on claim payments and to avoid investing in volatile markets.5 Their cash and short-term investment holdings increased from $49.9 billion to $73.3 billion (from 20.4% of invested assets to 26.3% of invested assets) between the first and second quarters of 2020; the bulk of the increase was in cash equivalents. In the remaining quarters of 2020, the amount of assets that health insurers held in the form of cash and short-term investments stabilized at a slightly lower value of $65.0 billion, compared with $73.3 billion in the second quarter of 2020. By the end of 2021, the share of assets invested in cash and short-term securities was 18.4%, similar to the 2019 share.

Second, the pandemic caused depressed economic conditions, which led the Federal Reserve to lower the federal funds rate from a range of 1.50%–1.75% to a range of 0%–0.25% in March 2020 to promote economic recovery. As a result, there was a 71% decrease in interest income earned from short-term investments in 2020, as these investments are highly responsive to changes in the short-term interest rate. This contributed to a 13.6% decrease in the industry’s investment income in 2020. The industry’s investment income further decreased by 5.3% in 2021 as the federal funds rate remained near the zero lower bound through 2021. Still, the sector’s realized capital gains were positive in 2020 and 2021, suggesting that changes in investment income were primarily a result of the change in interest rates.

Effect of the pandemic on profits

With the pandemic impacting both costs and investment income, the health insurance industry experienced changes in its profitability in 2020. On the one hand, underwriting income increased as earned premiums increased and the decrease in costs associated with the decline in non-Covid-related medical care utilization offset the negative impact of Covid-related costs. On the other hand, investment income decreased in 2020 due to the decrease in interest rates. Ultimately, the gains from the decrease in medical care utilization were significantly greater than the losses resulting from a decrease in investment income, thereby leading to a 38.1% increase in net income between 2019 and 2020.6

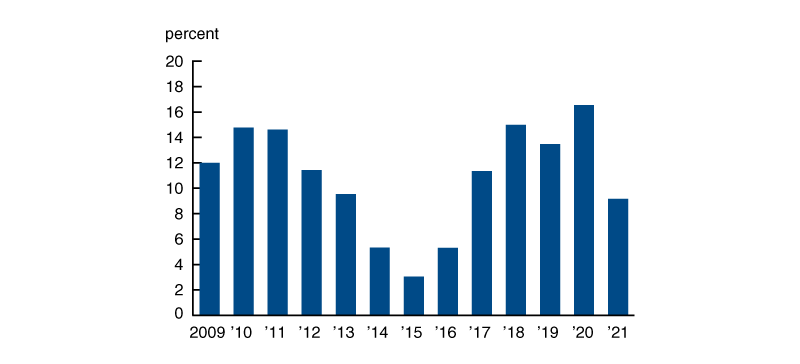

The return on policyholder surplus (net income/policyholder surplus), a measure of the industry’s profitability, increased by 22.7% between 2019 and 2020 (see figure 3), making 2020 the most profitable year for the health insurance industry since before the 2008 financial crisis.

3. Return on policyholder surplus (net income/policyholder surplus)

The industry’s increase in profitability did not continue into 2021 as claim payments increased due to pent-up demand for medical care. In fact, 2021 profits were the lowest they have been since the 2014–16 period when the health insurance exchanges that were created as a part of the ACA led to losses for many insurers. With the decrease in profits in 2021, the total return on policyholder surplus across 2020 and 2021 stands at an annual rate of 12.9%, which is comparable in magnitude to the sector’s average annual return from 2017 through 2019.

Conclusion

The Covid-19 pandemic was the worst public health crisis of the last 100 years. Despite the surge of Covid-19 cases, hospitalizations, and testing requirements, in 2020 the health insurance industry experienced its most profitable year since before the 2008 financial crisis. However, the positive impact of the pandemic on health insurance profits was short-lived and did not continue into 2021. As such, the industry’s profit for the combined 2020–21 period is comparable to that of prior years.

Notes

1 I use insurance regulatory filing and investment holdings data collected by the National Association of Insurance Commissioners (NAIC) as the primary data source unless cited otherwise. I exclude California-specific health insurers when calculating the health insurance industry’s total financials as most California-specific health insurers are only required to file with the California State Department of Insurance and not the NAIC.

2 Underwriting income = total revenue-underwriting deductions. For health insurers, total revenue primarily consists of premium income. Underwriting deductions are the costs associated with underwriting health insurance policies. Health insurer costs primarily consist of claim payments and administrative expenses. Net income is approximately equal to net underwriting income + net investment income – capital gains tax – foreign and federal taxes.

3 The overall increase in underwriting income was dampened by an increase in administrative expenses and claims adjustment expenses in 2020. The increase in administrative expenses occurred due to the return of the health insurer fee, which is an annual fee charged to health insurers providing health policies.

4 The effects of the pandemic were captured despite rebates being calculated based on a three-year rolling average.

5 Property and casualty (P&C) insurers increased their investments in cash and short-term securities by 32.0% between the first two quarters of 2020, thereby reaffirming the idea that insurers were focusing on avoiding uncertainty and additional market risk at the beginning of the pandemic.

6 Capital gains taxes and federal and foreign taxes increased in 2020, offsetting some of the increase in net income from the decrease in non-Covid-related medical care utilization.