The Phillips curve captures the empirical inverse relationship between the level of inflation and unemployment. The reciprocal of its slope, sometimes referred to as the “sacrifice ratio,” represents the increase in the unemployment rate associated with a 1 percentage point reduction in the inflation rate. In this Chicago Fed Letter, we provide evidence that the Phillips curve has steepened in many industrialized countries since the start of the recovery from the Covid-19 pandemic. This suggests a lower sacrifice ratio now than before 2020.1

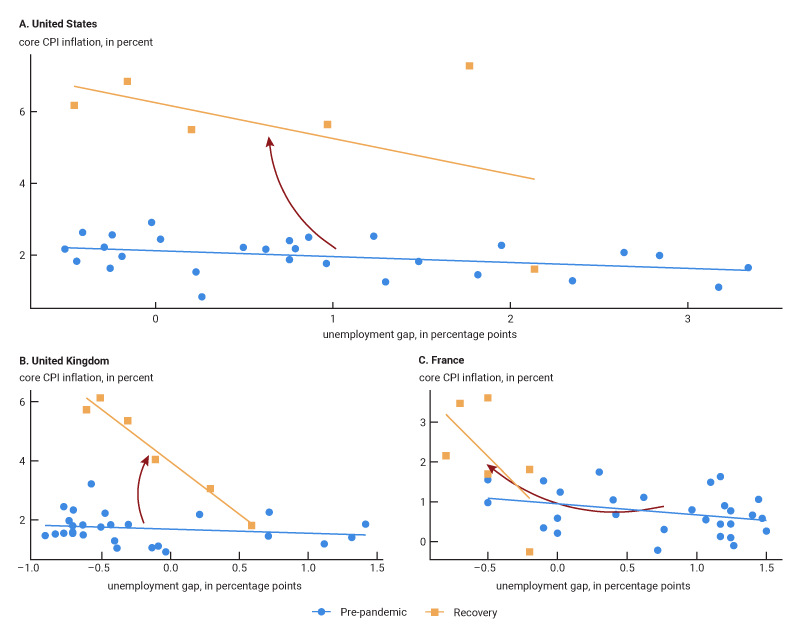

The gist of our main result is apparent in figure 1, which shows the Phillips curves of the United States, United Kingdom, and France during two time periods: the seven years (or 28 quarters) before the pandemic (2013:Q1–2019:Q4) and the six quarters of the recovery for which we have data (2021:Q1–2022:Q2).2 These three countries’ Phillips curves have steepened significantly during the recovery, in stark contrast with their flat Phillips curves of the pre-pandemic period. Before the pandemic, the U.S. Phillips curve had been flattening for over a decade3 and was considered “dead” by many economists.4 It appears this pattern has sharply reversed over the first six quarters following 2020.

1. Phillips curves of the United States, United Kingdom, and France: Pre-pandemic and recovery periods

Sources: Authors’ calculations based on data from the Organisation for Economic Co-operation and Development and Haver Analytics.

In the rest of this article, we show that Phillips curves have steepened across a sample of 29 industrialized countries using data from the Organisation for Economic Co-operation and Development (OECD).5 This change in the relationship between unemployment and inflation is robust to the inclusion of crude oil prices, inflation expectations, and other measures of economic slack besides the unemployment gap.6 What drives our results is that declines in unemployment rates are associated with larger increases in inflation rates during the recovery from the pandemic than during the pre-pandemic period. Our results are generally the same when we examine countries individually (within-country variation) or when we study them pooled together (cross-country variation).

An important limitation of our analysis is that we only have six quarters of data for the recovery period. Therefore, it is still too early to determine whether this steepening of the Phillips curve is temporary or persistent. Moreover, our results are purely statistical and do not necessarily imply a change in the inflation–unemployment trade-off for monetary policy.

A simple Phillips curve framework

Throughout the rest of this article, we apply a cross-country Phillips curve regression model to analyze variation in core inflation—a measure of inflation that excludes food and energy prices—across the industrialized world. In general, a regression model is a statistical exercise that estimates the strength of relationships between variables. In particular, our model captures the dependence of core inflation, ${{\unicode{x03C0}}_{c,t}},$ in country c and quarter t on the unemployment gap, ${{u}_{c,t}},$ as well as a set of control variables, ${{x}_{c,t}},$ as follows:7

\[{{\unicode{x03C0}}_{c,t}}+{{\unicode{x03B4}}_{c}}+{{\unicode{x03B2} }_{c}}{{u}_{c,t}}+{{\unicode{x03B3} }_{c}}{{x}_{c,t}}+{{e}_{c,t}}.\]Inflation is the annualized quarterly change in the core consumer price index. The unemployment gap is the gap between the observed level of unemployment and the long-run trend rate of unemployment from the OECD’s pre-pandemic forecasts.8 The controls are made up of three types of variables: additional measures of economic slack, oil prices, and inflation expectations. To capture components of economic slack not accounted for by the unemployment gap, we include the labor force participation (LFP) gap and the output gap (i.e., the gross domestic product, or GDP, gap). Both of these gaps are calculated by taking the difference between the actual measures of LFP and GDP and the OECD’s pre-pandemic estimates of their noncyclical components.9 Worldwide Brent crude oil prices (from Haver Analytics) are included to control for global supply shocks, which may impact inflation. Finally, expectations of inflation capture the insight from those who developed the modern Phillips curve that firms account for future price increases while setting their own prices.10 In each quarter, the inflation expectations in a given country are the most recently forecasted annual core inflation rate for that country in the biannual OECD Economic Outlook.

We allow for the slope of the Phillips curve, ${{\unicode{x03B2} }_{c}},$ and the impact of control variables on inflation, ${{\unicode{x03B3} }_{c}},$ to potentially vary across countries. In addition, the intercepts, ${{\unicode{x03B4}}_{c}},$ are country-specific to control for the cross-country variation in average inflation and unemployment rates, as well as the averages of the control variables. The error term, ${{e}_{c,t}},$ captures statistical error in the model. The model’s variables are listed in

box 1.

Box 1. Variables in cross-country Phillips curve panel model

Variable |

Definition |

Inflation |

Annualized quarterly change in the core consumer price index—which excludes food and energy prices |

Unemployment gap |

The difference between a country’s unemployment rate and its long-run trend forecasted in the November 2019 OECD Economic Outlook |

Labor force participation gap |

The difference between a country’s rate of labor force participation (LFP)—the percentage of people aged 15–75 years old in the workforce—and its long-run trend forecasted in the November 2019 OECD Economic Outlook |

Output gap |

The difference between a country’s actual gross domestic product (GDP) and potential GDP forecasted in the November 2019 OECD Economic Outlook |

|

Inflation expectations |

The most recently forecasted annual core inflation rate for a given country in the biannual OECD Economic Outlook |

|

Crude oil prices |

The annualized quarterly percentage change in the price of Brent crude oil |

|

Country fixed effects |

Controls for country-specific characteristics |

To illustrate the steepening of the Phillips curve in a broad set of countries, we estimate the parameters of this model separately for the pre-pandemic period and the recovery period. As we mentioned previously, the pre-pandemic period covers 2013:Q1–2019:Q4 and the recovery period covers 2021:Q1–2022:Q2.

The Phillips curve steepened across the industrialized world

Figure 1 plots inflation against the unemployment gap for the United States, United Kingdom, and France. The slope of the blue lines is the estimate of ${{\unicode{x03B2} }_{c}}$ without the inclusion of the controls, ${{x}_{c,t}},$ for each of these three countries before the pandemic. The slope of the orange line is the corresponding estimate during the recovery period. For all three countries, the estimated slope of the Phillips curve became more negative between the two periods.

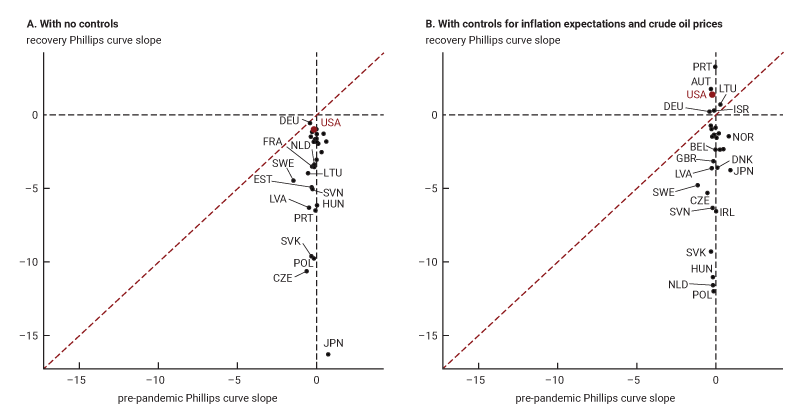

This steepening of the Phillips curve is not limited to the three countries in figure 1. It holds broadly for all 29 industrialized countries for which we have data. We run the regression model described in the previous section separately by country, omitting the control variables, and report the estimated slopes of the Phillips curve before the pandemic and during the recovery in panel A of figure 2. The horizontal axis in this panel is equivalent to the slope of the blue line in figure 1 for all 29 countries in the sample. The vertical axis corresponds to the slope of the orange line in figure 1. All the countries in panel A are below the dashed 45-degree line, indicating that their Phillips curve slopes have grown more negative. This suggests a widespread steepening of the Phillips curve in the industrialized world.

2. Phillips curve slopes for 29 countries: Pre-pandemic and recovery periods

Sources: Authors’ calculations based on data from the Organisation for Economic Co-operation and Development and Haver Analytics.

Before the pandemic, the estimated slopes of these countries’ Phillips curves were small in magnitude and centered at approximately zero. In other words, most countries had a very flat Phillips curve. In terms of the sacrifice ratio, this means that large swings in the unemployment gap were associated with small changes in the inflation rate. Since the start of the recovery, however, the estimated slopes have become universally negative and, on average, large in magnitude. The dispersion in the estimated slopes across countries has also gone up; this could be partially attributed to the limited reliability of the estimates due to the relatively small size of the recovery-period sample (with only six quarters’ worth of data). Despite this increase in dispersion, steeper Phillips curves suggest that the sacrifice ratio has declined substantially since the start of the recovery. This means a 1 percentage point increase in inflation is now associated with a smaller decline in unemployment than before the pandemic.

The qualitative finding from panel A of figure 2 is robust to the inclusion of country-specific inflation expectations and worldwide Brent crude oil prices, as shown in panel B of the same figure.11 Panel B also plots the estimated slopes of all 29 countries’ Phillips curves during the pre-pandemic and recovery periods. Inclusion of all controls in these country regressions is not possible for the recovery period because of the small sample of six quarters. The median country’s Phillips curve steepened by 1.4 units, suggesting that a 1 percentage point drop in the unemployment gap is associated with an additional 1.4 percentage points of inflation when compared with the dynamics between these two variables in the pre-pandemic period.

Because the small sample from the recovery period prevents us from including measures of economic slack other than the unemployment gap in country-specific analyses, we estimate a pooled version of our regression in which the slope of the Phillips curve, $\unicode{x03B2} ,$ as well as the impact of the controls on inflation, $\unicode{x03B3} ,$ are the same across countries but different across the pre-pandemic and recovery periods. The country-specific intercepts, ${{\unicode{x03B4}}_{c}},$ are allowed to vary between these two periods.

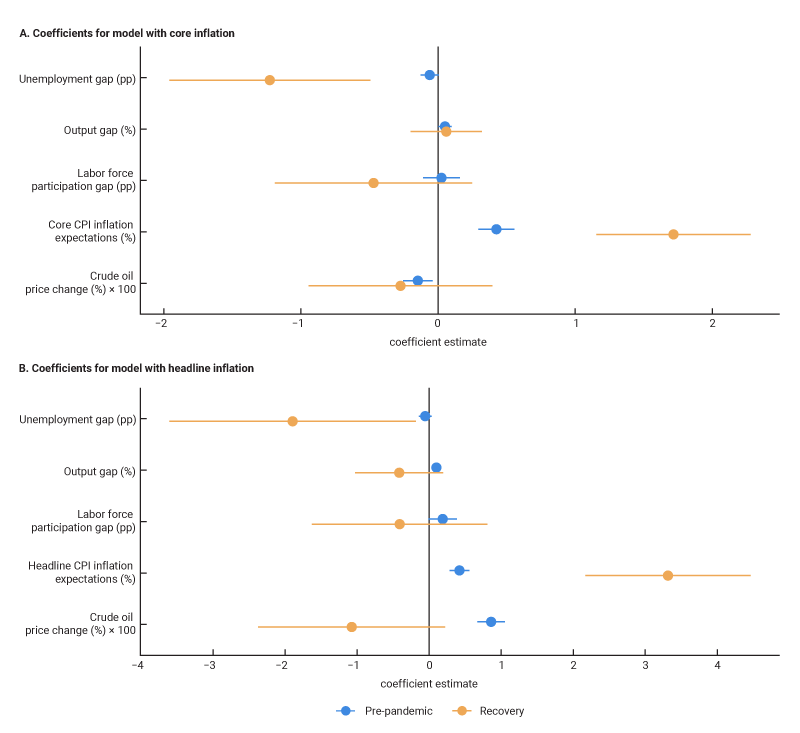

Panel A of figure 3 shows the model’s estimates of these variables’ relationships with core inflation. The pre-pandemic estimates are shown in blue, and the recovery-period estimates are shown in orange. The regression coefficients12 to the left of the vertical line at zero indicate a negative relationship with inflation, while coefficients to the right indicate a positive relationship. With the coefficient estimate as a circular point at its center, the horizontal line for each variable represents a 95% confidence interval. If the horizontal line does not cross zero, then a variable is considered statistically significant.

3. Effects of economic slack measures and control variables on inflation: Pre-pandemic and recovery periods

Sources: Authors’ calculations based on data from the Organisation for Economic Co-operation and Development and Haver Analytics.

The top of panel A of figure 3 shows that Phillips curves have steepened notably with respect to unemployment during the recovery period: The coefficient on the unemployment gap has decreased from about zero to approximately –1.2 between the two sample periods. This result is in agreement with the country-specific regressions considered in figure 2.

In contrast, the estimated impacts of the alternative measures of economic slack—i.e., the gaps in output and labor force participation—are close to zero and statistically insignificant for both sample periods, as shown in panel A of figure 3. These findings suggest that the degree to which changes in resource slack have affected inflation in industrialized countries during the recovery period is best captured by movements in the unemployment rate.

The effect of the unemployment gap is substantial, but it cannot account for all of the high inflation across the industrialized world. Another important factor is inflation expectations, measured by annual core inflation forecasts from various issues of the OECD Economic Outlook. Consistent with theories about forward-looking price-setting decisions by firms, increases in inflation expectations lead to current price increases in both sample periods. Notably, inflation expectations seem to matter more during the recovery period, as shown in figure 3, panel A. This is for two reasons. First, the magnitude of the impact coefficient of inflation expectations has more than doubled since the pre-pandemic period. Second, inflation expectations themselves have increased over the two periods: On average, across all countries in the sample, the OECD’s forecast for annual core CPI inflation expectations in November 2022 was 1 percentage point higher than its forecast in November 2019.13

As for the impact of crude oil prices on inflation, this is shown at the bottom of panel A of figure 3. Because we use core inflation (which removes food and energy prices), the impact of crude oil price changes on inflation is muted in both the pre-pandemic and recovery-period samples.

Lastly, changes in country-level fixed effects, ${{\unicode{x03B4}}_{c}},$ in addition to our explanatory variables, account for a sizable portion of the variation in international inflation. These changes account for country-specific factors such as a country’s average level of fiscal stimulus, monetary policy, and supply chain disruption across the pre-pandemic and recovery periods. Identifying the impacts of each of these factors would require a larger sample of recovery-period observations than we currently have available.

As shown in panel B of figure 3, when inflation is measured using headline CPI (which includes food and energy prices) instead of core CPI, the inflationary effects of economic slack and expectations in both the pre-pandemic and recovery periods are qualitatively similar to the results that we presented so far. Not surprisingly, when using headline CPI, the impact of crude oil prices on inflation becomes stronger. Interestingly, the estimated recovery-period Phillips curve is much steeper for headline inflation than for core inflation, suggesting that the association between unemployment and food and energy price inflation strengthened during the six quarters of the recovery.

Conclusion

During the seven years before the pandemic, economic slack had a limited impact on inflation in most industrialized countries; that is, their Phillips curves were very flat. However, since the start of 2021, the Phillips curve has steepened across a broad sample of industrialized countries. Based on the statistical results from our model, we find that the unemployment gap has had a major impact on this steepening of the Phillips curve during the recovery period. However, the same can’t be said of other measures of economic slack, such as the labor force participation gap and output gap. In addition to the unemployment gap, inflation expectations have also played an increased role in determining inflation in many industrialized nations during the recovery from the Covid-19 pandemic. With that said, it is still too early to determine whether this steepening of the Phillips curve will persist.

Notes

1 A. W. Phillips, 1958, “The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861–1957,” Economica, Vol. 25, No. 100, November, pp. 283–299, Crossref; and Paul A. Samuelson and Robert M. Solow, 1960, “Analytical aspects of anti-inflation policy,” American Economic Review, Vol. 50, No. 2, May, pp. 177–194, available online. Phillips (1958) identified a negative relationship between wage inflation and unemployment in the United Kingdom. Samuelson and Solow (1960) formalized the economic theory of the Phillips curve and were among the first to conceptualize a “sacrifice” between inflation and unemployment.

2 The National Bureau of Economic Research’s Business Cycle Dating Committee states the trough of the Covid-19 pandemic recession was reached in 2020:Q2 within the United States; however, given that we are examining Phillips curves of several countries (not just the United States’), we start tracking the recovery from 2021:Q1, when Covid-19 vaccines became available.

3 Economists have thoroughly discussed the flattening of the Phillips curve. See, e.g., Frederic S. Mishkin, 2007, “Inflation dynamics,” National Bureau of Economic Research, working paper, No. 13147, June, Crossref; Ben S. Bernanke, 2007, “Inflation expectations and inflation forecasting,” speech at the Monetary Economics Workshop, National Bureau of Economic Research Summer Institute, Cambridge, MA, July 10, available online; Olivier Blanchard, 2016, “The Phillips curve: Back to the ’60s?,” American Economic Review, Vol. 106, No. 5, May, pp. 31–34, Crossref; and Marco Del Negro, Michele Lenza, Giorgio E. Primiceri, and Andrea Tambalotti, 2020, “What’s up with the Phillips curve?,” Brookings Papers on Economic Activity, Vol. 51, Spring, pp. 301–357, available online. Mishkin (2007) and Bernanke (2007), among many others, point to sound monetary policy and better-anchored inflation expectations as key contributors to the flattening of the Phillips curve. Blanchard (2016), who also points to better-anchored inflation expectations as a possible cause, documents the steady flattening of the Phillips curve since the 1980s. Del Negro et al. (2020) point to stickier prices (i.e., the slower adjustment of prices to supply and demand changes) as a potential cause.

4 See, e.g., Peter Hooper, Frederic S. Mishkin, and Amir Sufi, 2019, “Prospects for inflation in a high pressure economy: Is the Phillips curve dead or is it just hibernating?,” National Bureau of Economic Research, working paper, No. 25792, May, Crossref. Hooper, Mishkin, and Sufi (2019) show that the Phillips curve appears flat and “dead” in the aggregate U.S. economy, but a strong inflation–unemployment relationship is visible in state and local data.

5 The 29 countries are as follows: Austria (AUT), Belgium (BEL), Czech Republic (CZE), Denmark (DNK), Estonia (EST), Finland (FIN), France (FRA), Germany (DEU), Greece (GRC), Hungary (HUN), Iceland (ISL), Ireland (IRL), Israel (ISR), Italy (ITA), Japan (JPN), Latvia (LVA), Lithuania (LTU), Luxembourg (LUX), Netherlands (NLD), Norway (NOR), Poland (POL), Portugal (PRT), Slovakia (SVK), Slovenia (SVN), Spain (ESP), Sweden (SWE), Switzerland (CHE), United Kingdom (GBR), and United States (USA). We use the three-letter country codes from the International Organization for Standardization (ISO), available online.

6 Broadly speaking, the unemployment gap is the difference between the actual unemployment rate and natural rate of unemployment—which is the unemployment rate that would prevail in an economy making full use of its productive resources without generating inflationary pressures. For this article, we define the unemployment gap as the difference between the observed unemployment rate and the pre-pandemic (2019) OECD forecast for the 2021 natural rate of unemployment—or the long-run trend rate of unemployment—of each country. The forecasts are from the Organisation for Economic Co-operation and Development, 2019, OECD Economic Outlook, Vol. 2019, No. 2, November, Crossref (which we refer to as the November 2019 OECD Economic Outlook).

7 This specification is similar to the one used in the cross-country panel Phillips curve specification of Kristin J. Forbes, 2019, “Inflation dynamics: Dead, dormant, or determined abroad?,” Brookings Papers on Economic Activity, Vol. 50, No. 2, Fall, pp. 257–319, available online.

8 See note 6 for more details on the calculation of the unemployment gap. The observed unemployment rates used to calculate the unemployment gap are from the OECD.

9 The OECD’s pre-pandemic estimates of each country’s LFP’s and GDP’s noncyclical components (or those components not sensitive to the business cycle) are from the November 2019 OECD Economic Outlook. (LFP’s noncyclical component is sometimes referred to as its long-run trend, and GDP’s noncyclical component is sometimes called its potential.) The observed levels of LFP and GDP data used to calculate the LFP and GDP gaps are from the OECD.

10 See Edmund S. Phelps, 1967, “Phillips curves, expectations of inflation and optimal unemployment over time,” Economica, Vol. 34, No. 135, August, pp. 254–281, Crossref, and Milton Friedman, 1968, “The role of monetary policy,” American Economic Review, Vol. 58, No. 1, March, pp. 1–17, available online. Phelps (1967) and Friedman (1968) introduced the expectations-augmented Phillips curve.

11 With no controls, all 29 countries’ Phillips curves steepened (as shown in panel A of figure 2). However, with controls, seven countries’ Phillips curves (including the United States’) experienced a positive shift (see panel B of figure 2).

12A regression coefficient represents the mean change in the dependent variable for a one-unit change in the independent variable (while holding constant any other independent variables).

13 We retrieved these inflation expectations in 2022 and 2019 from the Organisation for Economic Co-operation and Development, 2022, OECD Economic Outlook, Vol. 2022, No. 2, November, Crossref, and the 2019 November OECD Economic Outlook (see note 6), respectively.