In this article, we describe the spectacular collapse of several crypto-asset platforms in 2022 following investment losses and widespread customer withdrawals. These platforms offered and marketed to customers a number of products and services related to crypto-assets, including high-yield investments, trading, and custody services. The platforms were subject to run risk: They allowed customers to withdraw funds on demand while using those funds to make illiquid and risky investments, in part to generate the high rates of returns promised to customers on investment products. In one of the most severe episodes, customers withdrew a quarter of their investments from the platform FTX in just one day, according to our analysis of data from its bankruptcy filing. These episodes together formed a classic financial crisis in a novel setting that has raised urgent policy concerns.

Background

Interest in crypto-assets grew enormously over 2020 and 2021. As funding flowed into crypto-asset markets, prices rose rapidly and peaked around November 2021. For example, the price of Bitcoin rose almost ten times from January 2020 to November 2021.

Amid this boom, customers flocked to crypto-asset platforms. These platforms attracted users by offering the ability to easily trade and custody crypto-assets and invest in high-yield investment products. Figure 1 details a selection of platforms—focusing on those that have entered bankruptcy and shut down since the start of 2022. These platforms had both retail and institutional customers based in the United States and internationally. The number of customers each firm had as of its bankruptcy filing in figure 1 likely understates each one’s peak customer count, since the popularity of crypto-asset platforms declined during the early months of 2022 and customers left during the runs described throughout this article. For instance, FTX’s bankruptcy lawyers reported that it once had 9.7 million customers, larger than the 1.9 million with positive balances at the point when the firm filed for bankruptcy. In addition, Voyager Digital once reported 3.5 million customer registrations and 1.19 million funded accounts; in contrast, at the point of its bankruptcy filing, it had 975,000 customers with positive balances. Moreover, Celsius cumulatively had about 1.8 million customers, and the pace of new customer registrations peaked in late 2021.1

1. Major crypto-asset platforms that have entered bankruptcy since the beginning of 2022

| Platform | Date of withdrawal pause | Date of bankruptcy filing | Number of total customers owed debts in bankruptcy filing |

|---|---|---|---|

| Celsius | June 12, 2022 | July 13, 2022 | 542,333 |

| Voyager Digital | July 1, 2022 | July 5, 2022 | 975,521 |

| BlockFi | November 11, 2022 | November 28, 2022 | 599,766 |

|

Genesis (in partnership with Gemini) |

November 16, 2022 | January 19, 2023 | 340,600* |

| FTX | November 8–11, 2022 | November 11, 2022 | 1,869,269 |

Notes: This figure lists the number of customers with positive claims when each crypto-asset platform filed for bankruptcy. Each firm may have had additional customers that did not have positive claims at the time of the bankruptcy filing. In the case of Genesis, Gemini offered a retail-facing platform that allowed customers to place funds with Genesis, which did not deal directly with retail customers. The SEC reported that about 340,000 of Gemini’s customers invested in Genesis (see the SEC’s January 12, 2023, press release), and Genesis’s bankruptcy filing lists an additional approximately 600 nonretail customers. The number of customers may include those with high-yield investment products, custody accounts, and other types of accounts. The dates of withdrawal pauses come from various news reports. In the case of FTX, FTX’s international platform paused withdrawals on November 8, 2022, while its U.S. platform did not pause withdrawals until it filed for bankruptcy on November 11, 2022.

Sources: Authors’ calculations based on data from United States Bankruptcy Courts, bankruptcy filings (Official Form 206); U.S. Securities and Exchange Commission (SEC); and various news reports.

High-yield products were a key magnet for customers at some platforms. The pitch for the high-yield products was simple and highly attractive on the surface: Invest in crypto-assets like Bitcoin or a stablecoin and receive guaranteed interest rate payments higher than those of other investment options. For example, in August 2021, each of the companies in figure 1 offered interest rates on stablecoin investments in a range from 7.4% to 9%.2 The interest rates offered on Bitcoin and other non-stablecoin crypto-assets were typically the same as or somewhat lower than those on stablecoins, likely reflecting that assets like Bitcoin were expected to appreciate in value and provide an additional return. Some platforms offered even higher interest rates, such as 17%, on investments of select minor crypto-assets that they were promoting—some of which the platforms issued themselves or held as investments. In comparison, throughout this period, interest rates on most consumer bank accounts were effectively zero, and these platforms’ advertising suggested that users were not being adequately served by banks. Celsius, for instance, marketed the platform with the catchphrases “Banks are not your friends” and “Unbank yourself,” and Voyager Digital urged customers to “Beat your bank.”

The offering of high-yield investment products by platforms has been under regulatory scrutiny since at least 2021, when Coinbase announced it had received a warning from the U.S. Securities and Exchange Commission (SEC) that a prospective investment product could be a security. Coinbase never offered the product, but many other platforms did offer similar ones. In February 2022, the SEC charged BlockFi with violating securities laws because the agency deemed BlockFi’s Interest Accounts to be unregistered securities; BlockFi agreed to pay a $100 million penalty and to cease offering the product to new customers in the United States. The same charge for the unregistered offer and sale of securities was brought against Genesis and Gemini by the SEC in January 2023 and against Celsius by several state securities regulators (such as those in New Jersey) in 2021 and 2022. Overall, while crypto-asset activities are sometimes described as unregulated, it may be more accurate to describe many crypto-asset firms as attempting to avoid the existing regulatory system—which would have required them to provide important disclosures about the financial risks of their products, including those that led the platforms to file for bankruptcy.

Data

We used bankruptcy filings to characterize the outflows of customer funds from five platforms: BlockFi, Celsius, FTX, Genesis (in partnership with Gemini), and Voyager Digital. The United States Bankruptcy Courts’ Official Form 207 requires firms to report outgoing funds over the 90 days preceding their bankruptcy filings, including in these cases withdrawals by customers as well as funds sent to corporate insiders, vendors, lawyers, and others. Official Form 206 requires firms to report liabilities, including those outstanding to customers. (We used the Python programming language to extract these customer-level and transaction-level data from PDFs.) At the time of this writing, not all data for FTX are available, but we report certain data that have been reported on a preliminary and aggregate basis.

Runs

Figures 2 and 3 summarize several run episodes that can be documented with our data. These runs came in response to three shocks over the course of 2022.

2. Runs on crypto-asset platforms

| Platform | Period | Withdrawals | Estimated customer liabilities before run | Estimated percent outflows |

|---|---|---|---|---|

| Celsius | May 9–20, 2022 | $1.48B | $7.46B | 19.9% |

| Celsius | June 9–12, 2022 | $0.58B | $5.98B | 9.8% |

| Voyager Digital | May 9–20, 2022 | $0.52B | $3.75B | 13.8% |

| Voyager Digital | June 12–July 2, 2022 | $1.25B | $3.23B | 38.7% |

| BlockFi | November 9–16, 2022 | $0.17B | $1.41B | 12.2% |

| Genesis | November 7–15, 2022 | $1.10B | $5.29B | 20.8% |

| FTX | November 6–11, 2022 | $7.81B | $19.38B | 36.7% |

Sources: Authors’ calculations based on data from the United States Bankruptcy Courts, bankruptcy filings (Official Forms 206 and 207); the March 2, 2023, FTX presentation to the United States Bankruptcy Court for the District of Delaware; and CoinMarketCap.

3. Withdrawals of customer funds during 90 days before bankruptcy filings

Sources: Authors’ calculations based on data from the United States Bankruptcy Courts, bankruptcy filings (Official Forms 206 and 207); the March 2, 2023, FTX presentation to the United States Bankruptcy Court for the District of Delaware; and CoinMarketCap.

The first shock was the collapse of the TerraUSD stablecoin in May 2022 in response to doubts about its purported stabilization mechanism. We estimate that Celsius and Voyager Digital saw outflows of 20% and 14% of their customer funds, respectively, over 11 days following that news, as shown in figure 3. Celsius in particular had invested about $935 million in TerraUSD and the Anchor protocol, which offered up to 20% returns on TerraUSD.3 In addition, BlockFi likely also suffered large outflows in this period as it later reported that it had incurred outflows of $4.4 billion from January through May 2022; however, daily data are not available in May 2022 for BlockFi, since it did not enter bankruptcy until November 2022 (i.e., May 2022 is before the 90-day period prior to BlockFi’s bankruptcy filing for which it had to report its outflows, per Official Form 207).

The second shock was the failure of Three Arrows Capital (3AC), a hedge fund focusing on crypto-assets that suffered losses because of the collapse of TerraUSD and other investments. Figure 3 shows that Celsius and Voyager Digital incurred another round of outflows, estimated at 10% and 39% of customer investments, respectively, in reaction to 3AC’s collapse. Voyager Digital’s outflows started the day Celsius paused withdrawals, indicating that Celsius itself caused additional contagion. Again, BlockFi also likely experienced outflows amid 3AC’s collapse, as it later reported that there were outflows of $3.3 billion from June through November 2022 and only a small portion of that amount can be accounted for by the later run in November.

Exposure to 3AC was a common thread across the firms examined here and a major source of contagion. Each firm loaned assets to 3AC in efforts to generate the high returns promised to its users; 3AC received loans worth about $2.4 billion from Genesis, $1 billion from BlockFi, $350 million and 15,250 bitcoins (worth about $328 million in July 2022) from Voyager Digital, and a comparatively small $75 million from Celsius.4 Many customers of Voyager Digital and Celsius expressed surprise when they discovered that neither company’s loans were collateralized.5 Losses on these loans to 3AC led to a scramble for financial support. Genesis received a loan from its parent company, the Digital Currency Group (DCG).6 BlockFi received an investment from FTX, which also retained the right to acquire BlockFi.7 Voyager Digital also secured a credit line from FTX’s affiliate, Alameda, but declared bankruptcy anyway.8

A third shock was the failure of FTX in November 2022. FTX itself reported outflows of 37% of customer funds, almost all of which were withdrawn in just two days as shown in figure 3. At Genesis and BlockFi, we estimate customers withdrew about 21% and 12% of their investments that November, respectively. At this point in 2022, BlockFi appears to have been reduced to a shell of its former size, having survived billions of dollars of outflows already that year.

Understanding the runs

These data provide information on the severity of the liquidity problems that can develop under the business models of these platforms, which were evidently subject to run risk. To draw customers, these platforms offered and marketed high-yield investment products with the ability to withdraw funds on demand. They used customers’ funds for illiquid and risky investments (e.g., in 3AC or the Anchor protocol) in attempts to generate the high returns promised to their customers. In response to negative shocks, customers had an incentive to run in order to avoid taking losses that would be borne by others.

To understand the large size and rapid pace of the runs, we make the following four observations.

First, to draw a comparison with bank depositors, we note that customers of these crypto-asset platforms did not have access to protection akin to deposit insurance, and so they should have been expected to behave more like uninsured depositors. In this context, customers may have been primed for signs of weakness and wary of assurances that their investments were safe. In a study of bank runs, Iyer and Puri note the importance of trust in a survey of depositors, including trust formed from a long relationship with a bank.9 These crypto-asset platforms were only recently established, had not had the chance to develop years-long relationships or be stress-tested, and attracted customers in large part by promising high returns amid the excitement over crypto-assets. Customers may have also been wary because of past instances of fraud, crypto-asset price volatility, and failures of past platforms such as Mt. Gox. In fact, authorities have since charged a few of the firms involved in these episodes with fraud, false statements, or misrepresentations. According to a complaint by the State of New York, the founder of Celsius, Alex Mashinsky, made several false statements to customers in 2022, including, for instance, that his firm didn’t have any exposure to the collapse of TerraUSD.10 Bank regulators have stated that Voyager Digital misrepresented the applicability of deposit insurance to its customers’ investments, including a tweet stating that “USD held with Voyager is FDIC insured up to $250K.” Authorities, including the U.S. Department of Justice, have charged Samuel Bankman-Fried of FTX with multiple types of fraud.

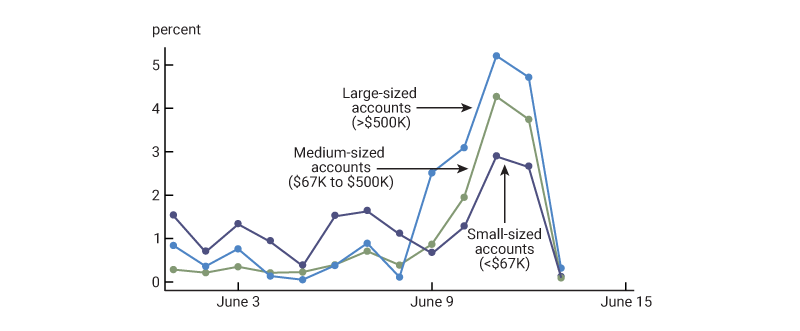

Second, while the platforms had many retail clients, the runs were spearheaded by customers with large holdings, some of which were sophisticated institutional customers. For example, figure 4 breaks down the outflows at Celsius by three groups of customers according to the size of their accounts. Each group had provided Celsius with about $1.9 to $2.0 billion worth of funding before June 9, 2022. The owners of large-sized accounts, with over $500,000 in investments, were the fastest to withdraw and withdrew proportionately more of their funding. In fact, during this run, 35% of all withdrawals at Celsius were by owners of accounts with more than $1 million in investments, according to our estimates.

4. Withdrawals at Celsius in June 2022, by account size

Sources: Authors’ calculations based on data from the U.S. Bankruptcy Court for the Southern District of New York, bankruptcy filings (Official Form 207); and CoinMarketCap.

Third, the runs were purely electronic, with customers withdrawing funds through apps or web portals with ease. It’s not as if customers had lined up in person, as in the classic movie It’s a Wonderful Life.

Fourth, efforts to generate high returns caused these platforms to hold insufficient liquidity buffers. At FTX, Bankman-Fried stated that FTX had held enough liquidity to meet 24 times average daily withdrawals, which he stated turned out to be 80% of what was withdrawn in one day at the height of the run.11 Celsius used an internal stress scenario that assumed a 20% outflow of customer funds in response to 40%–50% price drops, which would appear to be a conservative scenario; however, in 2022, when Celsius’s liquidity buffer became insufficient according to that stress scenario, the company adopted a weaker scenario involving smaller price drops.12 BlockFi’s liquidity strategy aimed to hold 10% of customer funds in assets that can be immediately liquidated and 50% in assets that could be liquidated within seven calendar days. All of these liquidity buffers were evidently insufficient, and it is hard to verify whether they ever existed.

This analysis may have wider applicability beyond crypto-asset platforms. For example, some of these general factors may also help explain the speed and severity of the runs on several banks in late 2022 and early 2023.

Conclusion

One view of customers’ withdrawals from crypto-asset platforms in 2022 is that market discipline has effectively punished firms that took excessive risks and committed other abuses in attempting to pay high returns to customers. At the same time, market discipline is small solace to the hundreds of thousands, if not millions, of retail users who were deprived of adequate disclosures for certain unregistered securities, have lost money, and who are waiting for the return of whatever can be salvaged of their investments as bankruptcy proceedings conclude. This turmoil has made consumers and investors more aware of the risks of crypto-asset investment opportunities than they may have been in 2021 amid the excitement of an asset class experiencing rapid price appreciation.

Most of the financial instability associated with these failures has been confined to the crypto-asset ecosystem. However, the failure of FTX put severe pressure on Silvergate Bank and Signature Bank in late 2022, which both provided an array of banking services targeted at crypto-asset firms; these two banks suffered severe deposit withdrawals and closed or failed in 2023, contributing along with the failure of Silicon Valley Bank to the recent banking turmoil.

Notes

1 Final report of Shoba Pillay, examiner, Doc. No. 1956, entered January 31, 2023, for the United States Bankruptcy Court for the Southern District of New York, Case No. 22-10964 (MG), in re: Celsius Network LLC et al., debtors, pp. 126–127, available online.

2 Celsius paid an interest rate of 8.88% on USD Coin (USDC) in August 2021, according to its website. Voyager Digital paid 9% on USDC in August 2021, according to its website. BlockFi paid 7.5% on USDC in late July 2021 for the first 50,000 USDC and amounts above that level received 5%, according to its website. Gemini paid 7.4% on Gemini Dollar (GUSD) in August 2021, according to its website. Both USDC and GUSD are stablecoins. Finally, FTX offered high-interest accounts through Blockfolio, which it acquired in August 2020; FTX’s website advertised a flat 8% return “on all crypto and fiat you deposit” in August 2021.

3 Complaint, People of the State of New York v. Alex Mashinsky, Supreme Court of the State of New York, County of New York, received on January 5, 2023, by New York State Courts Electronic Filing (NYSCEF), Doc. No. 2, pp. 18–19, available online.

4 Details on Genesis’s loans to 3AC are from the declaration of A. Derar Islim in support of first day motions and applications in compliance with Local Rule 1007-2, Doc. No. 17, entered January 20, 2023, for the United States Bankruptcy Court for the Southern District of New York, Case No. 23-10063, in re: Genesis Global Holdco, LLC, et al., debtors, p. 9, available online. Details on BlockFi’s loan to 3AC are from the declaration of Mark A. Renzi in support of debtors’ Chapter 11 petitions and first-day motions, Doc. No. 17, entered November 28, 2022, for the United States Bankruptcy Court for the District of New Jersey, Case No. 22-19361-MBK, in re: BlockFi Inc. et al., p. 27, available online, and Sam Venis, 2022, “A leaked investor call revealed Morgan Creek’s bid for BlockFi. Here are four more big takeaways from the call,” The Block, June 29, available online. Details on Voyager Digital’s loans to 3AC are from the investigation report of the Special Committee of the board of directors of Voyager Digital, LLC, Doc. No. 1000-1, entered February 14, 2023, for the United States Bankruptcy Court for the Southern District of New York, Case No. 22-10943 (MEW), in re: Voyager Digital Holdings, Inc., et al., debtors, pp. 25, 35–36, available online. Details on Celsius’s loans to 3AC are from the first affidavit of Kyle Livingston Davies, exhibit KLD-1, entered June 2022, for the Eastern Caribbean Supreme Court in the High Court of Justice, Virgin Islands, Commercial Division, Case No. BVIHC (COM), in the matter of Three Arrows Capital, Ltd., and in the matter of sections 159(1) and 162(1)(a) and (b) of the Insolvency Act 2003, p. 13, available online.

5 See, e.g., an investigative report into Voyager Digital by unsecured creditors that focused entirely on the loans made to 3AC: the Official Committee of Unsecured Creditors’ investigative report concerning loans made to Three Arrows Capital, Doc. No. 1112-1, entered February 28, 2023, for the United States Bankruptcy Court for the Southern District of New York, Case No. 22-10943 (MEW), in re: Voyager Digital Holdings, Inc., et al., debtors, p. 23, available online.

6 See the declaration of A. Derar Islim for the Genesis bankruptcy case, p. 9 (further bibliographical details for this source appear in note 4).

7 See the declaration of Mark A. Renzi for the BlockFi bankruptcy case, pp. 21–23 (further bibliographical details for this source appear in note 4).

8 Declaration of Stephen Ehrlich, chief executive officer of the debtors, in support of Chapter 11 petitions and first day motions, Doc. No. 15, entered July 6, 2022, for the United States Bankruptcy Court for the Southern District of New York, Case No. 22-10943, in re: Voyager Digital Holdings, Inc., et al., debtors, p. 21, available online.

9 Rajkamal Iyer and Manju Puri, 2012, “Understanding bank runs: The importance of depositor-bank relationships and networks,” American Economic Review, Vol. 102, No. 4, June, pp. 1414–1445. Crossref

10 See complaint, People of the State of New York v. Alex Mashinsky, p. 21 (further bibliographical details for this source appear in note 3).

11 Samuel Bankman-Fried, 2022, Twitter post, November 10, 8:13 am, available online.

12 See the final report of examiner Pillay for the Celsius bankruptcy case, pp. 205–206, 291–294 (further bibliographical details for this source appear in note 1).