When the Federal Reserve reduces the size of its balance sheet through quantitative tightening,1 changes in nonreserve liabilities impact the level of reserves in the U.S. banking system.2 In this article, I examine the category of “other deposits” on the liability side of the Fed’s balance sheet—namely, the deposits with Federal Reserve Banks other than bank reserve balances—to understand its evolution since March 2020, when the Covid-19 pandemic hit the U.S. I find that deposits of U.S. central counterparties (CCPs)3 at the Federal Reserve Banks (what I am referring to as “CCP deposits”) now account for most of these other deposits with the Fed. I also find some evidence that the balances of CCP deposits are sensitive to changes in short-term interest rates.

Once the new Securities and Exchange Commission’s (SEC) U.S. Treasury clearing mandate is implemented starting at the end of 2025, more Treasury securities and repo (repurchase agreement) transactions will be required to be centrally cleared; thus, the volume of financial transactions novated to and margined by U.S. CCPs is expected to increase markedly. This could lead to an increase in CCP deposits at the Fed if the composition of pre-funded resources and margin pledged to each CCP remains the same.4

If this market structure shift does result in an increase in CCP deposits with the Fed, it will reduce the level of reserves available to banks. Similarly, during times of financial market stress, sudden large cash inflows into CCPs from clearing members and their clients, which can result in an increase in CCP deposits, will also cause a decline in bank reserves. Given the relatively modest size of the other deposits with the Fed (just under $160 billion as of September 18, 2024) relative to the Fed’s overall balance sheet size of about $7 trillion, any such impacts to reserves are likely to be inconsequential for interest rate control when reserves are abundant. However, if not accounted for once reserves are less ample, unexpected and large increases in CCP deposits at the Fed could exert upward pressure on U.S. short-term interest rates.

Why CCPs maintain cash deposits at central banks

CCPs maintain cash deposits at central banks to have safe, liquid assets immediately available to meet their payment obligations in the event of a default of one of their clearing members. This practice by CCPs is consistent with recommended international standards and supported by regulators in most major industrialized economies.5 The sources of these CCP deposits could be the CCPs themselves, their clearing members, and the clearing members’ clients.

- CCPs may place their own funds at the central bank.

- Clearing members may keep both default fund resources and initial margin for their own positions in cash deposits with the CCP, which may then choose to deposit these funds at the Fed.

- Clients of clearing members may allocate some of their margin to cash with the CCP, which may then deposit these funds at the Fed. Clients may also negotiate with clearing members collateral management arrangements that allocate cash margin among several short-term investments and that also adhere to acceptable collateral policies at CCPs. In the U.S., the types of clients that clear financial transactions can vary widely; they include asset management firms that hedge their interest rate risk and agriculture producers that use futures to hedge their exposure to changes in commodities prices.

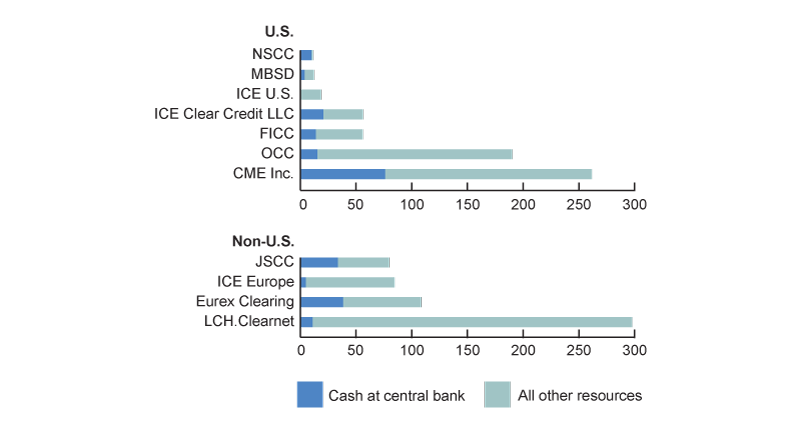

Figure 1 shows that for major CCPs globally, CCP deposits at the Fed and other central banks are a notable component of their pre-funded resources (which include default fund resources and initial margin), although this varies widely.

1. Pre-funded resources at major central counterparties (CCPs), 2024:Q2

Source: Author’s calculations based on data from Clarus Financial Technology, CCPView.

U.S. CCPs and deposit accounts at the Federal Reserve

In 2012, Title VIII of the Dodd–Frank Act authorized the Federal Reserve to allow designated financial market utilities (DFMUs) to maintain accounts with Federal Reserve Banks. Six of the eight DFMUs are CCPs; all have deposit accounts at the Fed. The Fed is authorized to pay interest on reserve balances (IORB) on these CCP deposits, at the same rate as that for depository institutions or “another rate determined by the Board from time to time, not to exceed the general level of short-term interest rates.”6

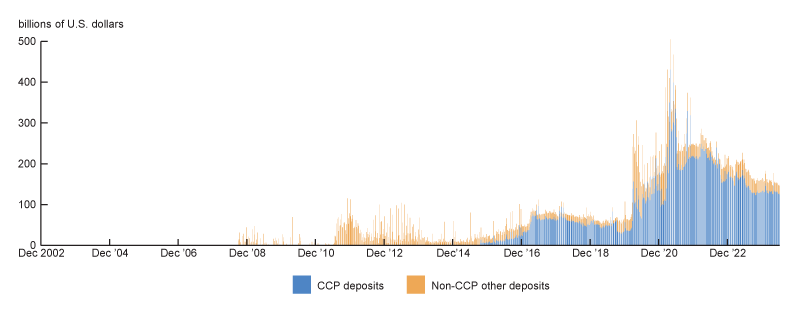

Figure 2 shows the evolution of U.S. CCP deposits since their accounts were opened starting in 2015. CCP deposits are included in the “deposits with F.R. Banks, other than reserve balances” category, which are among the Federal Reserve’s liabilities, as reported in the H.4.1 weekly report. By matching these data to the quarterly public quantitative disclosure (PQD) data for each CCP, I estimate that CCP deposits now make up 80% to 90% of these other deposits with the Fed each week. Other deposits at the Fed peaked at just over $505 billion in April 2021 and stood at just under $160 billion as of September 18, 2024.7

2. Federal Reserve liabilities: Other deposits, 2002–24

Sources: Author’s calculations based on data from the Board of Governors of the Federal Reserve System, 2002–24, H.4.1 statistical releases, from FRED; and Clarus Financial Technology, CCPView.

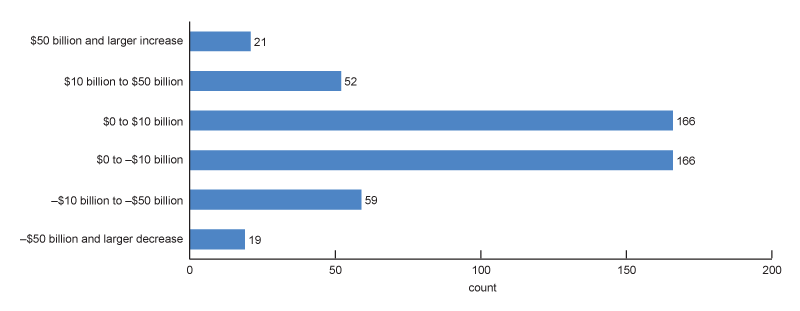

While there is no publicly available data on daily or weekly changes in CCP deposits, either by individual firm or in aggregate, a look at H.4.1 release data gives us a sense of the typical magnitude of weekly changes in other deposits with the Fed. Figure 3 shows that since 2015:Q3, when CCP deposit volumes started to grow, the vast majority of weekly changes in these other deposits have been under $10 billion. About half of all the weekly increases of $50 billion or more occurred in 2020—a period of elevated volatility and uncertainty in financial markets.

3. Distribution of weekly changes in other deposits with the Federal Reserve since 2015:Q3

Source: Author’s calculations based on data from the Board of Governors of the Federal Reserve System, 2015–24, H.4.1 statistical releases, from FRED.

Factors that affect U.S. CCP deposit balances at the Fed

The amount of CCP deposits is a function of 1) open interest8 of transaction volumes submitted for clearing; 2) margin requirements of each CCP; and 3) default fund and margin allocation preferences of the CCPs, clearing members (of the CCPs), and clients (of the clearing members). Allocation preferences may not be uniform across all parties. Whereas fluctuations in CCP deposits stemming from the first two factors are mostly mechanical in nature and are driven by predetermined rules and parameters, the third factor reflects active choices of market participants.

One key driver of clearing member and client margin allocation preferences may be the interest rate received for cash margin versus other alternatives. Importantly, CCPs may charge a fee to clearing members and their clients for placing cash at the CCP, which may vary over time depending on the interest rate environment. In the U.S. this generally means the clearing members and their clients may receive interest on cash margin equal to the rate of interest on reserve balances minus a fee (charged by the CCP for accepting cash). Changes in CCP fees can drive clearing member and client allocation to a range of short-term investments; these investments can include cash with either the CCP or a commercial bank, reverse repos, money market mutual fund investments, and short-dated Treasury securities. When clearing members and/or their clients pledge cash margin, they assess the trade-offs between the safety and liquidity of cash and the potentially higher returns that they could earn from other assets. Some may also prefer to leave cash with the CCP that they expect will be deposited at the central bank to eliminate counterparty exposure.

Client initial margin: Driver of CCP cash deposit swings since 2020

The U.S. CCPs began to shift cash into Fed deposit accounts within a year of being granted access in 2014. CCPs were later authorized to deposit cash margin from their clearing members’ clients as early as mid-2016, leading to another bump up in the level of deposits. Aggregate balances were relatively steady until the 2020 “dash for cash” at the onset of the Covid-19 pandemic in the U.S. and elsewhere; in 2020, the amount of cash placed with CCPs—and ultimately placed in CCP deposits at the Fed—increased markedly. According to discussions with market participants, many factors likely contributed to this increase: the open interest of transactions cleared at the CCPs; margin rates; and the relative rates of return available on cash deposits at the Fed when compared with other assets such as short-dated Treasury securities and reverse repos with commercial counterparties. A combination of these factors continued to influence the evolution of CCP deposits at the Fed throughout the policy rate tightening cycle that began in early 2022.

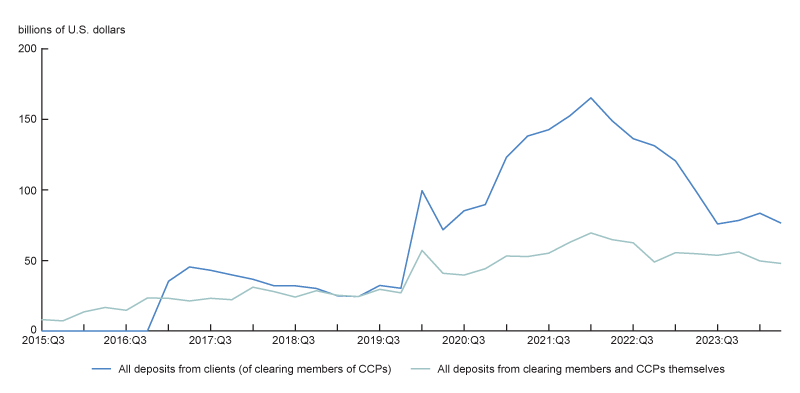

To further explore drivers of CCP deposit balance changes at the Federal Reserve since the pandemic hit the U.S., I examined quarterly CCP deposits by firm, cash use (initial margin or default fund resources), and depositor type (client, clearing member, or CCP) activity since 2020. Two findings emerged, as illustrated in figure 4:

- CCP deposits for pre-funded default resources increased steadily over this period. These increases were broad-based across firms, but most pronounced at FICC (Fixed Income Clearing Corporation) and OCC (Options Clearing Corporation). This is consistent with the notable increases in average open interest amid higher clearing volumes since 2020 that resulted in higher default funds from clearing members.9

- The largest swings in CCP deposit balances were primarily driven by changes in client initial margin. Firm-level data (not illustrated in figure 4) show that the vast majority of these changes can be attributed to a single firm: Chicago Mercantile Exchange Inc. (CME Inc.).

4. Breakdown of U.S. central counterparty (CCP) deposits at the Federal Reserve, 2015–24

Sources: Author’s calculations based on data from the Board of Governors of the Federal Reserve System, 2015–24, H.4.1 statistical releases, from FRED; and Clarus Financial Technology, CCPView.

Client margin collateral and rate sensitivity

There are three sets of factors that affect whether clearing members’ clients choose to allocate cash to the CCP for initial margin, which is then deposited at the Fed, versus other short-term investment options: 1) minimum cash requirements imposed by the CCP; 2) the rate for cash with the Fed (CCP deposit rate), which is generally IORB minus a fee charged by the CCP for accepting cash; and 3) the interest rate(s) available on one or more alternative investments (market rate).

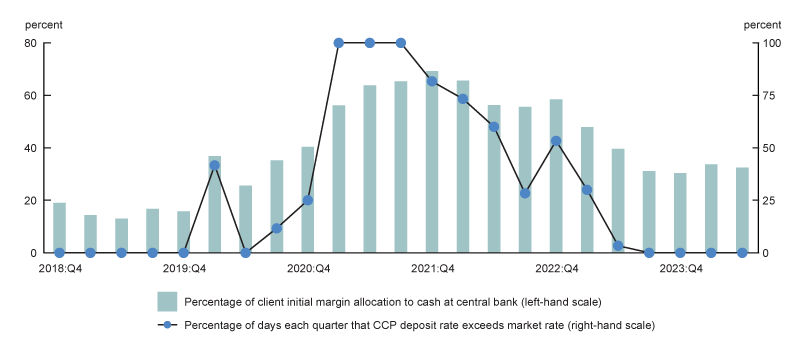

Since the largest swings in CCP deposits since 2018 were driven by client margin at CME Inc., I examined whether client margin allocation activity exhibited sensitivity to changes in the CCP deposit rate or the market rate.

Subject to preferences for credit and liquidity risk, client margin funds allocated to cash deposited at the Fed via the CCP should increase when the rate for cash with the Fed (CCP deposit rate) is higher than the rate for cash invested in another asset (market rate).

To conduct the study, I made the following two assumptions:

- I assumed the only other asset that client cash will be invested in is U.S. Treasury securities, as these made up 70% to 80% of the firm’s client margin that was not allocated to cash at the central bank over the period I examined. For simplicity’s sake, I used the yield on the four-week Treasury bill.

- I assumed that margin allocation preferences are somewhat sticky and that firms incrementally shift margin allocation into or out of cash at the CCP that ends up at the Fed. Each time there is a day with a higher CCP deposit rate, firms incrementally reallocate more collateral to cash than securities—and vice versa.

Using the firm’s announced CCP fee data and the level of IORB, I computed the daily CCP deposit rate. I then calculated the percentage of days each quarter in which the CCP deposit rate exceeds the market rate.

Figure 5 shows that when the percentage of days during which the CCP deposit rate exceeds the market rate is high, the allocation of client margin to cash that ends up at the Fed is also high. Put differently, changes in margin allocation over time appear to be correlated with shifts in relative rates, which suggests that client cash margin is rate sensitive. This is consistent with the idea that as rates of return for other assets exceed rates of return on cash, clients will increase their investments in noncash assets. As a consequence, the pool of assets they have to draw from for initial margin shifts as relative rates shift.

5. Client initial margin allocation to cash at the central bank and the relative interest rate of central counterparty (CCP) deposits

Sources: Author’s calculations based on data from the Board of Governors of the Federal Reserve System, 2018–24, H.4.1 statistical releases, from FRED; Clarus Financial Technology, CCPView; and CME Group.

For firms that have collateral management arrangements with their clearing members to invest across cash-like instruments, this finding is consistent with what may be expected in a client–clearing member relationship. Clearing members would likely optimize rates of return on client cash to best serve their clients. If the rate the CCP offers for keeping cash with them is lower than rates for other products, especially in periods without market stress, client money is likely to be allocated away from CCPs to higher-returning instruments.

Note that the allocation to deposits placed at the CCP is not zero during quarters in which there is no day that the CCP deposit rate is above the market rate. Clients may be willing to accept a lower rate of return for the safety of having cash immediately available from the CCP from an account that bears no credit risk rather than make other short-term investments or place cash in commercial banks.

Conclusion

Since March 2020, CCP deposits with the Federal Reserve have nearly doubled in size. The factors driving this increase in CCP deposits likely include increases in open interest of centrally cleared financial transactions; changes in margin rates; and cash allocation shifts by CCPs, clearing members (of CCPs), and clients (of clearing members). Implementation of the U.S. Treasury clearing mandate by the end of 2025 is likely to lead to higher total volume of centrally cleared activity, and this could lead to higher CCP deposit levels at the Fed. Additionally, a study of a single firm responsible for the bulk of changes in client margin with the Fed since March 2020 suggests that allocation of client margin at CCPs appears to be sensitive to changes in rates of various short-term investment instruments.

Deposits other than bank reserve balances with the Fed are sensitive to rates of return that CCPs offer their participants for pledging cash as initial margin. The safety and liquidity benefits of holding funds at the central bank appear relatively less important to these participants during periods without financial market stress. The rate sensitivity of CCP deposits is likely to have only a modest impact on the implementation of the Fed’s quantitative tightening, since the deposit volumes are relatively modest. However, in times of financial stress, sudden reallocation from other margin types to cash deposits at the Fed could lead to an unexpected and notable decline in reserves available to banks that could put modest upward pressure on short-term interest rates. All else being equal, this suggests the need for a somewhat larger buffer of reserves at the central bank.

I thank Gene Amromin, Ketan Patel, and Kelsey Burr for their helpful comments.

Notes

1 Quantitative tightening is a term used for the reduction in the size of a central bank’s balance sheet through either the passive maturity or sales of assets. For further details, see this July 2019 Open Vault Blog post from the St. Louis Fed.

2 Reserves are cash funds deposited by banks and other depository institutions with the Federal Reserve (plus the money in their vaults).

3 See Steigerwald (2013) for more on central counterparties and central counterparty clearing.

4 The definitions for margin (initial and variation) and several other key terms related to central counterparty clearing are available online from the Basel Committee on Banking Supervision.

5 See the Principles for Financial Market Infrastructures (PFMI) by the Bank for International Settlements (BIS) and the International Organization of Securities Commissions (IOSCO). Specifically, key consideration 8 of principle 7 of the PFMI indicates that firms like CCPs “with access to central bank accounts, payment services, or securities services should use these services, where practical, to enhance its management of liquidity risk.”

7 Weekly estimates of CCP deposits are calculated using quarterly PQD data from individual CCPs on cash at the Fed and the percentage of total other deposits at the Fed as of the end of the quarter. Weekly amounts of other deposits at the Fed are based on weekly (Wednesday) levels available in the St. Louis Fed’s FRED (Federal Reserve Economic Data) database.

8 Open interest is the total number of unsettled outstanding derivatives contracts (such as options or futures) for an asset. A more detailed definition of open interest is available online from the Commodity Futures Trading Commission.

9 For information on recent FICC clearing volume increases, see the March 12, 2024, press release from DTCC (Depository Trust & Clearing Corporation), FICC’s parent company. Clearing volume and open interest data for OCC are available from Clarus Financial Technology, CCPView.