On the Benefits of Running the Economy Hot

A speech presented by Charles L. Evans, president and chief executive officer, Federal Reserve Bank of Chicago, on February 18, 2022, at the 2022 US Monetary Policy Forum, sponsored by the Initiative on Global Markets at the University of Chicago Booth School of Business, in New York City, NY.

Introduction

Before I begin my remarks, let me remind you that the views I will express today are my own and not necessarily those of the Federal Open Market Committee (FOMC) or the Federal Reserve System.

This paper raises three important questions facing policymakers today: 1) What is the extent of current labor market vitality, and how important is that? 2) How should financial stability issues be considered? And 3) what is the outlook for inflation control today?1 A hallmark of the Monetary Policy Forum is that the conference paper written by academic and Wall Street economists inevitably raises a number of probing questions for Fed policymakers like Governor Waller and me to discuss. To honor this tradition, I will focus on the broader policy issues raised in the paper and try to avoid ticking off areas of agreement or technical concerns. That’s better left for the Money and Banking workshop in Chicago.2 Well, ok, I suppose you rarely hear areas of agreement in the workshop, but you know what I mean.

Macroprudential tools to manage financial stability risks

It is an understatement to say that our current situation is complex: two years of Covid-19 distress; global supply chains in disarray; strong fiscal, monetary, and financial support; and 7-1/2 percent annual CPI inflation in the U.S.3 As we discuss the implications of these factors for monetary policy, I feel the need for a quick public service announcement: Monetary policy is at its foundation a single tool capable of addressing a single objective. Asset purchases and forward guidance are different implementations of this tool, not independent instruments. Still, as a Fed policymaker, I enthusiastically embrace our dual mandate for maximum employment and price stability. The correlation structure of the economy means that usually there is no policy conflict in achieving both objectives. When a conflict does arise, we may face some difficult trade-offs, but these have been long-studied and the decision-making is manageable.

But monetary policy is not the only game in town. Fiscal and regulatory policies will be crucial complementary tools in many cases—such as when aggregate demand is far too weak or financial excesses loom large. Importantly, these situations are more likely to arise in a low r* environment4—when the proximity of the effective lower bound (ELB) reduces monetary policy capacity and investors’ views about potential returns may be at odds with the economy’s fundamentally lower average rate of return. On the former, the CARES Act and other fiscal measures provided strong support to the economy during this horrifying pandemic. The recovery we’ve seen could not have been achieved by monetary policy alone. On the latter, I have spoken about the roles of monetary and regulatory policy in addressing financial instability risks a good bit over the years since the Great Financial Crisis.5

My view is that as long as the U.S. and global economies are in a low r* world, nominal interest rates will remain low and we will experience episodes close to or at the ELB. Unless the FOMC is to jettison our responsibility to promote maximum employment and price stability, the financial stability burden should be primarily on financial regulators. Our dual mandate objectives are challenging enough without taking on a third financial stability mandate, all with a single interest rate tool. We instead need more macroprudential tools and appropriately vigilant supervisory oversight to address these concerns. Many prescriptions may seem unpalatable, such as Admati and Hellwig’s recommendation for at least 20 percent capital at banks.6 But I mention this example because the magnitude emphasizes that important unaddressed financial instability risks in the system could have serious consequences for tens of millions of households.

Current inflation situation is not typical

Before I turn specifically to the topic of “running the economy hot,” let me offer a little different perspective on the history of monetary policy “cooling off the economy.” The Federal Reserve’s low inflation credibility was fought for and attained in the Volcker and Greenspan eras. In order to reduce inflationary pressures, restrictive monetary policies repeatedly led to employment losses and recessions.

Why was so much restriction necessary? During this time, underlying inflation was well above the Fed’s (then implicit) objective, and periodically cyclical inflation also rose higher still. Monetary policy needed to counter both of these factors that pushed inflation well above target. This two-fisted restrictiveness led to recessions and high unemployment—sometimes intentionally and sometimes because the already moderating economy was subsequently hit by unexpected shocks. So, historically, the other side of “how hot should the economy run?” is the recognition that labor market vibrancy has been sacrificed at times by more restrictive monetary policies in the name of curbing excess inflation or even an inflation scare, with higher inflation never showing up.

What about now? Our present monetary policy setting is wrong-footed against the current, sharp increase in inflation. That is for sure. But the sources of these large relative price increases may be different from more typical cyclical inflation episodes. Furthermore, by my reading, underlying inflation appears to still be well anchored at levels consistent with the Fed’s average 2 percent objective, and so—unlike in the Volker and Greenspan eras—no extra monetary restraint is needed to bring trend inflation down. So I see our current policy situation as likely requiring less ultimate financial restrictiveness compared with past episodes and posing a smaller risk to the employment mandate than many times in the past.

That said, I recognize there is not a clean orthogonal decomposition between cyclical and underlying inflation, and we need to monitor developments carefully to make sure the current spike in inflation does not bleed over into an unwelcome increase in the underlying trend. If it does, more restrictive policy will be needed.

Inclusivity and the benefits of running the economy hot

Now, more directly, what about the question of “how hot should the economy run,” and how does it relate to our maximum and inclusive employment mandate? In a low r* environment that is devoid of Covid-19-induced disruptions, we would most likely find ourselves in the position of battling the downward-bias to inflation caused by the proximity of the ELB. As a monetary policymaker, I would cheer continued vibrancy for all segments of the labor market and hold off on potentially unnecessary policy restrictiveness until inflation began rising to levels that were incompatible with average 2 percent PCE inflation over time.7

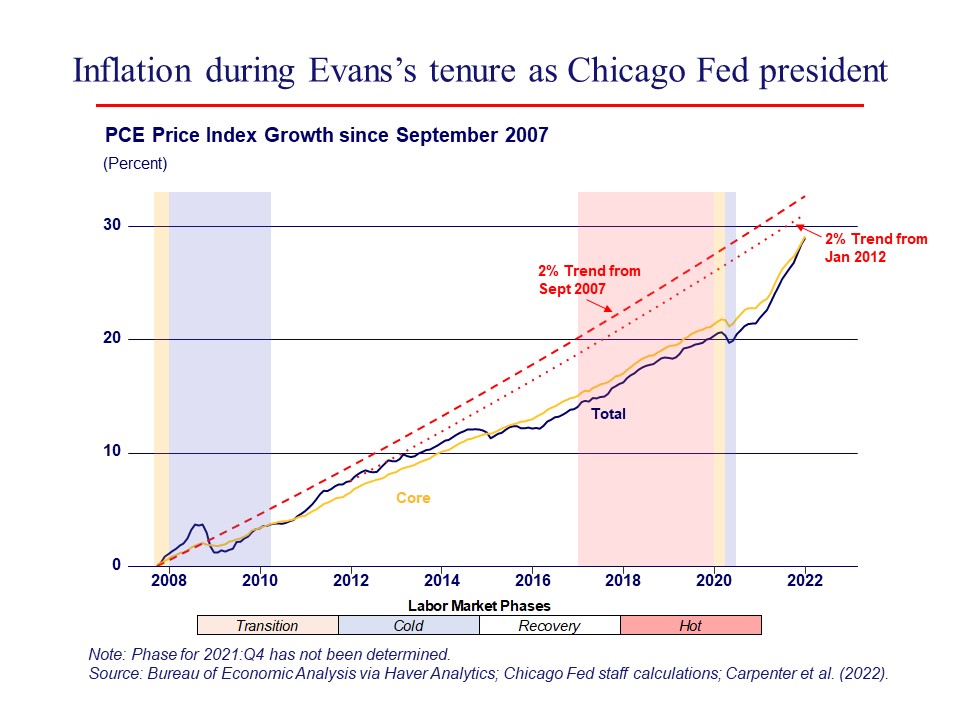

Indeed, as you can see from this chart, we have been fighting this low inflation battle for nearly my entire tenure as Chicago Fed President. Even with the recent spike, the price level today is still 2-3/4 percent below a 2 percent trend line starting at 2007, when I got the job. It’s about 1-1/2 percent below a 2 percent trend line starting from 2012, when we formally adopted the 2 percent target. And this gap actually increased some during the “hot period” identified in the conference paper and shaded red on this chart.

We don’t know what is on the other side of the current inflation spike, but if a low r* world reemerges, we may once again be looking at a situation where there is nothing to fear from running the economy hot. And there are important benefits of doing so. As shown in the conference paper, a hot economy has provided added improvements in unemployment for groups that generally experience worse labor market outcomes.

Now the paper does not identify similar improvements in labor force participation gaps. But there are significant long-term trends in the labor force participation rate that need to be accounted for. It’s also well documented that the cycle in participation lags considerably that of unemployment. So, the paper’s methodology, which is tightly tied to contemporaneous unemployment rate gaps, may not pick up relatively better labor force participation outcomes for disadvantaged groups. It seems natural that lower unemployment should eventually translate into higher participation. For instance, Hobijn and Şahin (2021) emphasize that people leave the labor force at much greater rates when they are unemployed than when they have a job, so lower unemployment rates would contribute to keeping people in the labor force.

I also believe greater inclusion should take account of different parts of the income distribution, given its increasing skewness over the past 20 years. Mean household income is $97,000; median household income is $67,000. Income skewness means that focusing on average income pushes focus to the 65th percentile, away from the 50th percentile. And if the 65th is an interesting object, why not also 35th percentile income developments?

Who bears the greatest costs from unnecessary restrictiveness or benefits more from strong and long growth? We should understand better the implications of restrictive policies in an economy with highly skewed income distributions. We can debate the merits of running the economy hot and the risks, sure. But I think we have a good deal of room to promote vibrant labor market outcomes for all up until the point we are more confident that inflation risks are incompatible with price stability.

A policy adjustment is in order

This brings me to our current high inflation situation. Despite all the typical Evans dovishness I’ve just expounded, I agree the current stance of monetary policy is wrong-footed and needs substantial adjustment.

Let’s go back to last spring, when prices first began to rise sharply. The April 2021 FOMC statement described the higher inflation then as coming from transitory factors.8 For me, this assessment hinged on the fact that the dramatic surge was accounted for by shockingly fast, large increases in prices for a limited number of items (used cars, gasoline, appliances, hotel accommodations, etc.).

These swift relative price increases didn’t look monetary in nature. The inflation path certainly didn’t follow the hallmark characteristics of the Friedman–Phelps narrative or many other models in which monetary accommodation slowly generates inflation: This encompasses inflation paths generated by movements along the Phillips curve (including a possible steeper one),9 excessive money growth, or even an erosion of Fed credibility.

Instead, the spike in prices looks more like a volatility shock of the kind in the models of Stock–Watson and Cogley–Sargent. Those statistical models don’t come with economic labels for these shocks, but economic factors that could fall into this category can include the following: an abrupt increase in demand for goods to replace lost consumption of in-person services; an unusually large and swift fiscal response quickly fueling stronger demand for goods; and a sharp collapse of just-in-time supply chains under the weight of this outsized flow of goods.

But by the fall of 2021, with continued stress from the Delta variant and dysfunctional supply chains, these price increases had proven more persistent and become more widespread than I had expected. Furthermore, labor-market pressures had intensified as labor supply did not bounce back as quickly as expected.

Clearly, it is another understatement to say that inflation has greatly exceeded the moderate persistent overshooting of 2 percent the Committee sought earlier and that a policy adjustment is in order. But how big will it need to be?

An uncertain inflation outlook

The conference paper addresses the likelihood of scenarios with greater and broader persistence in inflation. The paper uses the lens of the three-equation linearized New Keynesian model to describe current risks of experiencing persistently higher inflation—particularly those emanating from the deanchoring of inflation expectations. As I noted earlier, to date longer-run inflation expectations have remained contained. I am well aware of the risk that these might move higher, however.

Of course, there are other models to analyze. Our Chicago Fed dynamic stochastic general equilibrium (DSGE) model offers some insights into how to interpret the shocks emanating from semiconductor supply shortages, durable goods production straining logistics and transportation, and other factors. The model infers quarterly structural shocks from its history of forecast errors for real activity and inflation.

Currently, the data infer a configuration of shocks that portends declining inflation pressures through this year. This is because the model attributes most of the past year’s inflation to relatively shorter-lived markup shocks—and little to more persistent technology disruptions. Recall this shock identification reflects the model’s attempt to capture the full range of co-movements observed for output, consumption, investment, labor hours, and inflation. If the data roll-in in a way that is better explained by more persistent shocks in technology, then these would also generate more persistent high inflation pressures and lend support for a stronger policy response.

I find this additional source of information about inflation persistence to be a good discipline against scary guesses that the world is about to end. As we move through the year, we should gain more evidence on the sources of persistence and the sources of improvement in the inflation outlook. At the moment, to me it still appears that inflation is due more to real-side factors, which relative price signals should eventually correct, than to persistent nominal monetary phenomena. But how this plays out will be key for my monetary policy decision-making over the year. “Careful monitoring” will continue to be the watchwords.

Conclusion

So, to conclude, how should one come down on the question of whether running the economy hot is foolish—or when does it become foolish? Of course, the answer is it depends. It depends on how strong the relationship between growth and inflation is today, the dynamics of inflation expectations, the level of r*, and the associated proximity of the ELB. Or, if you don’t believe in Phillips curves, the question is largely moot because you aren’t going to worry about high employment generating inflation.

With regard to the policy situation today, I still see current inflation as largely being driven by unusual supply-side developments related to the Covid-19 shock. But inflation pressures clearly have widened in the broader economy to a degree that requires a substantial repositioning of monetary policy. What that repositioning ultimately will look like will depend a good deal on the same factors that enter the running-hot calculus.

Notes

1 Carpenter et al. (2022).

2 Further details about the Money and Banking workshop that is organized jointly by the University of Chicago’s Kenneth C. Griffin Department of Economics and Booth School of Business are available online, https://economics.uchicago.edu/content/money-and-banking-workshop.

3 CPI stands for the Consumer Price Index from the U.S. Bureau of Labor Statistics.

4 The equilibrium (or natural) real interest rate, or the rate consistent with full employment of the economy’s productive resources, is often referred to as real r*.

5 See, for example, Evans (2013).

6 Admati and Hellwig (2013).

7 For price stability, the FOMC seeks inflation that averages 2 percent over time, as measured by the Price Index for Personal Consumption Expenditures (PCE) from the U.S. Bureau of Economic Analysis.

8 Federal Open Market Committee (2021).

9 The Phillips curve is a statistical relationship that describes a negative correlation between inflation and unemployment—that is, lower unemployment is associated with higher price and wage inflation. It is often drawn as a negatively sloped curve that has a measure of labor market tightness, such as the unemployment rate, on the horizontal axis and a measure of wage or price inflation on the vertical axis. See Phillips (1958).

References

Admati, Anat, and Martin Hellwig, 2013, The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It, Princeton, NJ: Princeton University Press.

Carpenter, Seth, Ethan Harris, Peter Hooper, Anil Kashyap, and Kenneth West, 2022, “Some benefits and risks of a hot economy,” report for the 2022 US Monetary Policy Forum, New York City, February 18, available online.

Evans, Charles L., 2013, “Financial stability and monetary policy: Multiple goals, multiple tools,” speech at the Financial Management Association Annual Meeting Luncheon, Chicago, October 18, available online.

Federal Open Market Committee, 2021, “Federal Reserve issues FOMC statement,” press release, Washington, DC, April 28, available online.

Hobijn, Bart, and Ayşegül Şahin, 2021, “Maximum employment and the participation cycle,” National Bureau of Economic Research, working paper, No. 29222, September. Crossref

Phillips, A. W., 1958, “The relation between unemployment and the rate of change of money wage rates in the United Kingdom, 1861–1957,” Economica, new series, Vol. 25, No. 100, November, pp. 283–299. Crossref