Small Business Credit Survey (SBCS) – 2017 Results for the Seventh District

Thanks to the participation of over a thousand businesses across Illinois, Indiana, Iowa, Michigan and Wisconsin, the latest round of the nationwide SBCS1 provides fresh information about small business economic trends in the area served by the Federal Reserve Seventh District. One of the most notable findings is the predominance of older firms among survey respondents and the small number of newer firms relative to the country as a whole. Other factors measured and summarized below for businesses in the Seventh District (relative to the country as a whole) include adequate access to capital, and the number of firms producing large revenues, and widespread optimism concerning future revenues and employment growth. Another important set of data gathered from the survey addresses debt and credit use. Both credit use and business dynamism are central to the overall business environment, so we will take advantage of the Small Business Survey’s comprehensiveness to examine these results in greater detail.

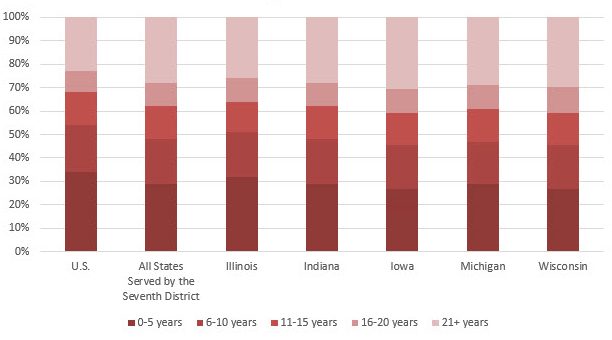

1. Age of firm

Nationally, 34 percent of firms were less than five years old. In the Seventh District, however, only 29 percent of firms fall into this category. At the state level, results ranged from 27 percent of businesses being under five years old in Wisconsin and Iowa, to 32 percent in Illinois. Indiana and Michigan came in at 29 percent – the average across the Seventh District. In all five states older firms were more prevalent than in the nation overall, with 28 percent of firms in the Chicago Fed’s District in business for at least 21 years. The national average for businesses that are at least on their third decade is only 23 percent.

This young firm-old firm dynamic in the Seventh District may be partly explained by the region’s lower population growth. Nationally, the places with the largest fraction of younger businesses have rapid population growth, including Florida with 40 percent of businesses under five years old and Texas with 38 percent. Another likely factor is the state-level fiscal and regulatory environment, while the industry composition of regional economies also may play a role in the proportion of younger businesses appearing in the survey.

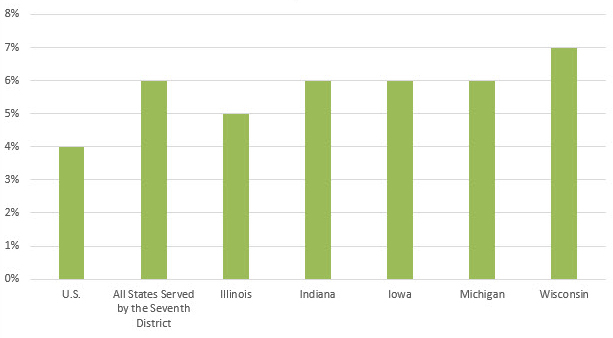

2. Firms exceeding $10M in revenue

Along the same lines, according to the SBCS, the Seventh District includes a larger proportion of high-revenue small businesses than the country as a whole. In Seventh District states, 6 percent of firms reported more than $10 million in revenue during the previous year. This rate is higher than the 4 percent reported nationally, and led by the 7 percent of Wisconsin firms reporting at least $10 million in revenue. Other states above the national average at 5 percent in Illinois and 6 percent in Indiana, Iowa and Michigan. When comparing Seventh District states with the rest of the country in lower revenue divisions, the differences are less striking; 17 percent of firms in the Seventh District earned $100,000 or less in revenue during the previous year, versus 18 percent nationally. Both nationally and in the Seventh District, 51 percent of firms earned between $100,000 and $1 million in revenue, and 26 percent of Seventh District firms earned between $1 million and $10 million, while 27 percent reached that revenue range nationally.

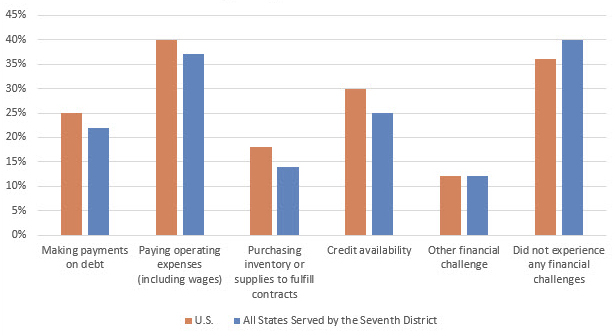

Broadly speaking, businesses in the Seventh District report similar challenges and levels of financial health compared with businesses around the country. In the country as a whole 29 percent of businesses surveyed said they were growing, while 28 percent of businesses in the Seventh District reported growth. Michigan firms were standouts in growth within the Seventh District, with 33 percent reporting growing, while 27 percent of Wisconsin firms, 28 percent of Iowa firms and 26 percent of both Indiana and Illinois firms reported growth. Forty percent of firms in the Seventh District did not report financial challenges in the past year, better than the 36 percent reporting no financial challenges nationally. Both nationwide and in the Seventh district, the number one financial challenge was paying operating expenses and wages, with 37 percent of businesses in the Seventh District calling it a challenge; 40 percent of businesses nationally agreed. Fewer Midwest businesses faced challenges with inventory purchases than the national average, with only 14 percent of Seventh District firms considering it a challenge while 18 percent of firms nationwide considered inventory and materials to be a financial challenge. One very important distinction for firms in the Seventh District was in credit access, with only 25 percent reporting that credit availability was a challenge compared with 30 percent of businesses nationally.

3. Financial challenges experienced in the last 12 months

The survey found that the states served by the Seventh District ranged from 36 percent of businesses reporting no financial challenges in Illinois, to 46 percent of businesses reporting no financial challenges in Wisconsin. In between, 37 percent of Michigan firms, 38 percent of Indiana firms, and 41 percent of Iowa firms reported no financial challenges. While in all states, operating expenses and wages were the most common source of financial challenges, about a third (33 percent) of businesses in Indiana reported that credit availability was a challenge. This contrasts with the other states in the Seventh District, particularly Iowa (22 percent) and Illinois (24 percent), but also Michigan (28 percent) and Wisconsin (27 percent). The only other widely reported financial challenges in any of the five states were debt payments; debt was named as a challenge by 20 percent of firms in Wisconsin and 24 percent of firms in Illinois.

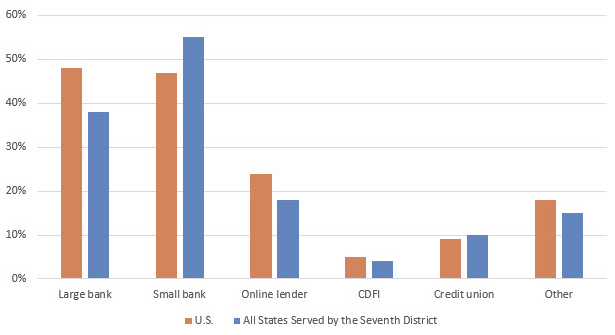

More than two-thirds (68 percent) of small businesses in the Seventh District reported prior outstanding debt; this matched the national rate. Around two in five firms in the Seventh District applied for additional credit in the past year. A majority (55 percent) of these credit applicants went to small banks; this ratio is a notably higher than the national average of 47 percent. In contrast, only 38 percent of Seventh District credit-seeking firms sought loans or lines of credit from large banks, and only 18 percent used an online lender. These rates are significantly lower than the national averages. In addition, 4 percent of Seventh District credit seekers applied with community development financial institutions (CDFIs); 10 percent applied with credit unions; and 15 percent sought some other source of funding.

4. Application rate by source of loan, line of credit or cash advance

For Seventh District firms that did not seek additional financing in the past year, a majority (55 percent) already reported sufficient financing. Fifty percent already used a small bank for financing needs, again exceeding the national rate. This indicates that small banks, while important around the country, are an even more central part of the financing of small business in the Midwest. This finding is consistent with the prevalence of community banks in states of the Seventh District. For example, in 2017 fully 47.5 percent of bank branches in Illinois, Indiana, Iowa, Michigan and Wisconsin were owned by banks with under $3 billion in assets. Nationwide banks with under $3 billion in assets only owned 30.3 percent of branches.2

Overall, the 2017 SBCS results suggest that the state of small business in the Seventh District largely mirrors that of the rest of the country, with a few important distinctions. First, the states of the Seventh District contain an elevated number of older firms and high-revenue firms relative to the rest of the country; this again is likely linked with the industrial makeup of the Seventh District and the flat population growth of the region. Seventh District small businesses face many of the same challenges as businesses around the country, but fewer of them consider credit availability to be a major challenge, and many small businesses already consider themselves to have sufficient financing. For those businesses seeking new financing, the prevalence of small banks of the Seventh District has meant they play a larger role in providing access to credit than the national average. Finally, firms in the Seventh district vary widely in their recent profitability growth, but match the rest of the country with cautious optimism for future revenue and employment growth.

To learn more about the SBCS and see all the most recent releases, please visit the Fed Small Business homepage.

1 The SBCS is a convenience sample. Since the sample is not selected randomly, the survey may be subject to biases that are not present in randomly-selected samples of firms. To control for potential biases, the results are weighted using U.S. Census Data to reflect the full population of businesses along the dimensions of industry, age, employee size, and geography.

2 Summary of Deposits, Federal Deposit Insurance Corporation, 2017.