The mouse that roared: Putting the sale of Chrysler in context

On Monday, May 14, 2007, DaimlerChrysler Corporation announced it would spin off its Chrysler division by selling it to Cerberus LLC, a private equity company. The news ended speculation regarding a possible sale of Chrysler as well as the identity of its ultimate acquirer. The pending sale of Chrysler has since been widely covered in the media. Some have referred to the sale as a watershed event for the U.S. auto industry, which has been undergoing structural change for a number of years. In recent years such changes resulted in new ways to approach the industry’s underlying problems, such as rising health care costs. Witness, for example, the unprecedented mid-contract negotiations between the Detroit Three, comprising Ford, General Motors (GM), and Chrysler, and the United Auto Workers (UAW), which resulted in increased cost-sharing for health care by employees and retirees of Ford and GM toward the end of 2005.

What follows is a brief analysis that places the sale of Chrysler into context from a Midwest perspective.

Who and what

Chrysler represents one of the most venerable names in the U.S. auto industry. For many years, it was one of the companies simply referred to as the Big Three. In 1998, Chrysler merged with Daimler AG of Stuttgart, Germany, in what was then widely hailed as a merger with great chances of success. By way of a $36 billion transaction, the DaimlerChrysler Corporation (DCX) was born.

However, the bond that was then forged by the merger was not to last for even a decade. On May 14, 2007, DCX ended several months of speculation by announcing its intention to sell Chrysler to Cerberus. This transaction is expected to close during the third quarter of this year. According to the terms of the agreement, Chrysler will subsequently be incorporated as Chrysler LLC. Cerberus will own 80.1% of this entity. DCX, soon to be renamed Daimler, will retain a 19.9% stake.

Cerberus is a private equity company based in New York City. It has controlling interests in a number of companies, representing various industries. Among them are a number of auto supplier companies. In 2006, Cerberus made news by acquiring 51% of General Motors Acceptance Corporation (GMAC), GM’s financing arm.

Chrysler’s footprint

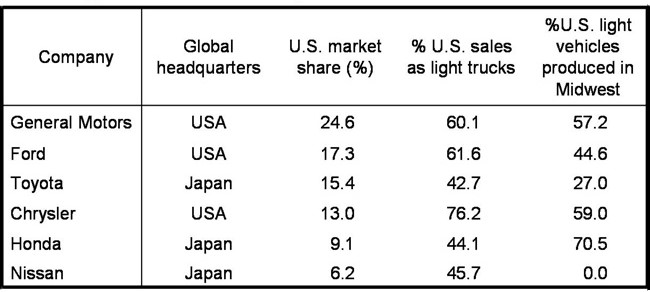

The newly incorporated Chrysler LLC will no longer be a Big Three company. It is now common to refer to the Big Six auto companies in the North American market; they are, ranked in order by U.S. market share: GM, Ford, Toyota, Chrysler, Honda, and Nissan. Chrysler will, however, rejoin GM and Ford as one of the Detroit Three.

Table 1. The big six U.S. vehicle producers in 2006

Note: In this table, the Midwest comprises Indiana, Illinois, Michigan, Ohio, and Wisconsin.

Chrysler is currently in the midst of a downsizing program that was announced on February 14, 2007. That restructuring will reduce its total number of employees in North America by about 13,000. The company is also cutting back its production capacity by closing one assembly plant and shutting down lines at two other plants. The new Chrysler LLC will be more concentrated in the Midwest in its production operations than the other domestic automakers (see map). It will also produce a higher share of its output as light trucks than any other Big Six automaker. Finally, of the Big Six, Chrysler will be the automaker most dependent on the North American market.

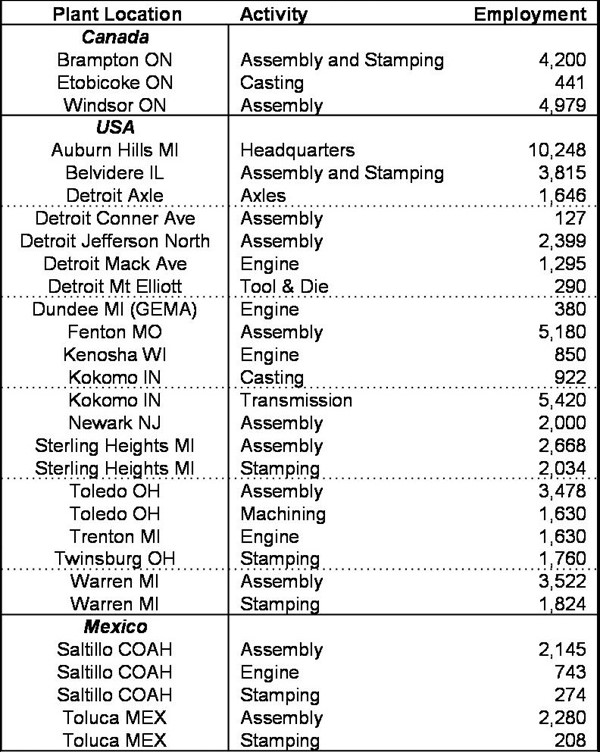

Figure 1. Chrysler footprint in U.S. and Canada employment

Table 2. Chrysler light vehicle production and parts operations in North America

Note: Jobs data from January 2007 (headquarter data from June 2005)

Why does this matter?

These are challenging times for the domestic auto sector. The Detroit Three continue to lose market share, a number of auto parts makers are in Chapter 11 bankruptcy, and the domestic automakers have been in strained negotiations with their unionized employees for the past two years. Delphi—GM’s former parts subsidiary, spun off in 1999 and instantly becoming one of the largest auto parts supplier companies—filed for Chapter 11 in 2005. Negotiations between GM, the UAW, and Delphi about finding a way for Delphi to emerge from Chapter 11 have been going on for over a year.

At the same time, private equity and venture capital firms have been quite active in restructuring the U.S. auto industry for a number of years. Against this background Cerberus’s purchase of Chrysler is noteworthy in that it represents the first time a private venture capital firm has acquired an automaker. As a consequence, by way of becoming a private company, Chrysler LLC will likely have the ability to take a longer-term, strategic approach toward regaining profitability. Yet its owners will want to see a return on their investment along the way.

On the product side, these demands on the company may require refocusing Chrysler products so that they line up with consumer demand. On the cost side, this primarily means addressing the growing health care liabilities that Chrysler, along with the other Detroit automakers, is facing. The next opportunity to do this will arrive soon. This summer the Detroit Three and the UAW are scheduled to negotiate a new labor contract, because the current four-year contract will expire in September. The presence of Cerberus at the bargaining table is likely to change the dynamic of these negotiations.

As the Detroit-based carmakers are struggling to stem their market share losses, Chrysler, the smallest of the Detroit Three, has just been moved into the spotlight by way of its sale to Cerberus. In the process of addressing a number of difficult competitive challenges, Chrysler—the car company that invented the minivan and, in 1980 as it was teetering on the edge of bankruptcy, was bailed out by the federal government—could well set the course for the Detroit Three for years to come.