Not Much House Lock So Far in Seventh District

Two years following the end of the national recession, the national unemployment rate remains above 9%. Part of the explanation stems from the financial crisis element of the recession. In the past, aggregate demand (including new hiring) has tended to bounce back only slowly under similar circumstances, in which household wealth has declined sharply and traditional lending channels have continued to struggle. This time, other potential influences are being suggested. One point of debate is the potential impact of house lock, which is a decline in household mobility that is said to hamper job search. In particular, due to a high degree of underwater mortgages (where the mortgage debt level exceeds the current sales price of the home), working age adults may be constrained from long distance job-related moves by their inability to pay off their existing residential mortgage.

A new Chicago Fed Letter examines whether house lock has, in fact, contributed significantly to a higher than expected unemployment rate. To start, the authors lay out the background of concerns about house lock against the backdrop of the pickup in job openings during late 2009 and 2010 that has failed to translate into increased hiring rates.

To further analyze labor mobility, Aaronson and Davis compare the residential mobility of renters versus that of homeowners. The idea here is that, if house lock is important, the mobility of home owners would decline relative to that of renters, who are unencumbered by mortgages. In their analysis of the U.S., the authors define a household move as the relocation of a household across a state border. They further measure the migration rates of renters versus owners, in the preceding four months. In their results, they find no statistically significant changes over time in the difference between the tendencies of moving between renters versus owners.

To further explore this dynamic, Aaronson and Davis evaluated separately the five states that experienced the steepest house price declines (California, Florida, Nevada, Arizona and Rhode Island), postulating that the larger the decline in home prices, the more likely households would have negative equity, thereby reducing their ability to move. But even in these states, they find that homeowners do not appear to have changed their migration behavior relative to renters.

Midwest

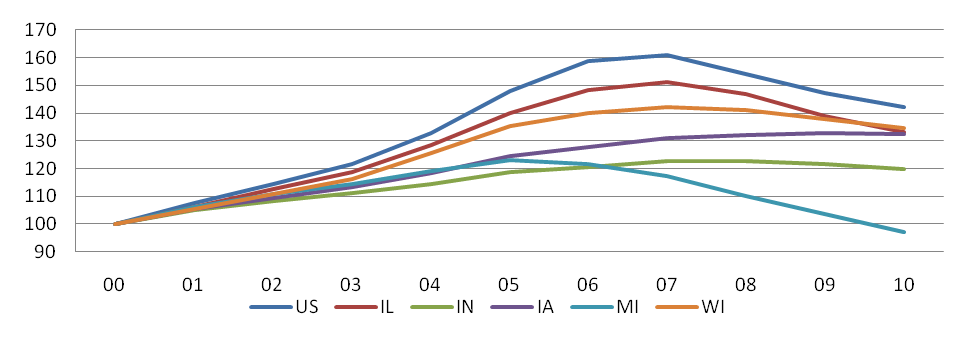

How does the Seventh District compare if we apply the same methodology as Aaronson and Davis? First, as seen from the chart below, the Seventh District seems to have had a varied experience in the past decade’s run up in home prices. In general, home prices did not rise as much as the U.S. average, though in some instances, the home price falloff was just as steep. In Indiana, Iowa and Wisconsin, home prices did not fall much from their peak. However, Illinois did experience a similar pattern to the U.S., and in Michigan home prices have actually fallen below their 2000 levels.

Chart 1. Federal Housing Finance Agency house price index (index 2000=100)

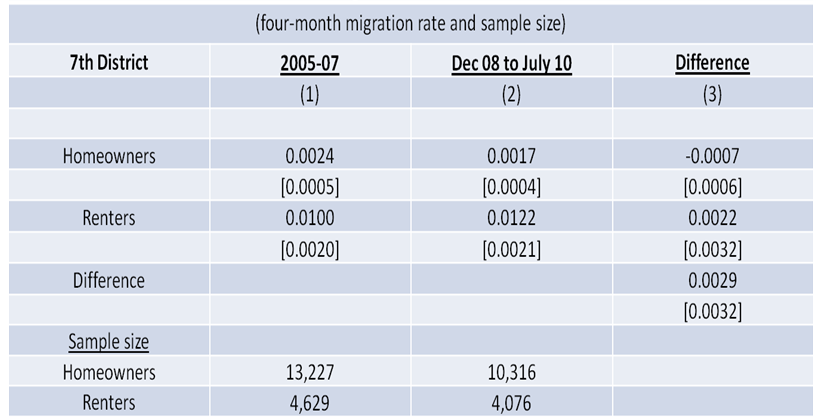

On average, did the Seventh District experience some level of house lock during the most recent recession? Aaronson and Davis were willing to run their methodology for the Seventh District states for us, and the results are shown below. The four-month migration rate for Seventh District homeowners fell from 0.0024 to 0.0017, a 0.0007 decline (annualized, this would be 0.0007*3=.0021 or just over two-tenths of a percentage point). At the same time, renter migration rates barely increased, moving from 0.01 to 0.012. The last row, called “Difference,” compares the patterns between renter and homeowners and shows that the difference between the two is relatively small over time and statistically insignificant for the Seventh District states.

Table 1. State migration rates, recent evidence

Source: Author's calculations

And so, the experience of house lock in the Seventh District states appears to be consistent with that of the rest of the U.S. That is, while the continued home market weakness is detrimental in other regards, it does not appear to be a primary driver of lingering unemployment.

It is true that District homeowner migration rates fell slightly during the recession. This is consistent with past downturns; migration rates tend to be procyclical in nature, falling during recessions and rising during expansionary periods as job opportunities become more abundant.