Each year, the Federal Reserve conducts a survey to better understand small business demand, experiences, and outcomes in the credit markets: The Small Business Credit Survey (SBCS) is fielded annually by the 12 Federal Reserve Banks, and it provides insights on the financing needs of small businesses, or firms with fewer than 500 employees, across the United States. In this article, we take a closer look at the answers to the survey’s questions about small businesses’ relationships with lenders and the credit application results for such firms from the 2024 SBCS—the most recent vintage with published results. We pay particular attention to the survey responses of businesses with at least one employee in the five states of the Seventh Federal Reserve District, which is served by the Chicago Fed.1

Access to credit matters for many businesses, both for the day-to-day management of cash flow and for longer-term capital investment. The responses to the 2024 SBCS, especially from firms with employees in Seventh District states, may be of interest to businesses and financial intermediaries in the Chicago Fed’s region. The survey results based on the national sample are available on the Fed Small Business website. From our analysis of the 2024 SBCS results, we note that 1) small business respondents from Seventh District states and the entire nation most often sought no or low amounts of financing; 2) among those that did seek financing, many small businesses did not succeed in receiving the full amount of credit requested; 3) in the experience of the respondents, approval rates were higher for credit products with fewer small business applicants; 4) respondents’ use of and satisfaction with banks tended to be high; and 5) respondents used both formal credit channels and other sources of capitalization at about the same rate. Responses to the SBCS questions add to our understanding not only of trends in loan approvals and denials in the recent past, but also of small business views on lenders and the credit application process, which likely remain relevant beyond the timeframe of the 2024 survey cycle.

Who answered the survey?

There were about 3,750 total SBCS responses over the period 2019–24 from the five states of the Seventh District. In 2024, there were 238 responses from Illinois, 90 from Indiana, 56 from Iowa, 160 from Michigan, and 120 from Wisconsin.2 Because businesses are reached through networks of local, regional, and national business-serving organizations rather than by random sample, we reweight the survey answers from Seventh District states (as is done with the national sample) to reflect representation by age, industry, urban or rural location, gender of owner(s), race or ethnicity of owner(s), and firm size.

Finding 1: Many respondents borrowed little or nothing

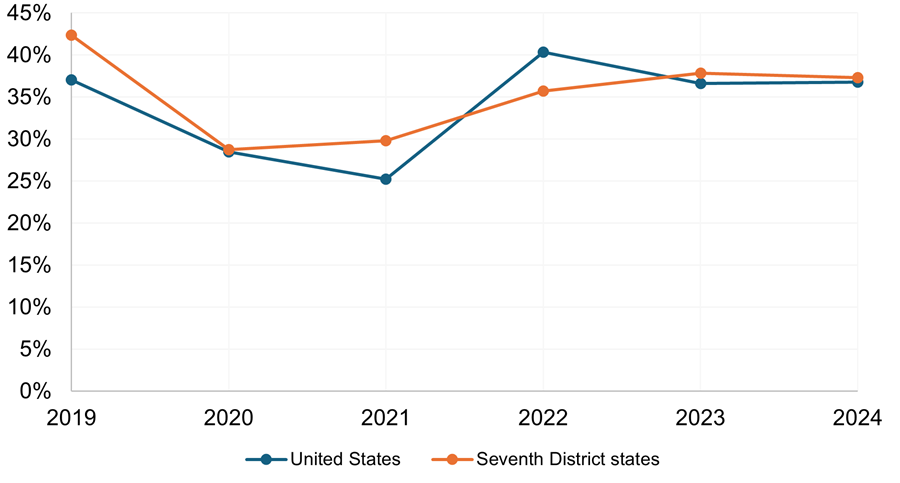

Small Business Credit Survey questions on whether respondents sought different forms of financing provide insights on the types of relationships that small businesses have with credit providers. The results show that most respondents did not pursue formal credit applications in a given year. According to the 2024 SBCS, fewer than four in ten respondents applied for a loan, line of credit, or merchant cash advance—types of credit broadly available to most businesses for a wide range of purposes.3 This data point extends a multiyear trend wherein fewer than half of respondents in Seventh District states, as well as in the nation as a whole, sought out such financing in a given year (see figure 1).

1. Annual percentage of SBCS respondents who applied for a loan, line of credit, or merchant cash advance, 2019–24

Source: Authors’ calculations based on data from the Federal Reserve Banks, 2019–24 Small Business Credit Surveys.

Finding 2: A large share of respondents did not receive the full amount of financing requested

Among the businesses in the 2024 SBCS that applied for financing, about 40% from Seventh District states and 48% from the U.S. as a whole reported that they did not receive the full amount of requested financing in the form of loans, lines of credit, or merchant cash advances. These shares account for those who received most, some, or none of the financing requested. These results were somewhat better than those from the pandemic years of 2020 and 2021, when more than half of such credit applicants did not receive the full amount of financing requested, but approval rates in 2024 were still lower than in 2019, according to our analysis of the SBCS data for the U.S. and Seventh District states. In response to why they thought they did not receive the full amount of financing requested, many survey participants answered that they did not meet the credit qualifications of their lenders. Figure 2 shows which factors small business applicants from Seventh District states in the SBCS thought led to their denials for credit in 2021 versus 2024. In 2024, these business owners were more likely to think they were denied financing because they had a low credit score, too much existing debt, or weak sales. Separately, when the 2024 SBCS asked respondents in Seventh District states who did not apply for credit in the past year why they chose not to, about 70% of them reported they already had sufficient financing. The remaining 30% reported that they didn’t apply because they were debt averse, felt the cost of credit was too high, or were discouraged.

2. Reason for credit application denial given by SBCS respondents in Seventh District states, 2021 versus 2024

Source: Authors’ calculations based on data from the Federal Reserve Banks, 2021 and 2024 Small Business Credit Surveys.

Finding 3: Approval rates tended to be higher for credit products that small businesses were less likely to apply for

In terms of the type of financing that businesses sought, respondents across the U.S. most often applied for business lines of credit, business loans, or Small Business Administration (SBA) loans.4 Businesses also applied for other types of loans, including auto or equipment loans, personal loans, home equity loans, and mortgages. Further, among the respondents who applied for these types of credit, the survey shows vastly different approval rates across these different forms of financing (see figure 3). While fewer SBCS respondents applied for mortgages and home equity loans, it appears that the mortgage and home equity applicants among them were far more likely to receive approvals than the business loan applicants. The survey also indicates higher approval rates for auto or equipment loans than for business loans. Thus, while application rates were the highest for unsecured forms of credit, businesses were more likely to be approved for secured loans (i.e., loans backed by an asset, such as a house or automobile).

3. Application rates and outcomes among SBCS respondents across the United States, by credit type, 2024

Source: Authors’ calculations based on data from the Federal Reserve Banks, 2024 Small Business Credit Survey.

Finding 4: Small businesses’ usage of and satisfaction with banks tended to be high

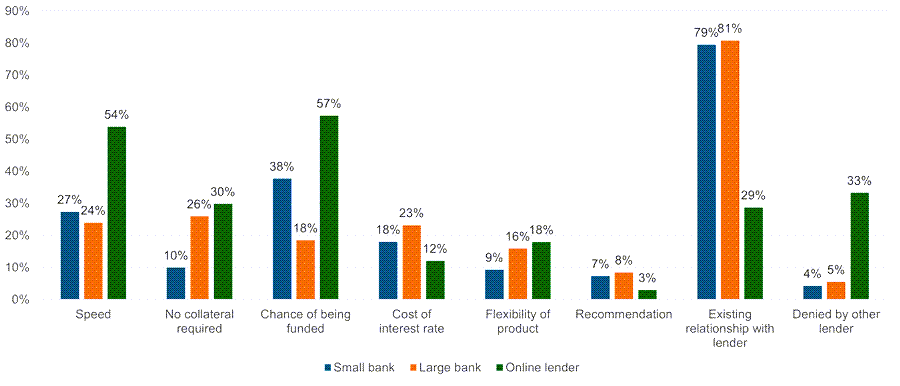

For those businesses that sought a loan, line of credit, or merchant cash advance, the survey asks about the type of institution that they applied to. In 2024, most SBCS respondents in Seventh District states sought such financing from a bank; specifically, businesses in these states applied to small banks about 42% of the time and to large banks about 29% of the time (differing somewhat from the national results, which showed a higher share of businesses applied to large banks than small ones).5 While the Seventh District states’ sample sizes were too small to report applications to other types of lenders, we note that at the national level, almost a quarter of credit applicants sought financing from online lenders6 and that such applicants were more likely to self-report as being a medium or high credit risk, compared with those who sought credit from other types of lenders.7 A lower percentage of SBCS respondents across the U.S. applied for credit at finance companies, credit unions, or community development financial institutions.8 When further asked why a business in a Seventh District state applied to their lender, SBCS respondents indicated that existing relationships were the driving force behind applications to both large and small banks (see figure 4). Likewise, when asked in a separate question about satisfaction with their lender, 2024 SBCS respondents from Seventh District states generally reported high rates of satisfaction with banks, with small banks garnering higher rates of satisfaction than large ones. Survey results based on the national sample show that customer satisfaction rates tended to be high for credit unions as well, but less so for finance companies and online lenders.

4. Reason for pursuing financing given by SBCS respondents in Seventh District states, by lender type, 2024

Source: Authors’ calculations based on data from the Federal Reserve Banks, 2024 Small Business Credit Survey.

Finding 5: About the same share of respondents sought out funding from other channels as formal credit channels

In addition to asking businesses if they applied for formal credit, the survey also asks whether businesses sought other types of capital, such as an equity investment, a grant, or a loan from family and friends. In 2024, 40% of small businesses in Seventh District states reported they sought these other types of funding outside of formal credit channels—about the same share that reported they applied for a loan, line of credit, or merchant cash advance from a formal lending organization. These answers reveal that small businesses generally do not make either/or choices in terms of whether to seek capital through a formal lending channel or another channel. Among survey respondents who applied for a loan, line of credit, or merchant cash advance from a formal lending organization, 44% of them also applied for these other types of funding. Likewise, among those who sought these other types of funding, 41% also applied for a loan, line of credit, or merchant cash advance from a formal lending channel.

Conclusion

The Small Business Credit Survey provides insights into lending trends among small firms across the U.S. The results from survey respondents with small businesses in Seventh District states show that many business owners in the Chicago Fed’s region rely on their own revenues or personal savings to fund their businesses. Yet, when small businesses do seek money from external sources, funding from formal credit channels, in particular banks, represent an important source of capital. According to the SBCS, small firms apply for a wide range of products—some of which (e.g., home equity loans) may not seem like traditional small business products—and approval rates for these products vary widely. Many SBCS respondents do not receive the full amount of credit requested. This may signal the need for further financial product innovation, greater transparency in small business financing terms (to help with comparison shopping), and more borrower education and technical assistance.9

Notes

1 The Seventh District comprises all of Iowa and major portions of Illinois, Indiana, Michigan, and Wisconsin. However, throughout this article, we discuss and analyze SBCS responses from small businesses with at least one employee in the entirety of all five Seventh District states.

2 Across the country, there were about 7,600 respondents to the SBCS in 2024. To ensure the survey data provide reliable estimates and to maintain the privacy of survey participants, each geography must have at least 50 responses to a question before its responses can be included in the analysis (according to the SBCS data agreement we signed).

3 The SBCS asks if respondents applied for other types of credit products in addition to loans, lines of credit, and merchant cash advances—such as credit cards, trade credit, leases, and factoring. If these other types of products are included, about 60% of the national sample applied for a credit product in 2024.

4 We report national level results because the sample sizes from Seventh District states are too small.

5 The SBCS defines small banks as banks with less than $10 billion in total assets and large banks as banks with at least $10 billion in total assets.

6 Online lenders/fintech companies are nonbanks that operate online. Further details about fintech lenders are available on this Fed Small Business webpage.

7 Credit risk is based on the self-reported business credit score or personal credit score; for more details, see the appendix (specifically, p. 52) of the 2025 Firms in Focus: Chartbook on Firms by Credit Risk (based on findings from the 2024 SBCS).

8 For the SBCS definitions of these types of lenders, see the appendix (specifically, p. 53) of the 2025 Firms in Focus: Chartbook on Firms by Credit Risk.

9 In March 2025, Fed Governor Michael S. Barr advocated for some of the same goals to help small businesses realize their potential.