The U.S. Bureau of Labor Statistics’ (BLS) Consumer Price Index (CPI) data include inflation information on several metropolitan areas across the country, including Detroit’s. In this article, I explore how Detroit’s inflation reading has compared with the nation’s recently and investigate why inflation in the Motor City metro area is lower now, although it had been higher throughout most of the period since 2021. This article is similar to my previous analysis comparing Chicago and U.S. inflation.

The four key results from my close examination of the CPI data are as follows:

- Recent 12-month (or annual) inflation readings show that Detroit inflation has been lower than U.S. inflation, although inflation in Detroit was higher through all of 2023 and most of 2024.

- Over a longer time horizon—specifically, since the start of 2021—cumulative inflation in Detroit has been higher than in the U.S. and most other surveyed metro areas.

- In 2023, Detroit inflation was higher partly because of higher price increases for transportation. In 2024, Detroit inflation was higher mostly because of higher price increases in the housing category.

- Detroit inflation has been lower in 2025 because of lower price increases in the housing category.

In the rest of this article, I describe how Detroit inflation compares with national inflation, as well as inflation in other U.S. metro areas. I also discuss whether the differences in inflation are due to relatively higher or lower price changes in the housing, transportation, or other expenditure categories.

Recently, inflation in Detroit has been lower than in the nation overall

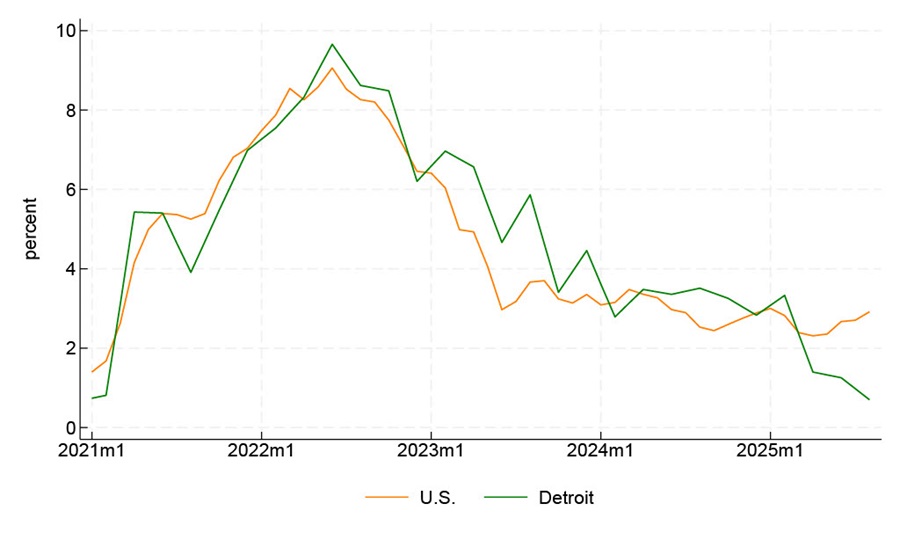

In addition to the national CPI, which is used to calculate the annual rate of inflation for U.S. urban consumers, the BLS releases inflation measures for individual urban areas (e.g., the Detroit metropolitan area), sets of urban areas (e.g., small Midwest cities, each with a population of 2.5 million or less), and the urban areas of regions (e.g., the urban Midwest).1 Figure 1 presents 12-month inflation for the overall U.S. and for the Detroit metropolitan area since January 2021—a period that covers the Covid-related run-up in inflation and the more recent decline.2 For the 12 months ending in August 2025, CPI inflation was 2.9% for the U.S. and 0.7% for Detroit. Figure 1 also shows that the Detroit inflation rate has been below the U.S. inflation rate for only the past six months. For most of the months (74%) since the national (and Detroit) CPI inflation peak in June 2022, Detroit inflation has been higher than U.S. inflation.

1. Detroit and U.S. 12-month Consumer Price Index inflation

Recent inflation in Detroit has been lower than in most other metro areas

Recent Detroit inflation can also be compared with that of other places for which the BLS reports CPI data. These data are reported for the four Census regions and nine Census divisions, plus 27 metro areas—23 large metro areas (including Detroit) and four collections of smaller cities (one in each Census region). A map of these places (i.e., CPI primary sampling units, or PSUs), established in 2018, is available online.3

To determine how much higher or lower Detroit inflation is relative to inflation in most urban places, I compare inflation in Detroit and the 26 other metro areas (or collections of metro areas) the BLS reports CPI data for. Of these 27 places, seven are reported each and every month (the top three metro areas by population as of the 2010 U.S. Census—New York, Los Angeles, and Chicago—and the small-city collections within each of the four Census regions), 11 (including Detroit) in only even months (February, April, and so on), and nine in only odd months (January, March, and so on). I refer to the 18 areas observed in even months as “even-month-reporting places” and the 16 areas observed in odd months as “odd-month-reporting places.”

The focus of this article is on how prices are changing differentially across places. Exploring how price levels differ across places is also interesting to analyze and would rely on a separate data source.4

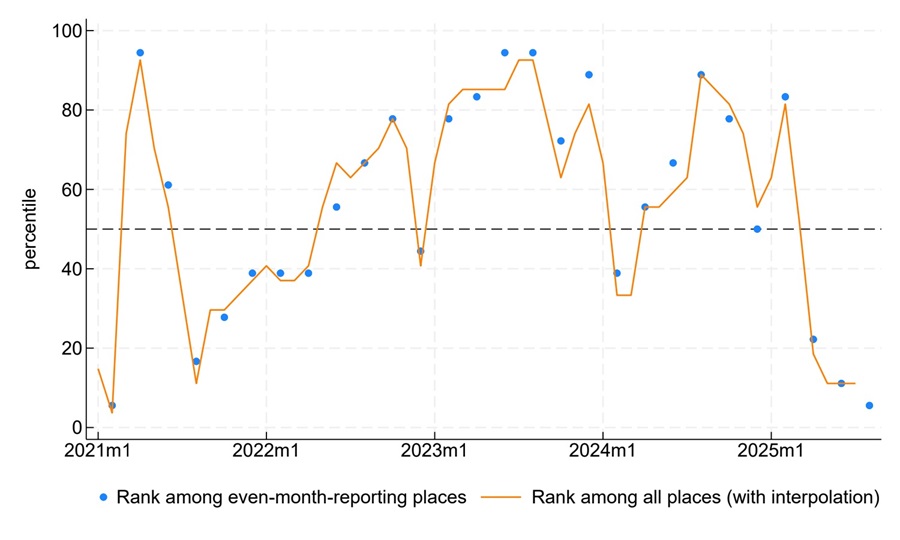

Figure 2 shows Detroit’s percentile rank for annual inflation (with higher ranks equating to higher inflation) over time relative to the 26 other areas in two ways. First, it compares Detroit with the 17 other even-month-reporting places. Second, it compares Detroit with all 26 other metro areas. To make this second comparison, I interpolate price indexes between available months and drop the last month of data and calculate 12-month inflation based on this interpolation. More specifically, as of September 2025, I have August CPI data. However, for August 2025, I do not have data for the odd-month-reporting places. So I end this sample in July 2025, given that I already have July data for odd-month-reporting places and can linearly interpolate July data for the even-month-reporting places based on the June and August data.

2. Detroit’s percentile rank for 12-month Consumer Price Index (CPI) inflation

Source: Author’s calculations based on data from the U.S. Bureau of Labor Statistics from Haver Analytics.

Figure 2 shows that Detroit has had low 12-month inflation relative to other areas’ 12-month inflation recently. For July 2025, Detroit was at the 11th percentile for inflation among all places (with interpolation); only Dallas and Phoenix had lower 12-month inflation in July 2025. For August 2025, Detroit was at the 6th percentile of even-month-reporting places; none of the even-month-reporting places had inflation lower than Detroit. Figure 2 also shows that Detroit’s 12-month inflation has often been above the median across all the surveyed places since January 2021.

Detroit’s cumulative inflation since January 2021 has been above the nation’s

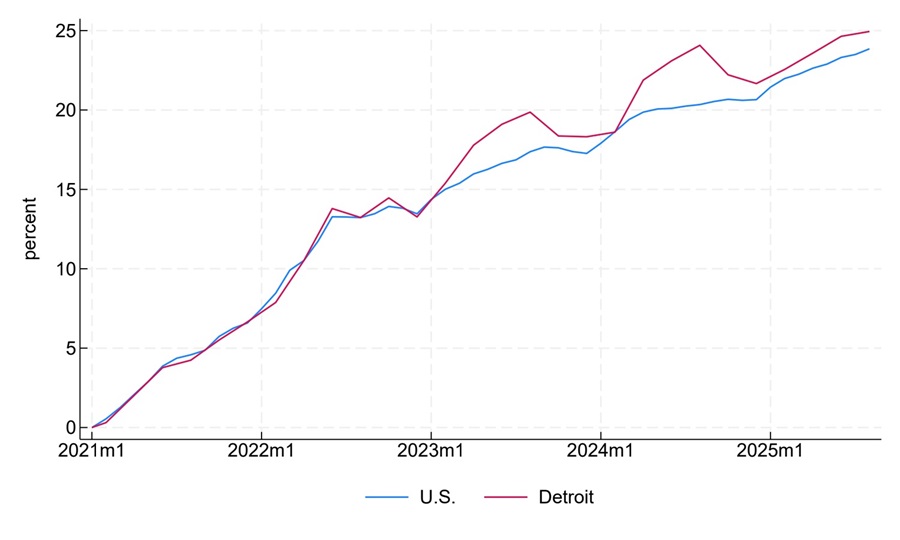

To better understand how inflation has evolved and how Detroit’s price growth compares with the nation’s over the past four-plus years, I plot cumulative inflation since January 2021 (i.e., the total percentage change in the price level since 2021) in figure 3. This period covers the Covid-related run-up in inflation and the more recent decline. This figure shows that the percentage change in the price level in Detroit is moderately above (about 1.1 percentage points) the national total since January 2021. Over the first two years of the period, Detroit’s inflation tracked U.S. inflation. Since January 2023 Detroit’s cumulative inflation has periodically diverged to be higher and then dropped back to be largely in line with the nation’s.

3. Detroit and U.S. cumulative Consumer Price Index inflation since January 2021

I can also compare cumulative inflation in Detroit with cumulative inflation in other places (not graphed). Through July 2025, Detroit was at the 74th percentile for cumulative inflation since January 2021 among all 27 places. Six places had higher cumulative inflation from January 2021 through July 2025 than Detroit; one of those six metro areas was Phoenix, which was also one of the two places with lower 12-month inflation in July 2025.

The combination of higher longer-term cumulative inflation and lower recent 12-month inflation indicates that some of the recent lower annual inflation in Detroit represents Detroit’s cumulative inflation since January 2021 falling closer to the national level after being above the level of cumulative inflation in the U.S. and other metro areas. However, even after the recent lower 12-month inflation readings, cumulative inflation since January 2021 in Detroit is still above both the U.S. level and the median across the surveyed metro areas. These results for Detroit contrast with the results for Chicago, given that the Windy City has recently experienced higher 12-month inflation, though its cumulative inflation since January 2021 has been lower than the U.S. level.

Which expenditure categories have been driving Detroit’s inflation lower or higher than the nation’s since June 2022?

Next, I investigate whether there are specific expenditure categories that have been driving Detroit’s 12-month inflation lower than the nation’s over the past few months. I also look into which expenditure categories were driving Detroit inflation higher than U.S. inflation from the June 2022 peak through March 2025.

To investigate which specific categories are driving inflation gaps between Detroit and the U.S., I take advantage of the underlying data used to generate the BLS inflation numbers. To create inflation data for metro areas and broader regions, the BLS surveys prices in different urban areas and publishes percent changes in prices for about 60 different items or categories of items on either a monthly basis or bimonthly basis (i.e., in only odd or even months, depending on the place). To generate an inflation reading for an area, the BLS weights these price changes by spending in each category based on area expenditure data collected as part of the Consumer Expenditure Survey.

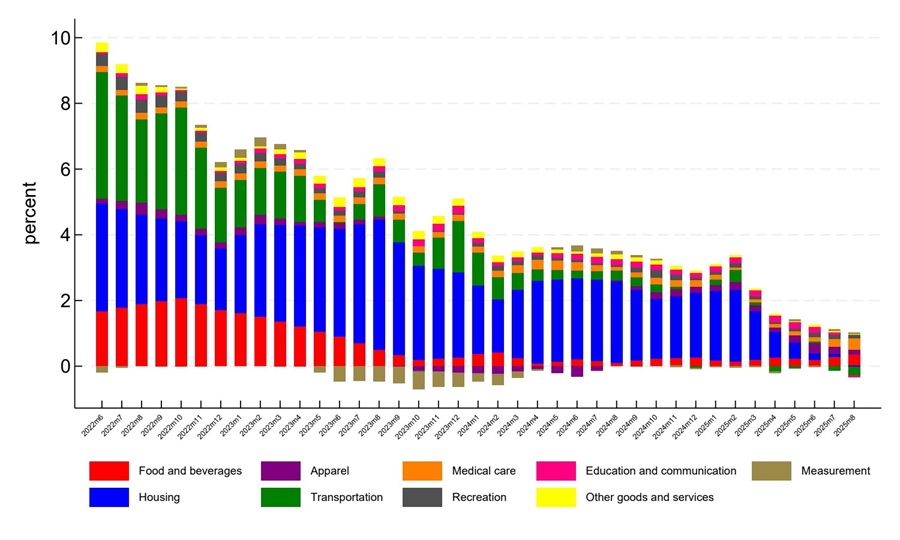

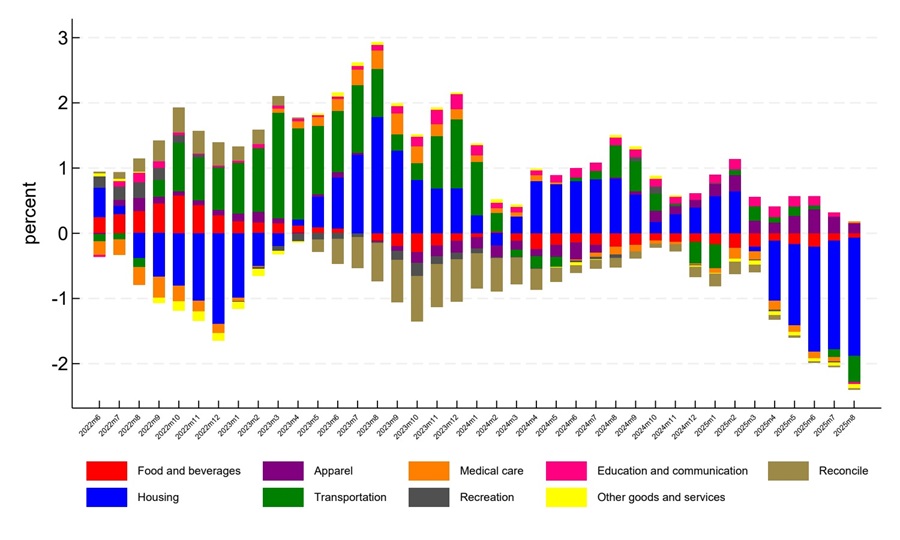

Figure 4 breaks down Detroit inflation since the CPI inflation peak in June 2022 into contributions from the eight major expenditure categories; for this figure, I use 12-month price changes by category and expenditure weights from the previous December.5

4. Contributions to Detroit 12-month Consumer Price Index inflation, by major expenditure category

Source: Author’s calculations based on data from the U.S. Bureau of Labor Statistics from Haver Analytics.

An expenditure category can have a high contribution to inflation if it has been experiencing large price increases or if the category receives a lot of weight because it is a big component of overall spending. A couple of patterns emerge in figure 4. Most notably, the figure is dominated by the blue housing category, which represents almost 45% of the Detroit expenditure weight. Note that the BLS housing category comprises shelter expenses (in particular, rent and owner’s equivalent rent), household fuel and utility expenses, and household furnishing and operations (e.g., dishes and lawn care). In addition, the overall height of the bars is declining over time and is small in the last months of the figure, with the housing category having become a tiny negative bar in August 2025.

Figure 4 shows the sources of Detroit inflation by category. But I am more interested in the sources of the gap in inflation between Detroit and the U.S. by category. To explore the inflation gap I first do an additional set of calculations that involve generating counterfactural Detroit inflation using U.S. expenditure weights. This merits further explanation.

A positive (negative) gap in inflation between Detroit and other places could happen either because the changes in prices by category are higher (lower) for Detroit or because people in Detroit consume more (less) in a category that experienced a bigger price change everywhere so that the category receives a larger (smaller) weight in the calculation of Detroit inflation than in the calculation of U.S. inflation. One way to explore the sources of the gap in inflation is to focus on the changes in prices by category and remove the differences due to expenditure weights. I compare the U.S. and Detroit in this way by comparing U.S. inflation and a counterfactural measure of what inflation would have been in Detroit using the U.S. expenditure weights and Detroit price changes by category. This approach (relying on a common set of expenditure weights) allows me to explore which categories contribute to the gap in inflation between counterfactural Detroit inflation and actual U.S. inflation.6

5. Sources of the gap in 12-month Consumer Price Index inflation between Detroit and the U.S.

Source: Author’s calculations based on data from the U.S. Bureau of Labor Statistics from Haver Analytics.

I display the breakdown in the gap between counterfactual Detroit inflation using the U.S. expenditure weights and U.S. inflation in figure 5. The figure also includes a ninth category, labeled “reconcile,” that makes the total inflation gap in the figure equal the total gap in the official BLS data (where Detroit inflation is based on the Detroit expenditure weights). The necessity for this ninth category arises from the differences due to my use of the U.S. expenditure weights to determine the contributions of the eight major expenditure categories to total inflation for not only the nation but also Detroit; and it also arises from the differences between my measurement methodology and the offical CPI measurement methodology (see note 5).

For the past few months, when Detroit inflation has been lower than U.S. inflation, this result has been almost entirely due to lower price increases in the housing category. Of the 2.2 percentage point gap in inflation between Detroit and the U.S. in August 2025, 1.8 percentage points were due to the housing category. Digging further into the housing number, I observe that it is almost entirely due to shelter inflation, the largest portion of the housing category.

For the period of higher Detroit inflation throughout 2023 and most of 2024, transportation and housing inflation both contributed to the metro area’s higher inflation. During that period, the “reconcile” category is negative—which indicates that using U.S. expenditure weights combined with the “measurement” category from figure 4 pushes Detroit inflation higher. The large transportation contribution to the inflation gap is due to relatively high price increases for new and used motor vehicle purchases, particularly in 2023. This is an interesting narrative for the Motor City that might merit further research. However, this followed a period of relatively low vehicle and transportation price increases in 2021 and 2022. This pattern might have been influenced by measurement issues during the pandemic.7

Conclusion

In this article, I closely examined the CPI data and compared Detroit and U.S. inflation. Detroit inflation has been lower than U.S. inflation over the past few months because of relatively lower price increases in the housing category, but notably, this inflation pattern for the Motor City followed multiple years of inflation generally running higher in Detroit than in the nation as a whole.

Notes

1 Further information on all these different CPI inflation measures is available online.

2 The BLS provides inflation data for core-based statistical areas (CBSAs), as defined by the Office of Management and Budget and used by the BLS for CPI purposes, as explained in the CPI’s 2018 geographic revision notice. However, I will use city or metropolitan (or metro) area rather than CBSA throughout this article. For instance, I refer to the CBSA of Detroit–Warren–Dearborn, MI, as the city of Detroit (or Detroit metro area).

3 CPI data are also reported for all the large cities together (size Class A cities), all the small cities together (size Class B/C cities), and the large cities by region (e.g., Midwest size Class A cities). According to BLS definitions, Class A cities have a population greater than 2.5 million and Class B/C cities have a population of 2.5 million or less. The 27 metro areas (or collections of metro areas) I focus on are those that do not geographically overlap with one another. For example, I only include Detroit in my sample of places for this article and exclude size Class A cities and Midwest size Class A cities because Detroit is part of those two collections of metro areas.

4 Data that compares the price levels across places is released annually by the U.S. Bureau of Economic Analysis (BEA). The most recent BEA data release comparing price levels across places is for a vast set of places throughout the U.S. in 2023.

5 I interpolate price indexes by category for missing (odd) months and calculate inflation based on that in a similar manner as was done for the overall inflation measure. Occasionally some of the category price indexes for Detroit are missing in even months, especially for the lowest-level categories during the pandemic. I interpolate those missing months in a similar manner based on the available data. Figure 4 also features a ninth category, labeled “measurement,” because my calculation differs modestly from the official CPI inflation calculation. In particular, I do not update weights every month based on price changes as is done for the official CPI (an adjustment the BLS calls relative importance). Including the measurement category guarantees that the bars in figure 4 sum up to the total BLS measure of Detroit inflation.

6 In my Chicago Fed Letter article comparing Chicago and U.S. inflation, I go into additional detail explaining the benefits of using the U.S. expenditure weights after showing that most of the gap in inflation between Chicago and the nation is due to differences in price changes across expenditure categories rather than differences in expenditure weights. The same is true for the inflation gap between Detroit and the U.S.

7 Notably, the BLS did not release data on the new vehicle CPI for Detroit from June 2020 through February 2023 because of inadequate information for publication. As a result, I impute the CPI for the new and used motor vehicles. The overall transportation CPI was released during this period. Various series were unpublished for different locations during the pandemic. See, e.g., table 7 on this BLS page documenting the impact of the Covid-19 pandemic on CPI data for April 2021.