The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Crop production estimates released on September 12, 1988, by the U.S. Department of Agriculture were not good news for consumers worried about the drought’s effects on food prices. USDA projected 1988’s overall crop production to be

- down 17% from last year;

- down 25% from the all-time highs, most recently reached in 1985; and

- comparable to the curtailed output of 1983 when drought and a large reduction in acreage pulled crop production to a nine-year low.

Of the major crops, barley, oat, and spring wheat production are expected to be down about 50% from last year. Fortunately, the decline in total wheat production may be held to 14% as the winter wheat crop virtually escaped this year’s drought damage.

Corn and soybeans, the major crops of the Seventh Federal Reserve District, were also hard hit. Nationwide, corn production is expected to be down 37% from last year and soybean production down 23%. Estimates for the five district states point to a 43% decline in corn production and a 27% decline for soybeans.

The bulk of the production losses stem from reduced per-acre yields. Corn and soybean yields per harvested acre this year are expected to be the lowest since 1974, down 34% and 23%, respectively, from last year. In addition, the production losses for most crops partially reflect an increase in acreage abandonment—fields simply left unharvested because of extensive drought damage—that offset a slight rise in planted acreage this year.

The drought affected a wide range of other crops as well. Hay production will likely be down 12%, despite beneficial late-season rains and emergency measures that permitted haying on acreage originally intended to be held out of production this year under government farm programs. Several fruits and vegetables grown in the Great Lakes region were also hit, contributing to the estimated declines of 23% and 30% in the nation’s apple and cherry harvests, respectively. Major Great Lakes vegetable crops, such as peas, sweet corn, and beans also suffered extensive losses.

Prices

Farm prices have risen sharply in response to the drought and most observers expect a surge in food prices. These expectations, in turn, have added to other concerns—the tightening labor market, high capacity-utilization rates in manufacturing plants, and the low value of the dollar—about a rekindling of inflationary pressures. Indeed, the food component of the Consumer Price Index rose at an annual rate of 10% during June and July, substantially above the 3.5% annual rate of increase during the first five months of this year.

Retail food prices may continue to register large gains in coming months. But a review of food price trends associated with recent droughts offers some hope that the surge in food prices may be short-lived and have only a modest impact on overall inflation.

The way a drought affects prices and inflation can be significantly influenced by underlying economic factors and trends. Recession or expansion, weak or strong dollar, and prevailing inflationary trends must be factored into the equation.

History

Figure 1 summarizes the trends in prices received by farmers and in retail prices for food and for all consumer items that were associated with the major droughts occurring in 1974, 1980, and 1983. National average per-acre corn and soybean yields fell sharply in each of those years. But 1983 saw the sharpest drops, 28% for corn and 17% for soybeans.

1. Price trends in recent droughts

| Year before drought | Year of drought–First 2 quarters*** | Year of drought–Entire year | Year after drought | |

|---|---|---|---|---|

1974 Drought |

(73 Q2-74 Q2) | (74 Q2-74 Q4) | (74 Q2-75 Q2) | (75 Q2-76 Q2) |

| Background economy | 1st oil shock & subsequent recession; high inflation; weakening dollar; low carryover grain stocks; growing food exports | |||

| % change* in farm prices** | 3.3 | 18.4 | 2.1 | 4.8 |

| % change* in CPI–food | 15.6 | 10.7 | 8.1 | 4.4 |

| % change* in CPI–all items | 10.6 | 12.6 | 9.7 | 6.1 |

1980 Drought |

(79 Q2-80 Q2) | (80 Q2-80 Q4) | (80 Q2-81 Q2) | (81 Q2-82 Q2) |

| Background economy | 2nd oil shock; high inflation, back-to-back recessions; dollar hits bottom; food exports peak, turn down; normal carryover grain stocks | |||

| % change* in farm prices** | –8.4 | 23.7 | 9.6 | 0.2 |

| % change* in CPI–food | 7.0 | 11.4 | 9.0 | 4.7 |

| % change* in CPI–all items | 14.5 | 9.2 | 9.8 | 6.8 |

1983 Drought |

(82 Q2-83 Q2) | (83 Q2-83 Q4) | (83 Q2-84 Q2) | (84 Q2-85 Q2) |

| Background economy | Beginning recovery; dollar strong & rising; inflation low & dropping; carryover grain stocks high; food exports weak | |||

| % change* in farm prices** | –3.9 | –1.0 | 5.0 | –7.8 |

| % change* in CPI–food | 2.2 | 0.7 | 3.3 | 2.5 |

| % change* in CPI–all items | 3.3 | 4.2 | 4.3 | 3.7 |

**Figures shown for teh 1974 drought are based on the index of prices received by farmers for all farm products. For the 1980 and 1983 droughts, the figures are based on the index of prices received by farmers for food commodities.

***Percent change in this column are at an annualized rate.

Farm and consumer prices varied widely among those three periods. Much of that variation was due to different underlying trends in the farm sector and the economy.

Both the 1974 and the 1980 droughts occurred when the economy was experiencing sluggish growth and brief periods of recession. By contrast, the 1983 drought occurred in the early stages of the present economic recovery.

The 1974 and 1980 droughts also coincided with periods of double-digit inflation that stemmed largely from the two energy shocks of the 1970s. In addition, price controls imposed in 1971 were winding down when the 1974 drought happened.

There was a far more modest inflation rate in 1983 that more nearly mirrored the 4.5% rate that held at the beginning of 1988’s drought.

The strength of the dollar was different during past dry spells, as well. That factor had some effect on foreign demand for farm commodities during such periods of relative scarcity. The dollar was weakening in 1974, and in general continued to decline, hitting bottom at about the time of the 1980 drought. At the time of the 1983 drought, the dollar was substantially higher. In recent years, the dollar has been declining and now approximates the lows of 1980.

Conditions within the farm sector also varied widely during these periods of stress. Carryover stocks of grains and beans had already been pulled down to extraordinarily low levels just before the drought-reduced 1974 harvest, reflecting the surge in exports when the U.S. resumed grain sales to the Soviet Union in mid-1972. That drawdown on U.S. stocks helped trigger an explosion in food prices even before the 1974 drought struck.

U.S. exports of grains and soybeans continued to expand during the 1970s, reaching a peak in the fiscal year that ended with the 1980 drought. Despite this expansion, carryover stocks had been rebuilt to more traditional levels when the 1980 drought hit.

Exports weakened in the early 1980s (as the dollar strengthened) and carryover stocks became more burdensome. But it was those “burdensome” grain and soybean stocks that helped to minimize the supply disruptions that followed the sharp downturn in the 1983 crop harvest.

As a buffer against the 1988 drought, carryover stocks of grain are large—roughly comparable to those of 1983. Soybean stocks, however, are tighter, and more comparable to conditions in 1974.

Parallels

While trends in farm and consumer prices were different in each of the three recent droughts, some interesting tendencies are evident in the accompanying table. For example, trends in retail food prices more closely parallel the overall inflation rate than the more volatile farm price index.

Further, in each episode, the rise in retail food prices four quarters after the onset of the drought was less than the rise in the overall CPI. And, in each case, retail food price rises moderated in the year after the drought.

The table shows that a major drought can lead to an acceleration in the rate of retail food price increases over a quarter or two, such as occurred in 1980. But several factors can dampen that rise, limit the time over which it occurs, and ease the effects of such increases on the overall inflation rate.

With respect to the effect on inflation, food prices account for only 16% of the overall consumer price index. Hence, all else equal, a lO% rise in retail food prices would translate into a 1.6% rise in all consumer prices.

With respect to drought effects on retail food prices, several factors tend to dampen the pressures. First, the food industry is fairly competitive. This tends to guard against indiscriminate price increases when a major drought leads to perceived food shortages.

A second dampening factor relates to the comparatively minor share of retail food expenditures that is represented by the farm value of raw food commodities. In recent years, the farm value of domestically produced raw food commodities has been equivalent to about 26% of all consumer food expenditures, including expenditures on imported foods and for foods in food-service establishments. In terms of a market basket of domestically produced foods bought in grocery stores, the farm value component averaged only slightly higher, 31% (see figure 2). The remaining share encompasses the assorted costs of processing, shipping, packaging, and retailing food beyond the farm gate; costs which tend to rise more in line with the overall inflation rate.

2. Farm share of food dollar

Source: USDA.

Moreover, for foods that tend to have the biggest supply cuts in a drought, such as cereals and bakery products, oilseeds, fruits, and vegetables, the farm value component is even less than the average for all foods.

Thus, as long as food processing and distribution costs are held in line, a surge in the farm cost of food should translate into a much smaller rise at retail.

Response

The production response of farmers to drought may also hold down the size and duration of food price increases. As has been the case this year, the prices of crops most directly affected by the drought rise sharply with the drought’s onset and remain high for months. These higher prices, in effect, ration the consumption of the crops and thus lessen the possibility of shortages. At the same time, they encourage expanded plantings for the next production cycle, both in the U.S. and elsewhere in the world.

Domestically, the crop production response to a drought is about a year for most field crops but can be as short as a few weeks for some vegetables that have short growing seasons and multiple harvests within a year. In 1989, the domestic crop production response will be enhanced considerably because government price support programs will be altered to permit a large portion of the 54 million acres of cropland held out of production this year to be planted next year. On a worldwide basis, the crop production response can be shortened to about 6 months because of different planting and harvesting schedules in the Southern Hemisphere.

The production response of livestock farmers can also ease the pressure on retail food prices, at least in the short run. A drought-induced surge in feed costs forces some livestock and poultry producers to scale back their operations. This scaling back can lead to temporarily increased supplies and lower retail prices for meat.

For poultry producers, this period of increase is fairly short. With hogs, the period is longer. For cattle the period of increased supplies can be considerably longer and the drought-related bulge in supplies more pronounced, because of the differences in life cycle, breeding practices, and feeding alternatives for cattle.

But, with the beef cow inventory at its lowest level in over 20 years, any bulge in cattle marketings from this year’s drought will likely be shorter than normal.

Outlook

It seems probable that the rise in retail food prices will accelerate, but projections of the magnitude of the rise vary. Top USDA officials have projected an average annual rise of 3% to 5% for retail food prices this year (versus 4% last year) and 5% to 7% for next year. Other analysts have projected increases of up to 9% for 1989.

But assuming that the overall inflation rate holds fairly stable-thus holding the line on processing and distribution costs-there is hope that retail food price rises may be at the lower range of recent projections.

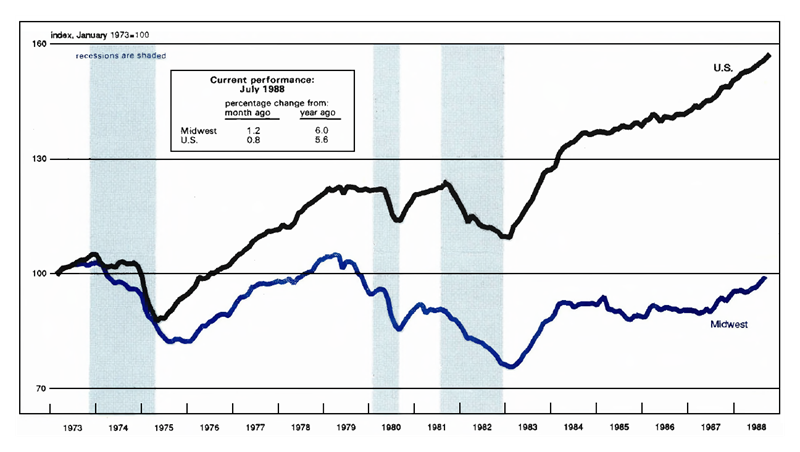

MMI—Midwest Manufacturing Index

Industrial production in the nation grew at its second lowest rate of the year in June, according to the Federal Reserve Board. Flatness in auto assemblies, which have been a major source of strength all year, accounted for much of the slowdown. Industries supplying the auto industry, such as primary metals, also experienced some slowing. Nondurables continued to be weak relative to durables.

Midwest Manufacturing activity jumped by 1.5 percent in June. This was the largest increase in the MMI of the year. Transportation equipment continued its strong performance with a 2.2 percent rise. Food processing and chemicals each rebounded from a sluggish May with increases of 2.7 percent and 2.2 percent, respectively.