The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

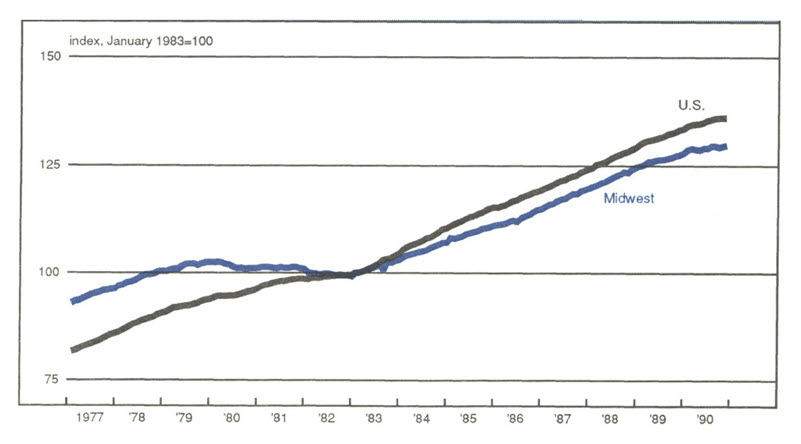

Since the last recession, Midwest manufacturers have been translating new plants and advanced technologies into production growth that has exceeded gains made by their counterparts nationwide (see figure 1 for a comparison of output trends). Prior to the mid-1980s, many Midwest manufacturers could be characterized as “producers of last resort”—their plants were the first to cut production when the economy slackened and the last to expand when the economy rebounded. Massive capital spending in the early 1980s, coupled with extensive closings of outdated plants, substantially improved manufacturing efficiency and competitiveness in the region especially in recent years when the economy was operating at near full capacity. But the U.S. economy has entered a recession during the second half of 1990. With its heavy dependence on cyclical industries, the Midwest economy has not escaped the effects of the national recession. The question is whether its improved competitiveness will allow the region to weather this recession in better form than during previous economic downturns.

1. Index of manufacturing activity

In 1990, the Midwest experienced both sides of the business cycle. Its economic performance over the year can be used as an initial test of a widespread expectation that the region’s improved competitiveness will strengthen the expansion and blunt the impact of a recession. This Chicago Fed Letter reviews the economic performance of the Midwest in 1990 for the manufacturing, service, and construction sectors and evaluates the initial impact of the current national recession on the Midwest in the context of previous recessions.1

Manufacturing set the tone for 1990

The economic expansion over the first half of 1990 continued the recent pattern of the Midwest outpacing the nation. Based on specific trough-to-peak values for the Midwest and U.S. Manufacturing Indexes (MMI and USMI), output in the Midwest was rising at an annualized average rate of 6.7%, compared to a national rate of 5.5%. Both indexes started from a near-term trough level in December 1989, but the Midwest reached its peak level in June—just one month before the nation. Over the remainder of the year, manufacturing activity in the Midwest declined 8.7% (annualized)—slightly steeper than the 8.3% rate of decline nationwide. But before concluding that the Midwest is once again bearing the brunt of a recession, three factors need to be considered: How did total hours worked respond to the decline; how did major sub-sectors within manufacturing fare; and how did the decline compare with similar periods in previous recessions?

Consider first the behavior of a key input to the manufacturing indexes—total hours worked—over the first and second half of 1990. For the year as a whole, total hours worked declined by only 2.1% in the Midwest, compared to a national decline of 3%. However, during the expansionary part of the year, total hours worked grew at an annualized average rate of 2.4% nationally, while in the Midwest total hours worked rose 10.3%. From the midyear peak to the end of the year, total hours worked nationally declined 7.9%, while in the Midwest total hours worked dropped 11.1%.

Total hours worked is a more cyclical measure of business activity than employment, because it adjusts for overtime and part-time employment. With manufacturers aggressively seeking ways to lower unit labor costs, production changes are being accomplished through adjustments in hours worked per employee (e.g., overtime) in addition to adjustments in employment. Indeed, manufacturing employment in the Midwest has yet to return to its previous cycle peak in 1981. Yet, as shown in figure 1, output in the Midwest last year easily exceeded its 1981 peak and was close to its 1979 peak. To be sure, some of the growth in output despite sluggish employment gains can be attributed to productivity growth, but some may also be attributed to new technologies and management practices that have made manufacturers more flexible in adjusting hours worked to production needs. Consequently, the larger adjustments in total hours worked in the Midwest relative to the nation suggest that the Midwest is becoming more flexible in response to changes in the business cycle, hence more competitive with other regions of the nation.

The broad scope of the Midwest’s improved performance is another encouraging fact. During the expansionary phase of 1990, all five major manufacturing subsectors in the Midwest outpaced their national counterparts, and during the recessionary phases, only one sector—transportation—did significantly worse (see figure 2). The transportation sector experienced a pronounced surge and slump over the year, which was linked to a swing in auto production from a 4.1 million-unit annual rate at the beginning of the year to a 7 million-unit rate by midyear to 4.8 million units at year’s end. Yet, it still outperformed the national sector over the entire year. Machinery also slumped in the second half of 1990, but less than the national sector. Metalworking, chemicals, and consumer-related did slightly worse in the second half, but all three had significantly stronger expansions in the first half of 1990, outperforming their national counterparts over the entire year. Thus, sector performances in the Midwest generally were quite impressive and indicate that in the region, improved competitiveness is broad based and not restricted to a small set of industries.

2. Manufacturing output growth by sectors, 1990

| Annualized average rates of change (percent) | ||

|---|---|---|

| Trough-to-peak | Peak-to-current | |

| Machinery | ||

| Midwest | 0.3 | −9.7 |

| U.S. | −0.7 | −11.6 |

| Metalworking | ||

| Midwest | 8.9 | −14.7 |

| U.S. | 4.2 | −14.3 |

| Transportation | ||

| Midwest | 47.8 | −39.4 |

| U.S. | 16.2 | −27.2 |

| Chemicals | ||

| Midwest | 6.3 | −4.5 |

| U.S. | 0.8 | −4.0 |

| Consumer-related | ||

| Midwest | 3.9 | −6.9 |

| U.S. | 0.1 | −6.0 |

The final fact to consider is that the most recent decline in Midwest manufacturing activity was generally much closer to the national experience than in the previous two recessions. For example, in the 1980 recession, manufacturing national output dropped at an annualized average rate of 2.7% during the first five months of its specific contraction, compared to the Midwest manufacturing decline of 20.3% over the same period. By any standard, the difference in the rates of contraction between Midwest and national manufacturing at the onset of the 1980 recession was far greater than at the onset of the current recession.

During the 1981-82 recession, the annualized average decline in national manufacturing activity over the first five months of its specific contraction (July-November) was 8.1%. The decline in Midwest manufacturing over the first five months of its specific contraction (June-October) was 11.1%, and for the same five months that the national index declined (July-November), manufacturing activity in the Midwest declined 13.8%. Again, by either measure the Midwest experience was harsher than the national experience over the early phase of recession in 1981 than is currently the case.

Taken together, these three factors indicate the extent of the structural changes that have occurred in the Midwest’s manufacturing sector. The region’s image as a producer of last resort appears to be fading. To be sure, the region has achieved its success in production without a comparably sized expansion of employment. Nevertheless, the role of manufacturing will remain crucial to the overall performance of the Midwest economy and, though it may never be the growth center of high-paying jobs that it once was, a revitalized manufacturing sector may support growth in other sectors of the Midwest economy.

Midwest service sector pulls even with the nation

While the manufacturing sector generates most of the cyclical activity in the economy, the service sector is a larger share of the economy than manufacturing and, as a provider of business services, is linked to the vitality of manufacturing activity.

Given the service sector’s link to a troubled manufacturing sector in years past, it is not surprising that, on a trend basis, the Midwest’s service sector has lagged the nation historically (see figure 3). However, service sector activity is not restricted to local business services and consequently its growth is becoming less dependent on local manufacturing. With the recent strengthening of its manufacturing sector adding to other sources growth, the Midwest’s service sector should also begin to show new strength.

3. Index of service activity

In 1990, national service sector activity grew at an annualized average rate of only 1.5% in 1990—less than half the growth rate of 1989—due in part to the national economic slowdown and layoffs in the financial services and retail industries. Service sector growth in the Midwest last year was also slower than in the previous year. But more significantly, it kept pace with the nation for only the second time in over ten years (the last time being 1987, which was also a robust year for manufacturing activity in the Midwest). The region continued to lag the nation over the first half of the year. But when the manufacturing recession began about midyear, the service sector slowdown in the Midwest was milder than in the nation, offsetting the relatively poor showing in the first half of the year.

Comparisons with past periods around a cyclical peak are equally favorable to the 1990 experience in the Midwest. Over the 12-month periods centered on the 1979 and 1981 manufacturing peaks discussed above, the Midwest’s service sector grew at a substantially slower rate than the nation. In fact, the Midwest’s service sector declined during the 1981 period and also declined late in 1980, while the national service sector continued to grow. Historically, the service sector has generally been recession proof nationally but much less so in the Midwest. With the national economy continuing to decline in the early part of 1991, the Midwest’s service sector may yet experience its own recession. But so far, the region is not only continuing to expand, but to keep pace with the nation—something that the Midwest has rarely accomplished in the past.

Construction soft, but Midwest not overbuilt

Construction activity in the Midwest is the third major sector to follow a pattern of expanding in the first half of 1990 and contracting over the remainder of the year. The construction sector has been weak nationally for several years, due to substantial overbuilding in the early 1980s. The problem has been particularly acute in New York and New England, where speculative commercial building has been hurt by weakening property values over the last two years. The Midwest never experienced the speculative surge in construction in the early 1980s, because its economy was severely depressed and plants were being closed. As the region entered 1990, the Midwest’s strength in manufacturing and lack of commercial overbuilding meant that the Midwest would avoid the severity of a construction slump that was beginning to affect other regions.

Based on F.W. Dodge’s construction contract awards data, one of the few available regional measures of construction activity, the Midwest experienced a decline of 4% in construction activity last year, compared to an 11% decline nationally.2 However, as with other sectors, construction activity peaked during the year—expanding through midyear but contracting for the year as a whole (see figure 4).

4. Growth in construction contract awards

| Cumulative rates of change (percent) | ||||

|---|---|---|---|---|

| January through June | January through December | |||

| Midwest* | U.S. | Midwest* | U.S. | |

| Total | 6 | −8 | −4 | −11 |

| Residential | 7 | −8 | −5 | −14 |

| Nonresidential | 5 | −9 | −7 | −13 |

| Manufacturing | −28 | −42 | −31 | −42 |

| Commercial | 2 | −13 | −17 | −19 |

| Education and science | 18 | 7 | 19 | 6 |

| Hospital and health treatments | 28 | 3 | 22 | 1 |

Source: F.W. Dodge, Construction Potentials Bulletin.

Aside from manufacturing construction, which declined throughout the year, the breadth of the relative strength in Midwest construction activity stands out in sharp contrast to the nation. Nationally, construction activity was declining throughout the year in most major categories (public-related buildings, such as government, health, and education, were the primary exceptions). Overall, the Midwest expanded construction activity by 6% in the first half of the year over the first half of 1989, compared to an 8% decline nationally. Even the nationally depressed commercial building segment was expanding in the Midwest over the first half of the year. Thus, to the extent that construction activity is linked to the economic conditions of the region, construction activity in the Midwest reflects the broad improvement in the region’s economic performance.

Looking to 1991 and beyond

Given the industrial structure of the Midwest economy, there is no way the nation can enter a recession without the region following suit. The region has too many cyclical industries, most notably the auto industry. And, of course, the current recession has only just begun and much can still happen both nationally and regionally. But to date the single most important finding of this review of the Midwest economy is that the region performed well relative to the nation during 1990 and entered this recession in much better shape relative to the national experience than ever before. The most likely explanation for the Midwest’s good fortune is consistent with widely held expectations—that the improved competitiveness of Midwest producers has not only enhanced the manufacturing sector’s performance but has supported economic activity in the service and construction sectors.

In December 1990, business economists and analysts attending the Federal Reserve Bank of Chicago’s fourth annual Economic Outlook Symposium discussed the outlook for 1991. The consensus forecast was for a mild recession for the national economy, with manufacturing declining through the first half of 1991.3 Auto sales and production are expected to remain weak in the first half but should lead the economic rebound in the second half of the year—almost the inverse of the economic pattern in 1990. For the reasons discussed in this Fed Letter, the Midwest can expect to follow this mild recession scenario. But more importantly, if the Midwest stays on its current track, it will come out of this recession in better shape than in past recessions. And it will start its recovery at a higher level of economic activity, relative to the nation, than in past recoveries. Building on a firmer foundation should lead to brighter economic prospects for the Midwest.

Notes

1 The Midwest is defined here to consist of Indiana, Illinois, Iowa, Michigan, and Wisconsin.

2 F.W. Dodge’s Midwest region is similar to the definition used elsewhere in this discussion, with the exception that Ohio is included and Iowa is excluded.

3 See the February 1991 Chicago Fed Letter for a discussion of the 1991 consensus outlook.