The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

In a recent Chicago Fed Letter, I examined the motivations for, and the consequences of, the tremendous wave of U.S. bank mergers during the 1980s and 1990s.1 In that document I reached three main conclusions. First, I argued there is little evidence of any systematic reduction in competition in retail banking or small business financing markets as a result of the bank merger wave. Although the largest commercial banks have a much more prominent national position today than 20 years ago, these banks’ shares of local banking markets have not increased materially.

Second, I suggested that the current bank merger wave is showing signs of maturing. A number of commercial banks have achieved nationwide or near-nationwide geographic coverage, and as additional banks attain this geographic scope the demand for large market extension mergers will naturally diminish. Furthermore, the rapid development of the internet and e-commerce may allow banks to replace, or at least complement, their merger-based growth strategies with internal growth via electronic distribution of financial services. Since Part I was written, the Financial Institutions Modernization Act (FIMA) of 1999 abolished the historical separation of commercial banking, investment banking, and insurance underwriting. This long-awaited development will likely dampen the bank merger wave further, as acquisitive banks shift their focus—and their scarce acquisition capital—away from purchasing other banks and toward purchasing insurance companies and securities firms.

Third, I indicated that from our vantage point at the end of the 1990s, it may be too early to evaluate the eventual competitive implications of the bank merger wave. If fully successful, the electronic delivery of retail and wholesale banking services may make the notion of “local” banking markets obsolete. To the degree that this happens—and to the degree that large banks can limit the entry and/or the mobility of small banks in electronic markets—the increasing national market shares of large commercial banks may have more serious competitive implications than is generally thought.

In this Fed Letter, I discuss the prospects for small commercial banks in a post-merger-wave banking industry in which electronic delivery of financial services becomes commonplace. In such a world, should we expect “branchless” delivery of financial services to be dominated by a few large banks, or will the advent of electronic banking markets provide important strategic opportunities for small banks? I propose a simple conceptual framework for thinking about this question, a framework that considers the strategic advantages and disadvantages of increased bank size.

Local versus national banking markets

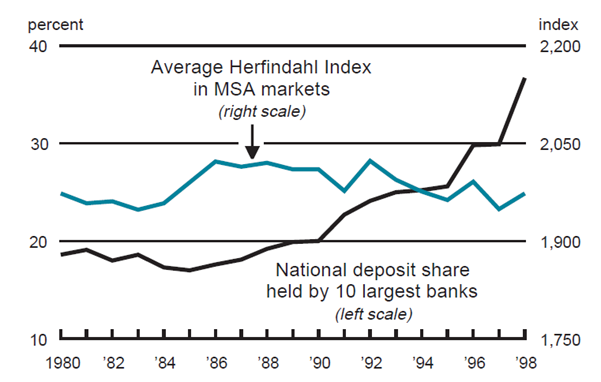

Between 1980 and 1998 the share of domestic deposits held by the nation’s ten largest commercial banks nearly doubled.

Large banks achieved this growth primarily by making market extension mergers, which change the ownership of the acquired bank without affecting the structure of local banking markets. As seen in figure 1 (which is reprinted here from Part I of this Fed Letter), the national market shares of large banks increased markedly during the bank merger wave but the concentration of local banking markets remained stable. Hence, by traditional measures of market structure, 20 years of bank mergers had little adverse impact on competitive conditions in U.S. commercial banking markets.

1. National and local market structure

Source: Board of Governors of the Federal Reserve System.

But these structural changes occurred during the traditional “brick and mortar” banking paradigm, in which most retail banking and small business banking services were provided by local banks in local markets. Today, a growing number of household and business customers access account information, transfer funds, pay bills, make trades, and apply for loans electronically, without ever setting foot in a branch office. The banking industry may be in the midst of a paradigm shift, in which electronic delivery channels and automated lending technology will increasingly allow out-of-market banks to compete for retail and small business customers without establishing a physical presence in the local market.

No one knows for sure how electronic delivery channels will ultimately alter the banking landscape, but some changes seem fairly certain. An increasing number of banks will begin to offer financial services to retail and small business customers nationally. As this happens, local market concentration will become a less relevant yardstick for assessing the competitive impact of bank mergers. And bank mergers themselves will become less necessary for geographic expansion, because electronic distribution will provide an alternative channel for growth.

Successfully managing this new technology may require existing bank managers to develop new styles and approaches. Some of the most acquisitive U.S. banks of the past decade have recently experienced subpar financial performance, due to unexpected difficulties absorbing the operations of the acquired banks, dissatisfied target bank customers, and the challenges of managing a firm that suddenly doubles or triples in size or complexity.2 These difficulties suggest that the skills required to build large banking empires are not necessarily the same skills needed to operate those empires successfully. Similar managerial challenges could arise as banking companies recently reshaped by geographic transformation enter a new period of technological transformation.

New technology and nationwide banking markets

It seems certain that the Internet will bring more banks, regardless of their size or location, into closer competition with each other. Will large banking companies have an advantage in this competition, or will the internet level the playing field by neutralizing large banks’ existing distributional advantage, i.e., their systems of multiple branch and ATM locations?

The answer may depend on a decidedly low-tech strategic behavior not generally included in the analysis of banking markets: advertising. Although establishing a physical presence on the internet is relatively inexpensive, attracting customers to the website can be difficult. Potential customers trying to decide among hundreds of online banking options will find themselves guided by brand images developed with expensive advertising campaigns. Not only do large banks have deeper pockets than small banks, a regional or national advertising campaign is likely to resonate more for a large bank than for a small bank—the high visibility of large banks’ many branch locations helps remind customers of the advertising campaign and increases the chance that they will visit the internet site. This potentially potent combination of “brick and mortar” puts small banks at a clear marketing disadvantage.

These large bank marketing advantages could be reinforced by the passage of FIMA. In a world in which large, diversified financial firms can cross-sell an increasing array of financial products to their customers, these firms could be willing to spend more on advertising to attract a new customer than will a more specialized bank. This may be especially true for retail buyers of financial services, who have clear incentives to shop for loans, bill paying, insurance products, and asset management services at a single site.

Despite these apparent marketing advantages, it is unlikely that the internet will allow large banks to dominate all banking markets. Large banks often tout economies of scale—cost savings associated with large production volume—as an important factor motivating their growth. For example, credit card lending and mortgage banking are lines of business that exhibit scale economies and as the banking industry has consolidated an increasing portion of these activities has become concentrated in a relatively small number of large banks.3 Large financial services firms tend to be well suited to highly standardized, commodity-like activities like these that can be produced and distributed in large volumes at low unit costs, and the internet tends to be well suited to delivering highly standardized financial products in large volumes. For example, Allstate insurance is phasing out its traditional, relationship-based distribution channel of insurance agents in favor of selling its retail insurance products directly over the internet and through call centers.4

However, some of the most desirable banking customers are those willing to pay high prices for customized financial products and services. Given the impersonal nature of the technology, the internet may prove to be a poor channel for delivering customized financial services. For example, the creditworthiness of many small businesses cannot be ascertained using a “one-size-fits-all” underwriting approach like credit scoring, but only by the close monitoring and relationship-based practices provided by small, local banks.5 Similarly, some private banking customers may require high-touch, personalized services that simply cannot be delivered via a nexus of ATMs, call centers, and the internet. Although some large banks may prove to be exceptions (e.g., the private banking strategy of a Northern Trust or the automated small business lending practice of a Wells Fargo), the future profitability of small banks may ultimately depend on how well they exploit their natural advantages at serving relationship-based banking niches.

A framework for strategic analysis

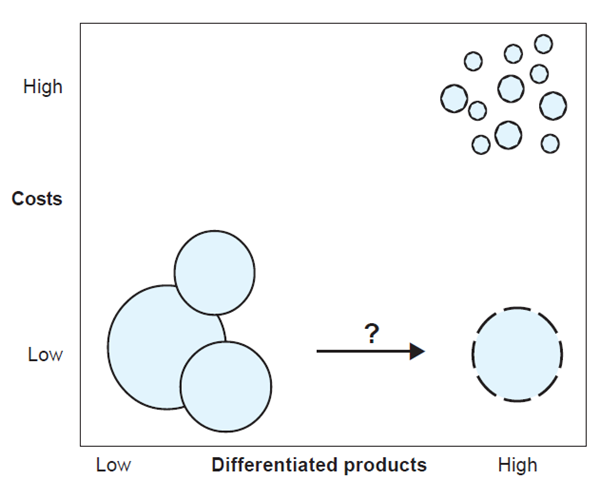

Figure 2 presents a strategic map of the banking industry.6 This map is a greatly simplified depiction of the strategic options available to banks, based loosely on the above discussion. Space near the bottom of the box marks banking strategies that stress larger scale and lower unit costs (as opposed to strategies that stress smaller size and higher unit costs, located near the top of the box). Space near the left side of the box marks banking strategies that stress commodity-like financial services that are not personalized or otherwise differentiated from competitors’ products (as opposed to strategies that stress personalized financial services or financial services differentiated by brand image, located near the right side of the box). The circles represent hypothetical banks, with the size of the circle indicating bank size.

2. Strategic map of commercial banking

Hypothetical small and local banks are located in the upper right corner. These banks operate at low scale, incur high unit costs, operate predominantly through physical branch locations, and sell relationship-based financial services for which customers are willing to pay relatively high prices. Hypothetical large regional or nationwide banks are located in the lower left corner. These banks operate at large scale, incur low unit costs, operate through a combination of physical branches and the internet, and offer commodity-like products for which customers are less willing to pay high prices. In this example, the most profitable strategy is to locate in the lower right-hand corner, operating at large scale (which reduces unit costs) and offering differentiated products (which command high prices).

By definition, small banks cannot migrate to this most profitable strategy—unless they become large banks. However, it might be possible for large banks to implement this strategy, depending on the skill with which they can deploy personalized products over electronic delivery channels. Large banks currently customize financial services for some of their large business clients (for example, M&A financing); if large banks can customize financial services for retail and small business customers on a large-scale basis—perhaps using electronic delivery channels to reduce production costs and make these services more convenient—they will be able to take away some of small banks’ most profitable customers. The low-cost structures, wide product offerings, and differentiated brand images of large banks would be difficult for small banks to overcome. However, if large banks can only mass produce commodity-like products (such as credit-scored small business loans, standardized insurance products, or automated asset management without personalized investment advice), then relationship banking will continue to provide a profitable niche for small banks.

Conclusion

Just as the wave of domestic bank mergers has produced the first nationwide banks, the implementation of new electronic delivery channels threatens to transform the banking landscape once again. This Fed Letter explores the prospects for small commercial banks in a post-merger-wave, post-internet banking industry. I argue that the future success of small banks hinges on their traditional advantages in relationship banking and personalized financial services and on how these advantages stack up against the combination of low costs, convenient one-stop shopping, and powerful brand images that large banks may be able to wield over electronic delivery channels.

As we consider how the internet will transform banking, it is important to remember that this new delivery channel is unlikely to change the fundamental nature of the financial products delivered over it. Consider an example from e-commerce. Amazon.com and its competitors may be making the traditional bookstore obsolete, but they have not (yet) made the printed book obsolete—ironically, these internet firms deliver the books they sell not electronically, but by surface mail. Whether e-banking leads to a substantial change in the number and/or size of commercial banks or just changes the way that existing banks deliver financial services to their customers remains for now an open question.

Tracking Midwest manufacturing activity

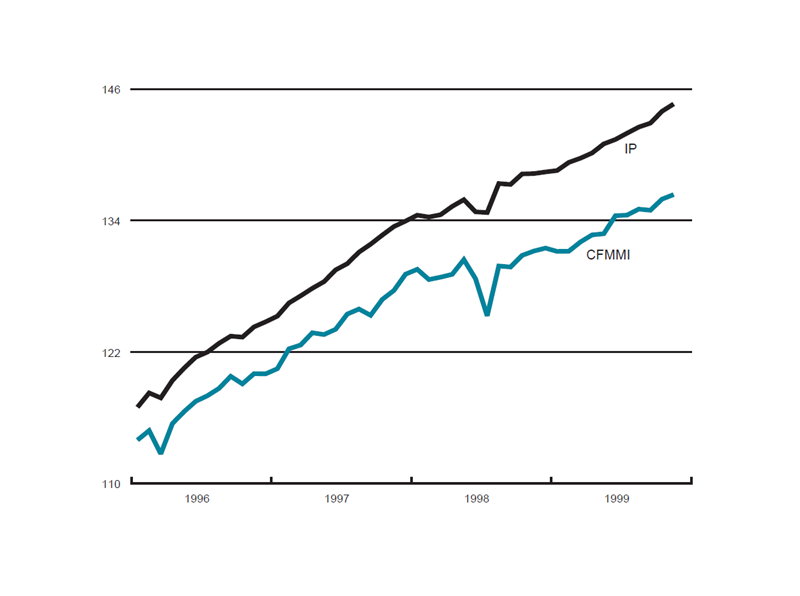

Manufacturing output indexes (1992=100)

| November | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 136.4 | 136.0 | 131.2 |

| IP | 144.7 | 144.0 | 138.3 |

Motor vehicle production (millions, seasonally adj. annual rate)

| December | Month ago | Year ago | |

|---|---|---|---|

| Cars | 5.6 | 5.9 | 5.8 |

| Light trucks | 6.9 | 7.1 | 6.5 |

Purchasing managers' surveys: net % reporting production growth

| December | Month ago | Year ago | |

|---|---|---|---|

| MW | 57.0 | 61.6 | 54.4 |

| U.S. | 58.7 | 57.4 | 46.8 |

Purchasing managers' surveys (production index)

The CFMMI rose 0.3% from October 1999 to November 1999. In comparison, the Federal Reserve Board’s IP for manufacturing increased 0.5% in November, after increasing 0.8 in October.

Light truck production decreased from 7.1 million units in November to 6.9 million units in December, and car production declined from 5.9 million units to 5.6 million from November to December.

The Midwest purchasing managers’ composite index (a weighted average of the Chicago, Detroit, and Milwaukee surveys) for production decreased to 57% in December from 61.6% in November. The purchasing managers’ index decreased in all three surveys. The national purchasing managers’ survey for production increased from 57.4% to 58.7% from November to December.

Notes

1 Robert DeYoung, 1999, “Mergers and the changing landscape of commercial banking (Part I),” Chicago Fed Letter, Federal Reserve Bank of Chicago, No. 145, September.

2 For a discussion of the post-merger experiences of Bank One, First Union, and other ultra-acquisitive banking companies, see Euromoney, 1999, “When cutting cost is not enough,” November, pp. 58–60.

3 By mid-1999, the top ten credit card issuers in the U.S. held more than a 75% market share (see Chicago Tribune, 1999, “Cards getting less credit for bank industry growth,” August 27). For evidence on scale economies and growing concentration mortgage banking, see Clifford V. Rossi, 1998, “Mortgage banking cost structure: Resolving an enigma,” Journal of Economics and Business, Vol. 50, No. 2. pp. 219–234, and Mitchell Stengel, 1995, “From traditional mortgage lending to modern mortgage banking,” Office of the Comptroller of the Currency, Quarterly Journal, No. 4, pp. 11–18.

4 See Chicago Tribune, 1999, “Allstate points to new future,” November 11.

5 See Loretta J. Mester, 1999, “Banking industry consolidation: What’s a small business to do?” Federal Reserve Bank of Philadelphia, Business Review, January/February, pp. 3–16.

6 For an introduction to strategic maps, see Michael E. Porter, 1980, Competitive Strategy, New York: Free Press.