The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

When two large banks merge, where does the headquarters go? The recent Bank One–J. P. Morgan Chase merger is following well-established banking industry trends.

If the recently announced acquisition of Bank One Corporation by J. P. Morgan Chase & Co. feels like history is repeating itself in Chicago, the impression is an accurate one. This merger echoes acquisitions of leading Chicago banks by large, out-of-state companies: Bank of America purchased Continental Bank in 1994, the Bank of Montreal purchased Harris Bank in 1984, and Dutch banking giant ABN-Amro purchased LaSalle Bank in 1979. Indeed, Bank One’s short stay in Chicago—it relocated here in 1998 from its previous headquarters in Columbus, Ohio—began with its purchase of the First Chicago–NBD Corporation.

Although J. P. Morgan Chase plans to run its retail banking activities out of Bank One’s existing offices in Chicago, the corporate headquarters of the combined firms will remain in New York City. The J. P. Morgan–Bank One deal will leave Chicago with one less major commercial banking company headquarters and possibly substantially fewer banking sector jobs.

Why is this happening? And what does it mean for Chicago’s future as a financial center? This Chicago Fed Letter puts Chicago’s loss of Bank One in perspective. We argue that Bank One’s exit from Chicago is part of a larger process of industry evolution, the seeds of which were planted long ago and the economics of which may be working in favor of other cities.

The economics of headquarters location

Whenever two companies headquartered in different cities merge, the combined companies must decide where to locate their headquarters. History shows that one of the most important factors in this decision is city size. Larger cities tend to have a greater range of inputs and services that corporations need, such as skilled white-collar and technical workforces, legal, financial, and advertising services, as well as proximity to corporate customers. As more companies locate in a given city, these locational benefits—which economists refer to as agglomeration economies—tend to increase as the network of companies selling to and buying from each other grows.

If agglomeration economies were all that mattered, all company headquarters would gravitate toward the same city. Companies often choose to locate their headquarters in smaller cities or even in rural areas, for instance, because key inputs are readily available (such as low-cost labor or raw materials) or for access to transportation networks. Maintaining a link to a company’s history can also be an important reason for retaining headquarters in a smaller city, as can the personal preferences of company executives—even if these considerations do not seem to maximize shareholder value. After two firms merge, the headquarters of the combined company often stays in the city of the larger firm; this tends to minimize post-merger organizational disruptions but can also be an indication of political clout within the new firm.

In a recent study, Klier and Testa (2002) argue that in recent years phenomena other than city size have become increasingly important for determining where corporate headquarters are located.1 They found that the percentage of large, public U.S. corporations headquartered in the very largest metropolitan areas (MSAs) declined during the 1990s, while the percentage in middle-tier MSAs (population between 1 million and 6 million) increased. They suggest two explanations for these changes. First, technological advances and falling costs of travel have likely improved the ability of top managers located in smaller cities to gather information, purchase business services, and administer their company’s operations in national and global marketplaces. In other words, new technology may result in agglomeration economies being exhausted at a smaller city size. Second, companies are following their customers: The ongoing shift in U.S. population toward the South and the West has gradually shifted these companies’ markets toward the mid-tier cities located in those regions.

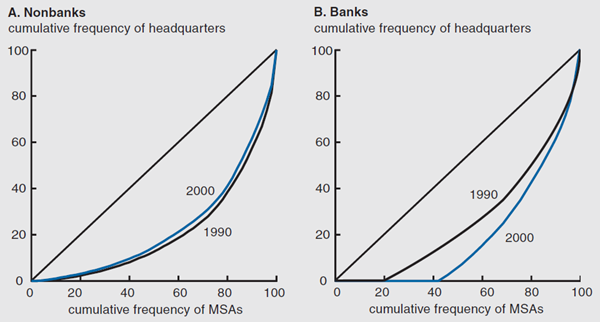

However, the authors found strikingly different results for the headquarters of large banking companies, which tended to move from smaller to larger MSAs between 1990 and 2000. The Lorenz curves in figure 1 capture the divergent distributions of headquarters locations for large banking and nonbanking corporations during this decade. The Lorenz curve for large nonbanking companies (panel A) moved closer to the 45-degree line (which represents a hypothetical world in which corporate headquarters are distributed evenly across the top 50 MSAs), while the curve for large banking companies (panel B) moved further away from the 45-degree line.

1. Distribution of large company headquarters, top 50 MSAs

;

;These data suggest that economies of agglomeration may be especially important for determining the headquarters locations of large financial companies. Moreover, these data are consistent with the examples at hand: the relocation of Bank One’s headquarters from Columbus to Chicago following its acquisition of First Chicago–NBD in 1998 and the planned relocation of much of Bank One’s headquarters activities from Chicago to New York following its acquisition by J. P. Morgan Chase in 2004.

The J. P. Morgan Chase–Bank One merger

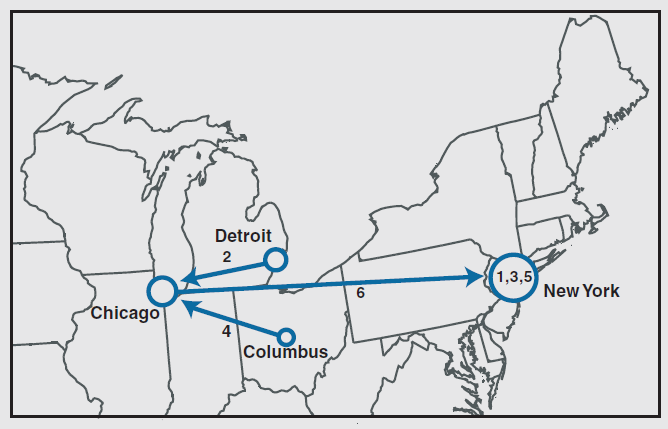

The merger of J. P. Morgan Chase with Bank One is the culminating (at least for now) acquisition in a string of earlier mergers among major U.S. banking companies between 1991 and 2000. This family tree has two branches (see figure 2): the Bank One branch, in which a series of mergers moved bank headquarters to progressively larger cities; and the J. P. Morgan Chase branch, in which a series of mergers retained bank headquarters in the largest U.S. city.

2. Geography of the J. P. Morgan Chase–Bank One merger

Sources: FR Y-9C database and company websites.

The Bank One branch is geographically complex. Bank One (at the time, Banc One) was established in 1967 as a multibank holding company headquartered in Columbus, OH. It practiced a decentralized business strategy, and by year-end 1994 the organization had 76 separately chartered and locally focused affiliates spread across 11 primarily midwestern states. By the late 1990s, however, Bank One had changed its strategic course and was rapidly centralizing its operations into a single bank in each state, typically located in the largest city. In 1998, Bank One purchased First Chicago–NBD, and moved its headquarters from Columbus to Chicago, the larger of the two metropolitan areas. First Chicago–NBD was itself a product of a 1995 merger of two large Midwest banks—NBD Bancorp Inc. and First Chicago Corporation—that resulted in NBD’s headquarters moving from Detroit to Chicago, again the larger of the two metropolitan areas.

The J. P. Morgan Chase branch of figure 2 is a history of New York City banking in a nutshell. In 1955, Chase–Manhattan Bank was formed by a merger of the Chase Bank (founded in 1877 and the namesake of Salmon P. Chase) and the Manhattan Company (founded by Aaron Burr and Alexander Hamilton, among others, in 1799). In 1961, the Manufacturers Hanover Trust Company was formed by a merger of Hanover Bank (founded in 1851) and the Manufacturers Trust Co. (founded in 1853). During the 1990s, both these storied banking companies were acquired by Chemical Bank: Chemical acquired Manufacturers Hanover in 1991 and Chase–Manhattan in 1996, with the latter merger retaining the Chase–Manhattan name and creating for a short time the largest banking company in the U.S. Finally, in 2000, J. P. Morgan acquired Chase–Manhattan, creating J. P. Morgan Chase & Co.

Deregulation and the migration of bank headquarters

Both the J. P. Morgan Chase–Bank One case history and the more systematic headquarters location data suggest that the agglomeration economies available in large cities are especially attractive for large banking companies. But if a large city headquarters location is so important for banks, then why haven’t large banks been located in the largest cities all along? Why, for example, has the management of Bank One’s assets jumped, in turn, from small Midwest towns, to state financial centers, to Chicago, and finally to New York City during the past ten years?

This question can best be answered by revisiting the regulatory history of the U.S. banking industry. The McFadden Act of 1927 prohibited banks from branching across state lines, and many states restricted the ability of their banks to expand within the state. Nowhere were state-level restrictions more binding than in Illinois, where unit banking laws limited banks to operating within a single county. During the 1980s and 1990s individual states gradually relaxed their geographic restrictions on banks, and the Riegle–Neal Act of 1994 brought an end to these restrictions in the remaining states. In states that deregulated earliest, states that relaxed most broadly, and states that had few geographic restrictions to begin with, banks have been able to grow faster and attain the critical mass to make large out-of-state mergers.

Today the largest U.S. banks are located in international banking centers, such as New York or San Francisco, where agglomeration economies are strong and high demand for financial services has allowed even purely local banks to grow large, or in states like California and North Carolina where geographic regulations have historically been less restrictive. For example, California has never prevented its banks from branching freely within its very expansive borders, and North Carolina began permitting (by interstate agreement) its banks to operate affiliates virtually anywhere in the southeastern U.S. over a decade before Riegle–Neal. In contrast, Illinois’s strict unit banking laws placed an effective upper bound on the size that Chicago banks could attain—hence, when nationwide banking became legal in the mid-1990s, Chicago banks were at a disadvantage because they lacked the critical mass and experience to participate fully in the wave of acquisitions that followed.

Figure 3 lists in chronological order the 23 largest commercial bank mergers since 1991 that combined banks headquartered in different cities. At first glance it appears that bank size was the strongest determinant of headquarters location—the post-merger headquarters stayed in the city of the larger bank (in bold) in 19 of the 23 mergers. A closer look, however, reveals the importance of city size, agglomeration economies, and the lasting effects of restrictive geographic regulations. In 12 of the 23 mergers, the larger of the two cities (in bold) retained the post-merger headquarters, while in 10 of the remaining 11 mergers the city that retained its headquarters was either Charlotte, NC, or San Francisco, CA—as discussed above, banking center cities in which banks were relatively less handicapped by geographic regulation. The lone exception is the Firstar–Mercantile merger in which the headquarters was moved from St. Louis to Milwaukee (the smaller of the two cities)—but this was undone just a year later when U.S. Bancorp purchased Firstar and moved it to Minneapolis (the largest of the three cities).

3. Mergers between large commercial banks, 1991–2004

| City retained HQ |

City lost HQ |

|||

| Year | Bank | City | Bank | City |

| 1991 | NCNB | Charlotte | C&S/Sovran | Atlanta |

| 1991 | BankAmerica | San Francisco | Security Pacific | Los Angeles |

| 1993 | Society Corp. | Cleveland | KeyCorp | Albany |

| 1994 | BankAmerica | San Francisco | Continental Bank | Chicago |

| 1995 | Shawmut National | Boston/Hartford | Fleet Financial | Providence |

| 1995 | First Union | Charlotte | First Fidelity | Philadelphia/Newark |

| 1995 | First Chicago | Chicago | NBD Bancorp | Detroit |

| 1996 | Wells Fargo | San Francisco | First Interstate | Los Angeles |

| 1996 | NationsBank | Charlotte | Boatmen's Bank | St. Louis |

| 1997 | First Bank System | Minneapolis | U.S. Bancorp | Portland |

| 1997 | NationsBank | Charlotte | Barnett Banks | Jacksonville |

| 1997 | First Union | Charlotte | CoreStates | Philadelphia |

| 1998 | First Chicago NBD | Chicago | Bank One | Columbus |

| 1998 | NationsBank | Charlotte | BankAmerica | San Francisco |

| 1998 | Wells Fargo | San Francisco | Norwest | Minneapolis |

| 1999 | Firstar | Milwaukee | Mercantile Bancorp | St. Louis |

| 2000 | U.S. Bancorp | Minneapolis | Firstar | Milwaukee |

| 2000 | Wells Fargo | San Francisco | First Security | Salk Lake City |

| 2000 | FleetBoston | Boston | Summit Bancorp | Princeton |

| 2000 | Fifth Third Bancorp | Cincinnati | Old Kent Financial | Grand Rapids |

| 2001 | First Union | Charlotte | Wachovia | Atlanta/Winston-Salem |

| 2003 | Bank of America | Charlotte | FleetBoston | Boston |

| 2004 | J.P. Morgan Chase | New York | Bank One | Chicago |

Sources: Federal Reserve Bank of Chicago, bank merger database; Board of Governors of the Federal Reserve System, consolidated financial statements FR Y-9C database; and Wall Street Journal.

Implications for the Chicago economy

The ongoing consolidation of the financial sector has reduced the number of large U.S. banks and increased the concentration of large bank headquarters in the largest cities of the country. Moreover, because the unwinding of the old (regulated) industry structure is not complete, we are likely to witness more bank mergers and further movement of large bank headquarters to large cities.

The economic impact on a city that loses a major banking headquarters depends primarily on how the post-merger company allocates banking functions across its new geographic space. Early indications are that the retail banking functions of J. P. Morgan Chase will be managed from the (former) Bank One offices in Chicago, which will exploit Bank One’s relative expertise in retail banking. Although Chicago will lose a considerable number of capital markets and other bank-related jobs, it would be premature to conclude that this merger marks the decline of Chicago as a financial center. Indeed, Eurex’s decision to locate its new all-electronic derivatives exchange, Eurex US, in Chicago indicates otherwise.

Finally, what about attracting and retaining nonfinancial headquarters? Does the loss of Bank One make Chicago a less attractive headquarters city in general? The evidence suggests otherwise.

While large banking companies have been relocating to large “banking center cities,” large nonfinancial firms have been spreading out across medium-sized cities. Although the agglomeration benefits of a large city location continue to be important for banking companies, the improved ability to communicate, pass information, and travel across long distances means that for large nonfinancial companies being located near their financial services providers has become less important—perhaps signaling a reduction in the importance of city size for delivering agglomeration economies. Other city characteristics matter more for headquarters retention. For example, Diacon and Klier (2003) find that cities with well-educated workforces, good access to international transportation, and reputations as global business centers are more likely to retain large nonfinancial company headquarters.2 These and other characteristics will play important roles in determining Chicago’s future as a headquarters city.

Notes

1 Thomas Klier and William Testa, 2002, “Location trends of large company headquarters during the 1990s,” Economic Perspectives, Federal Reserve Bank of Chicago, Second Quarter, pp. 12–26.

2 Tyler Diacon and Thomas Klier, 2003, “Where the headquarters are—Evidence from large public companies 1990–2000,” Federal Reserve Bank of Chicago, working paper, No. 35.