The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Recent problems with the debt of less-developed countries (LDCs) suggest the need for fresh approaches. In particular, the U.S. Congress has shown increasing reluctance to fund International Monetary Fund (IMF) rescues, suggesting the erosion of political support for the existing structural arrangements for LDC debt workouts. In 1997, former Secretary of the Treasury William E. Simon remarked that “[t]he House and Senate now have a golden opportunity to force the long overdue elimination of the International Monetary Fund (IMF). There is no longer any reason to burden taxpayers with the expense of this outmoded institution.”1 A year later, during the 1998 debate on an $18 billion funding request, House Majority leader Dick Armey stated, “I am far from convinced that we should provide any new resources for the IMF.”2 Regardless of one’s position in this debate, the intended role of the IMF is an important issue. In this Chicago Fed Letter, I explain how a recent financial innovation, the securitization trust, could become an alternative mechanism for handling LDC financing needs.

The IMF was organized in 1946, during a period when the bank model was a dominant feature of the financial architecture. That predominance is less apparent today. Markets have evolved new financial structures that may be better suited for resolving LDC debt problems than is the bank model. One of these new structures, the securitization trust, has proven to be a very effective vehicle for circumventing some of the inherent problems arising from debt finance.

The core of the approach I propose is a shift of the current IMF negotiating and policing functions to an institution owned by syndicates composed of debtor nations. This approach offers two advantages. The first is the lessening of the moral hazard that arises because, in the current framework, the IMF cannot credibly refuse to provide its assistance. LDC ownership of the proposed institution, because it would mutualize risks among its beneficiaries, offers more effective control over the risk-taking incentives of its members. A second advantage is that the framework proposed would provide a successor to the increasingly unpopular IMF workout arrangements. Under the current arrangements, the natural conflicts of creditor and debtor interests exacerbate frictions between have and have-not countries. As Charles Calomiris points out, “[t]he conditions imposed by the IMF along with its financial support help to ensure that tax increases to finance the bailout will be forthcoming, making the IMF an accomplice to the transfer of wealth from taxpayers to domestic oligarchs and global lenders.”3 Further wealth transfers will elevate public skepticism and further erode support for the existing arrangement. Steps must be taken to provide for a successor lest LDCs face a future financial crisis with no access to needed liquidity.

What is a securitization trust?

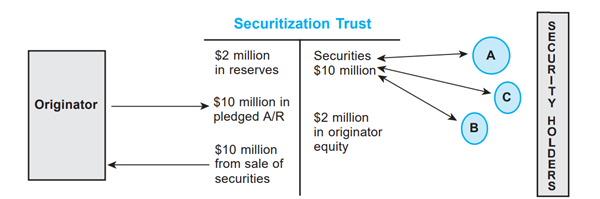

Securitization trusts operate as intermediaries servicing the wholesale side of the financial markets.4 An originator pledges assets, generally assets for which secondary markets do not exist, to a trust that is empowered to issue securities against the assets it holds (see figure 1). The securities issued by the trust generate funds that are channeled to the originator. Essentially, the originator sells the assets to its trust subsidiary. For example, a hypothetical Chi-Town Bank originates credit cards through mail solicitations. Households using these cards generate accounts receivable that Chi-Town pledges to its trust operation. The trust pays for these receivables using funds obtained from the securities it issues.

1. Illustration of securitization

The innovation that makes these transactions attractive comes through the way the securities are structured. The greatest fraction of these securities— industry jargon refers to this tranche as the “A piece”—are highly rated large-denomination bonds. Two features of trusts lead to high ratings for the A-piece securities they issue. First, the originator maintains an equity interest in the trust. Thus, losses realized from the assets it pledges are marked first against its equity stake. In the Chi-Town example cited above, these would be losses realized on the credit card accounts that were pledged to the trust. Second, to keep the trusts’ equity-issuance costs low, “A-piece” covenants are much more stringent than those found in traditional debt issuances. Indenture provisions vary, but all are written to protect A-piece owners from losses arising from default on trust-held assets. An early amortization provision is frequently included and is especially effective. Early amortizations are event-determined paydowns of outstanding A-piece balances. Generally, paydown periods are the 12 months immediately following the triggering event. The rapidity of paydowns concentrates managerial attention on asset sales and reduces their loss-recognition flexibility. Both elements heighten incentives for originators (or trusts) to minimize losses based on market-determined prices. The indentures list a number of events that can lead to early amortization. Such events might include ratings downgrades or an unfavorable debt–equity ratio. The simplicity of these triggers enhances transparency.

The threat of a large and rapid amortization prompts originating institutions to respond to crises as they develop. For example, Chi-Town, our hypothetical credit card originator, might respond by pledging additional accounts receivable to replace accounts that have been deemed uncollectible. The structure concentrates credit risk in the equity tranche of the trust and substantially reduces funding costs for the A-piece portion.

The success of these structures is remarkable. Despite their very high apparent leverage, in the 15-year history of securitization trusts, the principal of every A-piece owner has been paid. This is all the more remarkable given the period’s variation in interest rates and historically high levels of credit card default. This success continues to contribute to the shift of outstanding credit card balances into securitization trusts. At present over 50% of credit card receivables in the U.S. are securitized.

Background for the proposal

Presently, LDC debt defaults are negotiated under the auspices of the IMF. Though not required to do so, the IMF typically offers to assist in a workout plan provided the LDC initiates economic policies intended to improve its future creditworthiness. This arrangement has come under criticism from two angles. First, funding of the IMF has prompted concerns regarding the effectiveness of the organization. Johnson and Schaefer5 compare the per capita gross domestic product (GDP) in the first-year recipient nations received IMF funding to per capita GDP in 1993. After adjusting for inflation, they find that for the 89 recipients of IMF support from 1965 to 1995, 48 countries were no better off than before receiving loans and, of those 48, 32 were actually worse off. This weak performance record has decreased political support for the IMF, and the U.S. Congress appears increasingly reluctant to approve funding for IMF loans. Mitigating the decreased political support has been concern about the impact that sovereign default may have on the world’s financial markets. In the fourth quarter of 1998, for example, Congress approved $5 billion in IMF funding targeted for assistance in the Russian debt crisis. The initial reluctance of Congress to approve this funding package was overcome by its recognition that an unsuccessful workout would have significant adverse consequences for the financial markets. In his testimony to Congress in 1998, Federal Reserve Chairman Alan Greenspan described the repercussions from problems originating in East Asia a year earlier:

However, the most recent more virulent phase of the crisis has infected our markets as well. Concerns about business profits and a general pulling back from risk-taking in the midst of great uncertainty around the globe have driven down stock prices and pushed up rates on the bonds of lower-rated borrowers. Flows of funds through financial markets have been disrupted, at least temporarily. Issuance of equity, and of bonds by lower rated corporations, has come virtually to a halt; even investment-grade companies have cut back substantially on their borrowing in capital markets. Banks also are reportedly becoming more cautious and more expensive lenders to many companies.6

The second criticism arises from the workout requirements imposed by the IMF. These requirements are frequently viewed as reducing the autonomy of debtor nations. This is natural, given the IMF’s interest in encouraging capital investment in LDCs. The credibility of their promotion activities gives the IMF an interest in protecting credit-supplying institutions from default loss. IMF-arranged workouts must obtain a balance between the write-downs incurred by lending institutions and the impact of economic policy changes imposed as a condition of the workout. As in most negotiations, both parties typically give up something to obtain a compromise. In this case, while the economic policy changes may have been understood and accepted by the negotiating parties at the table, the necessity of their imposition is often less well understood by the citizens of the LDC. This exacerbates the debtor country’s political instability and potentially leads to further economic difficulty.

The proposal

I propose applying the securitization model to LDC debt and loan markets. The IMF in conjunction with a group of sovereign nations would supply equity to a securitization trust with majority ownership and controlled by the sovereign nations. Once in place, the trust could issue debt, using the proceeds to purchase the obligations of the respective countries. These debt purchases would be proportional to the equity supplied by the sovereign countries. As in the credit card example, the trust’s debt covenants would specify rapid amortization of an outstanding balance conditional on well-defined and transparent events. For example, a ratings downgrade for the debt issuances of the trust could precipitate early amortization if the participating sovereigns failed to respond by recapitalizing the organization. Further covenants would be limited only by the level of financial sophistication of the participants. As in the credit card case, a higher level of financial sophistication could be obtained by setting high face values on the A-piece issuances of the securitization trust.

This approach has the potential to substantially reduce IMF funding requirements. The aggressive use of covenants concentrates credit risk to a very narrow tranche and substantially lessens the credit exposure of individual debtholders relative to the holders of debt currently outstanding. Thus, IMF resources would be more effectively employed. Resources of the IMF that are now devoted to debt funding could then be shifted toward early warning systems to prevent invoking amortization events.

Complementing these considerations, securitizations induce vigilance on the part of the sovereign participants. Because each participant has an equity interest in the trust, each stands to lose if another participant fails to live up to the terms of participation. This mutualizes the interests of the members. When employed elsewhere, mutualization has been proved to be an effective mechanism for controlling credit problems. In addition, shifting the imposition of economic measures from the IMF to the participating sovereign nations subverts the autonomy argument.

Conclusion

A review of the developments of the last five years implies that political support for the IMF framework is declining. If we fail to look elsewhere for solutions to LDC debt problems, we risk a further decline in political support for the IMF and the eventual failure of its funding. This Chicago Fed Letter outlines one potential alternative to the present framework. Innovations in financial architecture have led to the successful development of securitization trusts as a cost-effective means of managing credit risk. Securitization trusts offer the potential to decrease the dependence of debtor nations on the well-developed countries. Greater LDC autonomy over their economic policies can go a long way toward lessening frictions between have and have-not nations, while simultaneously maintaining a supply of readily available credit to meet crisis situations.

Tracking Midwest manufacturing activity

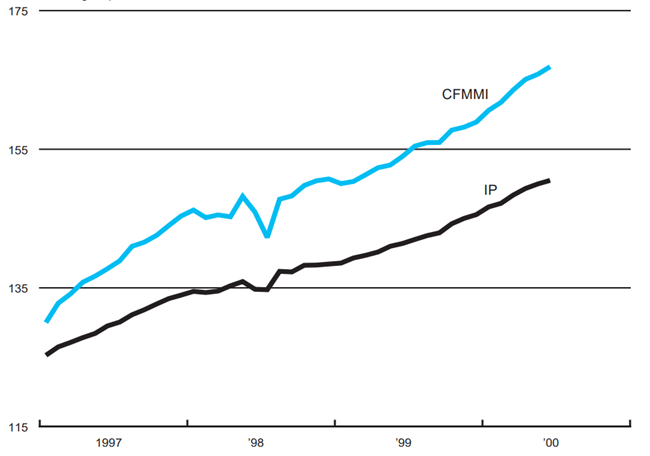

Manufacturing output indexes (1992=100)

| Junw | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 166.9 | 165.8 | 154.0 |

| IP | 150.5 | 150.0 | 141.4 |

Motor vehicle production (millions, seasonally adj. annual rate)

| June | Month ago | Year ago | |

|---|---|---|---|

| Cars | 5.8 | 5.7 | 5.5 |

| Light trucks | 7.3 | 7.1 | 7.2 |

Purchasing managers' surveys: net % reporting production growth

| July | Month ago | Year ago | |

|---|---|---|---|

| MW | 53.7 | 57.4 | 60.4 |

| U.S. | 53.4 | 53.6 | 58.7 |

Manufacturing output indexes, 1992=100

The CFMMI rose 0.7% from May to June, reaching a seasonally adjusted level of 166.9 (1992=100). Revised data show the index was at 165.8 in May and had risen 0.4% from April. The Federal Reserve Board’s IP increased 0.3% in June, after rising 0.4% in May. June output in the region was 8.4% higher than a year earlier, while output in the nation was 6.4% higher.

Light truck production increased slightly from 7.1 million units in May to 7.3 million units in June. Car production also increased slightly from at 5.7 million units in May to 5.8 million units in June. The Midwest purchasing managers’ composite index (a weighted average of the Chicago, Detroit, and Milwaukee surveys) decreased to 53.7% in July from 57.4% in June. The purchasing managers’ index decreased in all three surveys. The national purchasing manager’s survey decreased slightly from 53.6% to 53.4% during the same period.

Notes

1 William E. Simon, 1997, “Abolish the IMF,” Wall Street Journal, October 23, p. A18.

2 Dick Armey, 1998, “The IMF and the Clinton doctrine,” April 3. Emphasis in the original.

3 Statement of Charles W. Calomiris before the Joint Economic Committee United States Congress, Wednesday, October 7, 1998.

4 For an excellent introduction to securitization trusts, see Michael R. Dean, Chris Mrazek, Richard C. Drason, Mark Sun, Kathy Moon, and Michelle Galvez, 1999, “ABCs of credit card ABS,” The Securitization Conduit, Vol. 2, No. 2/3, pp. 26–37.

5 Bryan T. Johnson and Bret D. Schaefer, 1997, “The International Monetary Fund: Outdated, ineffective, and unnecessary,” Backgrounder, Heritage Foundation, May 6, No. 1113.

6 Testimony of Chairman Alan Greenspan on private-sector refinancing of the large hedge fund, Long-Term Capital Management, before the Committee on Banking and Financial Services, U.S. House of Representatives, October 1, 1998.