The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

On October 19, 1987, the Dow Jones Industrial Average dropped 22.61%, its largest ever percentage decline. The event aroused concern that the stock market was becoming excessively volatile. The 6.91% decline on October 13, 1989, heightened these concerns. Some charge that the relatively low margin levels required for positions in stock index futures contribute to the magnitude of stock price changes. In particular, according to this view, the problem is that margins required for stock futures are lower than margins required for stocks. According to this view, margin requirements for stocks and stock futures should be equal.

I disagree with this claim. In this Chicago Fed Letter, I show why the usual arguments for margin equalization, which refer to excessive volatility, are not convincing. I argue that margin equalization is an attempt to maintain the market share of trades placed by small investors. However, this attempt will fail because of competition from alternative markets.

What are futures markets?

Futures contracts are commitments requiring settlement based on cash-market prices at some date in the future. Thus, futures markets are derivative markets; i.e., futures prices derive from the value of their underlying cash-market assets. For example, futures contracts may be tied to agricultural products, foreign exchanges, interest rate obligations or stock market indexes. This aspect of the futures market provides certain advantages. Because futures positions can be held without provisions for owning the underlying asset, the cost of entering a futures position is lower than the cost of the corresponding position in the cash market. Investors in futures markets need not pay financing or other costs to take positions based on their forecasts. This lower trading cost attracts investors to futures markets.

As futures markets respond to the extent of investor positions, futures prices reflect the forecasts motivating these positions. What emerges is a consensus forecast of prices. Thus, futures speculations provide the economy with information about both expected future prices and risk. Businesses can use expected price information in forming plans. For example, the futures price for Treasury bonds might be useful to underwriters planning an offering of interest-sensitive securities. Diverse forecasts are likely to produce price swings in the futures market, implying uncertainty about future prospects. This provides the economy with a forecast of risk. A diverse set of forecasts might suggest to managers that they need to reduce their firms’ exposure to price changes. For example, observing increased volatility in interest-sensitive futures, underwriters will increase their measures to prevent losses from the issue.

The following example illustrates this price-discovery process. Suppose that Jamie, an investor, believes long-term Treasury bonds are undervalued; that is, Jamie believes that interest rates are presently too high. The cash market position taking advantage of this insight is purchase of long-term Treasury bonds. This long position in bonds ties up investment capital. A long position in a bond-futures contract enables Jamie to take a related position using less capital. Thus, with limited supplies of capital, Jamie can take larger positions in the futures market than in the cash market. The marketplace benefits because the greater extent of the Jamie’s position increases upward price pressure on futures contracts relative to its effect were Jamie limited to cash bonds. In turn, arbitrage between the two markets assures that whatever information is reflected in futures contract prices will quickly be used in pricing the cash bond. In summary, valuation forecasts motivate investment. The choice of investment vehicle is based on maximum benefit. When futures contracts lower the cost of investment, prices respond to new information more rapidly. As a result, prices are more informative.

The link between prices in futures and in cash markets demonstrated in the example also illustrates the second benefit of futures markets: risk management. Because the futures and cash prices move closely together, other investors already holding bonds, or long cash positions, can take short positions in futures contracts to avoid the risk of price changes. Returns from these short positions offset the price changes of the long cash position, reducing investor risk. This offset occurs because long and short positions respond differently to price changes. Long positions produce gains when prices rise and losses when prices fall. Short positions produce losses when prices rise and gains when prices fall. Thus, simultaneous long cash and short futures positions produce offsetting returns.

The ability to construct such combinations enables investment managers to control exposure to price changes. Of course, managers can always accomplish risk control by altering their cash positions. The lower cost of trading in futures augments this ability. In summary, futures markets provide the market with enhanced price discovery and risk management facilities.

Why some believe that margins are related to volatility

The idea that margins are related to volatility is exceptionally long-lived given the lack of evidence supporting this point of view. The reasoning behind this idea is that margin requirements determine speculation levels; and by controlling speculation, market volatility can be controlled. I call this the Excessive Volatility Argument. There are a number of objections to this argument.

Initial stock margins are set by the Federal Reserve Board of Governors. Since 1975, initial stock margins have been 50%; i.e., investors holding margined stock positions must have an initial equity stake in the position of 50%. Prior to 1975, the Board revised stock margin requirements intending to quiet markets. By raising the cost of speculating in stocks, it was hoped that volatility could be controlled. Repeated examination of the use of margin rules to control volatility indicates that it was not successful. There are good reasons for the lack of success. First, the extent of margin positions is too small. Regulation affecting only a small portion of trading activity is unlikely to have much of an impact. Second, margin rules restrict the use of stock as collateral. This restriction is readily avoided by basing the loan on other assets. Third, as Franco Modigliani and Merton Miller demonstrated years ago, the method of financing does not alter the fundamental performance of assets. The fact that changing margin requirements failed to reduce volatility explains why, despite retaining the authority, the Board has opted to leave initial margin requirements unchanged since 1975.

This well-documented failure of regulation in the stock market suggests that the use of margins to reduce volatility in the futures market will fail as well. Even if margin regulation did reduce volatility in the stock market, it would not necessarily work in the futures market because margin serves a distinctly different purpose in the futures markets. Whereas stock margins serve as collateral for loans secured by stock, futures margins are security deposits maintained daily to ensure performance of the contract holder. The guarantee that futures exchanges provide to the counterparties in contracts traded on the exchange places the exchange at risk. The exchange faces the risk that contract terms will not be performed. Margin balances manage exchange risk in two ways. First, as long as the margin deposit exceeds a zero balance, futures traders failing to perform lose their margin deposits. This loss threat provides them with an economic incentive to fulfill contract terms as long as the cost of performance is less than the amount remaining in the margin account. Second, should nonperformance occur, the exchange uses available margin to reduce its cost of completing the contract terms.

In my research, there is no evidence that raising margins reduces subsequent volatility.1 On the contrary, the evidence indicates that futures exchanges raise margins when volatility increases. Thus, just as the above arguments predict, exchanges act prudentially. They raise margins when the risk of nonperformance increases.

The Excessive Volatility Argument also assumes that speculation increases volatility. However, the opposite result is more likely. Speculators often take positions against the market. For example, betting that the market price is too low, speculators will buy. Thus, markets regarded as declining attract speculators who place buy orders, guessing the market to be too bearish. Speculation then, tends to reduce volatility. The lower margin requirements of futures markets probably do attract speculators, but it does not follow that these speculators increase volatility.

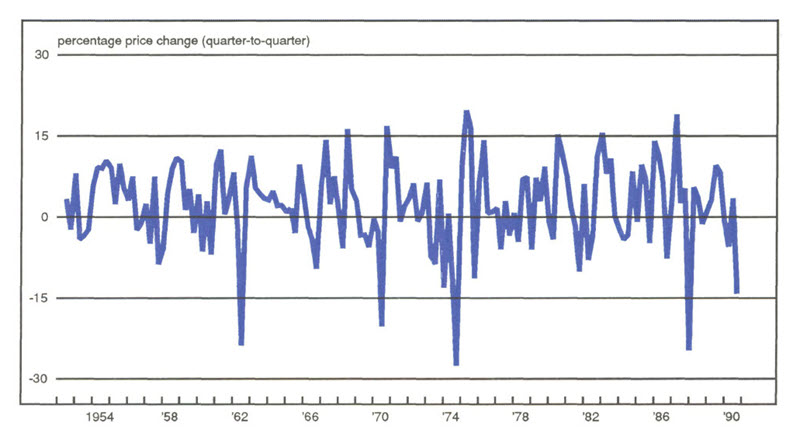

Lastly, is the stock market really more volatile since futures began trading in 1982? It might seem that the answer is yes, given what happened in the Octobers of 1987 and 1989, but these were very short-term events. It is inappropriate to characterize long periods of time by short-term results. Figure 1 graphs quarter-to-quarter percentage changes in the Standard and Poor’s 500 from 1952 to 1990. According to the figure, the magnitude of up and down price changes does not suggest that an important change in volatility has occurred since 1982. Even the price swings in the last quarters of 1987 and 1989 are less dramatic than those during 1974. In fact, statistical studies examining the effect on volatility from the introduction of stock index futures find the opposite has occurred. Volatility has declined since their introduction. Thus, stock index futures did not raise volatility.

1. Volatility of equity returns

Is there another explanation?

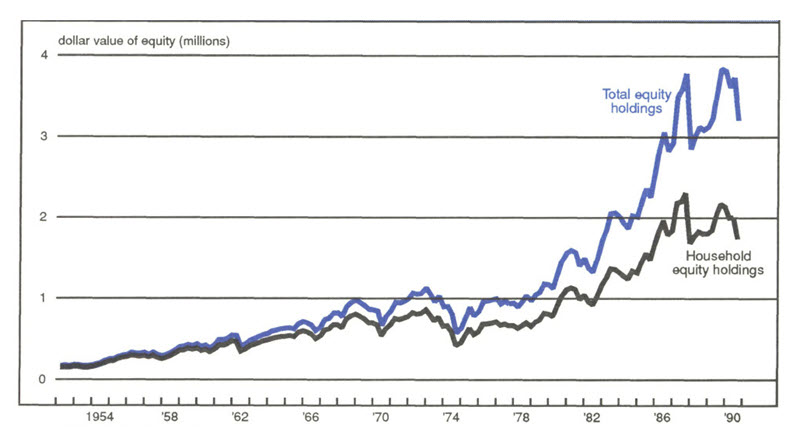

Both logic and evidence run counter to the claim that futures margins need to be increased. Why then does the debate continue? A better explanation for the interest in raising futures margins can be gleaned from figure 2. This graph compares the levels of new equity issues with direct ownership of equities by households. Since 1975, the two series steadily diverge, indicating that households began decreasing their shares of direct equity holdings.

2. U.S. equity ownership

Households are the retail customers of the stock exchanges. Their decreased participation implies an increase in holdings of institutions such as pension funds and insurance companies—the wholesale customers of the stock exchanges. As the graph indicates, the shift from direct household investment to indirect holdings through intermediating institutions accelerated during the mid-1970s. On May 1, 1975, the NYSE de-cartelized the brokerage industry by letting competition determine fees charged by brokers. The result was a retail-wholesale segmentation of customers. Brokerage fees obtained from these two different customer bases differ predictably. Retail customers are charged higher amounts for two reasons. First, retail trades are smaller and more costly to handle. This extra handling justifies a higher charge per transaction. Second, retail customers have fewer alternatives. While wholesale customers can shop off-exchange for lower transaction fees, retail customers lack the trading volume to justify the expense of this search. Failure to discount the transactions of wholesale customers will push these institutions to alternative markets. The lack of alternatives for small investors lessens the pressure to offer them discounts. Consequently, though trades by small investors represent less than 15% of average trades by volume, these are the highest markup trades in today’s market.2

Retaining these high-markup customers is vital to the present-day trading system used by the stock exchanges. Proponents of the Excessive Volatility Argument claim that volatility excesses cause small investors to leave the stock market. However, if this is true, the investment dollars placed by small investors do not disappear. They are rerouted through intermediating firms. This rerouting shifts trades from the retail market into the wholesale market. This insight clarifies the concerns of the stock exchange: Replacing the high-markup end of its business with more low-markup business implies losses. Thus, margin equalization is intended to retain this important customer base by controlling excess volatility. However, as previously pointed out, raising futures margins does not lower volatility.

Margin equalization does affect the retail customer base in other ways. Intermediary institutions offer return-enhancing and risk-management services to individuals. These services are uneconomic for small investors. For example, a pension fund can use index arbitrage to enhance the retirement accounts of its membership. Individuals will generally find that returns net of transaction costs are insufficient to justify this strategy. Similarly, portfolio insurance is generally uneconomic for individuals, but usefully provided by intermediaries. Increased trading costs brought on by higher margins diminish the ability of intermediary institutions to offer these services to customers. Thus, equalizing margin stems the shift from retail to wholesale trades by making the benefits from trading futures inaccessible to small investors.

Suppose futures and stock margins are equalized?

Raising futures margins to the present levels required for initial stock positions will raise the cost of futures trading, reducing the economic benefits from futures trading. Competition ensures that efforts will be made to re-establish these benefits using products from alternative markets. The low-markup clients of the stock exchanges will continue seeking low-cost routes for their trades. Trading volume at computer facilities which match trades in the so-called off-exchange market will rise. Also, foreign exchanges will not hesitate to offer contracts replacing those presently trading in the futures markets of New York, Kansas City, and Chicago. These trades will be motivated by competition between intermediaries to increase the effectiveness of risk management and return enhancement.

As substitutes for futures trading are developed in off-exchange and overseas markets, wholesale firms will re-establish intermediary services. The presence of substantial wholesale-retail cost differentials assures these wholesalers of a market for these services. Strategies such as portfolio insurance and index arbitrage will remain uneconomic for high-markup customers. Continued underperformance of self-managed investments relative to institution-managed portfolios will motivate further shifts from self-managed investments.

Thus, attempts to forestall the loss of retail trades by raising the cost of trading in alternative markets will fail. High mark-up customers attracted by the investment services offered by intermediaries will continue to place investments through intermediaries. Low mark-up customers seeking to lower the cost of providing these services will move more trading to alternative markets. In combination, the stock exchanges will lose business to institutions facilitating increased returns and lower risk from trading activity.

Conclusion

The Excessive Volatility Argument links trading costs to excessive volatility from speculative activity. Proponents of margin equalization hope to raise the cost of trading futures to solve this problem. I have shown that the Excessive Volatility Argument fails because margin increases do not lower subsequent volatility.

The proponents of margin equalization may have another goal in mind. By raising the cost of trading strategies designed to enhance returns and manage the risk of stock positions held through intermediaries, the exchanges seek to retain high-markup customers. I have argued that competition from alternative markets to provide the investment vehicles that enable these strategies ensures that margin equalization will ultimately fail to achieve this goal as well.

Notes

1 See my forthcoming article in Economic Perspectives, July/August 1991.

2 This is based on an average volume of SuperDOT trades of just over 85% since January 1988. SuperDOT trades are high volume trades which are much more likely to be placed by institutions.