The world’s communities and economies are already feeling significant effects from global warming and related climate and extreme weather events, as the latest United Nations Intergovernmental Panel on Climate Change (IPCC) world climate report published in August 2021 makes clear. In some industry sectors, such as insurance and energy, financial market tools have been developed specifically to mitigate the risk of financial loss related to climate. Such tools have yet to be developed for the U.S. mortgage market—one of the world’s largest at roughly $11 trillion as of the end of 2020.

In this Chicago Fed Letter, I provide an overview of the mortgage securities market and how market participants manage the credit and interest risks traditionally associated with housing finance.1 I summarize some existing financial market risk-management tools for climate and weather. Next, I explain how climate risks can negatively impact property values, which in turn can impact the mortgage market. Then, I discuss how derivatives could play a role in managing such risks in the mortgage markets.

Overview of the U.S. mortgage securities market

The U.S. mortgage securities market is one of the largest in the world. Financial risks in this market have generally been managed through hedging with derivatives and/or securitization. Derivatives are financial contracts in which buyers and sellers agree to settle obligations at a future date. Securitization is the process of pooling assets and repackaging them into debt and equity securities. The assets that are securitized typically have a stream of cash flows. Common examples of securitized assets include loans, receivables, and leases.

When we think of mortgage market risk, we typically think of credit risk and interest rate risk. While these risks are typically hedged systematically, the hedges do not account for geographical differences (see Hurst et al., 2016). This inevitably means that climate risks for distinct geographies are not accounted for in the risk-assessment process. The potential gap is starting to gain more focus this year as the Federal Housing Finance Agency (FHFA) has issued a request for input on climate and natural disaster risk, seeking feedback on how these risks should be managed.

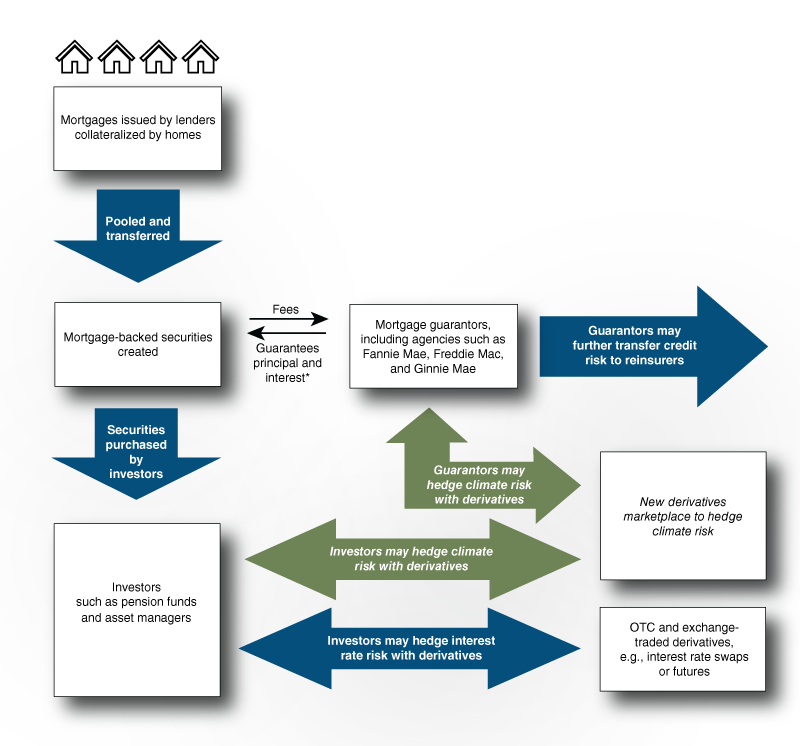

1. MBS diagram

Sources: Chicago Fed staff illustration, drawing on information from Christopher L. Culp, 2002, The ART of Risk Management: Alternative Risk Transfer, Capital Structure, and the Convergence of Insurance and Capital Markets, New York: John Wiley & Sons Inc.; Fannie Mae; and Investment & Pensions Europe.

The vast majority of mortgages are repackaged as securities known as mortgage-backed securities (MBS). At the end of 2019, over $10 trillion of MBS were outstanding, with over 80% issued by a U.S. mortgage agency, such as Freddie Mac, Fannie Mae, or Ginnie Mae. Agencies guarantee payment of principal and interest on the MBS they issue by covering the potential default risk of borrowers in the underlying mortgage loans (see figure 1).

The financial industry uses interest rate and credit derivatives to hedge key risks. For federal agency-backed mortgages, the agencies may transfer credit risk to reinsurance firms to move risk off their balance sheets (see figure 1). MBS investors may also use interest rate derivatives, such as Eurodollar futures, interest rate swaps, and Treasury futures to hedge interest rate or duration risk (see figure 1). Eurodollar futures are used to hedge short-term interest rate changes based on changes to the London interbank offered rate (Libor2), while Treasury futures and interest rate swaps are used to hedge longer-term interest rate changes. Interest rate swaps in particular are quite prevalent since swap dealers can customize them to match the maturity and cash flows of the underlying mortgage loans.

A typical MBS is secured with a portfolio of diversified properties collateralizing the underlying mortgages. Therefore, it is difficult to strip out the climate risks embedded in mortgages in geographical areas that are more susceptible to climate risk within the portfolio. Nevertheless, derivatives could be used to hedge the risk from climate-related extreme weather events as well as risk from climate change. Based on figure 1, for mortgages that are guaranteed, agencies could hedge such risks. On the other hand, since investors bear the risk of default for non-guaranteed MBS, they would need to hedge climate-related risks as they do interest rate and credit risks currently, as shown in figure 1.

Major mortgage market participants have even started listing climate risk in disclosures as events that can impact the risk of the underlying mortgage. Moreover, the expected risk of residential property (which secures the mortgage) losing value due to climate-related extreme weather events is a form of potential physical risk. Physical risk relates to the potential loss of property, infrastructure, and business supply chains from extreme climate-related weather events or gradual climate change.

It could be argued that flood insurance would cover some of the physical risk at the underlying mortgage level, but there have been some concerns around coverage and who bears the costs.3 Specifically, since flood insurance is typically renewed annually, there is a maturity mismatch with short-term insurance versus longer-dated mortgages that are typically 15 or 30 years. Also, in the longer term the risk of loss is likely to become more prevalent given the potential impact of climate change.

What do we learn from existing risk-management tools for climate and weather risk?

As I mentioned earlier, some financial market tools to manage climate and weather risk have been in use for years, especially in the insurance and energy markets. For example, the insurance industry has used catastrophe (CAT) bonds since 1997 to manage tail risk exposures from climate-related disaster events like hurricanes. CAT bonds transfer risk of climate-related disaster to investors who are willing to bear the risk. The risk transfer is accomplished by issuing security bonds to investors whereby under the terms of the bonds, the investors will lose some or all of the principal if certain enumerated climate-related disaster events occur. The size of the market for such bonds was greater than $40 billion in 2020 according to ARTEMIS, which tracks news and data on CAT bonds and other risk-transfer tools used by insurance companies. The CAT bond market has supported both capital benefits for issuers and improved pricing in the insurance market.

Another example is weather derivatives, which have been listed and traded at the Chicago Mercantile Exchange (CME) since 1999 in the form of futures and options. Derivatives are typically priced at prevailing market values at the contract inception. The market value may change during the contractual period, which in turn leads to the contractual parties garnering economic gains and losses as market value changes. Thus, the derivatives allow the transfer of the potential risk of market value changes and can be used as a mechanism to hedge risk among market participants. The final settlement could be to make or take physical delivery, which is common with derivatives based on commodities, or a cash settlement payoff based on an index or independent price.

The weather derivatives cleared at CME are cash settled based on a CME reference index and have been used to hedge the costs or revenues impacted by unexpected variance in temperature in U.S. or non-U.S. cities. Energy market participants use weather derivatives to hedge against changes in energy usage due to unexpected fluctuations in weather patterns. While this market is smaller than the CAT bond market, volumes of weather derivatives for some reference locations increased in a range of 10% to 25% year over year in 2020 compared with 2019.

How might derivatives be used to hedge climate risk?

What do we learn from the existing financial market tools? The transfer of climate risk allows energy and insurance firms to operate with more-predictable costs or revenues. The techniques also improve efficiencies in each market by allocating risks to those more willing to bear climate risk. What role might derivatives play in managing climate and weather risk in mortgage markets?

One possibility would be to establish a derivatives market to hedge and transfer the risk of loss from climate events. The derivatives could be longer dated so, similar to aforementioned interest rate hedges, the expected length of the risk and hedge are better aligned.

Moreover, derivatives referencing climate-related extreme events in specific geographies could offer the advantage of better aligning the hedge with the risk of loss. For example, properties in a coastal area are more prone to losses from a climate-related extreme weather event like a hurricane.4

Furthermore, other major climate-related weather events, such as tornados, winter storms, or wildfires, which are tracked by the National Oceanic and Atmospheric Administration (NOAA) could be covered. While the list from the NOAA may not cover all events, it would serve as a credible starting point for key climate-related extreme weather events that could affect some of the underlying collateral, which could in turn negatively affect the ability of borrowers to repay the underlying loans of an MBS.

The risk of climate events could be modeled based on historic data to forecast the probability and intensity of such events. Risk assessments, such as those performed by the National Risk Index, could be used for this purpose. Using an index would likely have an additional benefit of garnering market support from derivative market makers as they have expertise in trading derivatives that reference indexes on major future and option exchanges.

The structure of the derivative would need to consider the trade-off of using simple cumulative or average loss calculations while accounting for a higher potential loss from larger events where hedging may be most beneficial. In other words, a few small events added together may not generate the same risk exposure as one large event. For example, five category 1 hurricanes may not inflict the same amount of damage as one category 5 hurricane. Also, as mentioned in Alvarez, Cocco, and Patel (2020), historical data alone may not be sufficient to make accurate predictions; hypothetical modeling may be required, especially in the initial stages of market development.

Another potential role for derivatives could be to hedge the potential risk of loss due to longer-term climate change. Specifically, damage from gradual land erosion as sea levels rise could be considered as part of the hedging objective. As mentioned in Rodziewicz et al. (2020), there are a significant number of metro cities in coastal geographies that are at risk for potential economic losses of billions of dollars. Here, historical data may be less meaningful so hypothetical modeling could be used. Based on the modeling, risks could be hedged in one or more of the following approaches:

- On an expected loss basis—This calculation is typically derived by summing probabilities of loss events multiplied by the expected size of the loss resulting from the event;

- Loss in stress scenarios—This method would involve extending existing stress testing techniques to incorporate climate risk factors directly and/or estimating tails of loss distributions of a value at risk (VaR) based model; or

- Maximum loss—This calculation would be an estimate based on full notional value of the applicable mortgages within a portfolio, with an adjustment for expected recovery.5

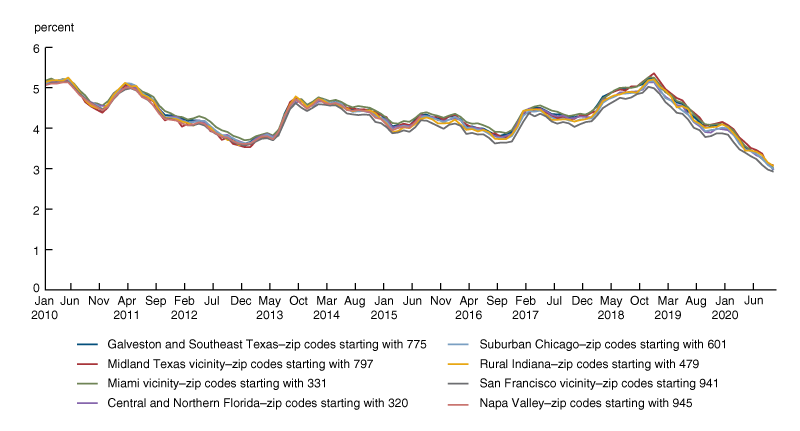

2. Rates on 30-year fixed mortgages across different geographies

Regardless of the approach, market expectations could be observed in market prices of the derivatives to hedge such risks. Changes in prices would reflect either increases or decreases in expected losses from climate-related risks. Conceptually, this would be similar to the changes in default loss expectations being observed in the variance of prices within the credit default swap (CDS) market.

As I mentioned earlier, previous research has shown mortgage rates do not materially account for regional or local differences. While this lack of variance has not been shown to affect calculations of default risk across regions significantly, the variation—and resulting implications for risk management—may be more significant for climate-related risks. For example, considering just the risk of loss from sea level rise, I compared mortgage rates for the past decade for coastal zip codes more prone to sea level rise with rates for zip codes less exposed to this risk based on the NOAA Sea Level Rise Viewer.

I selected mortgage rates for zip codes with higher risk of sea level rise in Texas (zip codes starting with 775), Florida (zip codes starting with 331), and California (zip codes starting with 941). I then compared them with mortgage rates for zip codes in the same states (zip codes starting with 797, 320, and 945, respectively) plus two additional zip codes6 from Illinois (zip codes starting with 601) and Indiana (zip codes starting with 479)—five zip codes that are less prone to the risk of sea level rise. The average daily mortgage rates are similar, as shown in figure 2, and do not seem to materially account7 for these areas’ different levels of risk of sea level rise.

Conclusion

In this article, I have discussed potential risks from both climate-related extreme weather events and longer-term climate change in the U.S. mortgage securities market. I have also highlighted the high degree of similarity in mortgage rates across different geographies, although they have varying degrees of potential climate risk. One way to hedge the negative impact of catastrophic climate events, as well as loss from potential gradual climate change, would be to use derivatives. While other risk-management tools, such as further securitization or reinsurance, could be employed as either complementary or substitutable means of risk transfer, derivatives are already used by mortgage market participants and therefore may be more natural for them to use in order to manage such risks.

While a market for derivatives to hedge climate risk may be useful for MBS issuers, such a market would require the full complement of participants to be efficient. Risk takers, such as hedge funds, which have historically been active in CAT bonds and weather derivatives, could potentially help garner critical mass for an efficient market. In addition, asset managers looking to further diversify their portfolios may consider the derivatives in their investment scope. Once a reliable market is developed, mortgage originators could potentially use the price of climate risks, as reflected by the derivatives, to adjust mortgage rates in order to reflect such risks—conceptually similar to how interest rate and credit risk are reflected currently.

Notes

1 I would like to thank John Spence, former financial market analyst at the Chicago Fed, for his research assistance. I would also like to thank Nahiomy Alvarez, Alessandro Cocco, Michael O’Connell, Deng Pan, Andy Polacek, and Ashvin Veligandla, Federal Reserve Bank of Chicago; David Rodziewicz, Federal Reserve Bank of Kansas City; Benjamin Keys, Wharton School at the University of Pennsylvania; and Leah Loguidice, CME Group, for their helpful comments.

2 SOFR referenced futures are expected to replace Eurodollar futures as the market transitions away from Libor as a reference rate.

3 Additional information is available online. Additional details on flood coverage are available online. HUD studied FHA loans in two flood zones in Florida and North Carolina to see what share of mortgages had appropriate levels of insurance. Compliance was deemed to be less than 50%. Details are available online by subscription,

4 CME previously launched futures with payouts based on hurricane intensity. The product was meant to support market participants in the CAT bond market with additional risk-management tools, but the product has not shown significant trading volumes or open interest to date.

5 Conceptually, the payoffs could be structured similar to binary options for notional loss hedging or credit derivatives where recovery rates are commonly used.

6 The Illinois zip codes are from the Seventh Federal Reserve

District, which is served by the Federal Reserve Bank

of Chicago.

7 I calculated a correlation of 99% between mortgage rates for zip codes starting with 775, 331, and 941 versus mortgage rates for zip codes starting with 797, 320, and 945.