While there is growing recognition that climate change poses a new risk for the economy, more research is needed to understand how climate change risk affects global financial markets. We establish a new framework for this research by merging the climate change risk categories of physical risk, transition risk, and liability risk with the risk categories commonly assessed in the financial markets: market risk, credit risk, liquidity risk, and operational risk. We then factor in market structure and market regulation as we seek to assess the overall impact of these variables on systemic risk. Our framework shows that climate change affects each of the risk-management categories commonly assessed in the financial markets as well as the ways that they interact to generate broader systemic risk.

In this Chicago Fed Letter, we define and briefly analyze the taxonomy of financial markets and climate risk types. We also touch on operational risk, market structure, and market regulation, then acknowledge the growing body of work from the public and private sectors on climate change. We propose a new framework to describe the overall impact of climate change risk on financial markets and on systemic risk, by assessing how these factors interact. We argue that we need a new framework, instead of the traditional separate financial, operational, and climate frameworks, because changes in climate patterns affect the interactions among financial risks, operational risks, market structure, and market regulation. Finally, we discuss the role of investor activism in the recent growth in ESG (environmental, social, and governance) funds and mention some ways our framework might be useful in future research projects.

Types of financial risk

Participants in the financial markets enter into financial transactions, such as purchasing bonds and stocks, or trading derivatives on an exchange, with a view to gaining financially from entering into those transactions. Whether an asset will increase or decrease in value will depend on a number of factors. For example, a dry summer may result in lower production volumes for some agricultural commodities, such as rice, wheat, or soybeans. As a result, the price will go up. Those who purchased those commodities at a lower price ahead of time will gain from the increase in prices. The risk of a dry summer is different (greater in some places, less in others) as a result of climate change, and this means there is market risk as a result of physical climate change risk. We define these types of risks in the following paragraphs. In our example, we illustrate a type of market risk as a result of physical climate change risk. In addition to market risk, risk managers analyze other types of risk to estimate the impact of future events on their investment portfolios or their derivatives contracts. The main types of risk commonly assessed in the financial markets are market risk, credit risk, liquidity risk, and operational risk.

Market risk is the risk that the market value of an asset will fall. A stock, a bond, or a derivatives contract may lose value as a result of a climate change related event. If governments were expected to tax carbon emissions heavily to address climate change, for example, the stock prices of coal-mining companies would likely fall. As climate events continue to occur with increasing frequency and severity, market risk will be impacted by climate change risk.

Credit risk is the risk of loss resulting from a counterparty failing to meet a payment obligation. Climate risk can create credit risk by causing losses that leave market participants unable to meet their obligations. For example, if rising sea levels force a manufacturer to abandon one of its major factories, the loss of that investment could leave the company unable to repay its corporate bonds or bank loans. Or if a bank or insurer loses money on its assets as a result of market risk related to climate change, the institution may have difficulty covering its liabilities, such as bank deposits and insurance claims.

Liquidity risk is the risk that a market participant is unable to come up with the cash needed to meet its immediate payment obligations, though it may have assets that could be sold to raise money over the longer term. For example, liquidity risk exists if a bank has invested too large a share of its deposits in long-term loans and kept too little cash on hand to satisfy depositors’ demand to make withdrawals. It is difficult to anticipate cases in which climate change risk causes liquidity risk without first causing market, credit, or operational risk, because typically climate change risk is unlikely to make an asset less liquid without making the asset lose value, making a borrower insolvent, or disrupting financial infrastructure. A possible example could be if, as a result of a radical change in investor sentiment, investors mainly buy green bonds (designed to support climate or environmental projects) when making new purchases. The issuers of non-green bonds (i.e., the borrowers) are still going to repay in full, but the market for non-green bonds becomes illiquid because there are fewer buyers. Investors who own the non-green bonds have to hold them to maturity if they happen to own them already. So now any investor owning non-green bonds is less liquid than before. In the real world, this lack of liquidity would likely impact the value of the bonds, and liquidity risk would result in market risk for those holding the non-green bonds.

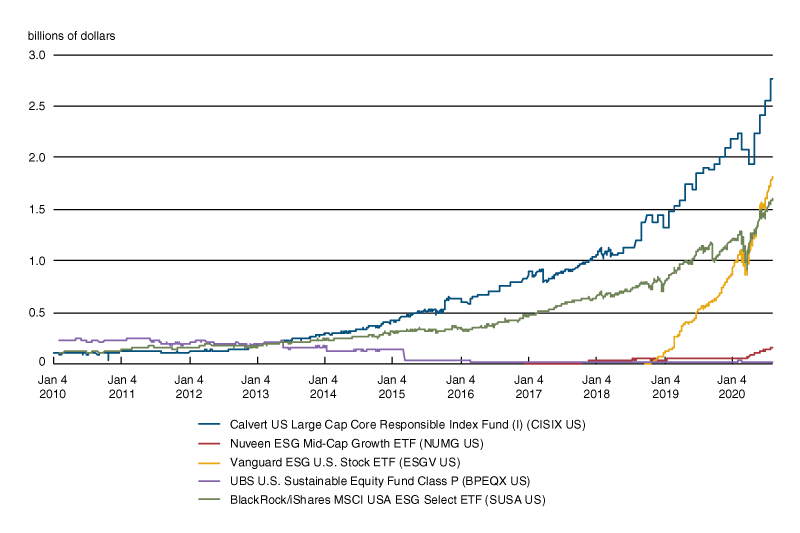

As consumers, investors, and governments increasingly focus on ESG standards, the ability and willingness of the private sector to address climate change risk will continue to be a topic of discussion. In the future, the financial success of a company and the liquidity of its stocks and bonds could depend at least in part on its practices regarding climate change. As Bolton et al. note, in the context of voting at shareholder meetings of publicly traded corporations, “the determining votes are cast by asset managers.”1 Accordingly, institutional investment managers can have considerable impact on the shares of publicly traded companies. The growing attention by these investment managers (for example, Vanguard, State Street, and BlackRock) to climate change policies is a strong indication that publicly traded companies will need to devote more attention to these issues to safeguard their market value and the liquidity of their equity and debt instruments. To illustrate the growing influence of climate-focused investing, we note that ESG and sustainability-focused funds have grown substantially over the last few years.2 Figure 1 shows the growth since 2010 in assets held by the five ESG funds with the largest fund inflows in 2019.

1. Five ESG funds with the largest inflows in 2019

Source: Bloomberg.

Operational risk is the risk of loss resulting from failed processes, systems, or practices. Climate change has had a clear impact on operational risk, as extreme weather may force office closures or damage crucial resources such as data centers.

Types of climate change risk

As the world grapples with the impact of the Covid-19 pandemic on the global economy, some have observed the parallels between pandemic risk and climate change risk: Both have the potential to cause recessions, unemployment, and sharp depreciation across all asset classes.3 As we look to assess the potential impact of climate change on financial markets, the Covid-19 crisis serves as a reminder of the scale of the risks involved.

Climate change risk can arise through three key categories: physical risk, transition risk, and liability risk.4 Climate change can both amplify traditional risks and create new risks.

Physical risk relates to the impact of events related to climate change—such as severe storms—on property, infrastructure, and business supply chains. For instance, businesses impacted by an extreme weather event may bear financial losses from damage to their property and, in turn, may fail to repay bank loans. In this case, climate change related events do not create a new category of financial risk but rather amplify credit and market risk for firms, banks, investors, and insurers. Physical risk also includes insurers’ costs for property damage claims and investors’ losses when assets decrease in value because of physical damage.

Transition risk refers to the risk that arises from actions geared toward making a transition to a sustainable economy, such as developments in climate policy, the deployment of green finance tools, the launching of new disruptive technologies, or investor sentiment about investing in companies that cause climate damage. Disruptors and early adopters may enjoy a financial advantage from early adoption of sustainable practices, and some market participants may be penalized for practices that do not align with a sustainable model. Stranded assets are an example of the effect of transition risk. A stranded asset is an asset that has lost value ahead of its anticipated life cycle due to write-downs occurring as a result of physical climate change; a change in laws, regulations, or policies designed to address climate change; litigation; or a change in consumer sentiment.

Liability risk refers to the risks that could arise when parties that have suffered losses from climate change seek to recover those losses from others they believe may have been liable, such as through lawsuits or insurance claims.

A growing body of research and policy

There is a growing body of research and policy on the topic of climate change. Recently, the Board of Governors of the Federal Reserve System has addressed the financial stability implications of climate change in the November 2020 Financial Stability Report. We highlight some key topics (for more details and citations, please see the online appendix5).

A comprehensive risk-management approach to climate change risk, articulated across physical risk, transition risk, and liability risk has yet to emerge. In the United States, clearinghouses and asset managers have begun to consider the challenges posed by climate change risk, but a methodology for assessing climate change risk has not emerged at this time. Similarly in Europe, an assessment of euro-area institutions by the European Central Bank shows firms have yet to develop comprehensive risk-management approaches. Academics are also studying the impact of climate risk on the economy. One example is the 2019 MIT Scenarios for Assessing Climate-Related Financial Risk study,6 which focuses on investigating a diverse set of climate policy scenarios, with a view to providing risk managers with tools to assess the impact of physical risk and transition risk on specific investment portfolios. In addition, in June 2020 the Network for Greening the Financial System, a group of 75 central banks and 13 observers, published a set of climate scenarios for assessing the potential impact of climate change risk on the economy and the financial system.

Carbon pricing is seen as a key development to reduce emissions. The introduction of a carbon price would represent a significant transition risk and affect how market participants allocate risk. The 2020 report of the Climate-Related Market Risk Subcommittee of the Commodity Futures Trading Commission’s Market Risk Advisory Committee finds that climate change could pose systemic risks to the U.S. financial system, and it articulates several recommendations for addressing this risk, starting with the recommendation that the United States establish a price on carbon.7 In addition, the report finds that the financial markets do not accurately price the climate impact of the companies that issue bonds and stocks. If an accurate methodology for assessing climate impact is developed, then the financial markets will be able to allocate the risk and cost of polluting in a more accurate and efficient manner. In September 2020, the Institute of International Finance sponsored the Taskforce on Scaling Voluntary Carbon Markets, an initiative aimed at creating and promoting the rapid growth of a voluntary market for trading carbon emission credits, as a way to create a set of market-led incentives to help meet the Paris Climate Agreement target to limit global warming to below 2°C and to pursue efforts to limit it to 1.5°C. This initiative is led by private sector representatives, with public sector representatives acting in a consultative capacity. One open question is whether establishing a global standard price on carbon would help in developing a carbon market.

An accurate framework for understanding climate change risk would enable companies to understand their risk. Accurate disclosure of climate change risk is key to an efficient emissions market. Accurate disclosure of climate change risk is important for many purposes. Even a company with no emissions needs to be disclosing how climate change risk affects it. Demand has been growing for accurate climate change related disclosures that enable investors to take climate change risk into account as they make investment decisions. In addition, given the recent emphasis on developing a carbon market, accurate disclosure of climate change risk practices by market participants will take on new relevance as a tool the market could use to price a company’s carbon footprint. As a result, companies would be incentivized to reduce carbon emissions. Much remains to be done in this area, given the high number of competing standards and the heterogeneity of data disclosures. As a result, it has been challenging so far for investors and policymakers to compare different disclosures.

Market structure and market regulation

Market structure and market regulation will have a material effect on the impact of climate risk, financial risk, and operational risk in a given economic scenario. Factors such as the amount of liquidity in a given market and whether a financial instrument is required to be traded on exchange or off exchange will be essential components of this analysis.

Market structure refers to how participants in a given market organize themselves. Factors such as the number of participants in the market and the size of the positions held by a single participant relative to the overall size of the market will affect the combined impact of a climate change related event that results in financial risk or operational risk. For example, if fewer insurers are prepared to insure waterfront homes due to climate risk, the market for waterfront home property/casualty insurance would become concentrated. Then a natural disaster could have a greater impact on the financial stability of those insurers, potentially exacerbating that market concentration.

By market regulation, we mean the underlying regulatory framework that governs a market. A market where regulators enforce stronger requirements for companies to disclose their risk exposures may be less at risk of a sudden revelation that a market participant has gone bankrupt, whether as a result of climate change or some other problem.

Market structure and market regulation influence how a market responds to shocks of any sort, including climate change events. For example, if a market has many strong and active participants, the resulting liquidity may support smoother adjustments to negative news, whether on climate change or something else.

Why we need a new risk framework

As we have noted, different types of climate change risk can cause different kinds of financial risk, in addition to causing operational risk. This impact can be amplified or absorbed depending on market structure and market regulation. Taken together, these factors affect the overall stability of the financial system. A distinguishing feature of climate change is that it can evolve in a nonlinear fashion, so data points from the past are not always reliable indicators of future developments. In our view, due to these factors, climate change has the potential to pose a serious threat to the stability of the global financial system.

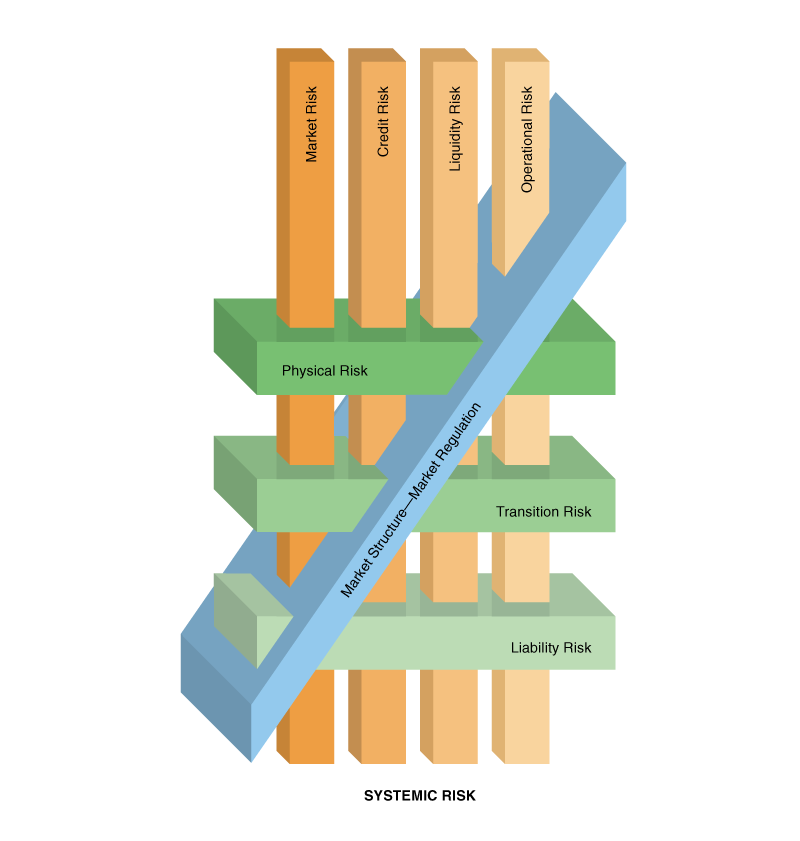

Notwithstanding the increasing attention devoted to climate change, the management of climate change-related risk remains at an early stage. In this article, we establish a new framework by merging the climate change risk types of physical risk, transition risk, and liability risk with the main categories of financial risk: market risk, credit risk, and liquidity risk. We then take into account operational risk, as well as market structure and market regulation to study the potential impact on systemic risk (see figure 2).

2. A new framework of climate change risk in financial markets

In the next few decades, climate change related events could have repercussions for systemic stability through their effects on derivatives and other financial markets. The mechanisms that may compound the impact of a climate crisis on the financial markets are worth including within our framework.

- Interconnectedness of global financial system: Given the interconnectedness of the world’s financial infrastructure, the aggregate impact of an accelerating cluster of climate related events could be of a scale never experienced before, with significant repercussions on systemic stability. Both the crisis of 2008–09 and the Covid-19 pandemic have shown that crises can spread very quickly through global financial markets.

- Concentration of global supply chain: Given the concentration of the global supply chain in specific regions of the world, and the dependence of global companies on that supply chain, what might have once been an isolated extreme weather event in one region of the world impacting a local economy may now affect the global supply chain with cascading effects on financial markets globally.8

- Compounded effects of irreversible changes: While some types of emerging risks are rare and have a discernible endpoint, climate events are expected to continue to play out with compounded, permanent adverse consequences unless action is taken on a global level. Research shows that human-caused global warming is a key factor in making extreme weather events more severe or more likely.9 Climate change events can materialize as natural disasters of increasing frequency and severity, such as hurricanes and flooding, or as incremental changes that reach a tipping point over time, such as sea levels rising and threatening waterfront communities. Financial markets will need to be prepared to face a new profile of risks as these changes continue to unfold.

What we learn from this framework is that climate change not only affects each of the financial risk-management categories, in addition to operational risk, but also affects how these risks interact with each other and add up to generate systemic risk. We need a new framework, instead of the traditional separate financial, operational, and climate frameworks, because changes in climate patterns affect the interactions among the financial risks, as we have outlined here.

Looking ahead

The impact of climate change is evolving in a nonlinear fashion. As a result, historical data sets alone are not sufficient to make accurate predictions of future climate change scenarios. Careful modeling and analysis are required. Future research can build on our framework by examining further how the main categories of financial risk, in addition to operational risk, are affected by climate change risk, and whether market structure and market regulation amplify or moderate climate change risk. More research is needed to address important questions, such as whether establishing a global standard price for carbon emissions can be leveraged as a tool to manage climate risk; and whether derivatives, or the development of a global emissions market, voluntary or mandatory, could help address some of the concerns expressed in this article and related literature. Clearinghouses, asset managers, and other financial institutions may consider taking into account climate change risk as part of their overall approach to managing risk. Policymakers and market participants need to continue to assess ways to manage and offset the risks climate change poses to financial markets and the global economy.

Notes

1 See Patrick Bolton, Tao Li, Enrichetta Ravina, and Howard L. Rosenthal, 2019, “Investor ideology,” National Bureau of Economic Research, working paper, No. 25717, March. Crossref

2 See US SIF Foundation, 2020, “The rise of ESG in passive investments,” report, Washington, DC, available online.

3 Luiz Awazu Pereira da Silva, 2020, “Green Swan 2—Climate change and Covid-19: Reflections on efficiency versus resilience,” speech by the deputy general manager, Bank for International Settlements, Basel, Switzerland, May 14, available online.

4 See Mark Carney, 2015, “Breaking the tragedy of the horizon—Climate change and financial stability,” speech by governor of the Bank of England and chairman of the Financial Stability Board at Lloyd’s of London, London, UK, September 29, available online; Bank of England, Prudential Regulation Authority, 2015, The Impact of Climate Change on the UK Insurance Sector: A Climate Adaptation Report by the Prudential Regulation Authority, London, UK, September, available online; and Bank of England, 2020, “Climate change,” webpage, Bank of England, updated November 16, available online.

6 Erik Landry, C. Adam Schlosser, Y. -H. Henry Chen, John Reilly, and Andrei Sokolov, 2019, MIT Scenarios for Assessing Climate-Related Financial Risk, Massachusetts Institute of Technology, MIT Joint Program on the Science and Policy of Global Change, report, No. 339, December, available online.

7 U.S. Commodity Futures Trading Commission, Market Risk Advisory Committee, Climate-Related Market Risk Subcommittee, 2020, Managing Climate Risk in the U.S. Financial System, report, Washington, DC, available online.

8 See Gary Gereffi and Joonkoo Lee, 2012, “Why the world suddenly cares about global supply chains,” Journal of Supply Chain Management, Vol. 48, No. 3, July, pp. 24–32, Crossref (an excerpt of which is available online); Tina L. Saitone and Richard J. Sexton, 2017, “Concentration and consolidation in the U.S. food supply chain: The latest evidence and implications for consumers, farmers, and policymakers,” Economic Review, Federal Reserve Bank of Kansas City, special issue, pp. 25–59, available online; and Jonathan Woetzel, Dickon Pinner, Hamid Samandari, Hauke Engel, Mekala Krishnan, Claudia Kampel, and Jakob Graabak, 2020, “Could climate become the weak link in your supply chain?,” McKinsey Global Institute, August 6, available online.

9 See American Meteorological Society, 2019, “New research examines climate change’s role in 2018 extreme weather events,” NOAA Climate.gov, December 9, available online.