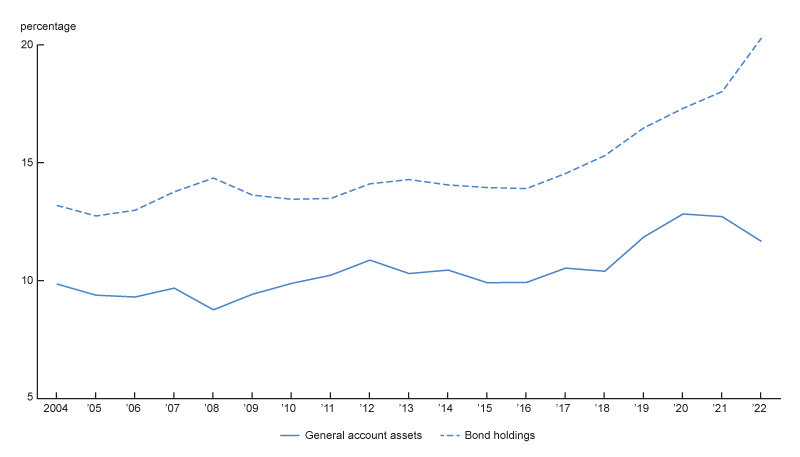

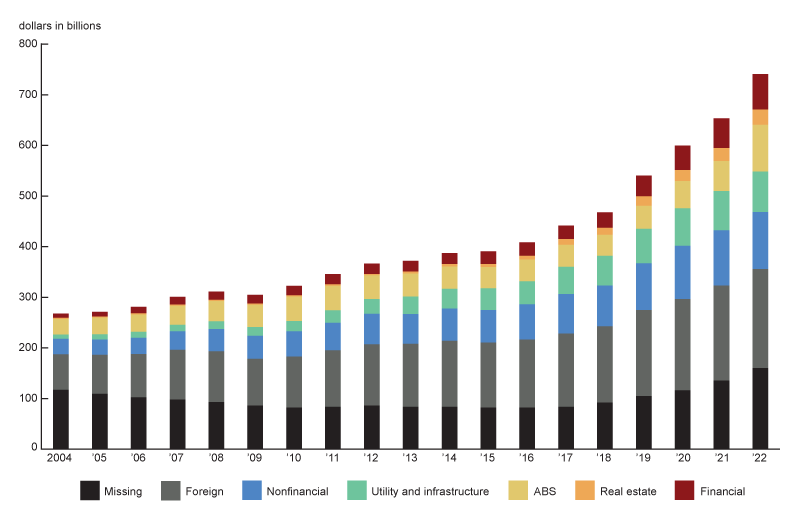

Life insurers buy long-term assets to match their long-term liabilities and hence are among the largest investors in corporate bonds.1 Over the past decade, insurance companies have shifted their corporate bond investments toward privately placed bonds (private placements). A private placement is an unregistered security that is sold to a limited pool of investors, primarily institutional investors, such as investment banks, pension funds, and insurers. While privately placed bonds accounted for 13% of life insurers’ bond investments in 2004, they accounted for over 20% in 2022 (figure 1).2

1. Growth of life insurers’ private placement investments

Despite the growing importance of this asset class on life insurers’ balance sheets, the characteristics of such investments, especially their liquidity and the potential ramifications for financial stability, are not well understood. Our two-part Chicago Fed Letter series fills this gap using novel data on insurers’ private placements that for the first time allows us to map individual securities to the private companies that issued them. Part 1 provides a brief discussion of the private placement market and the appeal of these investments to life insurers. Part 2 focuses on the potential systemic risks arising from insurers’ increased holdings of private placements.

The private placement debt market

In simple terms, a private placement is a security that is placed directly with a small set of accredited investors.3 As such, private placements allow companies to raise capital without needing to meet the legal and disclosure requirements for issuing equivalent public securities. A security is a tradable financial instrument typically issued in the form of an equity security, like a stock, or a debt security, like a bond. Almost all private placements are debt securities, especially those held by life insurers, and so this article focuses exclusively on the private placement debt market.

Publicly traded securities must be registered with the Securities Exchange Commission (SEC) and require significant disclosures following the Securities Act of 1933, often referred to as the “truth in securities” law, as well as subsequent legislation. These disclosures are regulated by the SEC and include the requirement for bond issuers to produce a prospectus detailing the terms of the bond issuance, any significant risks from the offering, the financial condition of the issuing company, and how the proceeds of the bond issue will be used. Additionally, companies that issue publicly traded securities must file quarterly reports detailing their financial balance sheets and describing any material risks to the company. These disclosures are meant to protect investors by fully informing them of any information relevant to their investment and to prohibit deceit and fraud in the sale of securities. However, these disclosures also produce a substantial regulatory and reporting burden for issuing companies. So, to reduce the cost of issuing securities and promote capital formation, not all security offerings are required to be registered with the SEC.

Private placements are one type of unregistered security. A security is a private placement if it is not required to be registered with the SEC, if it is not publicly offered, and if it is sold only to a limited number of accredited investors.

Despite what the name might suggest, both publicly traded and privately held companies issue private placement debt. Historically, private placements were typically issued by mid-cap companies ($2 to $10 billion in market capitalization), but more recently large-cap companies ($10 billion or more in market capitalization) have increased participation in the market, which has increased the size and diversity of the market. Private placements are also issued by both domestic and foreign companies. Approximately 60% of private placements are issued domestically, and the remaining 40% are cross-border with almost all the issuance coming from the United Kingdom, Australia, and Europe.

Types of private placements in life insurers’ portfolios

Private placements are usually structured as senior unsecured debt, as is most public corporate debt, but private placements also take on other forms. Debt structure refers to the order in which debtholders are paid in the event of a default, where debtholders always take precedence over equity holders. In a typical structure, senior secured debt, which is backed by some specific collateral, is paid out first, senior unsecured debt is paid out next from the defaulting company’s remaining unsecured assets, then junior debt tranches are paid out, and finally equity holders are paid from the remaining assets.

A significant share of private placements is related to the financing of infrastructure. Three types of infrastructure debt are most common. First, general infrastructure debt is issued by private corporations, like utility companies, and municipalities to fund long-term investments in transportation, energy, utility, and telecommunications infrastructure but is specific to a particular investment.4 Second, project finance is infrastructure debt that is used to finance and secured by a specific infrastructure project—for instance, to fund the construction of a hydroelectric dam. Third, private placement asset-backed securities (ABS) that are funding the construction of sports arenas or highways are similarly structured and pay investors out of the infrastructure projects’ cash flows.

Private placements not related to infrastructure include other types of ABS. Most commonly, these ABS are backed by receivables, cash flows received from pools of assets, such as consumer auto loans, credit cards, and home equity loans. These are structured in tranches like mortgage-backed securities, where the highest-rated AAA tranche is paid from the receivables first, and the remaining tranches are paid out in order of seniority.

More recently, private placements have shifted toward so-called esoteric credit. This asset class includes structured private credit, a hybrid corporate credit-ABS structure, and private ABS with collateral from niche asset classes (e.g., airline lease or data centers).5 We discuss the growth of life insurers’ investments in this complex subset of the private placement market in part 2 of this Chicago Fed Letter series.

Life insurers’ growing investments in private placements

For over a decade, life insurers’ investments in private placements have continually grown in both relative and absolute terms. Between 2010 and 2022, life insurers’ holdings of private placements increased by $418 billion to $741 billion—equivalent to 13.2% of insurers’ general account assets and 20.4% of their bond holdings (see figure 1). However, the relative growth in private placements began to accelerate in 2017 at a time when life insurers were looking for ways to increase yield after nearly a decade of low interest rates. Life insurers’ net purchases of private placements nearly doubled beginning in 2017, increasing to 10.5% of prior-year private placement holdings year-over-year between 2017 and 2022, compared to just 4.3% between 2010 and 2016 (as seen in figure 1).

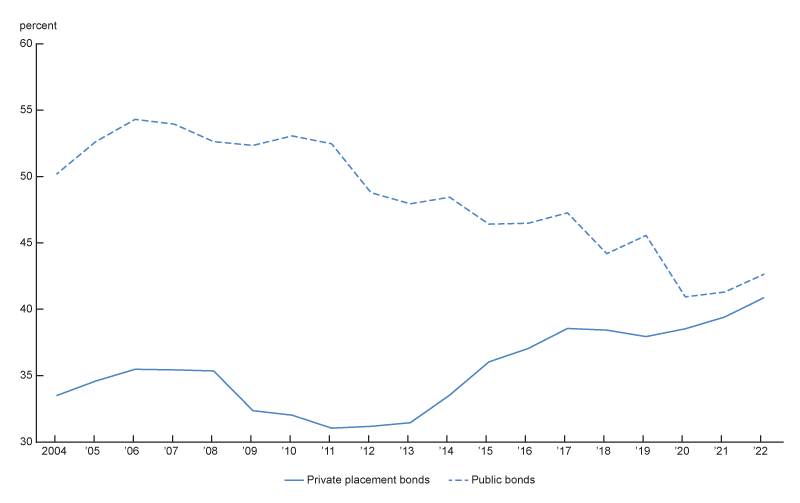

Since 2013, life insurers’ private placement holdings have shifted toward higher-rated investment grade securities (rated AAA to A), while their public bond holdings have shifted toward lower-rated BBB securities (see figure 2). The declining credit quality of life insurers’ publicly traded bonds is likely a result of the corresponding decrease in AAA- to A-rated public debt issuance, rather than an active shift on the part of insurers. However, over the same period, life insurers have been purchasing more AAA- to A-rated private placements, perhaps to maintain the overall credit quality of their portfolios.

2. Share of publicly traded and private placement bonds rated AAA, AA, and A

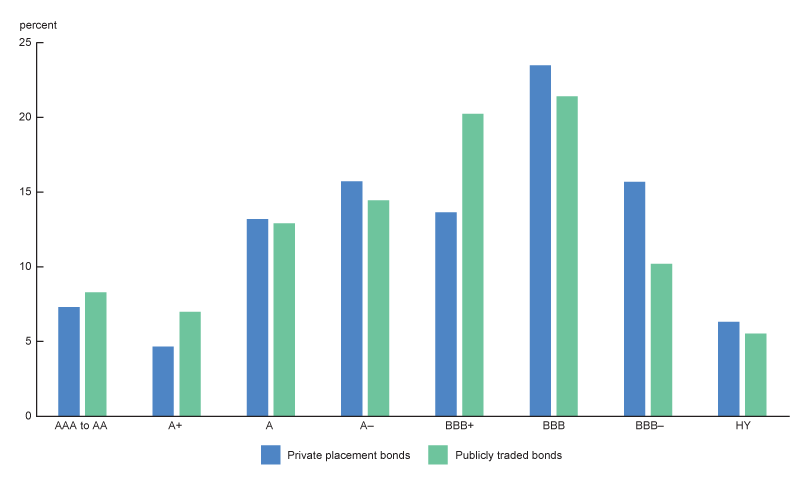

Despite the trend of investing in higher-rated private placements, the credit quality of life insurers’ publicly traded bond portfolios is better than that of the private placement portfolios. Figure 3 shows the share of life insurers’ publicly traded (green bars) and private placement (blue bars) bonds by rating and the difference between their private and public holdings. Within the AAA, AA, and A ratings, life insurers hold more highly rated AAA to A+ public bonds and fewer lower-rated A– bonds compared to their private placements. Similarly, within the BBB ratings, private placements are heavily skewed toward the lowest-rated BBB– bonds, while the publicly traded bond portfolios are skewed toward the highest-rated BBB+ tranche.

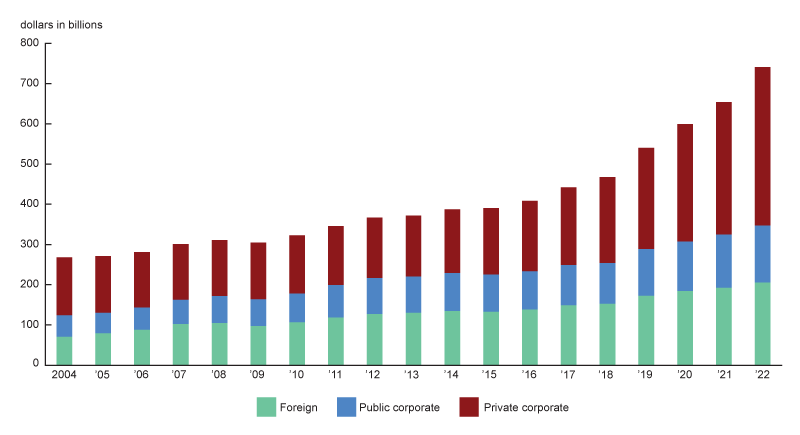

The increased growth in private placement holdings and the shift in the credit quality composition of these holdings coincides with a change in issuer composition. The strongest growth has occurred in investments in private placements issued by privately held companies (purple bar in figure 4). While holdings of private placements of foreign or publicly traded issuers have also increased, the growth has been less pronounced.6 This time-series evidence on the composition of private placements in life insurers’ balance portfolios suggests that the shift toward private company issues was driven by the life insurance industry’s broader move toward more illiquid and complex assets to increase portfolio yields, which we detail in the second part of this series. Next, we outline the characteristics of private placements that draw insurers to these investments.

3. Credit quality of life insurers’ public and private bond portfolios, 2022 year-end

4. Life insurers’ holdings of private placements by issuer type, 2004 to 2022 year-end

The appeal of private placements for life insurers

One benefit of private placements is that their maturity composition better aligns with life insurers’ preferred investment strategy of duration matching than publicly traded bonds. Life insurers prefer to invest in assets that match their long-dated (20-plus year) liabilities. As shown in figure 5, the vast majority of public bonds are issued with maturities of less than ten years, while 15% are issued with maturity of ten to 20 years, and 17% have maturities of greater than 20 years (see column 1). Within public bonds, life insurers are heavily skewed toward the longest-maturity bonds, with 48% of their investments in the 20-plus-year bucket. In contrast, private placements are typically issued with maturities between ten and 20 years, and around 75% of the issuance have maturities greater than ten years (see column 2). Life insurers’ publicly traded bond portfolio has a longer average remaining maturity of 14 years compared with ten years for their private placement portfolio, due to their overweight holdings of very long duration, publicly traded bonds. Still, the maturity composition of the private placement market offers insurers investment options that are generally better suited to their preferred investment strategy—matching long-duration liabilities with long-duration assets—than that of the publicly traded debt market.

A second benefit private placements offer life insurers is diversification into a broader set of companies and assets outside of public markets. Outstanding publicly traded bonds are made up of industrial companies (49%), financial companies (44%), and utility companies (6%).7 In contrast, life insurers’ private placement holdings exhibit more investments in infrastructure/utility-related debt (green bar in figure 6) and in private placements issued by small- to medium-sized companies that do not issue publicly traded debt. All in all, the private placement market offers a diverse mix of assets across companies and industries that complements insurers’ public bond holdings.

5. Maturity at origination

| Original maturity (years) |

Private placement market (%) |

Insurer holdings (%) |

||

| Public | Private | Public | Private | |

| < 10 | 67 | 24 | 39 | 41 |

| 10 to 20 | 15 | 57 | 13 | 35 |

| 20+ | 17 | 20 | 48 | 23 |

6. Private placement holdings by industry

The third advantage of private placements is that buyers can negotiate enhanced credit protections before issuance. Private placements help alleviate concerns about borrower distress through strong covenants and engaged relationships with borrowers. Private placement transactions usually contain financial covenants that limit certain actions by the issuing company that could affect the probability of the bond being repaid.8 In addition to restricting actions borrowers can take, covenants give investors early warning in the event of any credit distress that allows them to engage with management to find ways to avoid default, including restructuring the transaction. Private placements are held by a smaller investor base than public bonds—about half of the market consists of limited distribution deals with fewer than 15 investors—and this small base allows for easier coordination among investors and more flexibility if problems arise.9 The covenant and downside protections offered by private placement deals have led to historical loss rates that are 14% lower for private placements than for comparable public bonds.

The fourth advantage is that life insurers investing in private placements tend to earn higher risk-adjusted returns. According to a Barings report, investment-grade private placement debt is typically priced 20 to 40 basis points above comparable public corporate bond issues; and private placement infrastructure debt typically has a premium of 75 basis points over comparable public infrastructure debt. These higher yields are generally attributed to a complexity premium—additional spread needed to compensate investors for nonstandard deal structures or borrowing terms—and an illiquidity premium—the compensation needed for a potential fire sale discount. While it is difficult to disentangle the two premiums, in part 2 we will provide evidence for the presence of both the liquidity premium and the complexity premium in the private placement market and discuss the potential impacts on systemic risk of life insurers’ shift toward more illiquid and complex assets.

Conclusion

We document that life insurers have significantly increased their investments in private placements in recent years. We identify the main advantages of these investments from the life insurers’ perspective: better duration matching to liabilities, increased diversification, strengthened credit protections through covenants, and higher risk-adjusted returns. We also document that the increase in private placement investments does not appear to have resulted in a deterioration of the credit quality of private placement investments. New private placement investments exhibit higher ratings, on average, suggesting that the increased private placement investments compensate to some extent for the decline in the average credit quality of publicly traded investment-grade corporate bonds.

Notes

1 See Financial Accounts of the United States.

2 For a complete description of the data sources and data construction methods used in this article, please see the online data appendix.

3 “Accredited” investors are typically institutions, such as banks, pension funds, and insurers, but individuals who meet certain income thresholds may also be considered accredited and eligible to purchase private placements.

4 Infrastructure debt is typically backed by the entire operations of the company with few limitations on how the proceeds must be spent.

5 Details on structured private credit are available online; more information on niche asset class ABS is available online.

6 We identify private placements and separate them into subsets based on a special character in the sixth, seventh, or eighth position of the security’s CUSIP (Committee on Uniform Security Identification Procedures), the unique identification number assigned to each financial instrument traded on U.S. markets. Private notes issued by private companies have a special character in the sixth position of the issuer CUSIP. Public and foreign issuers have a special character in the seventh or eighth position; CUSIPs of foreign issuers also begin with a letter that denotes the country of origin.

7 Data from Mergent Fixed Income Securities Database (FISD) and authors’ calculations as of 2022 year-end.

8 A detailed list of typical private placement covenants is available online (see exhibit 4).

9 Bolton and Scharfstein (1996) provide a theory for why smaller investor bases help borrowers to avoid liquidity-driven defaults by reducing the cost of debt restructuring.