The Federal Funds Rate

Note

The Federal Open Market Committee announced substantial revisions to its policy framework in its updated Statement on Longer-Run Goals and Monetary Policy Strategy, dated August 27, 2020. The Committee’s previous framework can be found here and a guide to the changes can be found here.

The content on this page is for historical reference and discusses the FOMC’s dual mandate objectives and path for monetary policy under the previous framework.

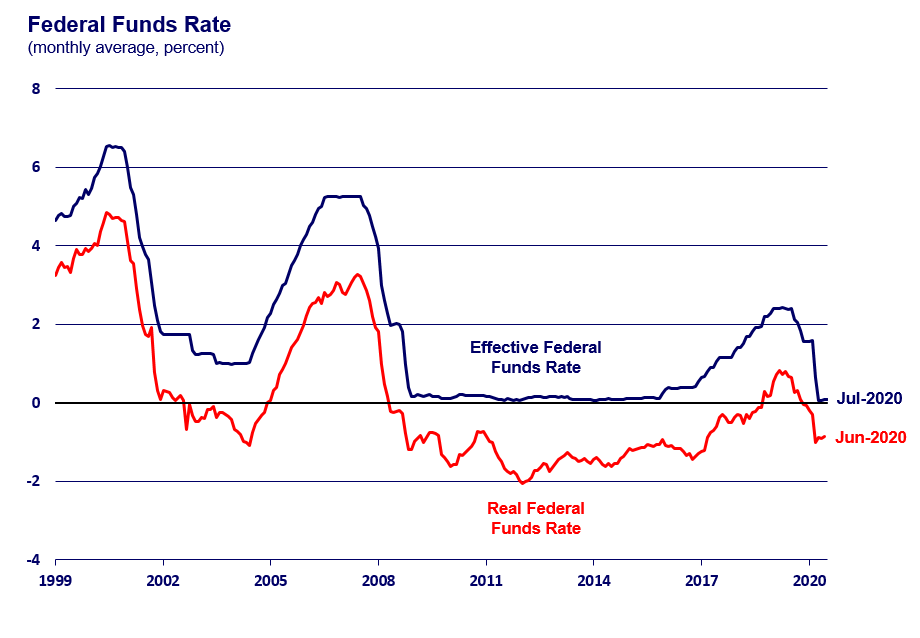

The federal funds rate1 is the FOMC's main policy rate. Changes in the federal funds rate trigger changes in other short- and medium-term interest rates, the foreign exchange value of the U.S. dollar, and other asset prices that influence households' and businesses' spending and investment decisions.

To provide more accommodation during the financial crisis of 2007–08 and the accompanying Great Recession, the FOMC cut the federal funds rate to its effective lowest level, where it remained until December 2015. Over the next three years, the FOMC increased rates very gradually to 2.25 to 2.5 percent in December 2018. The Committee maintained that range until July 2019 when, citing the implications of global developments for the economic outlook and muted inflation pressures, the FOMC voted to reduce the federal funds rate range by 25 basis points. The Committee reduced the range an additional 25 basis points in September 2019 and again in October 2019.

The federal funds rate target range remained at 1.5 to 1.75 percent until March 3, 2020. Citing evolving risks to economic activity posed by the Covid-19 pandemic, the FOMC cut the target range by 50 basis points and followed up with an additional 100 basis point cut on March 15, 2020, returning the target range for the federal funds rate to its effective lower bound of 0 to 0.25 percent. In explaining its move, the FOMC noted that the effects of the pandemic will weigh on economic activity in the near term and pose risks to the economic outlook. More information on the Federal Reserve’s response to the virus can be found here.

Sources: Board of Governors of the Federal Reserve System and U.S. Bureau of Economic Analysis from Haver Analytics.

Notes

1 To be precise, certain financial institutions hold reserve balances at the Federal Reserve (depository institutions, Federal Home Loan Banks, Fannie Mae and Freddie Mac, etc.). The federal funds rate is the interest rate these institutions charge when they lend reserves to other institutions overnight.