Low- and Moderate-income Survey Results

The Federal Reserve Bank of Chicago Community Development and Policy Studies Department participated in administering The Federal Reserve Bank of Kansas City’s low- and moderate-income survey to respondents in the Seventh District. The survey is administered online twice a year to measure “economic conditions of low- and moderate-income (LMI) populations and the organizations that serve them.” As a point of reference, LMI is defined as the incomes of individuals below 80 percent of “median income.” Median income is defined as “metropolitan median income for urban residents and state median income for rural residents.”

Additionally, survey questions were emailed to approximately 1,500 contacts that work with LMI populations within the Seventh District. There was sufficient participation to analyze the data as a non-scientific poll (about a 10 percent response rate). Respondents have a wide variety of backgrounds, including real estate development, finance, financial counseling, economic development, banking, consumer advocacy, small business development, philanthropy, law, higher education, agriculture, manufacturing, and human services. Survey questions included (among other areas) demand for services, jobs, affordable housing, financial well-being, access to credit, and access to capital. Additionally, to make sure that the respondents felt their voices were heard, the survey also had an expository component where respondents could provide additional detail about their concerns.

Our first set of findings from the initial responses will be published in the upcoming ProfitWise News and Views. Upon reviewing the second set of survey responses, we decided to look at two topics that were reoccurring: (1) low-wage jobs and (2) decreases in social service funding.

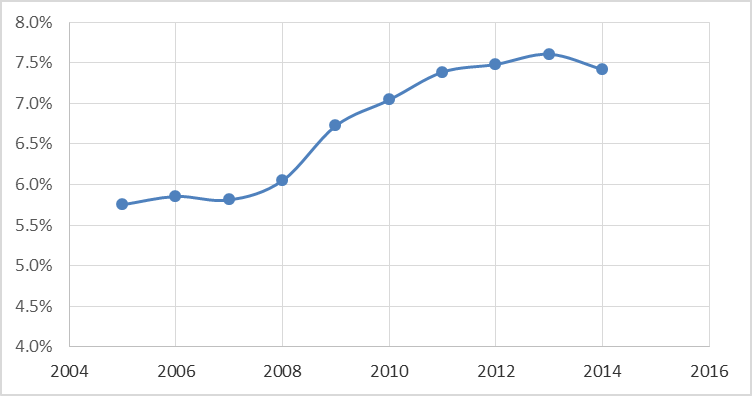

Many of the jobs held by LMI populations are part-time and/or low wage. Sometimes they provide for a lower standard of living than full-time jobs and fewer (if any) benefits. During the economic recovery, “lower-wage occupations were 21 percent of recession losses, but 58 percent of recovery growth.” This caused a higher percentage of employed workers to be in poverty, as indicated in the chart below.

1. Employed workers in poverty

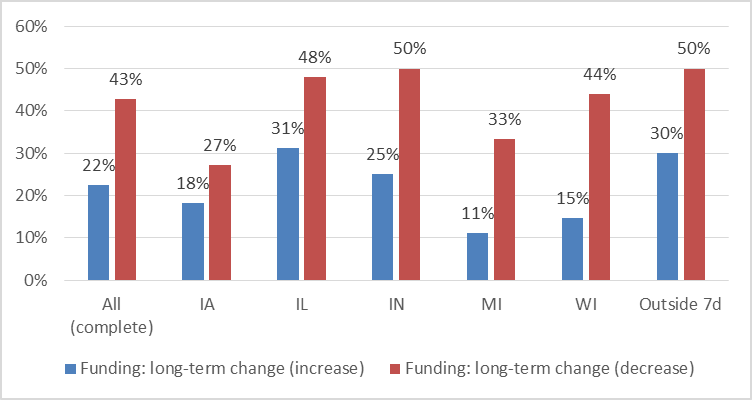

A higher proportion of low-wage jobs may also explain the difference in survey respondents’ outlook on financial well-being. Although 18 percent of respondents see a long-term decrease in job availability, 40 percent expect a long-term decrease in financial well-being in their communities. Increased low-wage jobs may be augmented by a decrease in social services funding that is supported by the survey responses. As shown by the chart below, the survey respondents expect to see a decrease in funding across all states.

2. Long-term funding changes by state

Two respondents captured the majority sentiment on cuts in social services: “Lack of a state budget and cuts to social services funding has reduced available resources to address lower-income peoples’ needs and is destabilizing nonprofits that provide services.” And “In rural southwestern Wisconsin unemployment is not the major problem. But low wages and lack of benefits is increasing the need for our services.” The respondent comments from Wisconsin are supported by the Center for Economic Development’s “Is Wisconsin Becoming a Low-Wage Economy? Employment Growth in Low, Middle, and High Wage Occupations: 2000-2013” article that highlights that the employment growth in Wisconsin has been concentrated mostly in low-wage occupations.

However, it is important to note that not all respondents were in agreement. There were a few outliers that pointed out “As the economy continues to grow, the LMI population will experience economic upward mobility.”

The Chicago Federal Reserve is looking to increase participation in this survey. If you work with LMI populations around the Seventh District and would be interested in participating in this survey, contact Emily Engel at Emily.Engel@chi.frb.org.