Changing the Narrative of Communities: Highlights from a Symposium on Business Growth and Employment in Chicago’s African American Neighborhoods

Narratives about place – the stories that surface in the news and in popular culture – have implications not only for the perceptions and impressions that circulate about neighborhoods, but for the economic potential of the residents who live there. Decisions about where to invest, how to allocate public resources, whether a home can be financed and so much more are affected by the impressions that people (and society) have about a community. The consequences for asset-ownership, wealth, and economic well-being can be devastating when the messages are overwhelmingly negative.

Shedding light on the assets and opportunities in Chicago’s Chatham neighborhood, and presenting alternative narratives about place, was the goal of a symposium on “Business Growth and Employment in Chicago’s African American Neighborhoods” organized by the Federal Reserve Bank of Chicago, The Greater Chatham Initiative and World Business Chicago in June 2017.1 The meeting brought together academics, journalists, funders, and business people to share perspectives on the programs and strategies that attract capital, support businesses, and strengthen communities.2

In this blog we highlight some of the insights and recommendations that were discussed during the symposium for how the Greater Chatham area may be able to enhance its success as a “community of choice” where people want to live and shop, and as a “community of opportunity” where residents are connected to jobs, businesses, and broader networks throughout the region.3

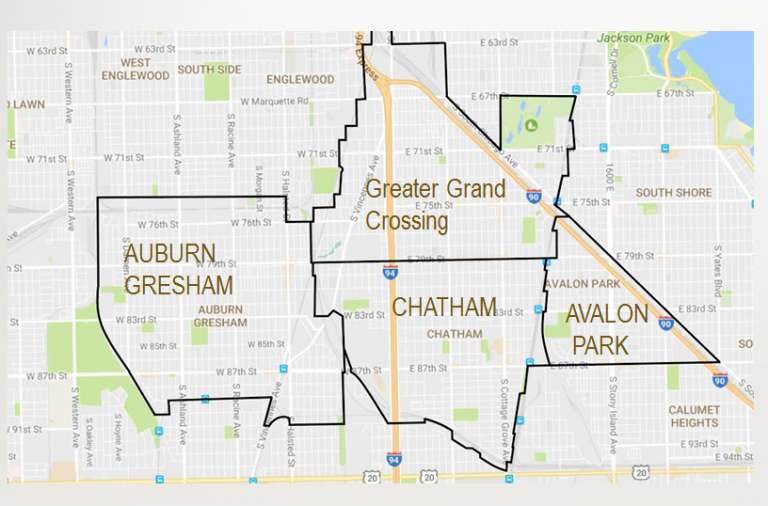

1: Greater Chatham

Greater Chatham is a 15-square miles area including the communities of Avalon Park, Auburn Gresham, Greater Grand Crossing and Chatham.

Session 1: Reflections on community change in south side neighborhoods

It’s the aggregated energy that helps to make a place great. – Theaster Gates, Director, Arts + Public Life at the University of Chicago and Executive Director, Rebuild Foundation

The Greater Chatham area and other south side neighborhoods possess many of the assets that comprise the building-blocks for economic development. The far south side of Chicago, from 79th Street to the Cook County line, is unique not only for its large tracts of industrial-zoned land, but for having the highest concentration of transportation assets in North America. South side neighborhoods also boast an array of local food and arts establishments, as well as corridors that include the highest retail census tract for African American shoppers in the city of Chicago. Some of the most popular cultural attractions, like The Chosen Few House Picnic, have long remained under the radar of mainstream media. Others, like the planned Obama Presidential Center in Jackson Park, are attracting widespread attention, and will likely bring additional arts, food, and hospitality investments in the coming years. In some cases the benefits of these community institutions extend beyond the amenities they provide. While the formerly- abandoned Stoney Island Arts Bank has been repurposed as a destination space for hospitality and culture, it has also sparked the re-development of adjacent properties and created an energy for people “to imagine a new kind of south side” in which artists, entrepreneurs, and “creatives” invest in African-American places.

Session 2 (part A): Accelerating business growth and employment in minority neighborhoods

There are new jobs and new ways of working. We have to prepare people for the new ways. – Karen Norington Reaves, CEO, Chicago Cook Workforce Partnership

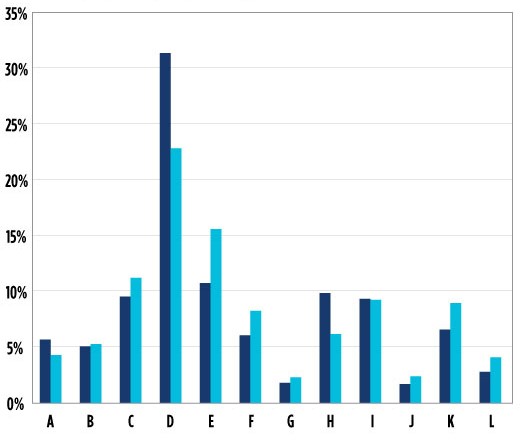

2. Share of employed people by industry, 2015

B - Other services

C - Arts, recreation, accommodation, food service

D - Education, health care, social assistance

E - Professional services

F - Finance, insurance, real estate

G - Information

H - Transportation, warehousing, utilities

I - Retail trade

J - Wholesale trade

K - Manufacturing

L - Construction

Sources: American Community Survey 2015, 5-year estimates.

A relatively high proportion of workers in Greater Chatham are employed in education, health services, transportation, and warehousing (Figure 2). A great many of Chicago’s manufacturing employers are located on the South Side, including a Ford Motor plant that employs more than 4,000 people and other Tier-1 automotive suppliers. These are the companies where employees can often start at entry level, earn their way up to a six figure income, and have no college debt. Yet many of these positions go unfilled by potentially qualified south side residents. Employers too are often unaware that public workforce system, represented at the symposium by organizations like the Chicago Cook Workforce Partnership, and Calumet Industrial Commission offers resources for training and job placement at no charge to the hiring firm.

Video Highlights: Session 2 (part A) |

| Karin Norington Reaves, CEO, Chicago Cook Workforce Partnership >>

Ted Stalnos, President, Calumet Area Industrial Commission >> |

Session 2 (part B ): Accelerating business growth and employment in minority neighborhoods

We have some wonderful African-American owned businesses on the south side. – Jackie Dyess, Owner, Inter City Supply

Small businesses are another component of economic activity in Chatham and other south side neighborhoods. About 600 of the 3,000 members of the University of Chicago’s business incubator, The Polsky Exchange, hail from the neighboring community and have no previous affiliation with the university. Many of these start-ups are tech and product design businesses. Through its work with Chicago Anchors for a Strong Economy (CASE), the University of Chicago’s Office of Civic Engagement reaches other neighborhood-based businesses as well, about 300 thus far, to align the university’s purchasing and hiring with the needs of the community. As one company represented at the symposium noted, this program not only doubled her business with the university, it enabled her to hire more workers from the surrounding neighborhoods. While getting capital and financing remains a challenge for many small businesses in the area, one of the few remaining black-owned banks in Illinois, Illinois Service Federal Bank, continues to operate in Chatham and surrounding neighborhoods, and provides business customers, at no cost, with technical assistance for preparing social security taxes, financial statements, and quarterly employment taxes. Loan funds and micro-finance groups including the Chicago Neighborhood Initiatives, The Chicago Community Loan Fund and others are also lending to small businesses in Chatham, Auburn Gresham and other south side neighborhoods.

Session 3: Challenging inequality, driving economic growth

Good neighborhoods require a strong middle class, decent schools, good quality housing and a strong small business base. – Andrea Zopp, Deputy Mayor City of Chicago

While acknowledging the scope of the challenges before them, civic leaders have been working on a series of initiatives for increasing investment in south side neighborhoods. These include The Neighborhood Opportunity Fund to which businesses along designated (underinvested) corridors can apply for money to promote commercial and cultural projects; The Chicago Community Catalyst Fund (also called Fund 77), a “fund-of-funds” administered by a board of trustees acting as investment managers, that uses $35 million in public money to leverage investment dollars from the private sector; and Benefit Chicago, a vehicle for providing loans and investments to mission-oriented businesses and social enterprises funded by foundations and social impact investors. The Chicago Community Trust (CCT) and other philanthropies provide capital to alternative and higher-risk projects aimed at stimulating revitalization. This includes CCT’s On the Table project that facilitates conversations between people who do not typically meet each other in their everyday lives, and thereby draws in the voices of community members who are often left-out of economic development planning. More than ever, these projects are taking into consideration their effects on inclusiveness and marginalization; and they are taking place at a time when decision-makers increasingly recognize that social capital – relationships and networks with business leaders and policymakers – can be as powerful as the financial capital that advocates seek for Chatham and the surrounding communities.

Footnotes

1 The Community Development and Policy Studies department of the Federal Reserve Bank of Chicago has long been interested in understanding the utilization of financial services and credit access in black Neighborhoods of Chicago and the Seventh Districts. See for example Bond and Townsend (1996) Formal and Informal Financing in a Chicago Ethnic Neighborhood, Economic Perspectives, July/August.

2 For additional analyses of data on key themes related to neighborhood demographics, employment, business and credit conditions in Greater Chatham, see Newberger, Robin and Maude Toussaint-Comeau, “Reinvesting in the Greater Chatham African American neighborhoods in Chicago: New data and Insights from Practitioners,” ProfitWise News and Views, Issue 3, 2017, available online.

3 See "Economic Opportunity in Greater Chatham" presentation by Gretchen Kosarko, RW Ventures.