Michigan increases minimum wage

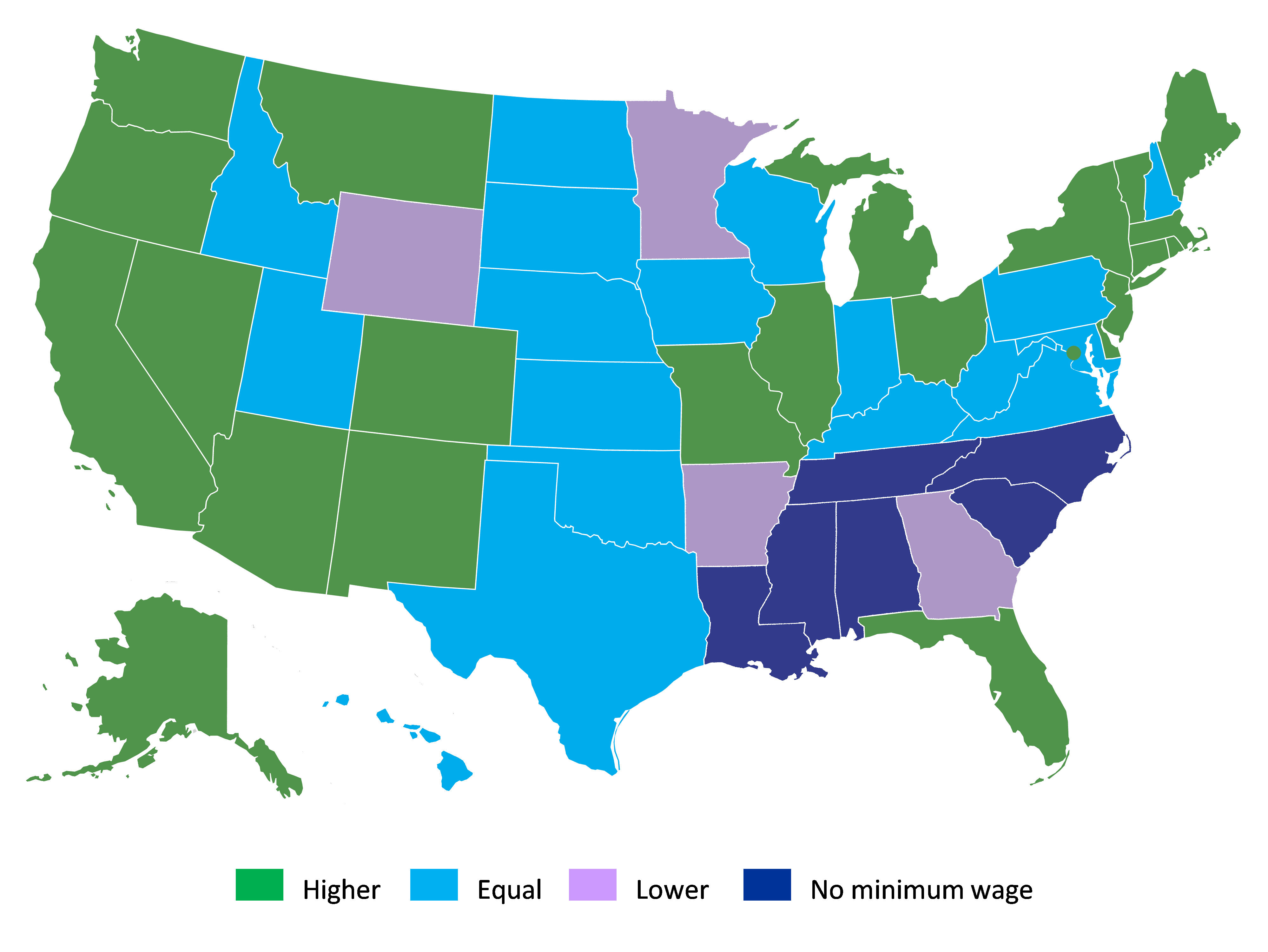

On May 27, Michigan Governor Rick Snyder signed legislation that would increase Michigan’s minimum hourly wage, making Michigan one of seven states together with the District of Columbia that have passed legislation to increase their minimum wage this year. The other six states are Connecticut, Delaware, Hawaii, Maryland, Minnesota, and West Virginia. In addition, 32 other states have considered minimum wage legislation during 2014, with 28 of those considering increases to their minimum wage.1 As of June 1, 22 states and the District of Columbia have state minimum wages above the federal minimum hourly wage of $7.25 (see map).

Figure 1. Minimum wage laws in the United States - January 1, 2014

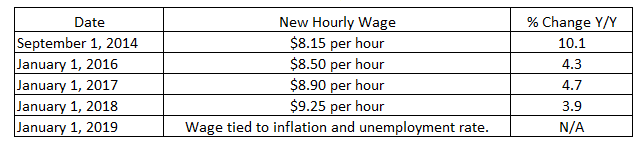

On September 1, Michigan’s minimum wage will increase from $7.40 to $8.15. As shown in table 1, under the new law Michigan’s minimum wage will continue to grow through 2018 until it reaches $9.25 per hour. From that point forward, the wage will continue to increase by the rate of inflation for Midwestern states up to a limit of 3.5%, so long as the unemployment rate is at or below 8.5% in the prior year.

Table 1. Planned increases to Michigan's minimum wage

The new law is thought by some to be a compromise by Michigan legislators aimed at preempting a November ballot initiative asking voters to raise the minimum wage to $10.10 per hour, including for those workers eligible to receive tips. Under the new Michigan law, workers who are eligible to receive tips must be paid a wage equal to at least 38% of the minimum wage and will start by receiving $3.10 per hour, rising to $3.52 per hour by 2018. Many employer groups, including the Michigan Restaurant Association, that were opposed to the ballot proposal seem to see the new Michigan legislation as a workable compromise.

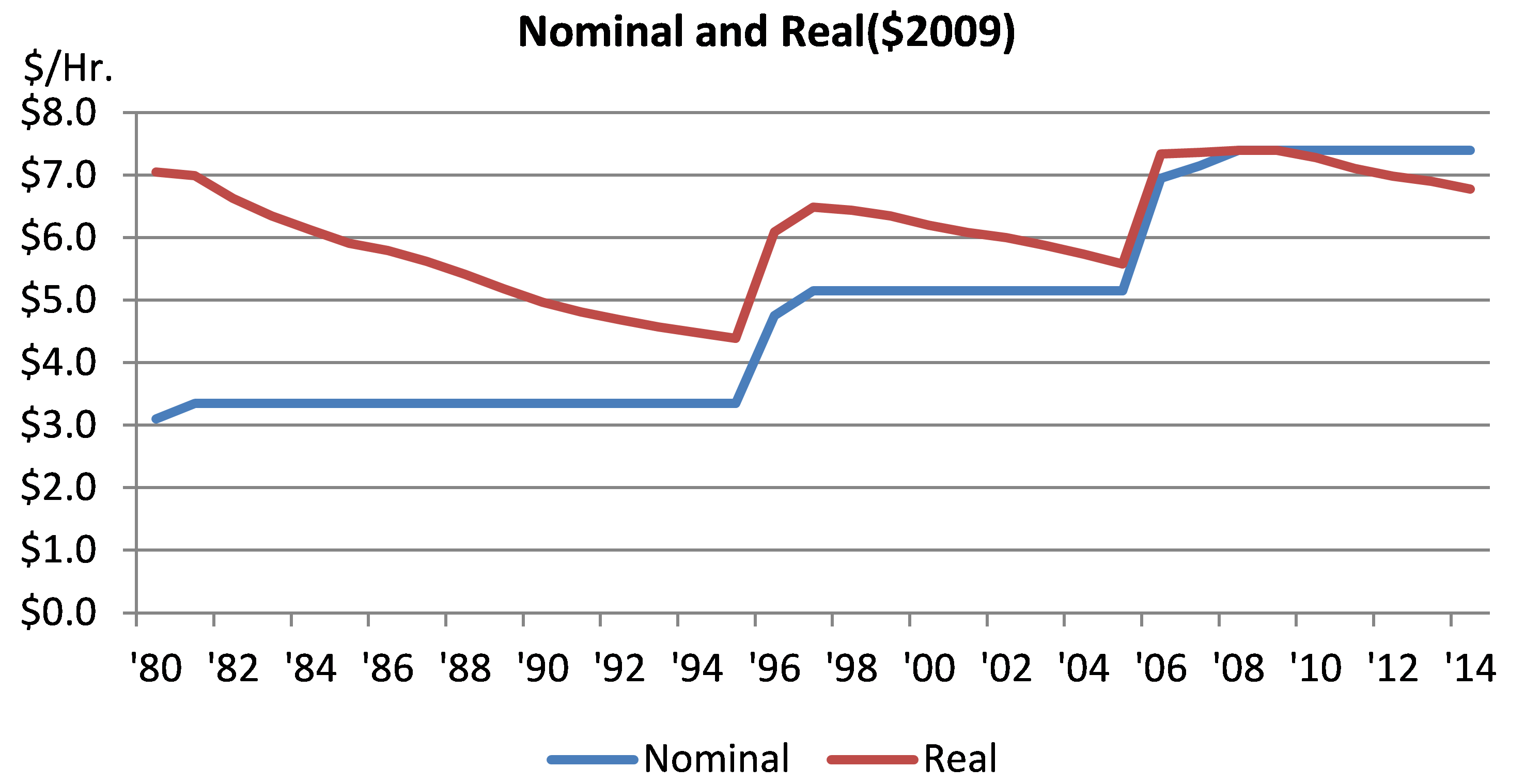

Since 1980, Michigan workers have seen the minimum hourly wage increase only six times. Chart 1 shows Michigan’s minimum wage in both nominal and real terms from 1980 through 2014.

Chart 1. Michigan minimum wage

After adjusting for inflation, using the personal consumption expenditures (PCE) price index, the minimum wage for 2014 comes out to $6.78 per hour, which is below 1980’s real hourly wage of $7.05 per hour. Throughout the years, increases in the minimum wage have repeatedly done no more than to return the real wage back to where it was in 1980, only to see it fall behind again as inflation ate away at the purchasing power of minimum wage workers. The biggest decline in purchasing power occurred during the 15 years between 1980 and 1995, when the real minimum wage fell by 38%.

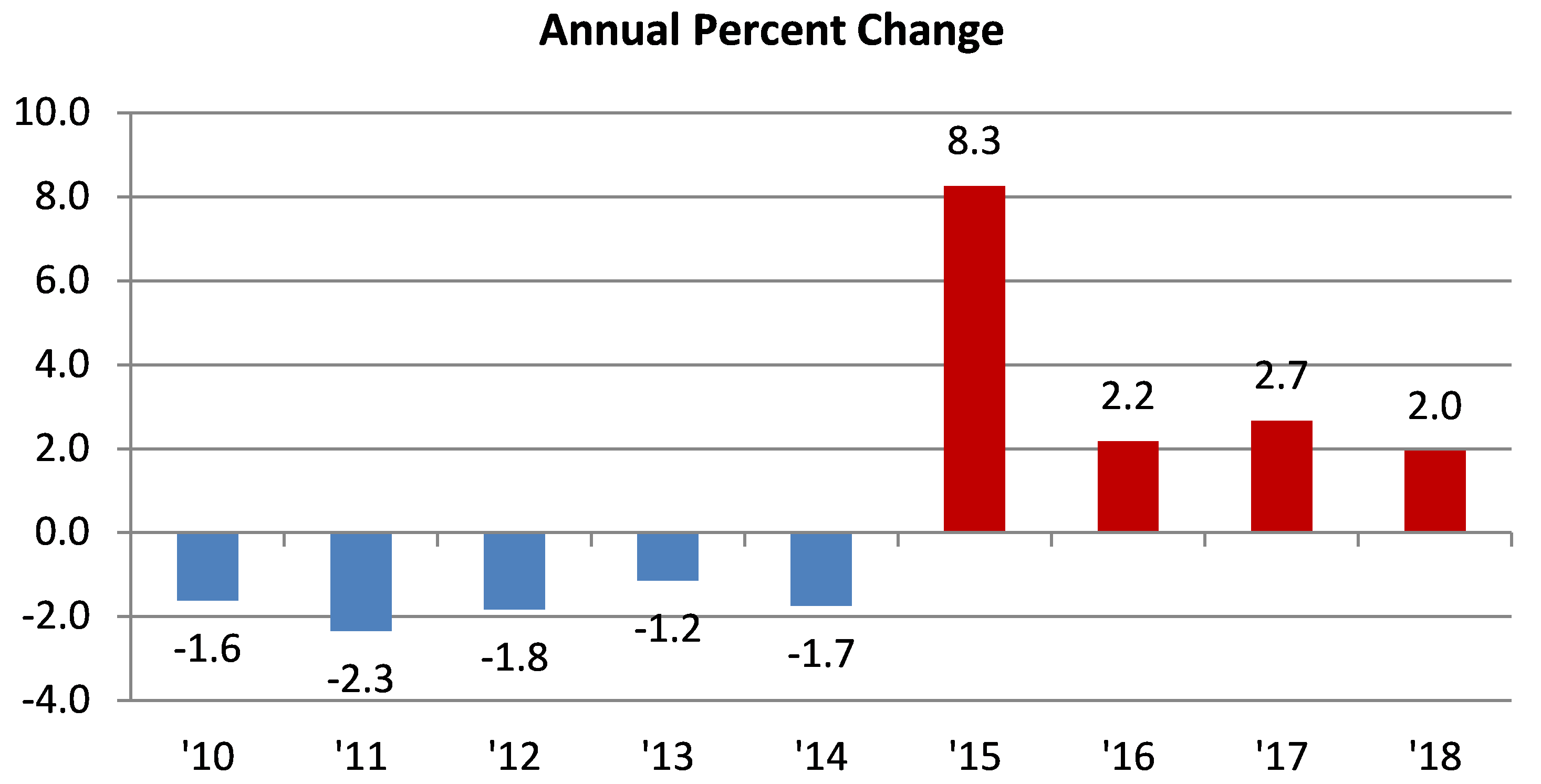

One of the biggest complaints about the new minimum wage is that it will hurt small business owners the most. Because higher wages will increase the cost of labor and business owners may not be able to pass all of the increased cost on to their customers, their profits may be adversely affected. Some business owners say that in response to their declining profit margins, they will be forced to cut back on employee hours worked or the number of employees in total. Chart 2 below shows the annual percentage change in the new minimum hourly wage adjusted for inflation. The wage is adjusted using PCE price index estimates of 1.8% for 2014–15 and 2.0% for subsequent years. At first glance, it looks as if wages are going to increase substantially, increasing 8.3% the first year.

Chart 2. Real Michigan minimum wage

In purchasing power terms, Michigan’s real minimum wage has fallen more over the past three decades than it has increased. The new legislation will increase the real minimum wage by 2018 (give the above-mentioned assumptions) to an estimated $7.85 in 2009 dollars, which is equal to a compound annual growth rate of 0.3% since 1980. So one way to look at the most recent increase in the minimum wage is that it will bring the real wage back to where it was 35 years ago. Going forward, the wage is tied to inflation or 3.5% (whichever is lower), helping to a somewhat stable real income for minimum wage workers and protecting their buying power in the process.

Footnotes

1 David Baily, Karen Pierog and Mary Wisniewski, 2014 “Michigan, in bipartisan move, raises minimum wage”, Reuters, chicagotribune.com, May 27, 2014.