Driving Indiana’s and Michigan’s Economic Performance

The Midwest economy is lagging the U.S., but some states are doing better than others. These differences may help us understand the reasons for the region’s lagging economy.

Last week in Indiana, I presented some evidence that the entire region is growing more slowly than the nation. Payroll job growth in our Seventh Federal Reserve District is up only 0.6% for September from one year earlier, versus 1.6% in the nation. In some respects, this performance is not surprising since, nationally, manufacturing jobs are still declining (down 1% year over year through September), and the Midwest’s economy is steeped in manufacturing. In addition, the region’s economy is bogged down by the structural change taking place in the automotive industry. Foreign nameplates continue to gain market share from the domestic automakers (previous blog). Since the foreign nameplate companies and their parts suppliers tend to locate in the South, jobs and income are seeping away from the Midwest.

In this regard, comparing the performance between Indiana and Michigan is telling. Though both states rank among the top 3 nationally in manufacturing concentration, the unemployment rate in Michigan stands at 6.1% in Michigan (Oct.) versus 5.4% in Indiana. Year over year, manufacturing payroll job growth is virtually flat in Indiana, but down over 3% in Michigan.

Table 1. Manufacturing payroll job growth

The economies of both states are automotive intensive, but Michigan to an even greater degree. Indiana’s automotive share dominates manufacturing inside the state, at 16%. But Michigan’s automotive sector accounts for 35% of its manufacturing employment. A weakening automotive sector, then, would be felt more sharply in Michigan.

On top this, the auto sector’s performance in Michigan has been worse. From 2001 to date, automotive jobs have fallen 24% in Michigan, compared to 8% in Indiana.

Indiana’s automotive performance is buffered by having a larger share of foreign auto parts and auto assembly plants than Michigan. According to senior economist Thomas Klier, 29% of automotive parts plants in Indiana are foreign owned, as are 2 of its 3 auto assembly plants.

Auto parts makers tend to locate close to their customers. In Indiana, the foreign-owned parts plants are more likely to supply parts to those automakers who are gaining market share—the foreign nameplates.

Michigan’s automakers are only 17% foreign owned; its only foreign owned assembly plant is the Mazda plant, versus its 15 domestic auto assembly plants.

If the current shifts in market share among automakers continue, it will be imperative for Michigan’s economy to attract investments from the successful auto suppliers and auto assembly companies.

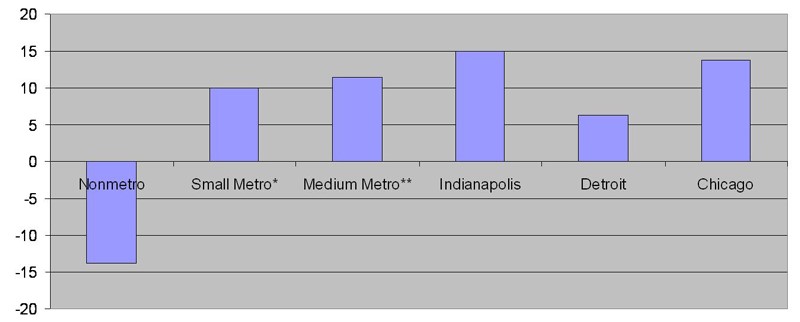

Other performance differences between Indiana and Michigan are intriguing, though one cannot draw any hard conclusions. The chart below illustrates the population growth of the largest metropolitan areas in each state—Indianapolis and the Detroit MSA. Indianapolis’ population growth has exceeded the surrounding areas, and far exceeded that of the Detroit metro area.

Figure 1. Midwest population growth, 1990-2003 — percent change

In searching for explanations, manufacturing concentration again comes to mind. As recently as 1969, only 26% of Indianapolis’ overall employment was manufacturing, versus Detroit’s 35%. Generally speaking, “factory towns” have had the roughest road in restructuring. As manufacturing employment shrinks, such cities must re-employ larger shares of their work force in new industries and activities. Otherwise, workers move from the area and create a different set of challenges to the town governments. That is, how to efficiently use and maintain their current roads and buildings for a less populous (and sometimes less wealthy) population.

Governance structures may also explain some of the challenges. Central city Detroit has been buffeted by job, population, and income flight, with concentrated poverty left in the wake. Detroit city leaders have been unable or unwilling to climb above the city’s fiscal problems to re-build its economy. To what extent has this failure come about because the central city was isolated from the rest of the metropolitan area (and state), and left to solve profound problems with its own (meager) resources?

Indianapolis and other cities have taken some modest steps in consolidating local governance to a closer fit with their metropolitan-wide economies. In the late 1960s, Indianapolis moved toward a “Unigov” structure. As Rick Mattoon discusses (working paper), the city’s boundary was expanded from 82 square miles to 402 square miles, with a legislative body responsible for governing the city. Though there remain many independent governments, taxing authorities, and school districts within the city, the consolidated city has six administrative departments below the mayor’s office.

Other Midwest cities with elements of regional governance include Minneapolis–St. Paul, which has a metropolitan sharing of property tax base. Columbus, Ohio, has not consolidated, yet its central city government has been aggressive in annexing land outward toward its interstate beltway. Both metropolitan economies have outgrown the broader Midwest.