Freight Movement Slows in January, While Freight Rates Remain High—Is it the Weather or Something else?

The severity of this winter season has had a noticeably negative impact on everything from retail sales to industrial production. Roadway freight operations are no exception.

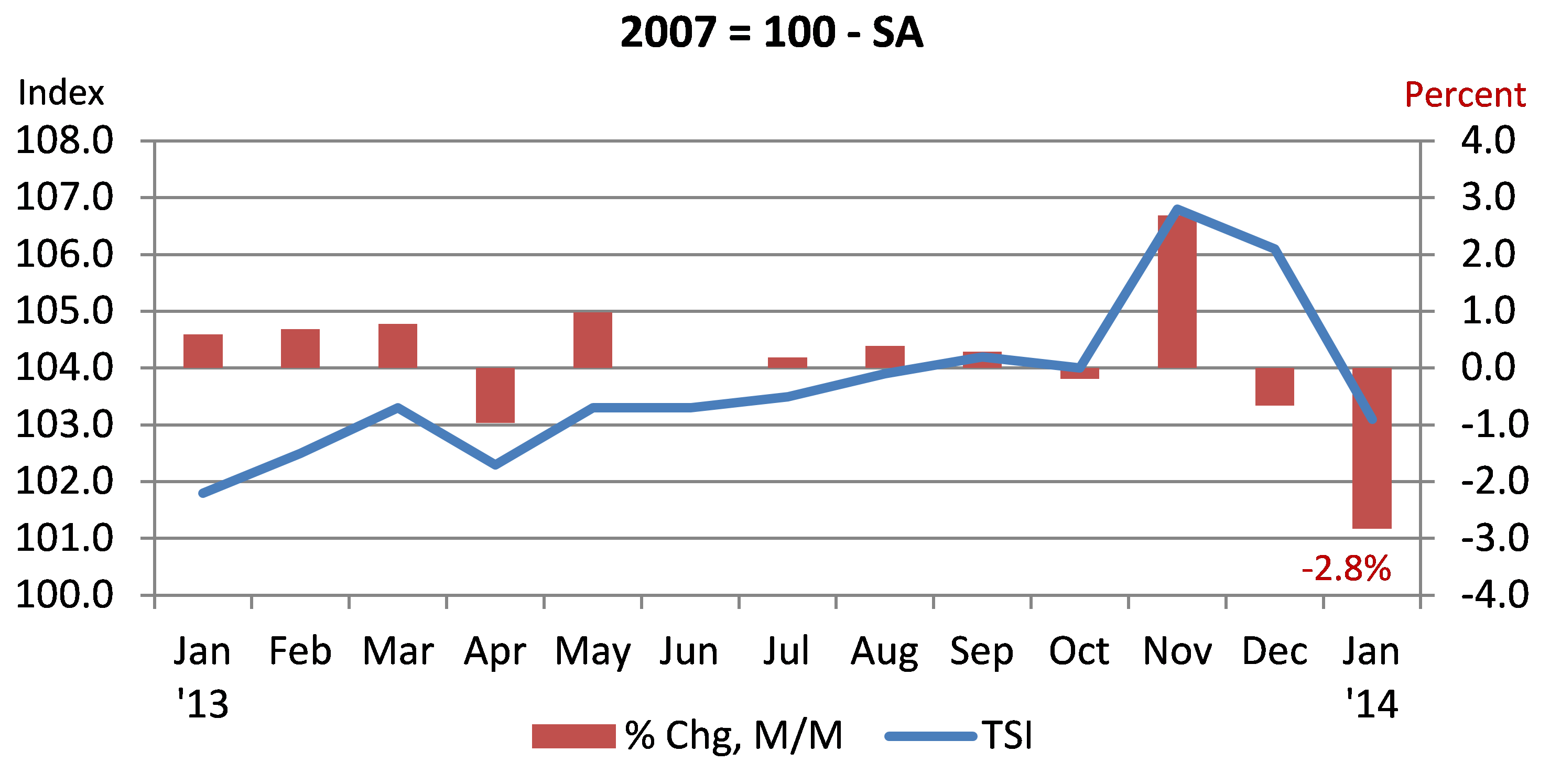

The effects of the extreme cold and heavy snow, which started last December and has continued into March of this year, seem to be showing up in some recent economic data on freight services. Chart 1 below contains the Transportation Services Index (TSI)1 for freight in the United States. The TSI contains freight data for most modes of freight transportation, including truck, rail, inland water, air, and pipeline. This index shows that on a seasonally adjusted basis, freight movement dropped in January by 2.8%. Since the data are adjusted for seasonality, the drop in January looks to be even more significant.

1. Transportation services index

Though all modes of transportation have been affected by this winter’s weather, trucking arguably experienced the worst of it. Many firsthand reports (including my own) have indicated that ice and snow shut down routes in states that do not normally face such harsh wintry conditions. Extremely cold weather also made the loading and unloading of trucks more difficult, causing delays and disrupting normal schedules.

This winter’s disruptions to trucking operations were also accompanied by price spikes. According to DAT Solutions, spot rates (excluding long-term contractual prices) for dry vans, which account for the majority of long-haul freight, are up 17.6% from October 2014. These price spikes could be partially due to the severe winter weather and may only be temporary; however, some evidence points to shifting fundamentals that may be contributing to rising cost trends in the industry. Since the U.S. economy reached the bottom of the Great Recession (in mid-2009), the U.S. Bureau of Economic Analysis’s producer price index for long haul truck-borne freight has climbed at an average annual pace of 3.9%.

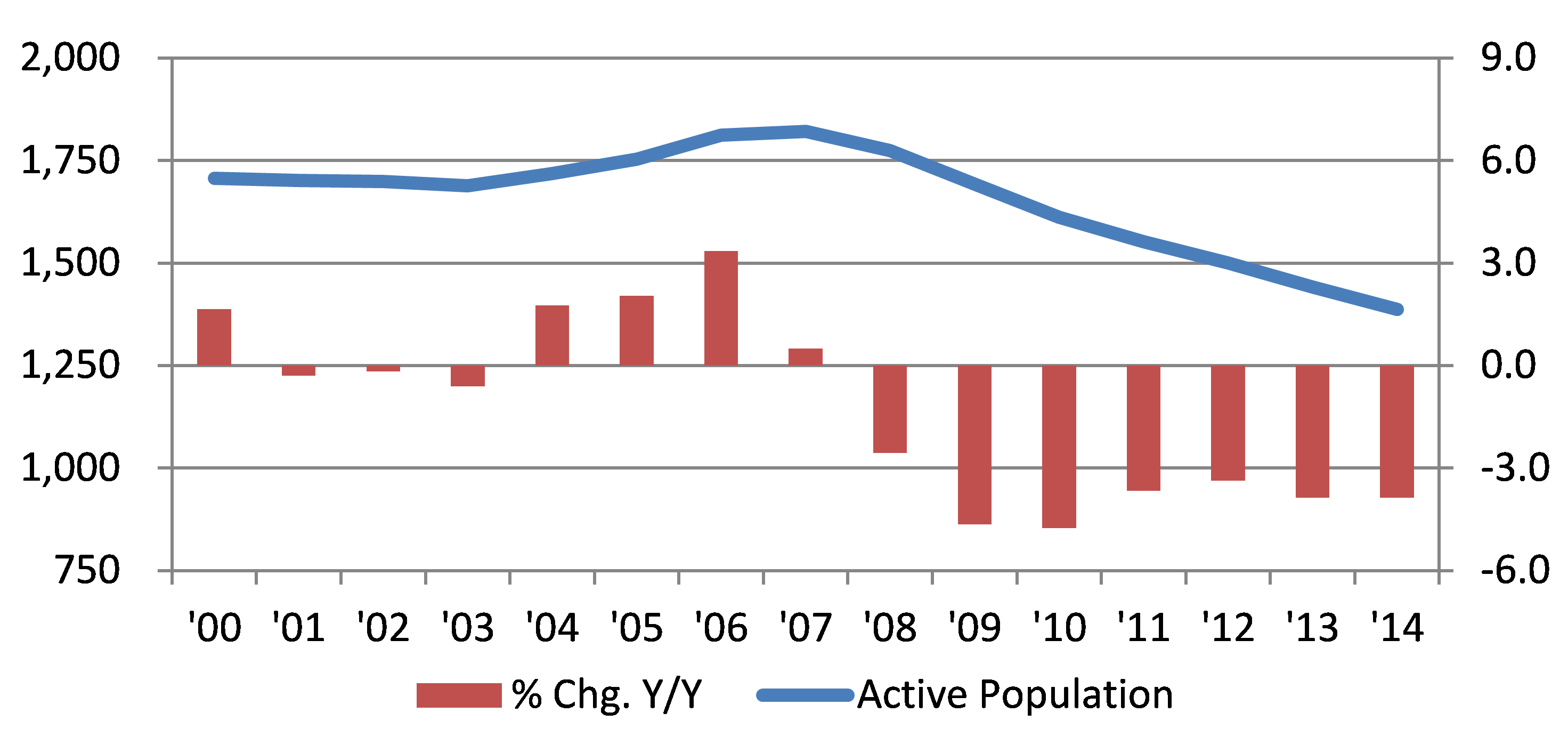

Many industry experts argue that tightening capacity together with rising costs in the trucking industry are driving up freight prices. As chart 2 shows, according to ACT Research, the so-called active population of heavy-duty (class 8) trucks has been declining steadily since 2007, even while the economic recovery has been ongoing.

2. Heavy duty trucks active population

ACT Research defines the active population of trucks as those trucks still in service that are 15 years of age or younger. The reason for this distinction is that once a vehicle reaches 15 years of age, it becomes much less likely to be used for hauling meaningful amounts of freight over long distances. So, at the same time the number of freight loads has been increasing on account of the recovering economy, the number of trucks available to carry those loads has been declining.

Another factor affecting freight rates has been the significant increase in truck prices. Truck prices started increasing in 2002 because of federally mandated diesel emission standards that required the costly development of new engine technologies. ACT Research analysts contend that since 2002 the cost of meeting these standards has added an estimated $30,000 to the cost of a new truck—a price increase of about 31%. Rising prices for new trucks have, in turn, made used trucks more attractive, causing their prices to go up as well. The average price for a used class 8 truck was higher in January of 2013 than ever before.2

There is yet another factor that is likely to drive up costs for the trucking industry: the projection for a severe shortage of qualified truck drivers. The effects of the shortage, which has been in the making for some time, were somewhat mitigated during the most recent economic downturn. Since then, as freight activity has recovered, the driver shortage has become a more serious problem. A shortage of drivers, coupled with fewer trucks on the road, has tightened freight utilization rates, which are said to be approaching uncharted territory: Some estimates now have capacity utilization rates in the trucking industry in excess of 95%.

If, as I would argue, the recent slowdown in freight activity is due primarily to the severe winter weather, then missed deliveries will need to be managed. But this will not be easy. In the trucking industry, backlogs can be difficult to make up because there is only so much the trucking industry as a whole can ship—and only so much any one truck can haul (due to legal weight limit restrictions on most highways). Making up for the backlogs will result in added demands on a truck fleet that is already running at near-full capacity.

Based on this analysis, it doesn’t look like freight rates will be coming back down any time soon, especially if the economy keeps improving. As businesses moved to optimize their supply chains with techniques such as just-in-time inventory,3 freight has taken on an increasingly important role in their production processes. As a percent of total logistics expense for private business, trucking-related costs comprise 77.4% of transport costs and 48.6% of total logistics spend.4 Accordingly, when real gross domestic product (GDP) increases by 1%, some analysts estimate that the truck transportation needed to bring this about increases by 2 to 3%.5 Should the demand for hauling freight by truck grow dramatically, the trucking industry’s capacity would be strained under the current circumstances. When trucking capacity is strained, prices for those freight hauls that are not under long-term contract can jump. Given the changing fundamentals to the trucking industry discussed previously, some analysts argue that the recent price spikes for shipping freight via trucks will ultimately work their way into long-term contractual prices for hauling freight (which are predicted to reset throughout the year). Some estimates have the increase for contractual freight in the coming months to be in the range of 4% to 6%.

Rising capacity utilization for the trucking industry, increases in the costs of new trucking equipment, higher demand for qualified truck drivers, and a declining number of heavy-duty trucks in operation are some of the reasons that freight prices are on the rise. North American heavy-duty truck production is increasing to meet demand, but recently announced fuel economy standards will continue to add costs to the production of new vehicles—and, in turn, increase their sale prices. So while rising freight rates have historically been a good predictor of improved economic activity, there are other factors at work driving up rates at this time. It remains to be seen how all of this will affect consumer prices, but if these expected freight rate increases cannot be readily absorbed, they will have some impact on the consumer. For these reasons we will be keeping an eye on freight and freight rates in the months ahead—long after the snow has melted.

Footnotes

1 Truck transportation makes up a significant portion of the Transportation Services Index (TSI), accounting for 40% of the data used.

2 Newscom Business Media Inc., 2014 “Used Trucks Cost More than Ever Before”, Today’s Trucking, February 27.

3 Just-in-time inventory is an inventory strategy employed by firms to increase their efficiency and decrease waste by receiving goods only as they are needed in the production process; this strategy reduces costs associated with carrying large inventories (of raw materials or finished goods, such as cars).

4 Dan Gilmore, 2013 “State of the Logistics Union 2013”, Supply Chain Digest, June, 20, 2013.

5 Jeff Berman, 2014 “Truckload capacity trends in 2014 are worth watching, say industry stakeholders”, Logistics Management, Jan. 10, 2014.