Autos: A Further Loosening of the Manufacturing Belt?

This year’s Nobel Prize in Economics was awarded to Paul Krugman for his insights into spatial concentration of economic activity and the relationships among industry clusters, firm or industry-specific economies of scale, and patterns of international trade. In illustrating the flavor of his theoretical work at his Nobel Prize lecture, Krugman explained the surprising prevalence of worldwide trade among goods within the same general product category. Such trade can arise from acute economies of scale in production that are achieved by firms or industries that produce slightly differentiated products. If accompanied by the ability to easily transport and widely export its products, the location of a firm’s product or of an industry’s production will often become quite concentrated and rooted in particular countries or regions. By way of illustration, the 1860-1970 era of Midwest-Northeast dominance in manufacturing was said to arise from vast scale economies of mass production that came into play during the 19th century, accompanied by sharply lower transportation costs (via railroad) which allowed the manufacturing belt to export its wares to other U.S. regions and to the world. Krugman ended the lecture by discussing how the manufacturing belt had finally been shifting away from the Midwest, most recently the automotive segment. To do so, Krugman drew on the work of our Bank’s Thomas Klier.

In a series of journal articles and a recent book, Klier has been documenting and explaining this shifting geography of the North American automotive industry. Such work helps us to understand the situation of the “Detroit” automotive industry today, as does the more general spatial clustering of some industries and firms that has been observed by Paul Krugman and others.

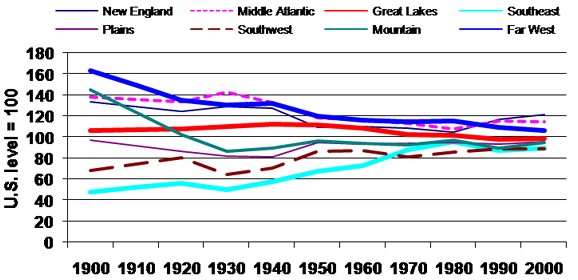

Today in the industrial Midwest, we lament the tarnished star of wealth and income that once elevated our region’s standards of living above those of many other regions. During the glory years of Midwest manufacturing, the Great Lakes region’s share of manufacturing was phenomenally high relative to its population share. The chart below illustrates the rise and sustained dominance of manufacturing activity in the region. It is remarkable that the region sustained this high share of manufacturing, and high per capita income (shown below), even while population was ebbing away to the South and West.

1. Great Lakes share of U.S.

2. Regional per capita personal income indexed to U.S. (1990-2000)

Per Krugman, manufacturing gained a foothold here as profound economies of scale in industries such as steel and meat packing grew rapidly, along with the ability to export these goods by rail. William Cronon documents these transport advantages for 19th century Chicago for meat packing, farm machinery and lumber in his celebrated book, Nature’s Metropolis. Manufacturing also thrived here due to ready access to abundant natural resources and energy inputs to production, along with the ability to feed, house and transport a large work force to work site factories in the cities.

Once established, the spatial proximity of firms and related industries helped to sustain the region’s manufacturing dominance, as the totality of these firms and industries became greater than the sum of their parts. That is to say, the Midwest’s manufacturing sector became highly productive in part because firms and their suppliers bought and sold to one another in close proximity. Steel makers sold to machinery producers; machinery producers sold to car and truck makers; car and truck makers sold to both steel and machinery producers. These efficiencies played out at much finer detail among many highly specialized suppliers and producers. In this way, transportation costs were minimized and economies of scale and scope were realized within the tight agglomeration of the manufacturing belt. So too, not unlike Silicon Valley of today, mutual proximity created a sharing and dissemination of new ideas and technology that gave producers a leg up in locating within the Midwest.

Klier has researched these spatial relationships within the Midwest automotive industry—both parts and finished vehicles. For much of its history (but with several major eras that either stretched or compacted its geography), North American automotive production has clustered in Michigan and neighboring states, enjoying the insulating benefits of great economies of scale in mass production and mutual proximity of parts suppliers within the industry, as well as proximity to Midwest steel making, machine tooling and other key industries … all the while enriching generations of automotive workers.

Of course, things look very different today, as the Detroit 3 automakers struggle to remain viable in an era of increased competition for dwindling consumer dollars. In part, competition has shaken loose the original industry and its Midwest geography as imported autos finally broke through into the U.S. consumer market during the 1970s gasoline crisis. Foreign-domiciled competitors have since chosen to produce autos on U.S. soil, though not exactly with the same geographic footprint as the original Detroit 3 auto makers. In their recent JRS article, Klier and coauthor Dan McMillen document how the older spatial cluster of automotive parts makers has been giving way to a re-fashioned but densely configured auto cluster sited further South.

This shift in location raises some questions: How do we explain this shift southward? Could (or should) anything have been done about it? Can anything be done about it now? No doubt the cost advantages of spatial proximity and the early economies of scale in automotive manufacturing were highly advantageous. At the same time, however, the very success and unchallenged structure of the domestic industry may have failed to keep the region’s institutions, policies and companies sharp and competitive.