Manufacturing in the Seventh District: Agriculture, Construction, and Mining Machinery

As discussed regularly in this blog, manufacturing has long played an important role in the Midwest economy. One of our most prominent manufacturing sectors is agriculture, construction, and mining machinery. This industry’s products are the large machines that plow fields and harvest crops, tear up and repave roads, dig mines and rescue miners. To define the sector specifically, we use the Census Bureau NAICS code 3331.

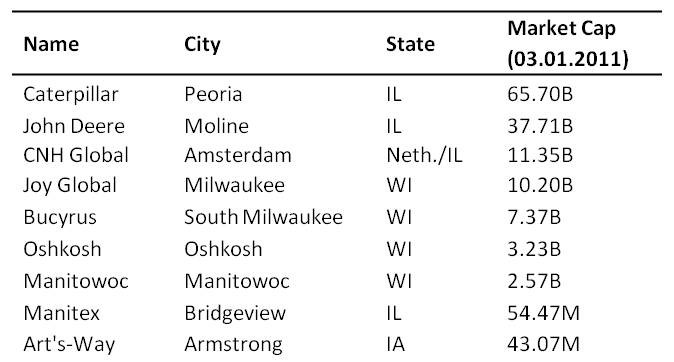

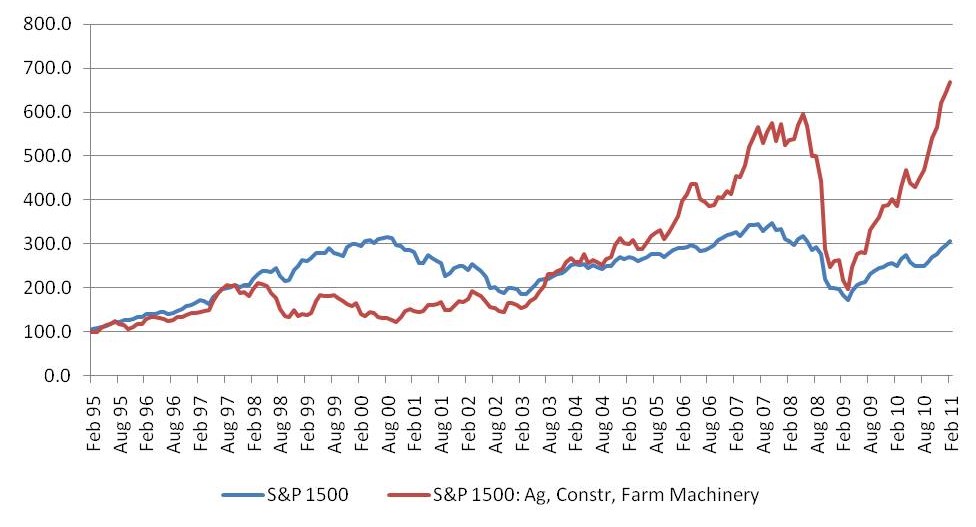

Two companies headquartered in the Midwest are such household names that you may have played with toy replicas of their products as a child–earth moving equipment maker Caterpillar and farm tractor and harvester maker John Deere. These two companies are the Midwest’s largest in the sector by market capitalization and revenue. As measured by company value, the agriculture, construction, and farm machinery industry has experienced a significant recovery since the financial crisis in 2008. Stock prices for all the sector’s companies based in the Midwest are near their 52-week highs and above their 2008 peak. From a low at the beginning of 2009, the S&P agriculture, construction and machinery index has dramatically outpaced the growth of the overall economy. In addition to the two heavy hitters mentioned earlier, the Midwest is home to a number of other companies, both public and privately owned, with a significant presence in this sector.

Table 1. Companies headquartered in the Midwest

Chart 1. Stock price indices

A couple of the publicly traded companies overlap with other sectors: Oshkosh also manufactures defense and fire & emergency equipment; Manitowoc also manufactures food service equipment.1

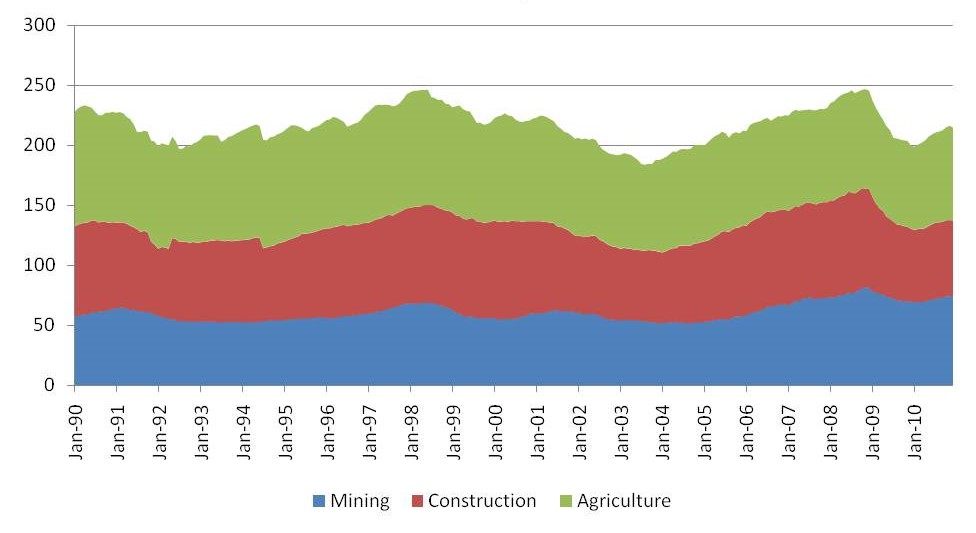

Like company stock prices, industry employment grew steadily until the financial crisis in 2008 and fell significantly in the aftermath. Employment began recovering in 2010, but is still 32,000 below the 2008 peak. Jobs are spread relatively evenly among the three subsectors. In December 2010, mining accounted for 35% of the sector’s total employment, construction 29%, and agriculture 36%.

Chart 2. U.S. 3331 employment (thousands)

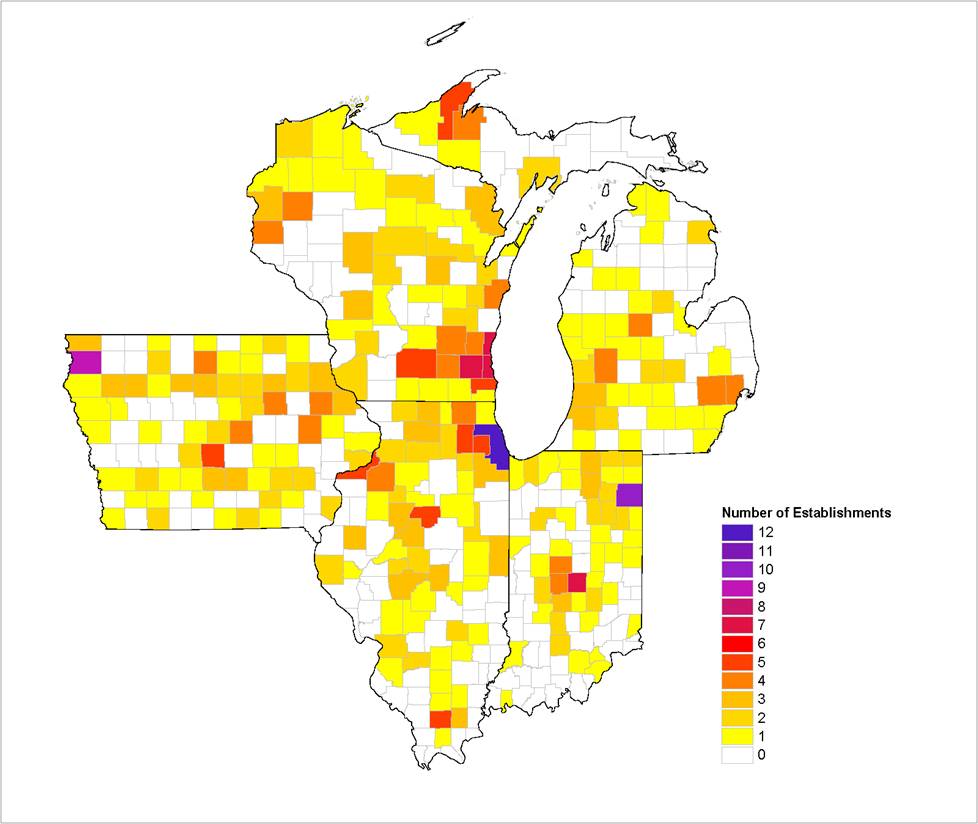

According to the U.S. Department of Commerce, there are over 500 manufacturing establishments for the sector in the Illinois, Indiana, Iowa, Michigan and Indiana. The counties that are part of major metropolitan statistical areas or MSAs have notable concentrations of establishments, but the map below shows that manufacturing establishments are well distributed throughout the region. Some rural counties have a relatively large number of establishments, such as Sioux County in northwest Iowa and Houghton County in Michigan’s western Upper Peninsula.

Map 1. Number of establishments

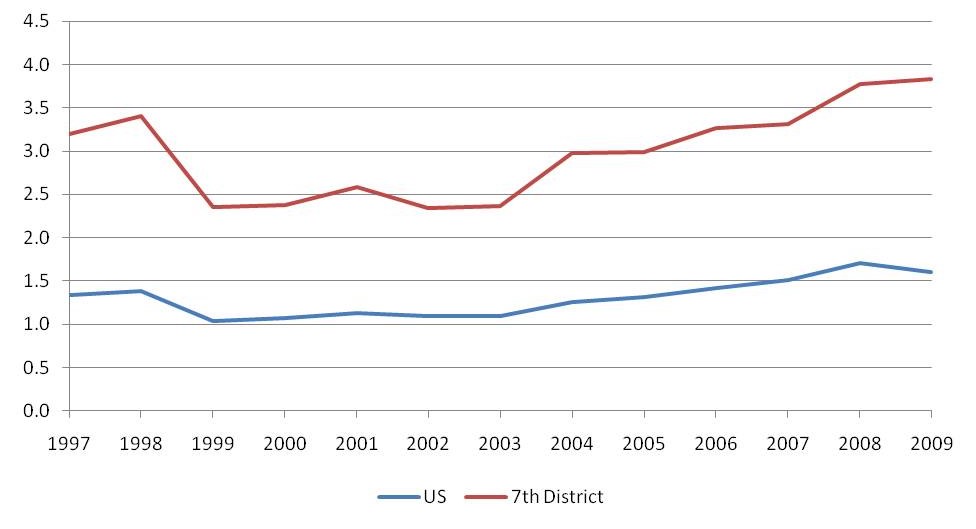

The construction, mining, and agricultural machinery sector is an important part of all manufacturing in the Midwest. In terms of value-added by this sector to total manufacturing activity, in 2009 the sector contributed 1.6% to total U.S. manufacturing and 3.8% to Midwest manufacturing.

Chart 3. 3331 share of value added for all manufacturing (percent)

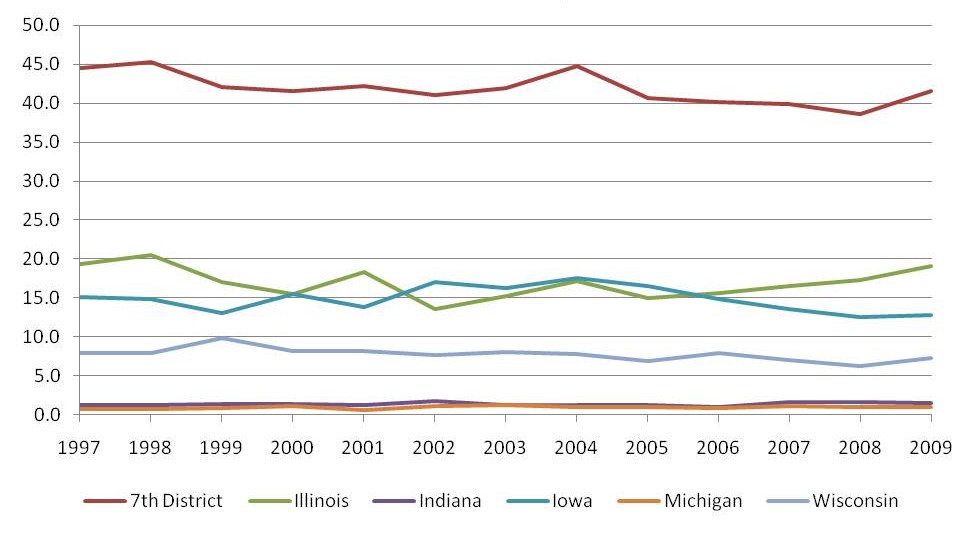

Within the sector, a significant proportion of manufacturing takes place in the Midwest. In 2009, almost one-third of all employees in the sector worked in the Midwest and just over 40% of the value added by the sector came from the Midwest. The sector’s footprint is largest in Illinois and Iowa, but Wisconsin makes a significant contribution as well.

Chart 4. Share of sector value added for the U.S. (percent)

In spite of its relatively small population, Iowa is the second largest producer of construction, mining, and agriculture machinery in the Midwest. For this reason, the industry is particularly important to Iowa in per capita terms. In 2009, more than 6 in 1,000 Iowans were employed by the sector–more than four times the regional average of 1.5 and ten times the national average of 0.6.

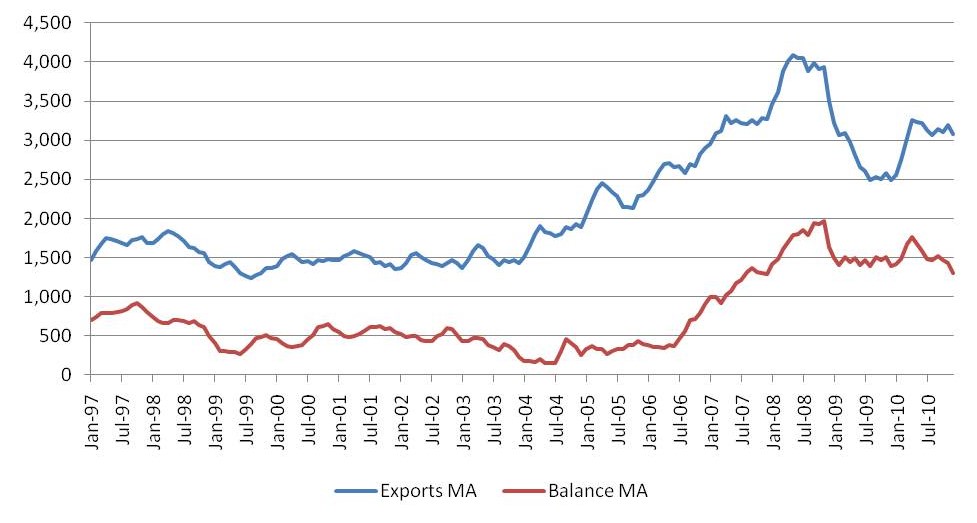

As reflected in recent trends, future prospects are bright for growth in the agriculture, construction, and mining machinery industry. Emerging economies such as China and India are continuing to experience significant economic growth, thereby lifting demand for machinery. With the growth of emerging economies, exports from the U.S. are becoming increasingly important. Beginning in 2004, exports for the U.S. industry increased by about 20% annually until the financial crisis of 2008. The parallel increase in the balance of trade provides further evidence that exports became an increasingly important part of industry growth between 2004 and 2008. While exports took a significant hit in 2009, they have recovered somewhat in 2010, and the trade balance is still well above levels in the early 2000s.

Chart 5. U.S. 3331 trade ($millions)

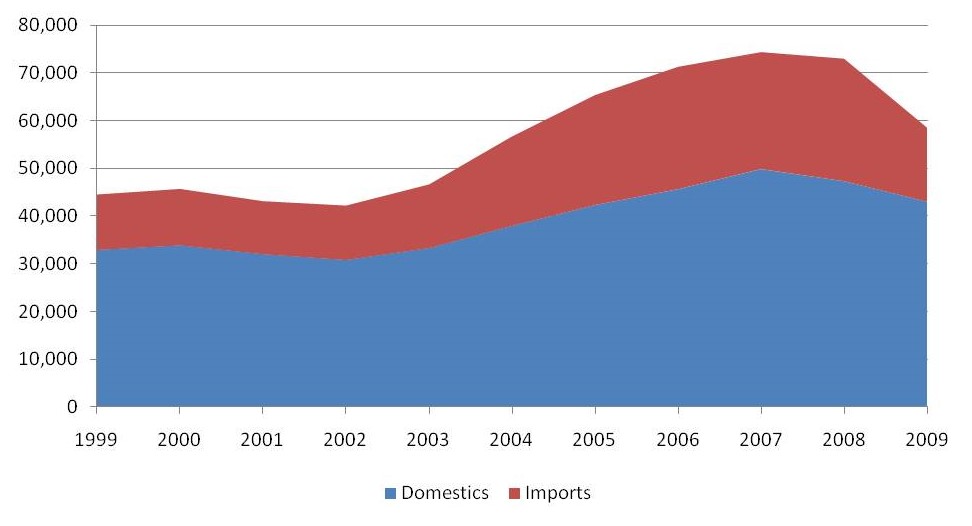

Producers of agriculture, construction, and mining machinery also serve a large U.S. market. Domestic sales in 2009 totaled nearly $60 billion; and domestic manufacturers hold a significant proportion of that market—73.6% in 2009.

Chart 6. U.S. 3331 purchases ($millions)

Companies based in the Midwest have a presence outside North America to varying degrees. For companies that reported such figures in their annual reports, an average of 45% of revenue came from outside North America in 2010. Not all of that foreign revenue is from exports because production often takes place outside the US. For example, using data from Caterpillar’s 2010 midyear report and fourth quarter 2010 earnings release, 45 % of their employment is U.S. based.

Among Midwest states, industry exports are most important to Illinois, representing 42.4% of sales, just below the U.S. average of 43.3%. For the Seventh District states, exports make up 31.0% of sales.

Footnotes

1 Aside from company financial data, the descriptive data to follow covers only the particular establishment sites that are primarily engaged in manufacturing products in the sector, whether the establishments are owned by public or private companies.