New Survey-Based Activity Indexes

In a recent Chicago Fed Letter, Scott Brave and Thomas Walstrum discuss a business conditions survey that the Chicago Fed has been conducting in conjunction with the Beige Book since March 2013. To measure economic activity in the Seventh District, they construct a set of diffusion indexes based on survey responses (which are explained in greater detail in the article itself). Brave and Walstrum then compare their diffusion indexes with the Institute for Supply Management’s (ISM) purchasing managers’ indexes (PMIs) and the Chicago Fed’s Midwest Economy Index (MEI), and demonstrate how the anecdotal evidence collected for the Beige Book can often be helpful in understanding pivotal or special economic events.

Survey respondents come from all of the major industries in the Seventh Federal Reserve District, with manufacturing contacts composing the largest subset. Respondents are asked to rate the performance of their respective businesses on a seven-point scale in a series of questions covering the demand for their products or services over the past four to six weeks relative to the previous four to six weeks. A series of diffusion indexes are then calculated from the survey responses that are intended to capture changes in the prevailing direction of regional business conditions.

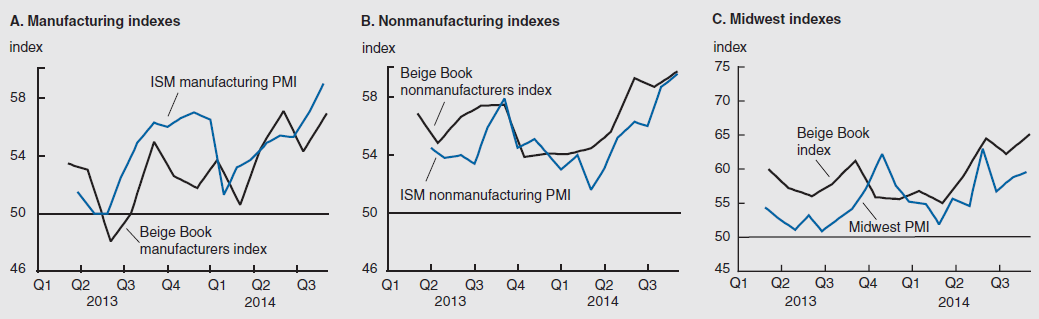

The figure below compares Brave and Walstrum’s Beige Book indexes against similar measures produced by the ISM. The ISM’s indexes are also calculated using a survey-based methodology allowing the authors to compare their survey responses for manufacturers and nonmanufacturers with the ISM’s national manufacturing and nonmanufacturing PMIs, as well as with a Midwest PMI (taken by averaging the ISM’s PMIs for Chicago, Detroit, and Milwaukee). Brave and Walstrum cite the strong correlation observed between their Beige Book diffusion indexes and the ISM’s national PMIs in the figure, suggesting that their indexes are capturing very similar business conditions. They also note that there may be some evidence that their Beige Book index leads the Midwest PMI.

Chart group 1

Sources: Authors' calculations and Institute for Supply Management data from Haver Analytics.

The authors next examine the ability of their main Beige Book index (covering both manufacturers and nonmanufacturers) to predict non-survey-based measures of economic activity by comparing them with with the MEI—a monthly weighted average of Midwest economic indicators measured relative to a trend rate of Midwest economic growth. To compare the Beige Book index with the MEI, the authors adjust their Beige Book index to be relative to survey respondents’ trend (or average) responses. Their analysis comparing the two indexes suggests that their Beige Book index may slightly lead the MEI in capturing changes in the direction of regional economic activity. Brave and Walstrum also describe two recent instances where anecdotal information collected for the Beige Book was useful in this regard: 1) discerning whether the slowdown in economic growth in the first quarter of 2014 was likely to be a temporary setback and 2) capturing the recent pickup in activity in regional labor markets.

A more detailed description of the survey and index methodologies can be found here. The authors note that they continue to study the potential applications of their survey and diffusion indexes, with the intention to make their results publicly available in the future.