First Quarter Review—A Good Start to the Year for the Seventh District

Summary: Growth in the Seventh Federal Reserve District picked up from an already healthy pace during the first quarter of 2018, with almost all indicators pointing to above-trend growth. The manufacturing sector was doing especially well, with good results spread across manufacturing subsectors. Outside manufacturing, most sectors returned to about trend growth, up from a lull that bottomed out in the summer of 2017. Overall positive outlooks for both the U.S. and global economies suggest that the Seventh District economy will continue to do well in the near term.

Now let’s look at the economic indicators that support this analysis.

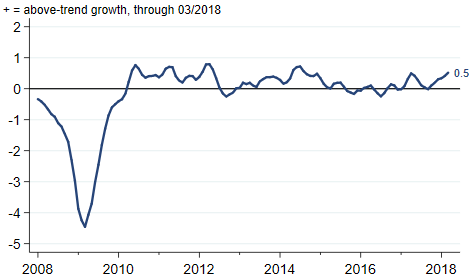

The March Midwest Economy Index (MEI), which summarizes over 100 state and regional economic indicators for the Seventh District, indicated that the pace of growth steadily picked up from a lull in the summer of 2017 (figure 1).

1. Midwest Economy Index

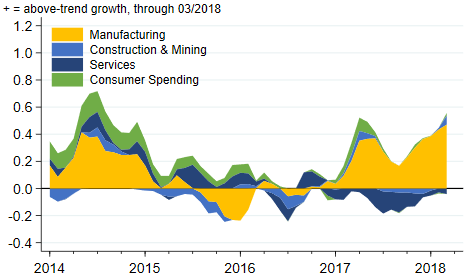

If we look at the sectors that make up the MEI (figure 2), we can see that the success of the manufacturing sector almost entirely explains the strong overall MEI reading at the end of the first quarter. The remaining three sectors were all at about trend growth.

2. Midwest Economy Index sectoral contributions

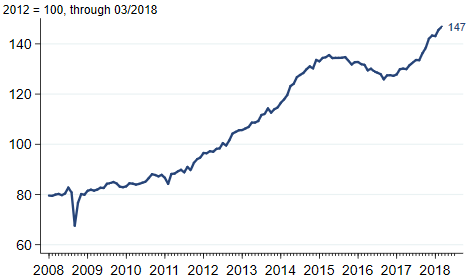

Why has manufacturing done so well? As I’ve been noting for a while, widespread growth across the world and rising output in the oil and gas industry appear to be the answers. The March reading of the J. P. Morgan Global Manufacturing & Services PMI (purchasing managers’ index) indicated that in spite of a downward spike, global growth remained solidly in expansion territory (figure 3). Meanwhile, U.S. oil and gas production continued to trend upward (figure 4).

3. J.P. Morgan global manufacturing & services PMI

4. Industrial production index for oil and gas extraction

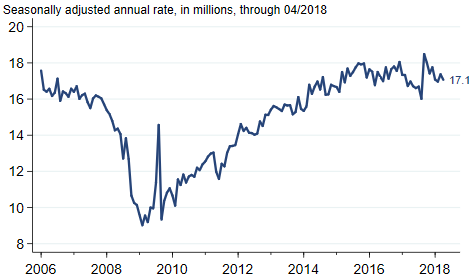

The auto industry had a good start to the year (figure 5). Forecasters generally expected 2018 sales to be slightly below 17.0 million light vehicle units, but sales in the first quarter came in at a 17.2 million unit seasonally adjusted annual rate.

5. Light vehicle sales

In spite of some concerns about disruptions to international trade (we discuss the steel and aluminum tariffs here), 2018 is shaping up to be a good year.