How do the Chicago Fed’s business contacts expect the steel and aluminum tariffs to affect their businesses?

On March 1 of this year, the Trump administration announced its intention to implement import tariffs of 25% on steel and 10% on aluminum. The tariffs went into effect on March 23. At the moment, a number of our major trading partners are excluded from the tariffs: For the time being, Canada, Mexico, the European Union (EU), South Korea, Argentina, Australia, and Brazil are among those that do not face the tariffs. And while a number of factors affect commodity prices, prices in the Midwest are about 11% higher for steel and 7% higher for aluminum since President Trump’s March 1 announcement.

How might the steel and aluminum tariffs affect businesses in the Midwest? We asked our business contacts about that in the most recent Chicago Fed Survey of Business Conditions (CFSBC).

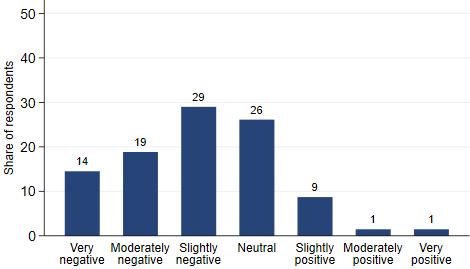

We first asked contacts across all sectors about how they expected the tariffs to affect their firms. Figure 1 shows that almost two-thirds expected a negative effect. There were three major reasons for our contacts’ negative outlooks: 1) They did not expect to be able to pass along higher input costs to their customers; 2) they expected that raising their prices would reduce demand for their firms’ products; and 3) they expected slower growth in their local economies because they host steel-consuming industries.

1. Impact of steel and aluminum tariffs on firm

Source: Federal Reserve Bank of Chicago.

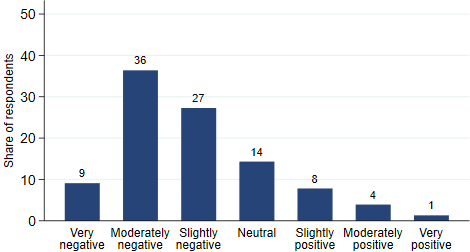

We next asked our contacts about how they expected the tariffs to affect the U.S. economy. Figure 2 shows that nearly three-quarters anticipated the tariffs would have a negative effect. Many who expected the tariffs to have a negative effect argued that while steel producers would benefit from higher prices, steel consumers would be hurt—and that the benefits to producers would be smaller than the costs to consumers. A prominent view of those who expected a positive effect was that the tariffs would put the U.S. in a stronger bargaining position during ongoing international trade negotiations.

2. Impact of steel and aluminum tariffs on US economy

Source: Federal Reserve Bank of Chicago.

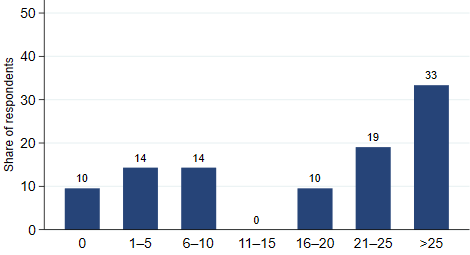

Because the manufacturing industry is the sector most directly consuming steel and aluminum in the U.S., we asked our manufacturing contacts a couple of more detailed questions about how they expected the steel and aluminum tariffs to affect their bottom lines. We first asked manufacturers to estimate what share of their input costs are for steel, aluminum, or steel or aluminum products. Figure 3 shows that the shares varied widely, though a third indicated that steel or aluminum inputs constituted more than 25% of their costs.

3. Manufacturers: Share of spending for steel, aluminum, or steel or aluminum products

Source: Federal Reserve Bank of Chicago.

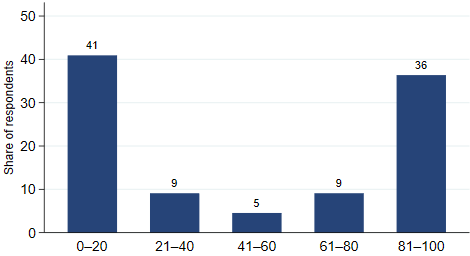

We next asked manufacturers whether they expected to be able to pass on higher steel and aluminum costs to their customers. Figure 4 shows that in general, firms expected to be able to pass along either almost all of the higher costs or almost none of them. Typically, the firms that didn’t expect to be able to pass along the higher costs didn’t spend much on steel or aluminum.

4. Manufacturers: Share of added expenses able to pass on to customers

Source: Federal Reserve Bank of Chicago.

How will the steel and aluminum tariffs affect businesses in the Midwest? Our survey results suggest that the effect will be negative more often than positive because most businesses here are steel and aluminum consumers, not producers. Our results also suggest that the costs of the tariffs will be shared between businesses and consumers, as some businesses will be forced to absorb the higher costs (leading to tighter profit margins), while others will pass on higher costs to their customers.