The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

The very first of these “essays on issues” (September 1987) spoke of the Midwest’s ordeal of change. Midwestern manufacturing had not only been lagging behind national output growth historically but had actually begun to decline around 1970. The 1980s began with back-to-back recessions in 1980 and 1981-82 that were particularly severe on Midwestern manufacturers. Then, after a promising auto-led economic recovery in 1983, the dramatic rise of the dollar dampened manufacturing activity around the nation by reducing U.S. competitiveness in international trade. Nonetheless, that issue of Chicago Fed Letter ended on a cautious note of optimism that economic change would lead to a more competitive Midwestern economy.

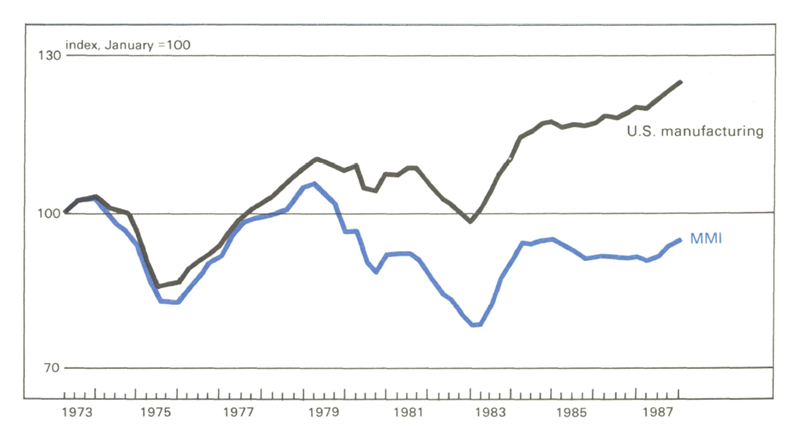

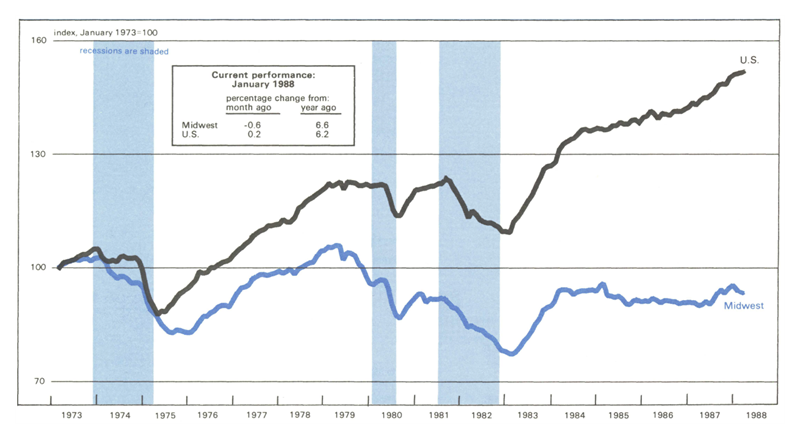

This issue of the Letter sounds a stronger note. Manufacturing activity, accelerating nationally in 1987, began to expand at an even faster pace in the Midwest than in the nation as a whole, as shown by the Midwest Manufacturing Index (MMI). Figure 1 compares the performance of the Midwest with a national index, constructed on the same basis as the MMI. This Letter breaks down manufacturing activity into five sectors to identify strengths and weaknesses underlying the Midwest’s performance in 1987 and to consider their implications for 1988.

1. Midwest and national manufacturing growth

For manufacturers, the most important economic event in 1987 was the long-awaited turnaround in foreign trade. The exchange rate of the dollar had been dropping since 1985, but trade deficits continued to grow. The weakening dollar only began to benefit domestic producers in 1987.

Once the turnaround in trade began, however, its effects were pervasive. Exports of electrical and nonelectrical machinery, i.e., capital goods that traditionally have been the strongest merchandise exports of the national economy, grew nearly 25 percent in current dollars from the fourth quarter of 1986 to the fourth quarter of 1987, compared to 20 percent for all merchandise goods. But that performance was matched or exceeded by the food processing, fabricated metals, and rubber and plastics. Even the long-suffering steel industry substantially increased its exports, albeit from a very low base. Only the transportation equipment industry seems to have been passed over so far by the trade turnaround, although a drop in import competition has boosted its domestic sales and production. The Midwest’s specialization in metalworking- and machinery- related industries make it ideally suited to be a major beneficiary of the nationwide turnaround in merchandise trade.

The good news

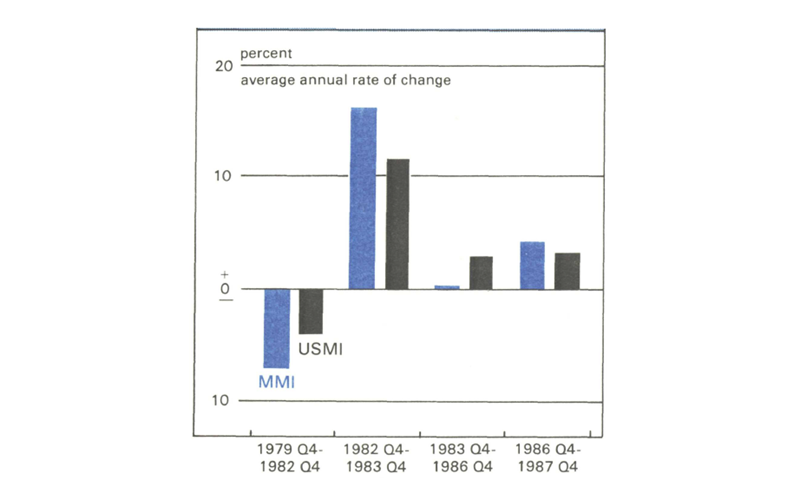

The Midwest’s success speaks for itself. From the fourth quarter of 1986 to the fourth quarter of 1987, manufacturing activity in the Midwest rose 4.2 percent, compared to 3.2 percent nationally. The only other time during the 1980s that the MMI outperformed the nation was in 1983—the first year of the current expansion (see figure 2). But a quick snap back from the poor performance in the 1980-82 period virtually assured the Midwest sizable gains in 1983, even though it failed to recapture the ground lost by those recessions. To surpass the national growth rate at a mature phase of an expansion was what made 1987 the year of the Midwest manufacturer.

2. Ups and downs of the ’80s

Capital usage in the Midwest seems to be what did the trick in thrusting the Midwest ahead of the national growth rate. Capital was being used more intensively and being upgraded more rapidly in the Midwest than in the nation as a whole during 1987. This is largely due to efforts by manufacturers during the previous lean years to improve their competitiveness. Unfortunately, one aspect of improving competitiveness often involves cutting labor costs. As a result, the growth in manufacturing activity in the Midwest did not translate into a growing demand for labor. Indeed, labor growth continued to lag the nation. Labor usage (employment times average hours worked) in the Midwest grew by only 1.8 percent in 1987, compared to 2.4 percent nationally on a fourth quarter-over-fourth quarter basis.

Indeed, what was most impressive about the performance of Midwestern manufacturing in 1987 was the broad scope of its success. Unlike 1983, when manufacturing activity was being pulled largely by a single product, autos, virtually every industry of each sector in the Midwest kept up with or exceeded its national counterpart. Moreover, some industries outperformed their national counterparts throughout the entire expansion.

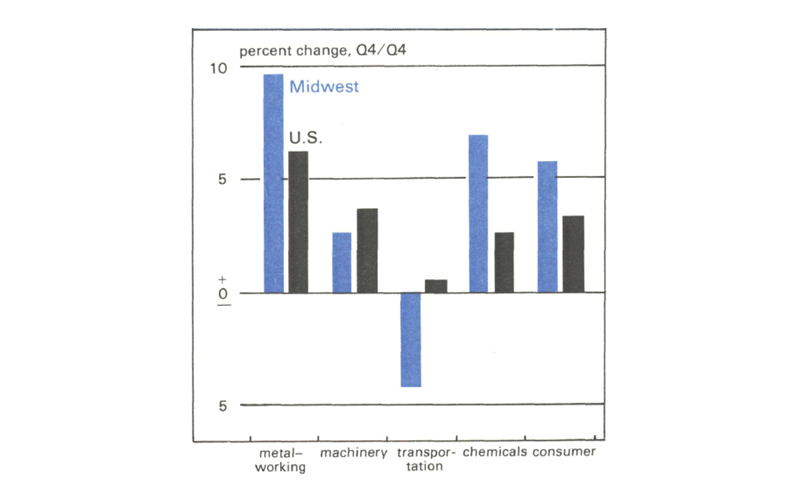

For convenience of analysis, industries have been grouped by similarity of product into five sectors of roughly equal size. The groupings reveal the following comparisons (see figure 3).

3. 1987 growth rates by sector

Metalworking leads the way back

Metalworking, which in the Midwest primarily means making and fabricating steel, as opposed to aluminum and other metals, has the best overall record of the five sectors. As a group, metalworking in the Midwest expanded 50 percent faster than the national average for the sector in 1987. It has been consistently strong throughout the current economic expansion relative to the sector nationally.

While trade problems of the domestic steel industry are by now legendary, much less is heard about the fabricated metals industry. This industry takes bulk steel and other metals and converts them to finished products, ranging from nuts and bolts to huge boilers. Foreign competition has been as much a growing problem for most fabricators as for any other manufacturer. Even large, structural fabrications, which normally are protected from foreign competition because of high transportation costs, have been experiencing trade-related problems in recent years.

The response of most fabricators has been typical of many domestic manufacturers—modernize and restructure. In the Midwest, restructuring frequently translates into reducing dependence on the auto industry. A case in point is Chicago White Metal Casting, Inc. Company sales were reported to be up 25-30 percent in 1987 and capacity is being expanded 50 percent in 1988. Part of the company’s success has been attributed to its shift away from supplying the auto industry to producing computer housings.

Thus, despite steel’s image as a troubled industry, the region’s metalworking sector had both the highest growth and the most consistent record for outperforming the nation of any sector in 1987.

An understatement in machinery

Despite lagging the national rate of growth in 1987, the Midwest’s machinery sector might also be counted among the better performing sectors. Growth in this sector was understated in 1987 because manufacturing activity in the electrical equipment industry was very strong in the fourth quarter of 1986, causing the fourth quarter-over-fourth quarter growth to be low compared to the national sector, which experienced steady growth over 1986. Indeed, unlike many Midwestern industries that declined in 1986, electrical equipment activity grew nearly 5 percent that year, compared to about 2 percent nationally on a fourth quarter-over-fourth quarter basis. As a result, electrical equipment had one of the best performances in the region over the 1984-86 period. Indeed, the whole Midwestern machinery sector grew faster than the national sector between 1983 and 1986.

The Peoria, Illinois, based Caterpillar Inc. is an excellent illustration of the machinery sector’s experience. After financial losses during much of the 1980s, Caterpillar reported solid profits for the fourth quarter of last year. Sales of construction machinery rose 12 percent and operating rates rose 10 percent over the course of 1987. Its recovery in part must be attributed to the fact that 50 percent of Caterpillar’s business comes from overseas sales.

Another effect of a weak dollar, however, was also revealed recently. Komatsu Ltd., an archrival, announced a tentative joint venture with another Illinois producer, which could result in Japanese construction equipment being produced in Caterpillar’s backyard.

Strong year for chemicals

Manufacturers of chemical-related products also did reasonably well last year, but the sector had lost a lot of ground relative to the national sector during the 1984-86 period. The problems, however, seemed to be confined to the chemical and petroleum industries, both of which experienced sharp declines in activity between 1984 and 1986. The chemical industry, facing pricing pressures from global overcapacity, was restructuring in the early 1980s by closing plants, consolidating operations, and modernizing.

On the other hand, the rubber and plastics industry in the Midwest kept pace with its national counterpart. The industry has been moving away from its dependence on the auto industry, which may benefit the industry’s performance in the Midwest.

Transportation is still adjusting

The most disappointing sector in the region was transportation. Manufacturing activity in the Midwest’s transportation sector declined 4 percent in 1987, even though the sector edged upward for the nation as a whole.

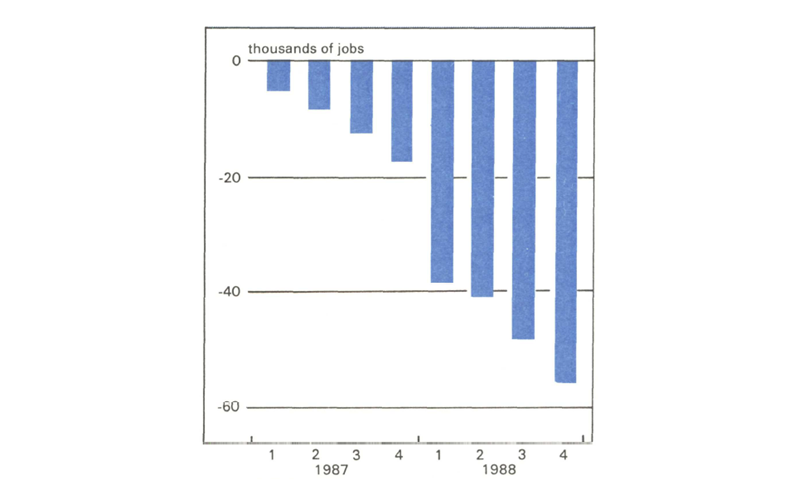

Yet, even here the sector may be only a temporary drawback for the region. Michigan, for example, was particularly hard hit by auto plant closings, which might rightly be regarded as a carryover of structural change from the early 1980s. Employment losses associated with these closings were roughly 17,000 in Michigan alone last year, with another 38,000 anticipated in 1988 (see figure 4). Nevertheless, the region has some of the most efficient auto plants in the country, including Ford’s Torrence Avenue operation in Chicago, Chrysler’s Belvidere, Illinois, plant, and General Motors’ truck plant in Ft. Wayne, Indiana, and will have two new state-of-the-art facilities operating in 1988 with the completion of the Diamond-Star Motors plant in Bloomington-Normal, Illinois, and the Mazda plant in Flat Rock, Michigan.

4. Michigan auto-based job loss

Consumer products are still a mixed bag

Finally, consumer-product manufacturers in the Midwest had an oddly mixed performance. Clearly, 1987 was a good year for the consumer products sector in the Midwest, with its manufacturing activity expanding at nearly twice the rate of the sector nationally. However, the region had the poorest overall record during the 1984-86 period, when both the paper and food processing industries faced stiffening foreign competition from the dollar’s rise. Most industries in the sector, however, declined during that period. The sole exception was lumber and wood products.

Structure vs competitiveness

An important reason that manufacturing performed so well in 1987 was the region’s structural composition, that is, its concentration of trade-sensitive industries. But, if that were all there was to the region’s growth in 1987, there would be little cause for the Midwest to continue to outperform the nation in 1988 and beyond as the thrust from trade-related growth subsides.

While structural advantage can help explain why the Midwest had stronger growth in manufacturing activity in 1987 than it had during the 1984-86 period, it cannot explain why the region grew faster than the nation. The Midwest simply does not have a sufficient structural advantage to account for its above-average growth in manufacturing activity.

Over long periods of time, growth-rate differentials between regions are generally due to regional competitive advantages, such as declining relative wages, improved production efficiency, and access to growing markets. What structural advantage cannot explain about the Midwest’s recent performance most likely is explained by improvements in competitiveness. The fact that over time more and more Midwestern industries have been outperforming their national counterparts is encouraging evidence that the real force behind the growth in Midwest manufacturing activity is its increasing competitiveness. If so, the Midwest manufacturers will continue to gain market share in the future.

MMI—Midwest Manufacturing Index

Industrial production in the nation edged up 0.2 percent in January, after an upwardly revised 0.5 percent growth in December. Nondurable-goods industries accounted for much of the net gain in January. Continuing strength among machinery-related industries was offset by a 7.5 percent decline in auto production, resulting in no change in production among durable-goods industries.

Manufacturing activity in the Midwest declined in January for the second consecutive month. Most durable-goods industries declined, led by a sharp drop in transportation equipment. Auto plant closings account for much of the weakness in the capital-usage component of the MMI. Gains in the nonelectrical machinery industry were an exception in the durable-goods sector.

Note

The authors thank Peter Schneider for his programming assistance.